Performance at Glance

| | |

| | User-friendly and offers a simple interface for payroll and HR management. |

| | Offers a straightforward onboarding process, making it easy to set up and get started. |

| | Gusto's pricing is competitive and offers great value for small businesses. |

| | Comprehensive suite of payroll and HR features, including benefits management, time off accrual, and tax filing. |

| | Offers excellent customer support with access to a dedicated support team via phone, chat, or email. |

| | Gusto has a high rating on G2 with positive reviews from verified users, highlighting its ease of use, functionality, and customer support. |

Ease of Use

This refers to how user-friendly and intuitive software is to use. Ease of use is an important factor for businesses as it affects the overall productivity and efficiency of the payroll and HR processes. Gusto offers a simple and intuitive interface, making it easy for users to navigate and perform tasks.

Ease of Setup

This is how quickly and easily a software can be set up and implemented in a business. Gusto offers a straightforward setup process, with a helpful onboarding experience that guides users through the steps necessary to get started.

Value for Money

The balance between the cost of the software and the features and benefits it provides is important. Gusto offers a competitive pricing model with affordable plans that include a wide range of features to help businesses manage their payroll and HR processes.

Features

This includes the capabilities and functionalities of the software. Gusto offers a comprehensive set of features, including payroll processing, tax management, benefits administration, time off tracking, and more. These features are designed to help businesses streamline their payroll and HR processes, saving them time and money.

Support

This refers to the level of customer support and assistance provided by the software company. Gusto offers a dedicated support team, with a range of resources and tools to help businesses get the most out of their software.

G2 Rating

G2 is an independent software review site that provides ratings and reviews of software products. Gusto has a high rating on G2 of 4.0/5.0, indicating that it is well-regarded by users and provides a high level of customer satisfaction.

Features of Gusto Payroll Software

Gusto offers a wide range of features to help streamline payroll and HR processes for small businesses:

| |

| |

User, Role & Access Management | |

Performance & Reliability | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

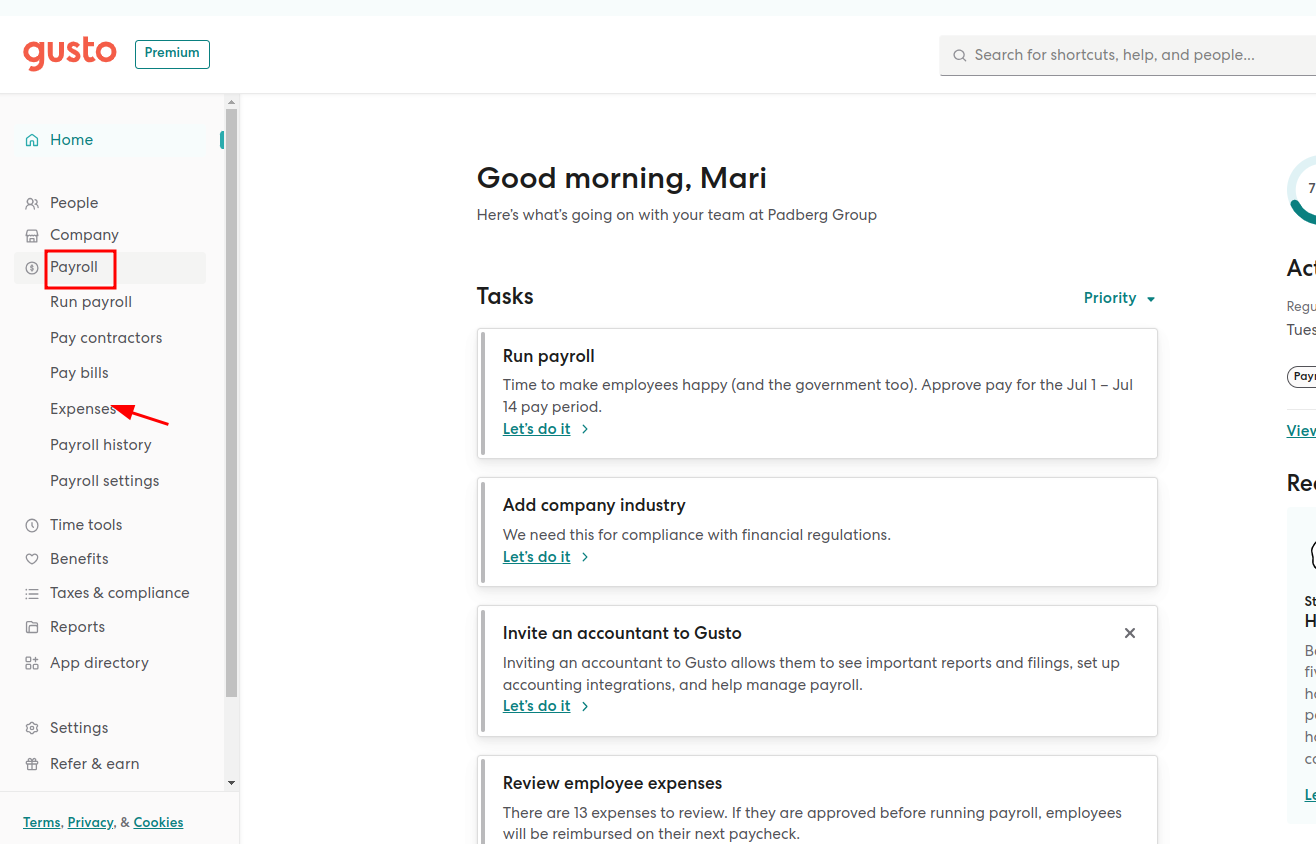

Gusto Payroll Software Dashboard Overview

Home Page

The homepage of the Gusto Payroll Software is where you begin with. It has all the important information that can help you plan your day, such as:

- The To-Do List

- Reminder

- List Of The UpComing Events

- Celebrations

If you want to sync your reminders to your calendar, move to the bottom right corner of the page for the same. Gusto is compliant with Google, Outlook and iCall.

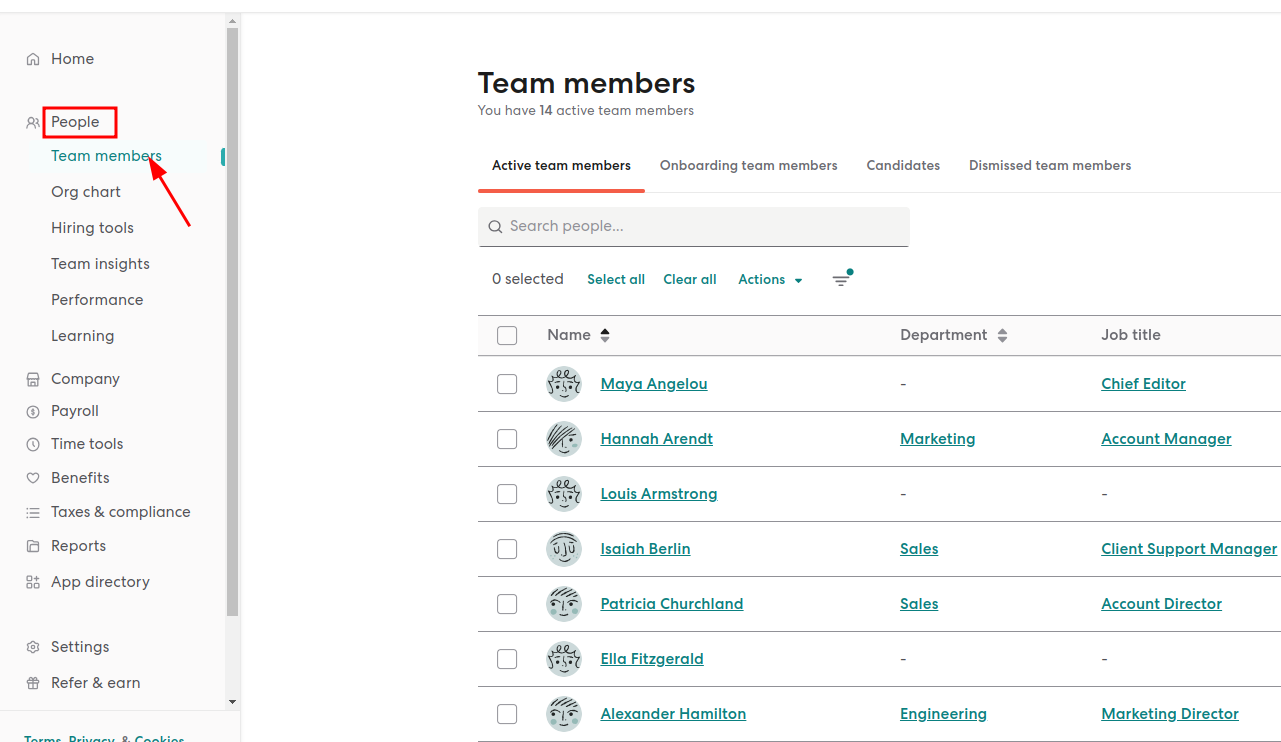

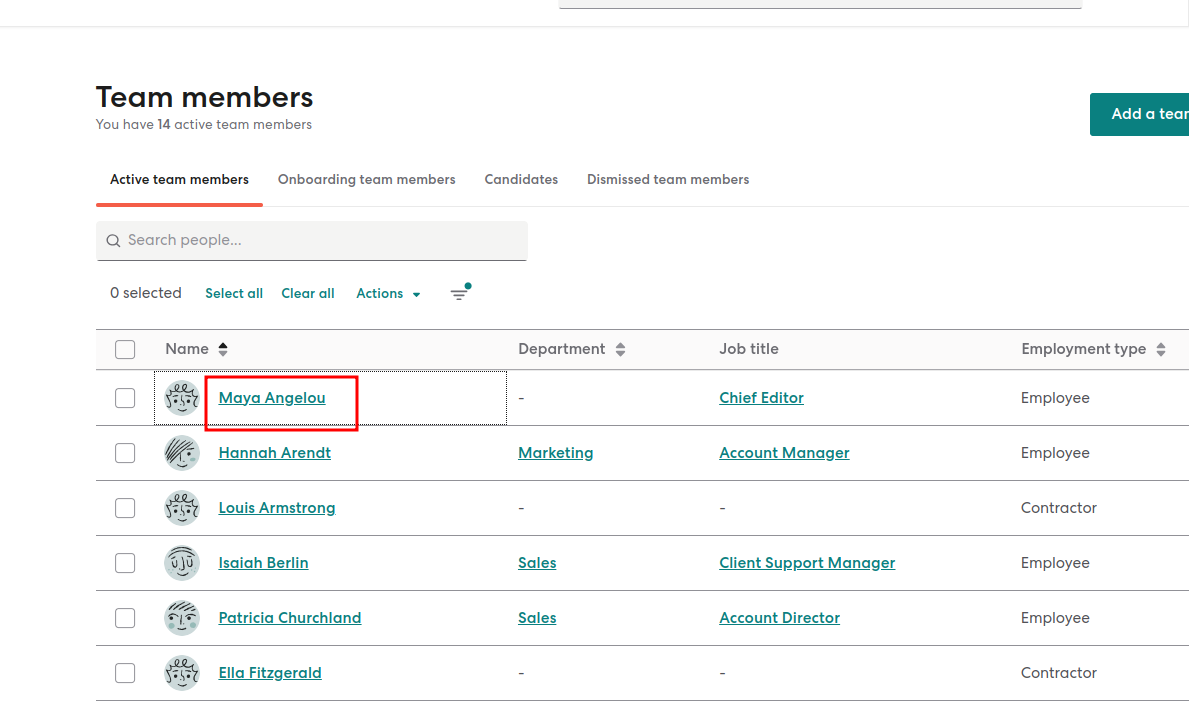

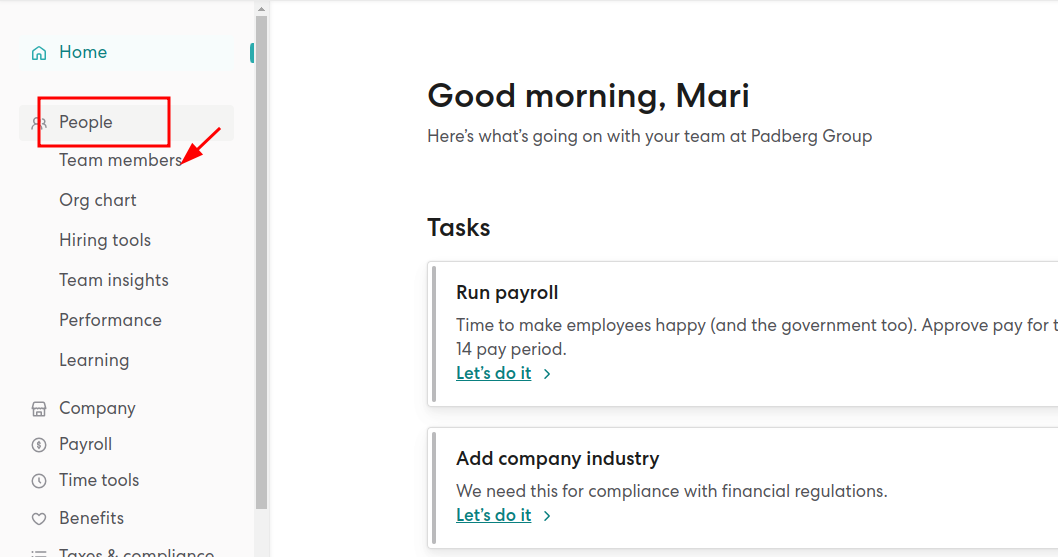

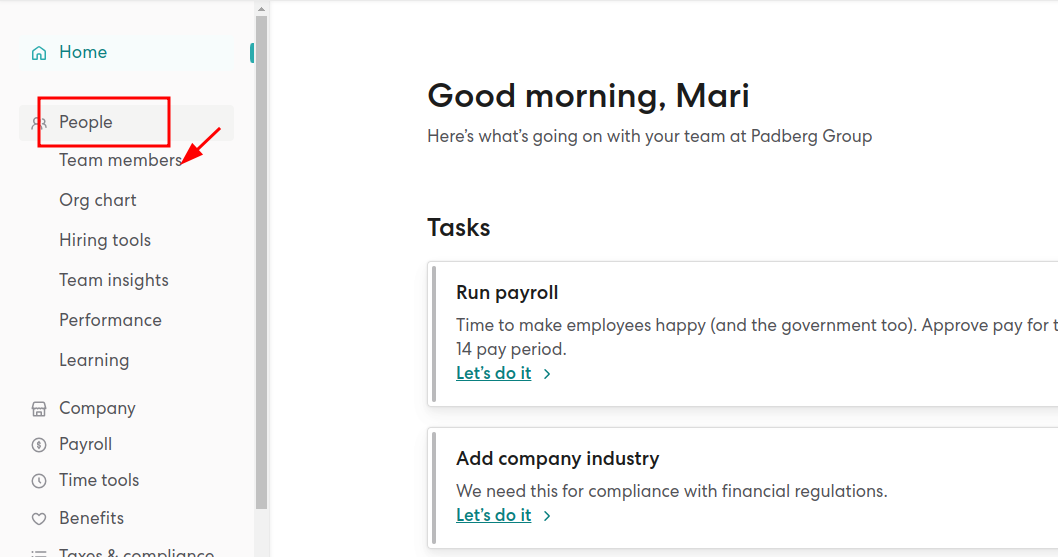

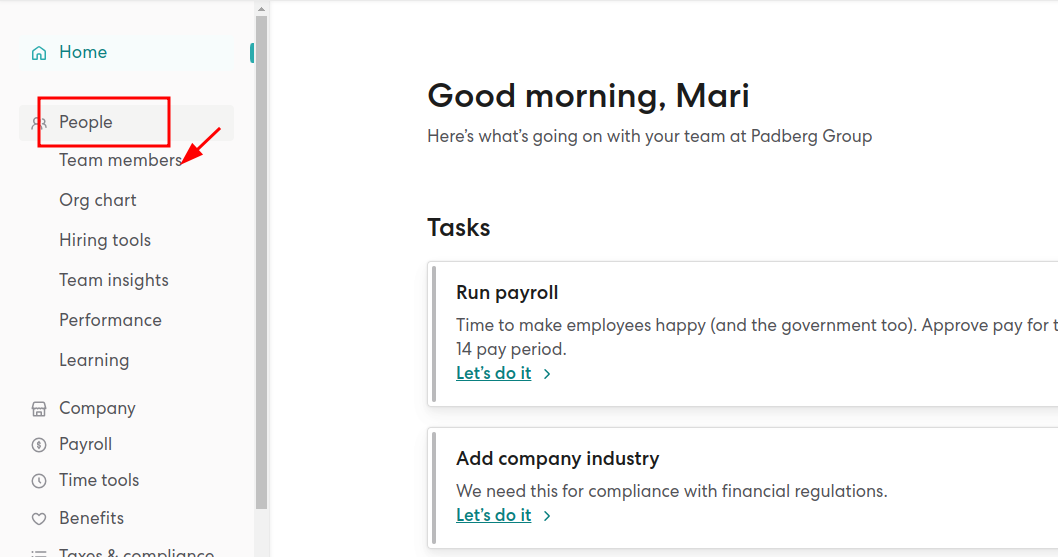

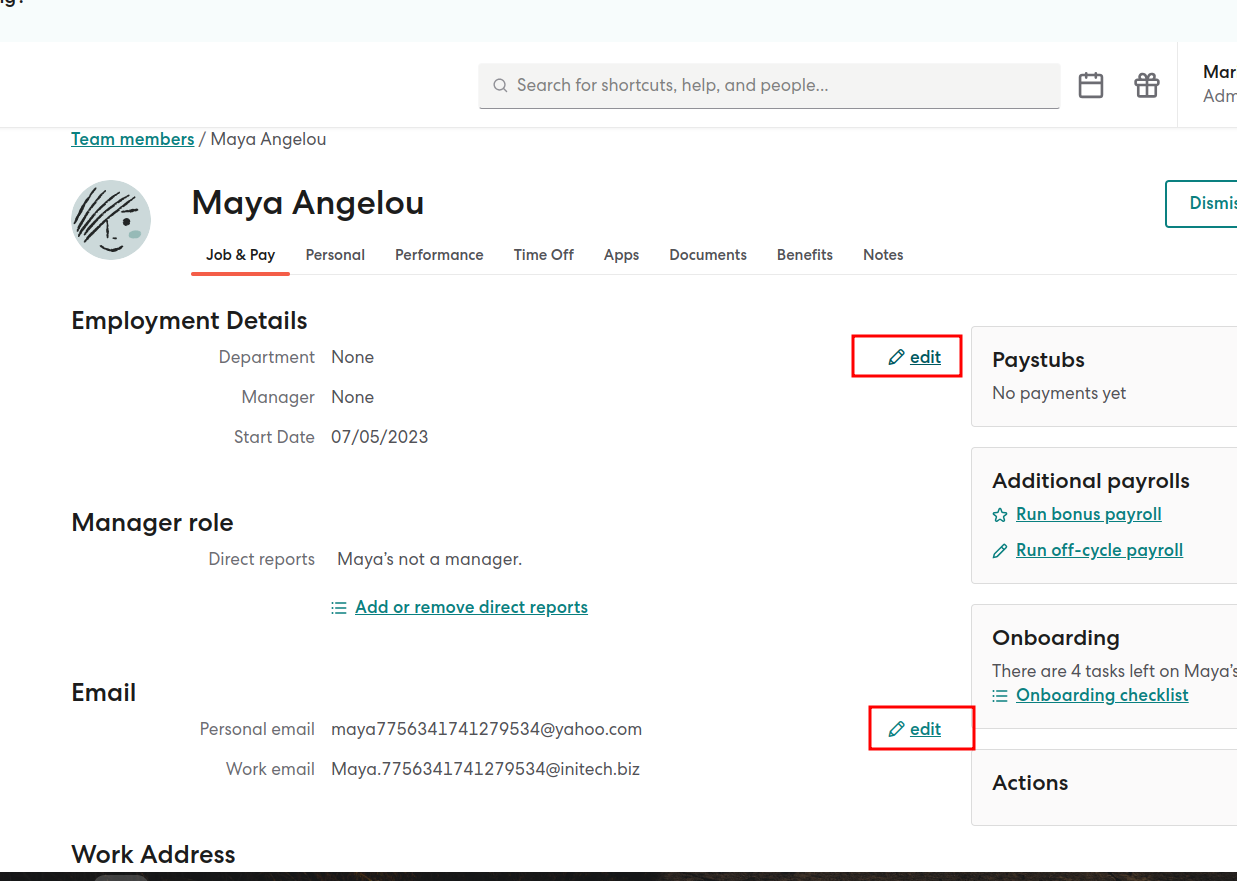

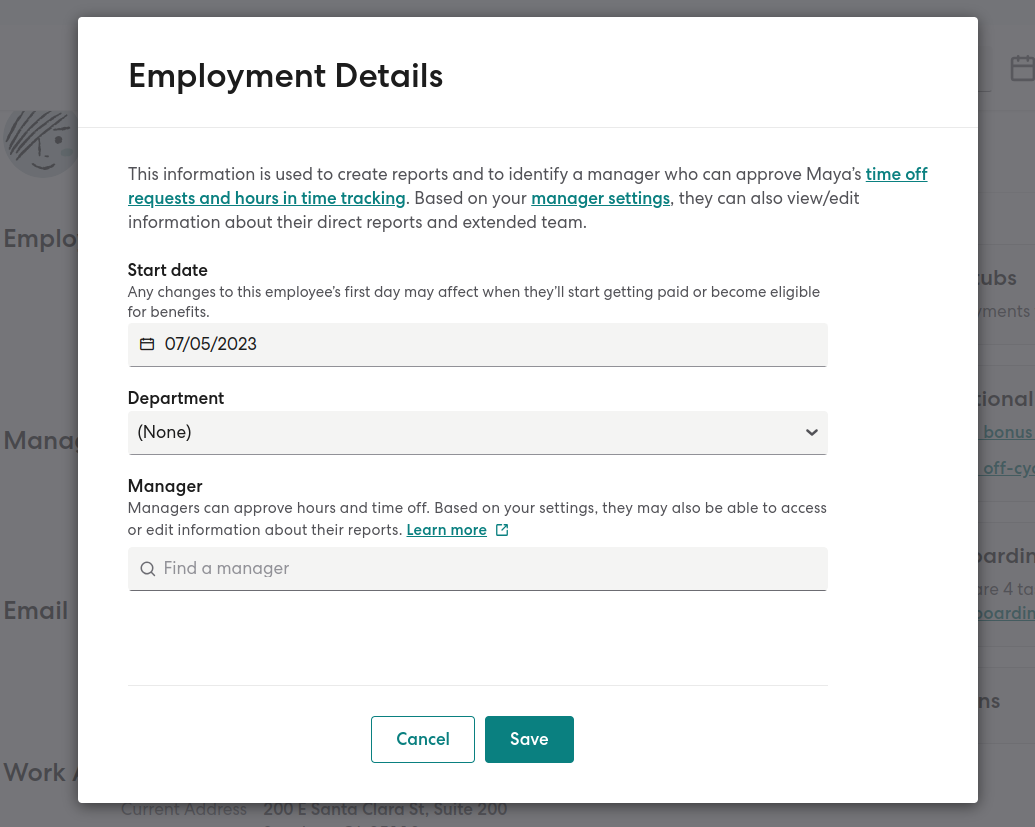

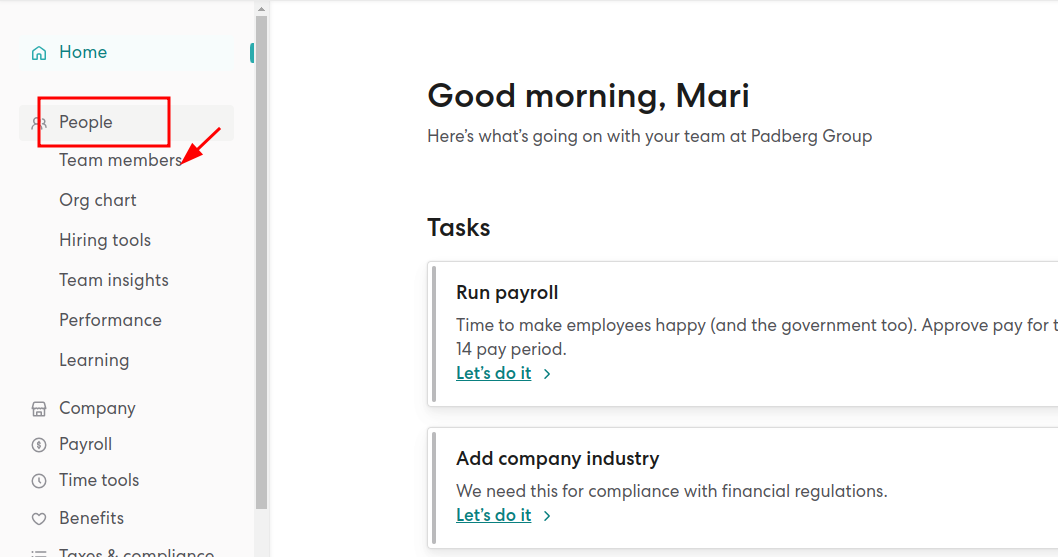

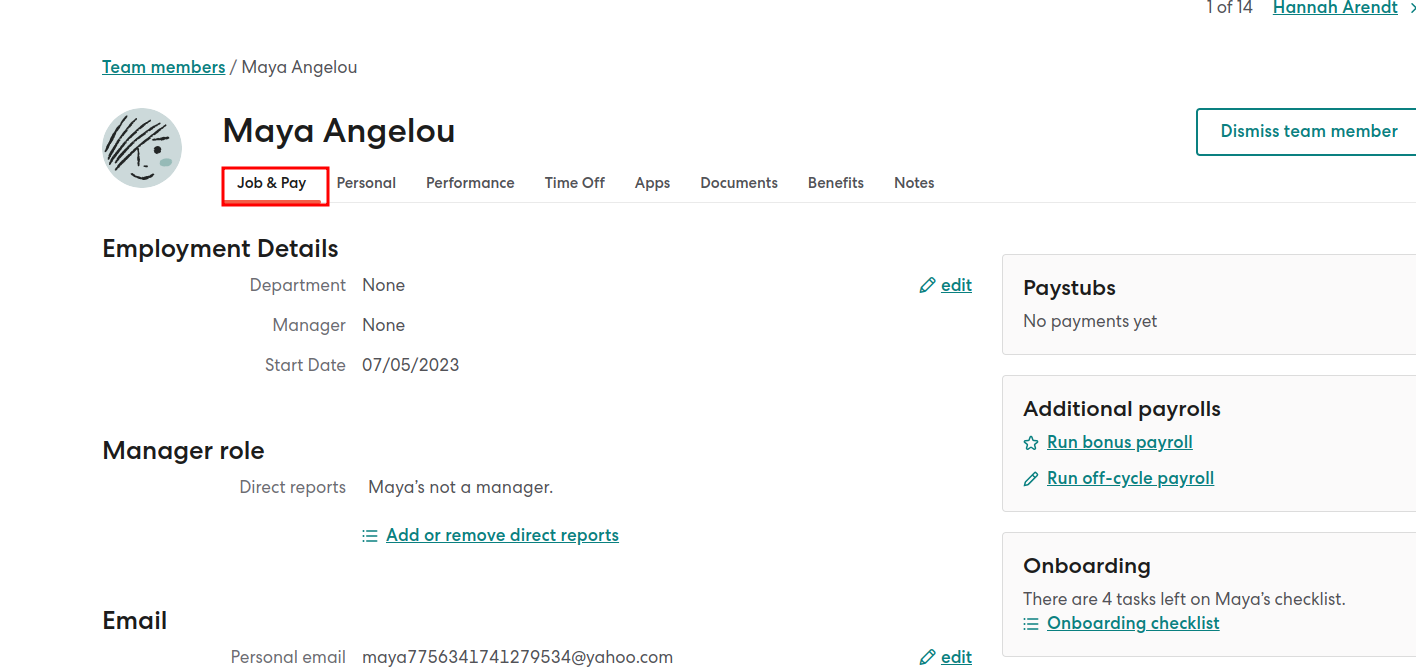

People Tab

In this tab, you can add the information of the new employee or the contractor that you welcome in your organization. Here you can find several forms which require you to mention the correct information of the new joining. The tab also has a section for the employer to add the documents of the employee.

You can send offer letters right from the system and Gusto will file the new hire reports with the IRS for you.

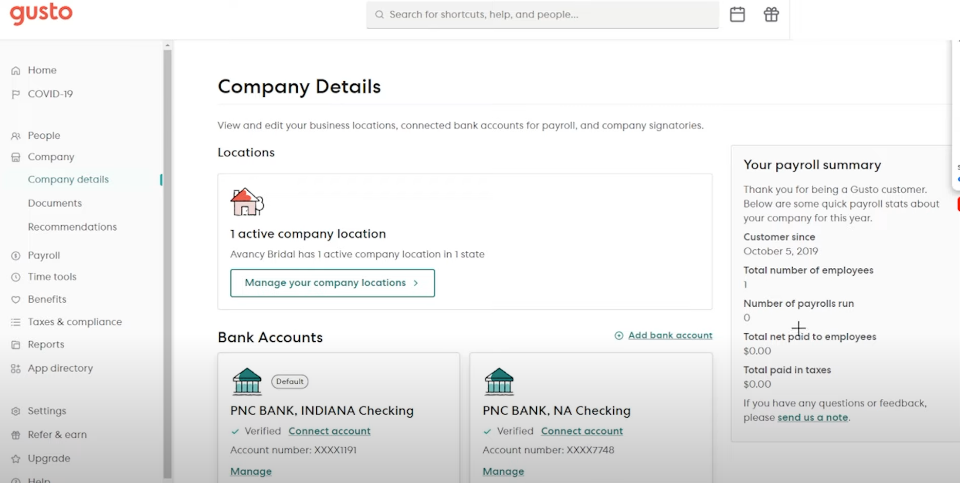

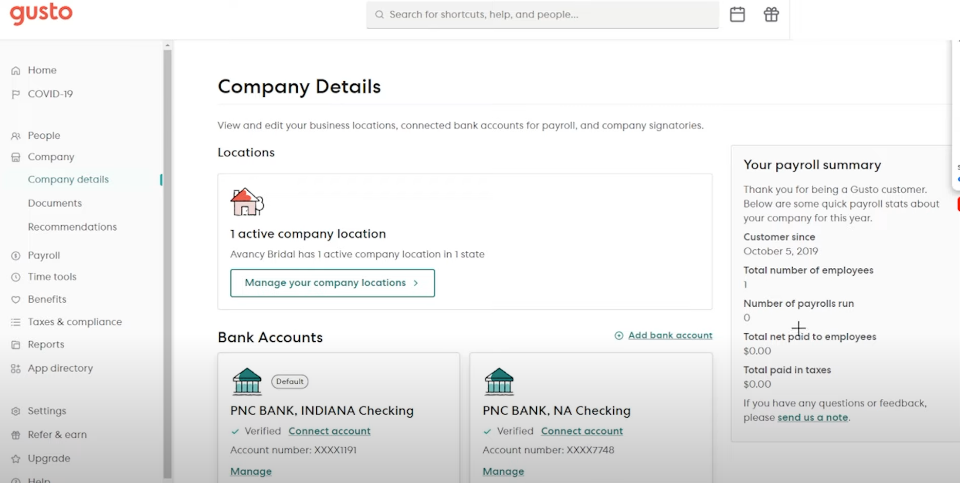

Company Tab

In the company, you can store all the information related to your company like:

- Name of the company

- Location

- Bank Account details

- Quick Payroll Summary

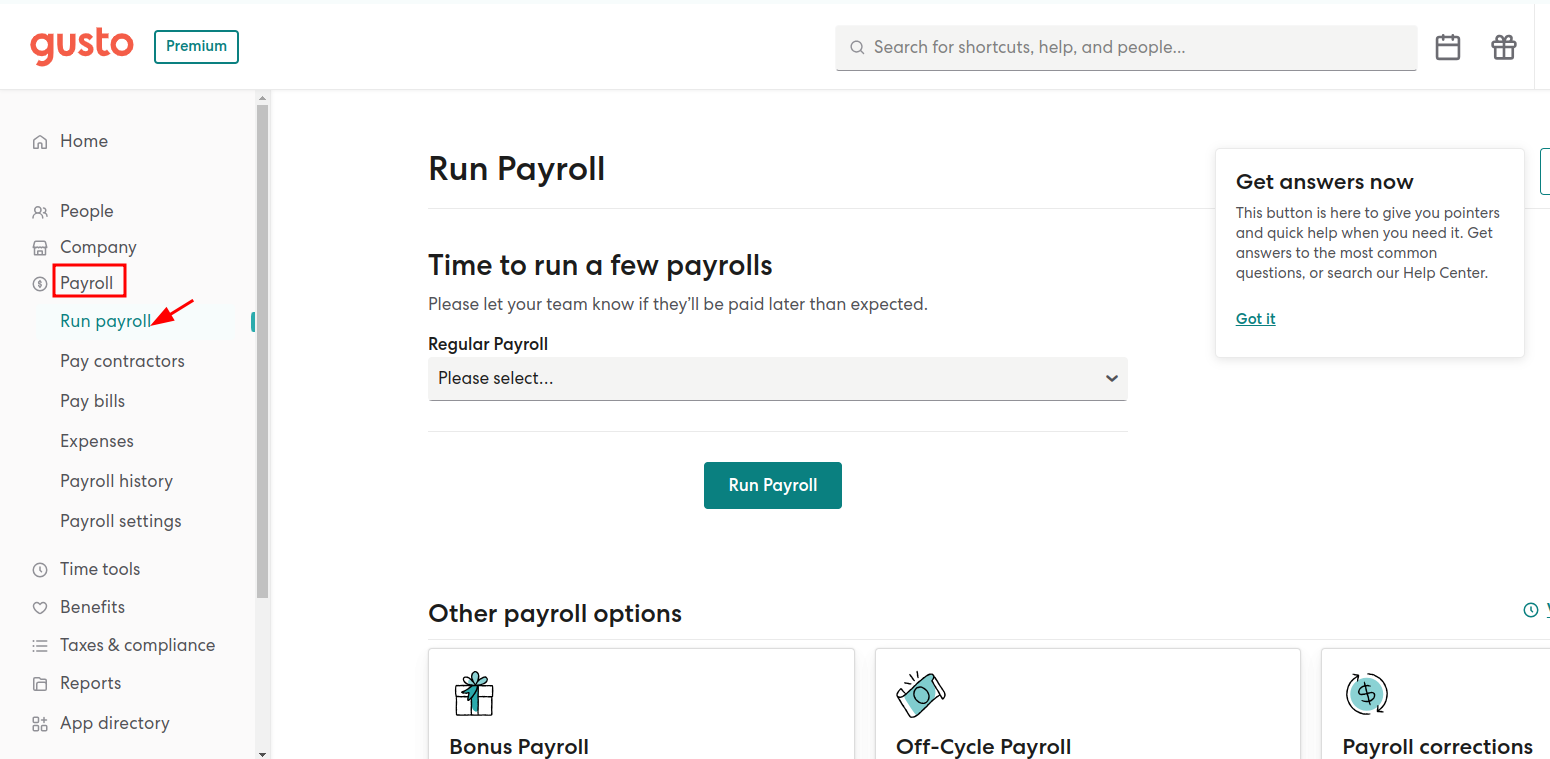

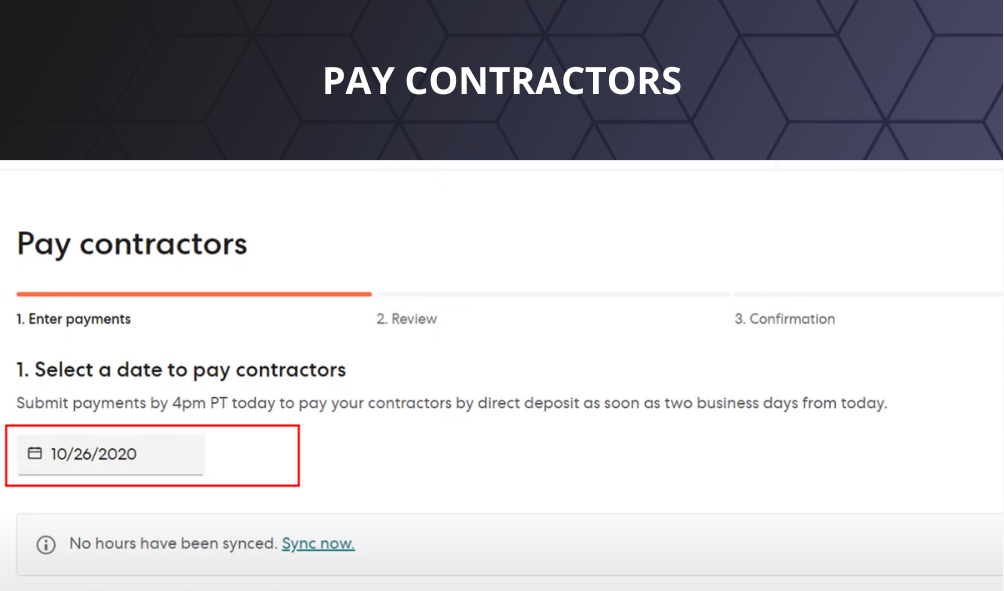

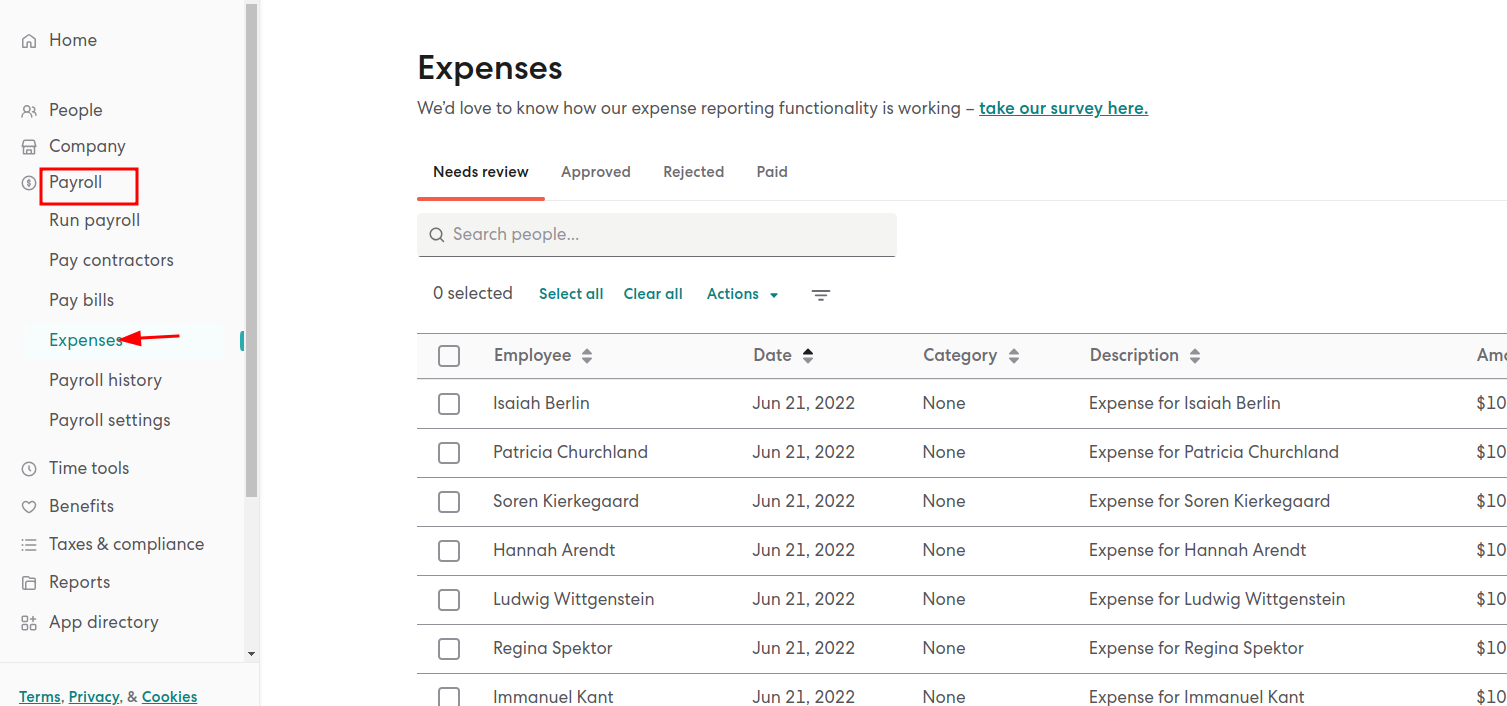

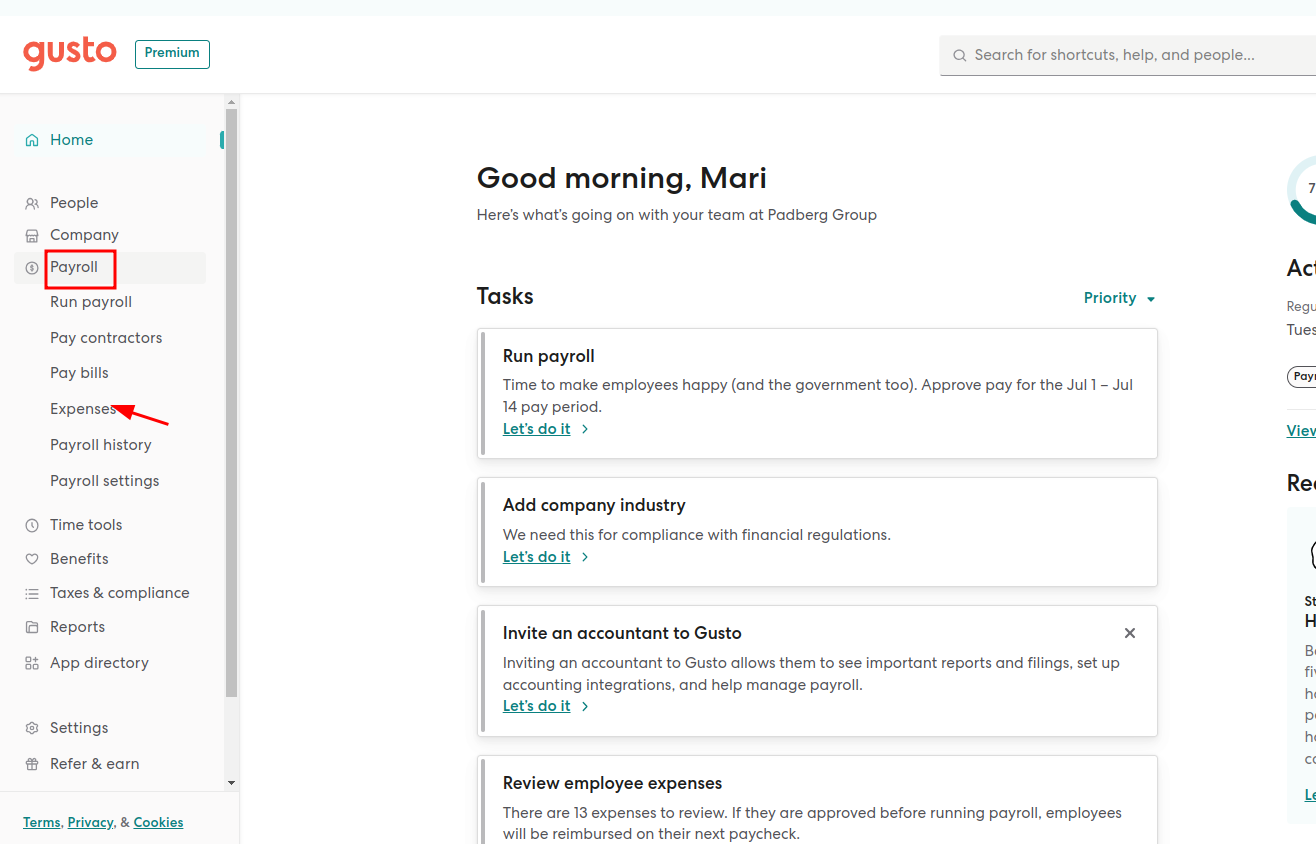

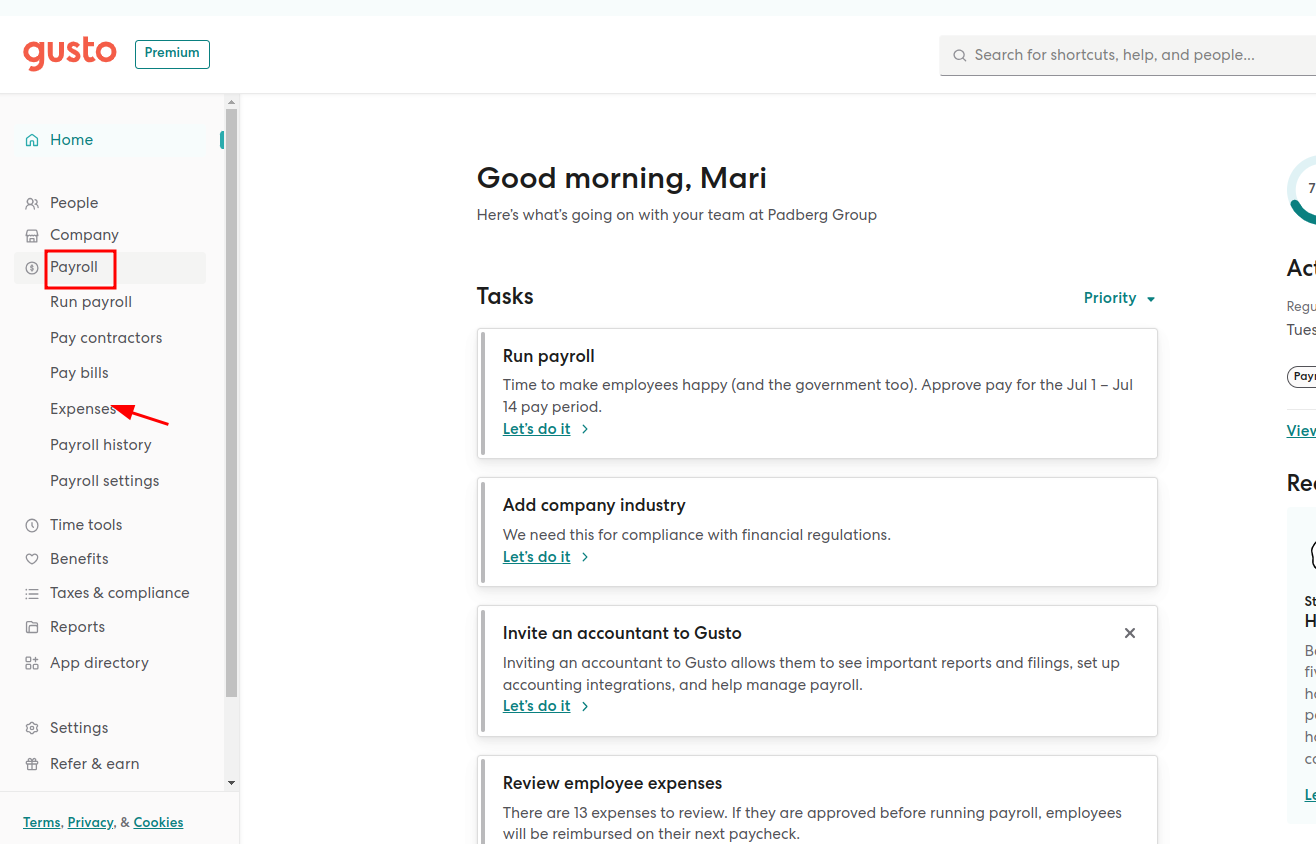

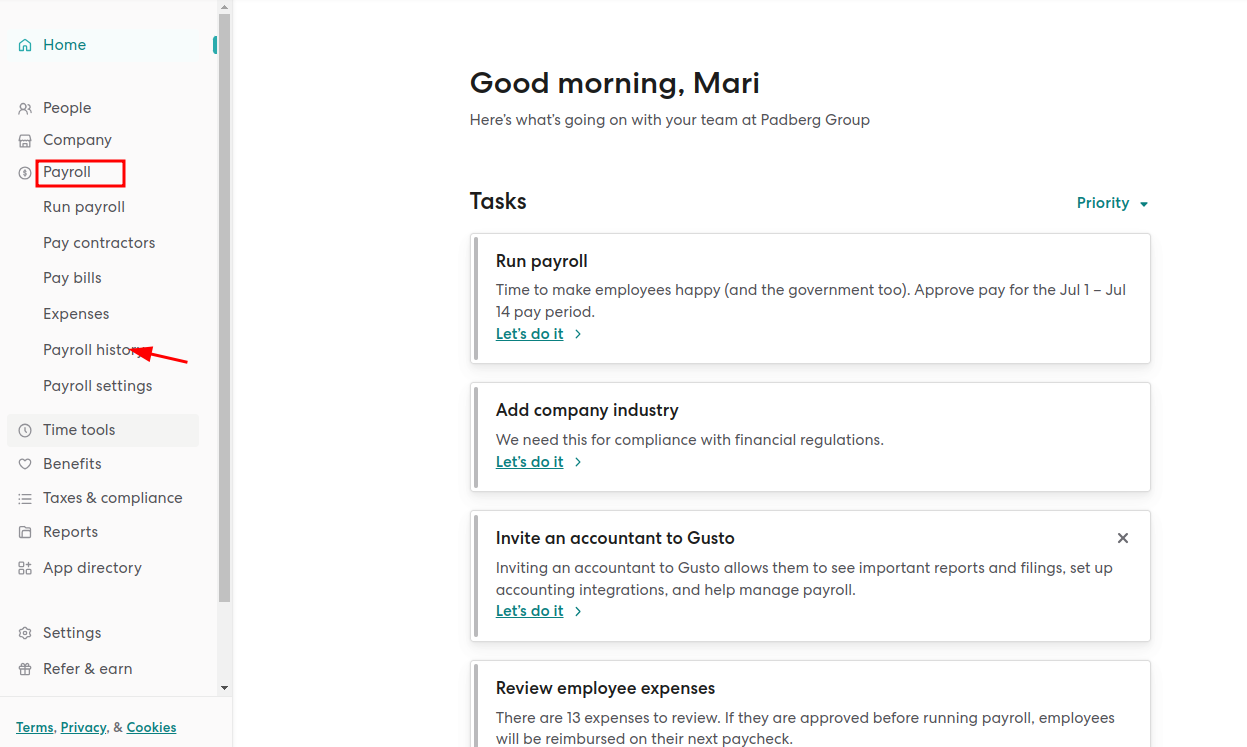

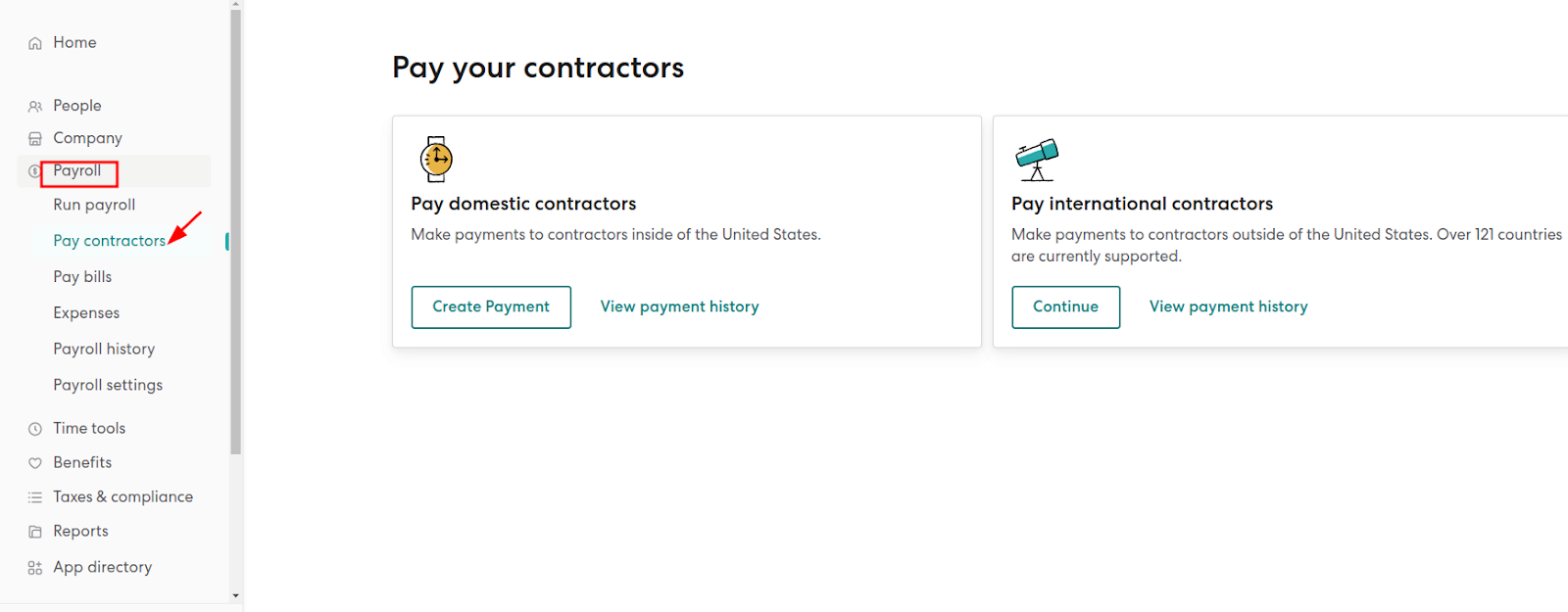

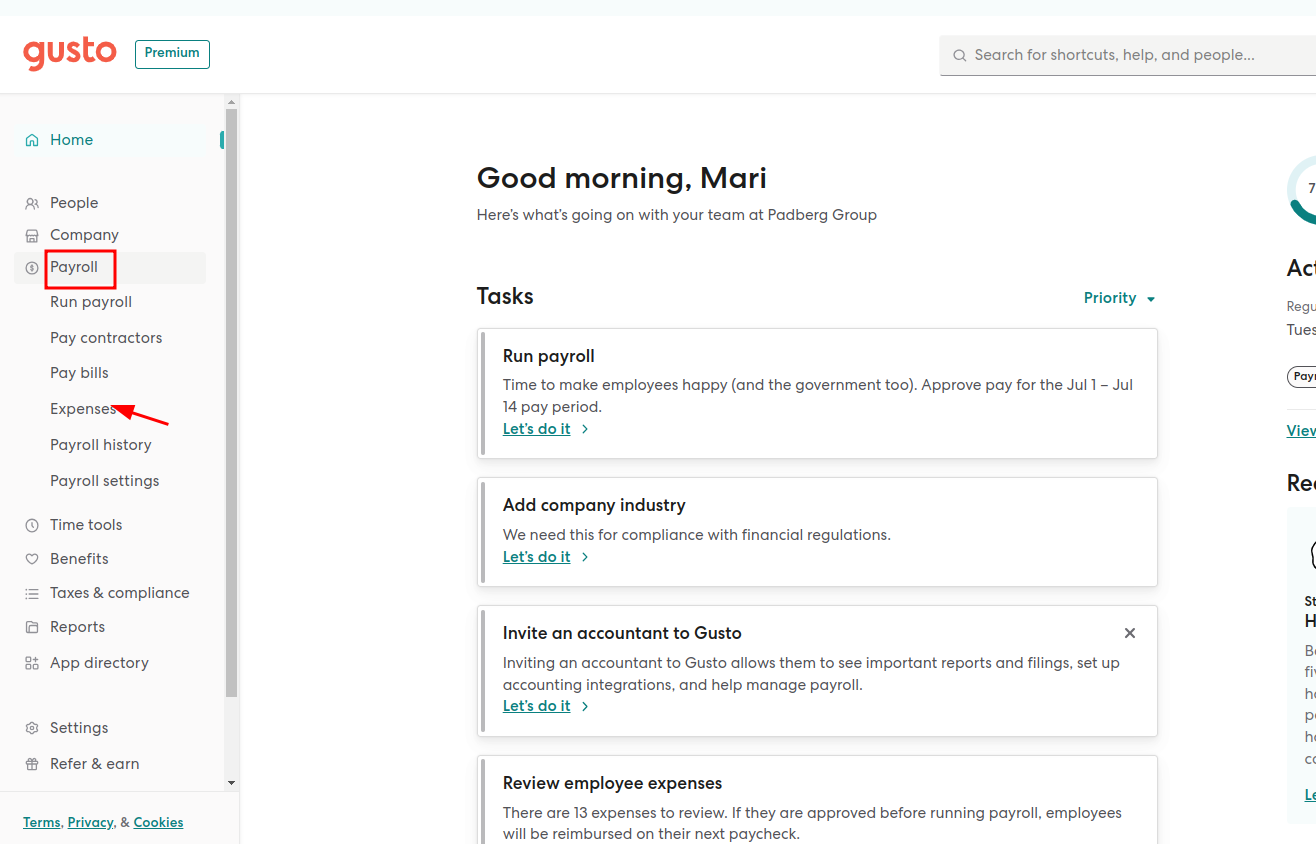

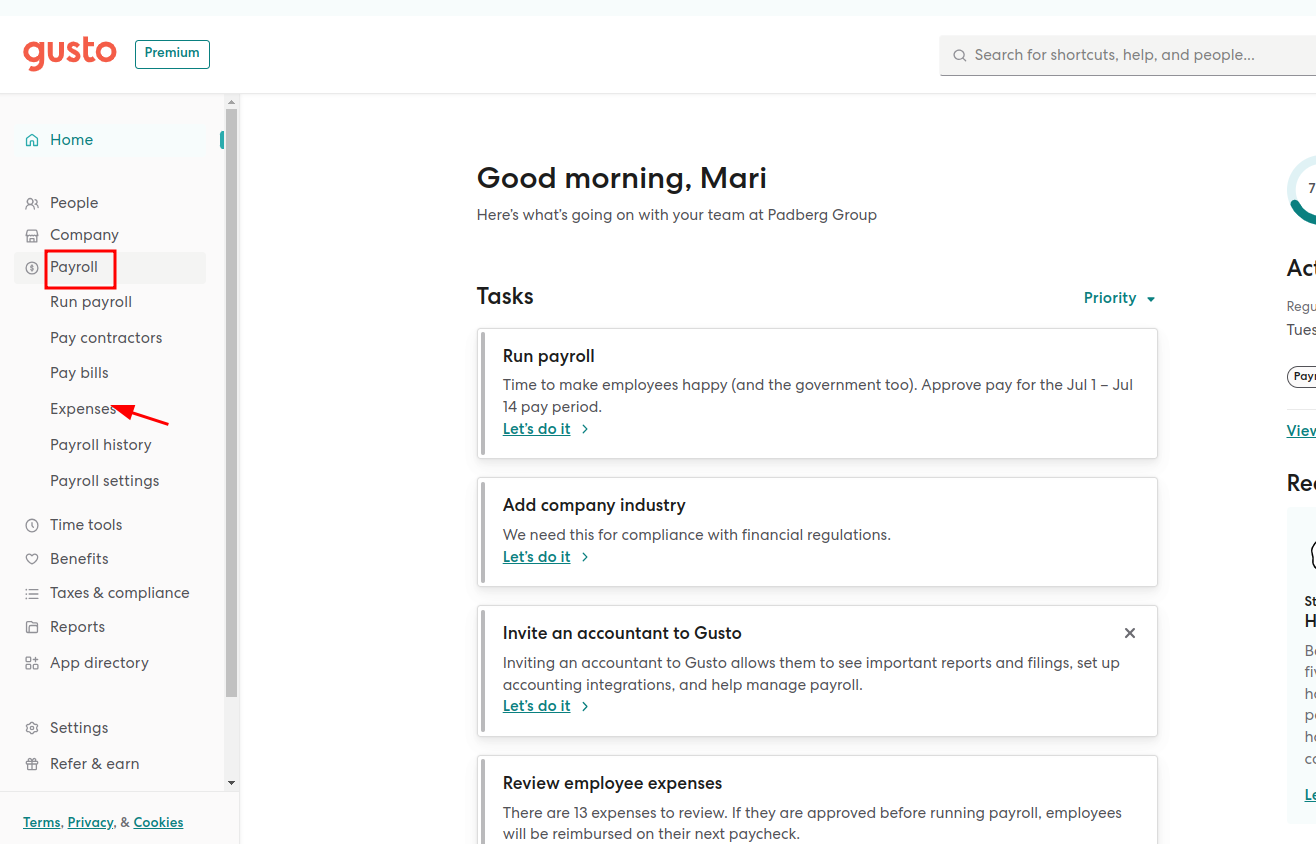

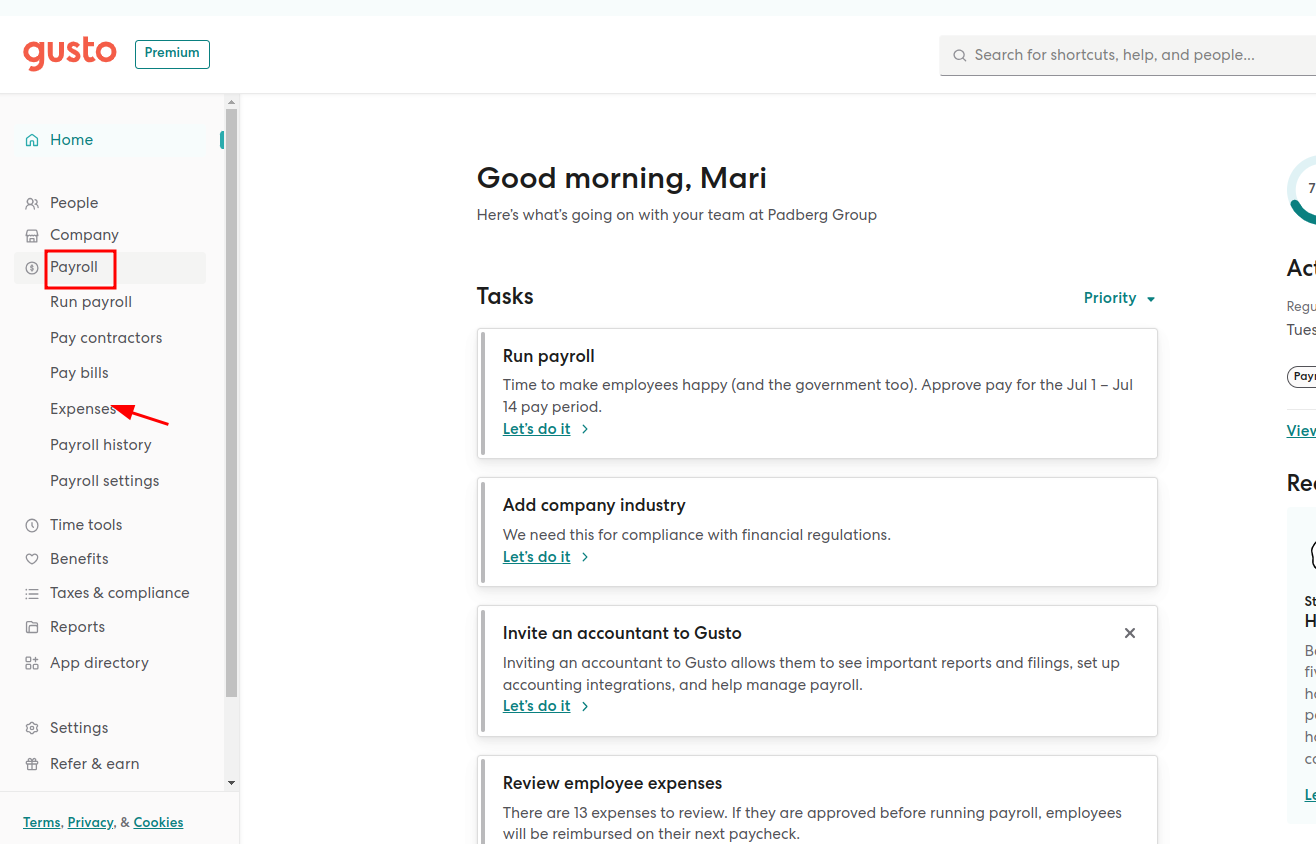

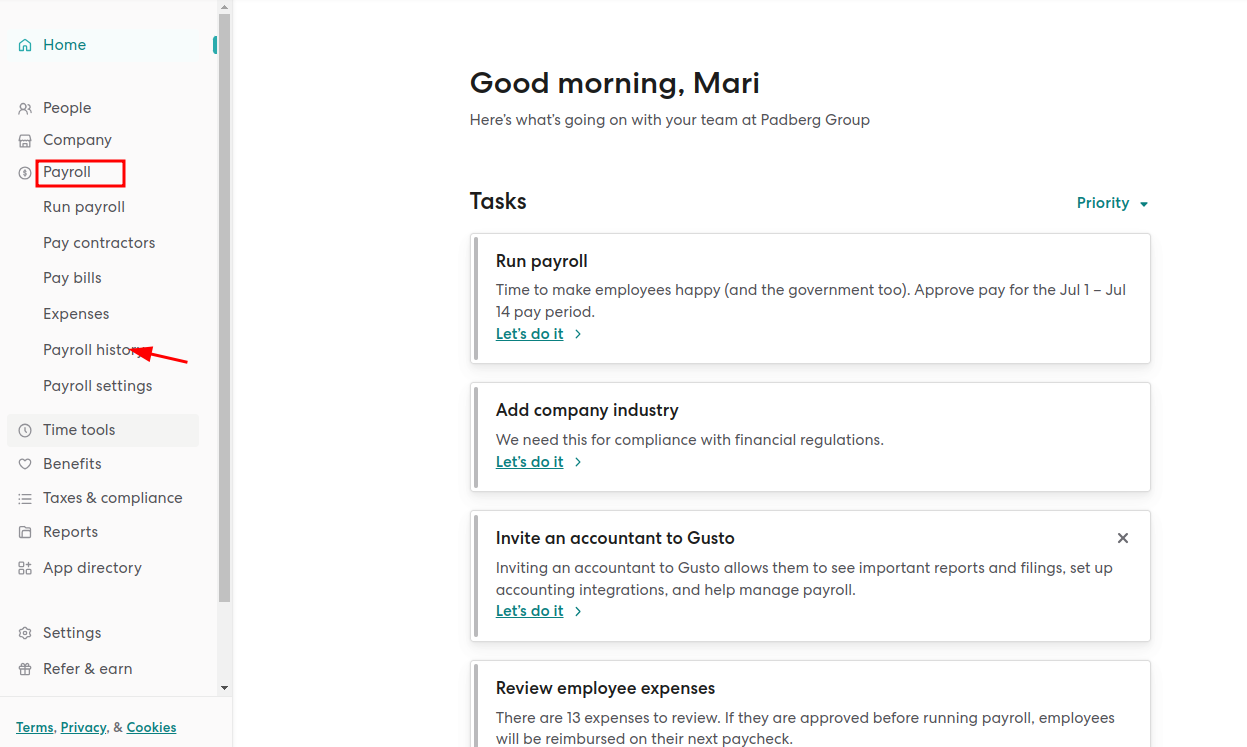

Payroll Tab

Within this tab, you can run several processes like:

- Run Payroll

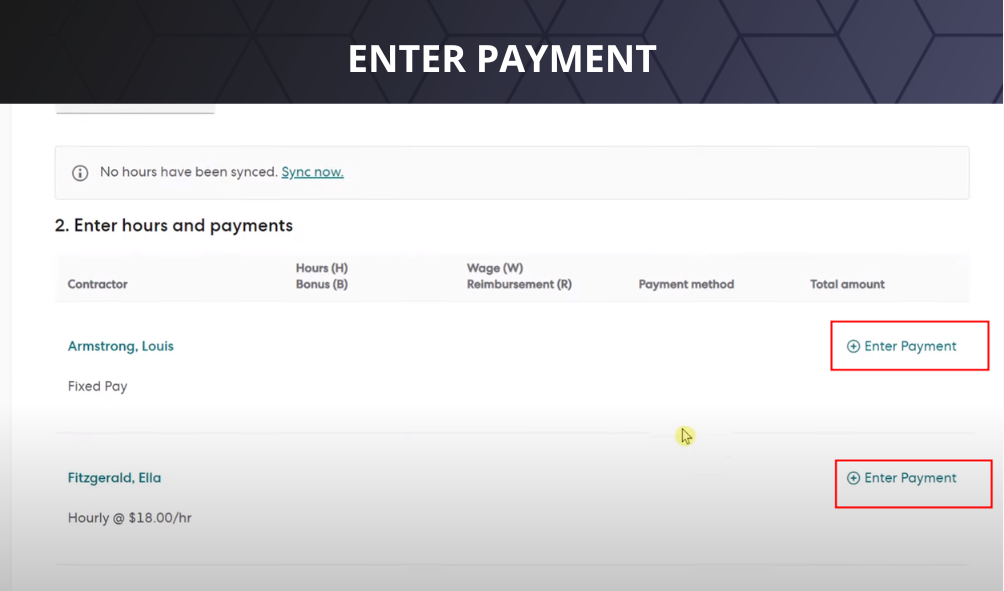

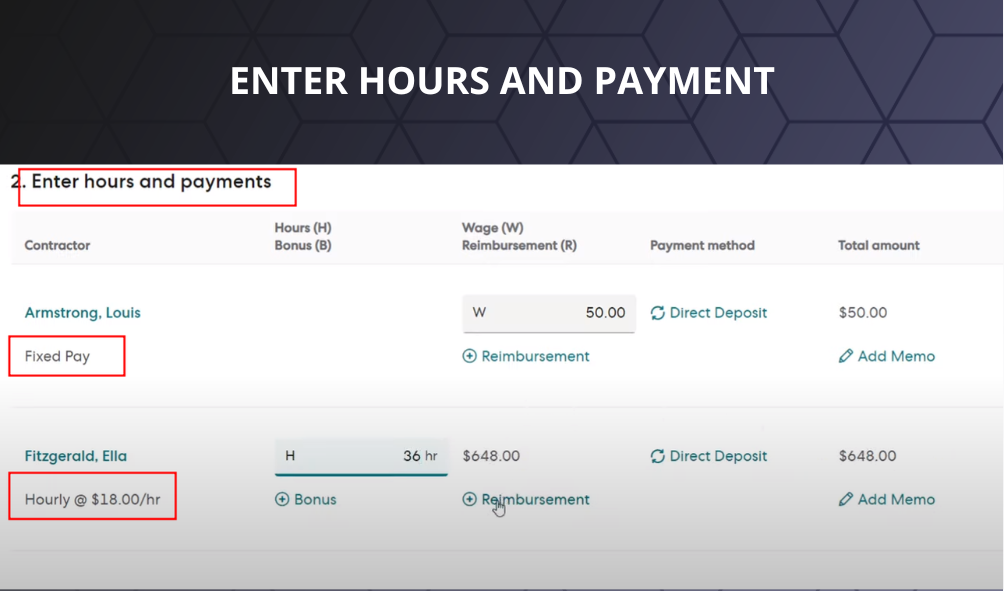

- Pay Contractors

- Check The Expenses

- Payroll History

- Payroll Settings

The payroll system of the tool handles all the tax calculations, benefits withholdings, direct deposit and the summary of the payment to the contractors.

- For the salaried employees, you just need to enter their salary and the rest of the calculations would be taken care of by Gusto. It checks the employees logs and tax reduction policy to calculate the final monthly salary.

- For the hourly employees, Gusto adds up their work hours, calculates taxes and prepares a pay slip as per their hourly wage.

The best part is that if you are still not sure about the worker’s compensation insurance, Gusto handles it for you too. The company partner’s with AP Intego to provide worker’s compensation insurance, which you can apply through Gusto.

It offers flexibility to choose the payroll schedule such as Monthly, Weekly, Bi-Weekly or whatever suits your requirements.

Employees can even choose the method of payment like direct deposits, paychecks be it manually or through the Gusto software.

Benefits Tab

It helps to manage several employee benefits offered by the employer such as Health Insurance, Retirement Plans and others.

If you offer benefits Gusto takes care of Benefits management, providing informative resources to your employees about the packages available to them and bringing them to select the package from the self-service dashboard.

The competitive benefit packages help the employer to attract and retain high quality employees for a longer period of time.

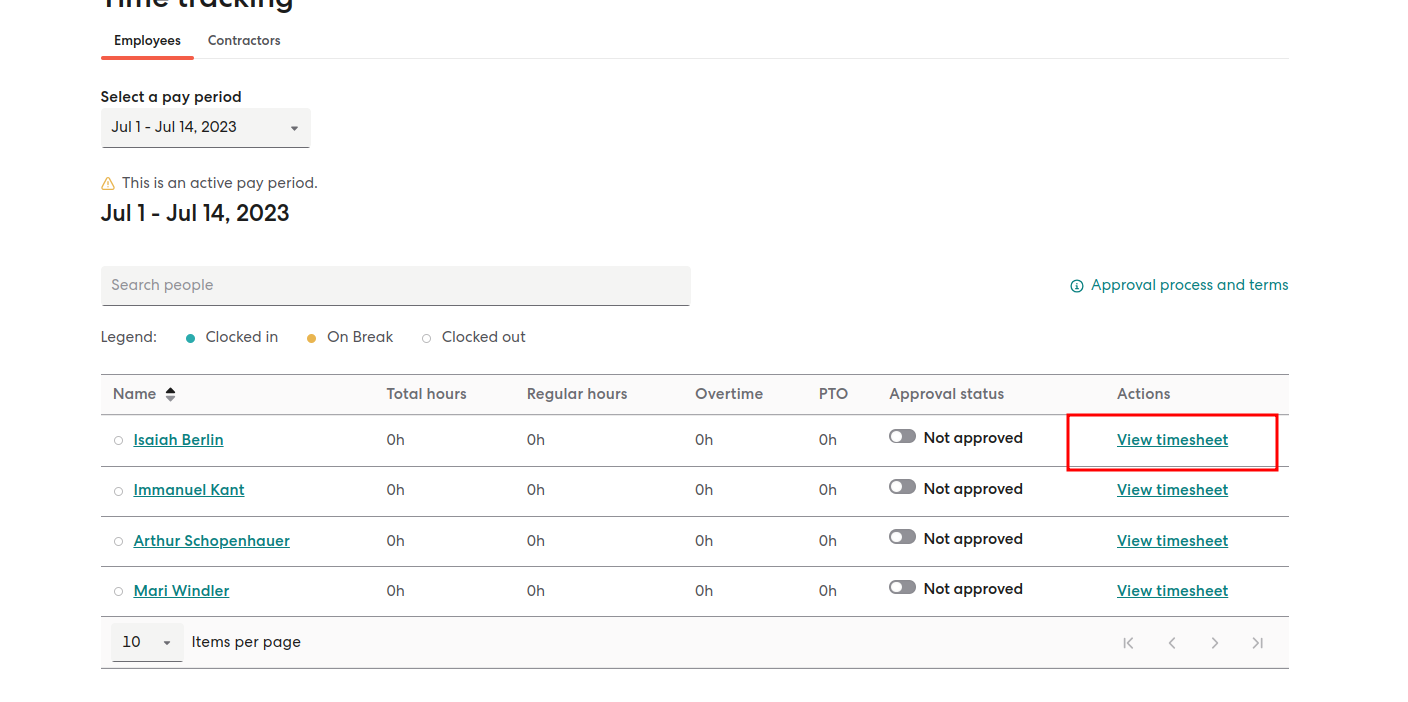

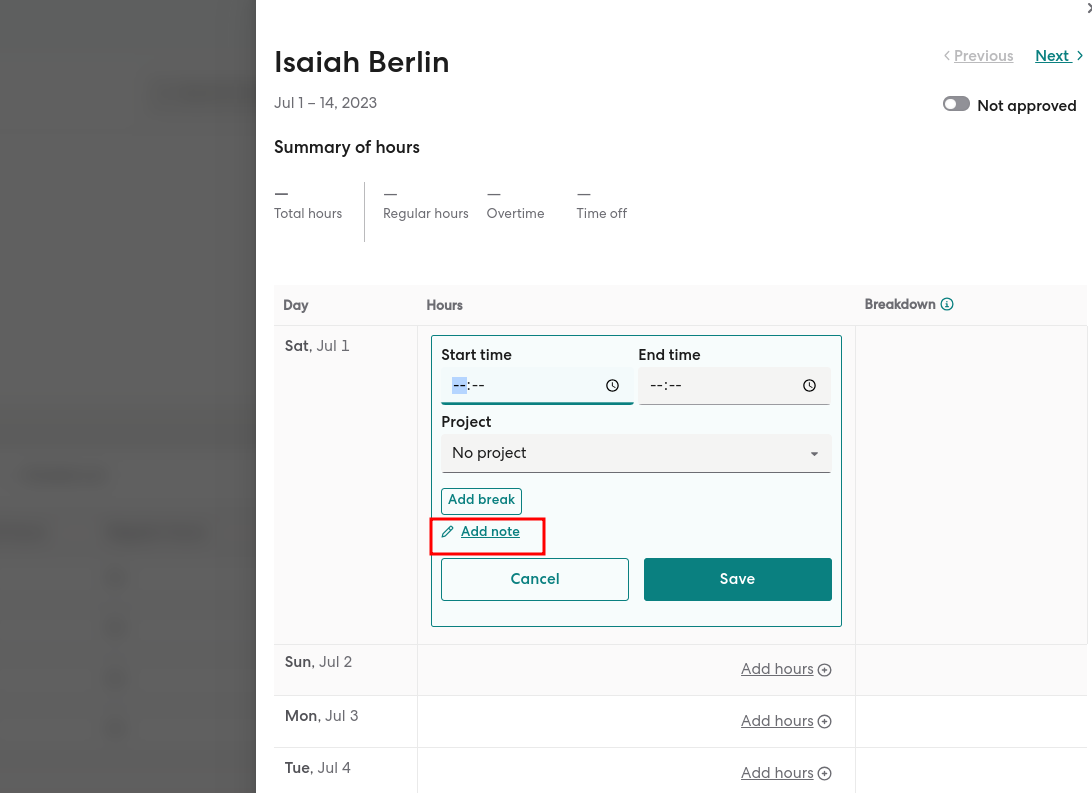

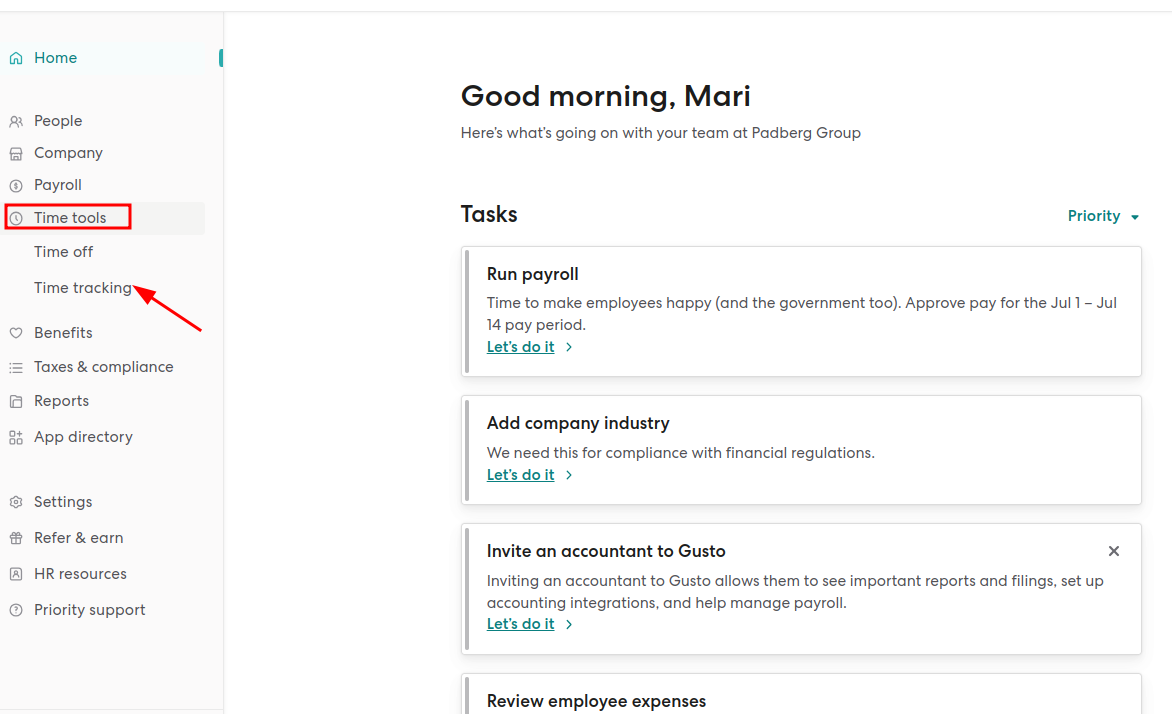

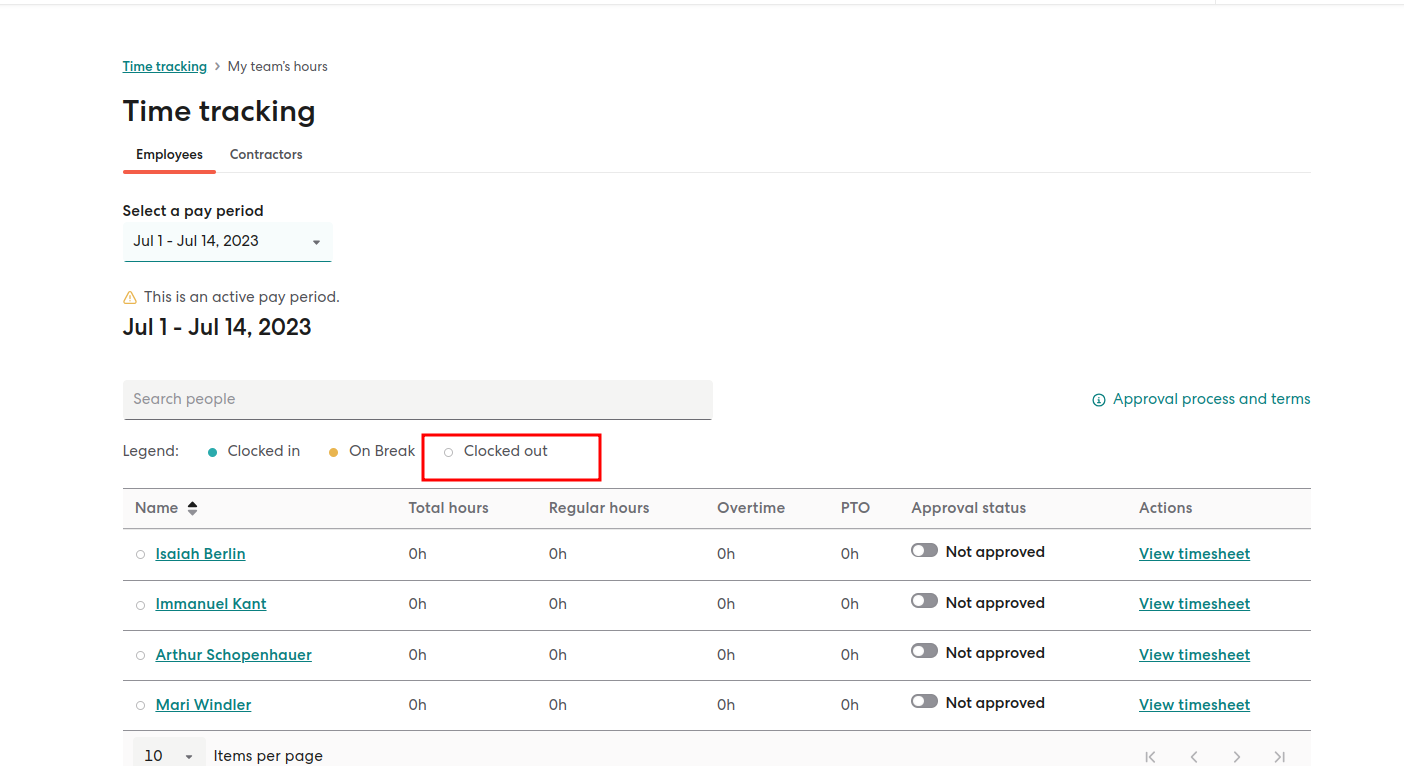

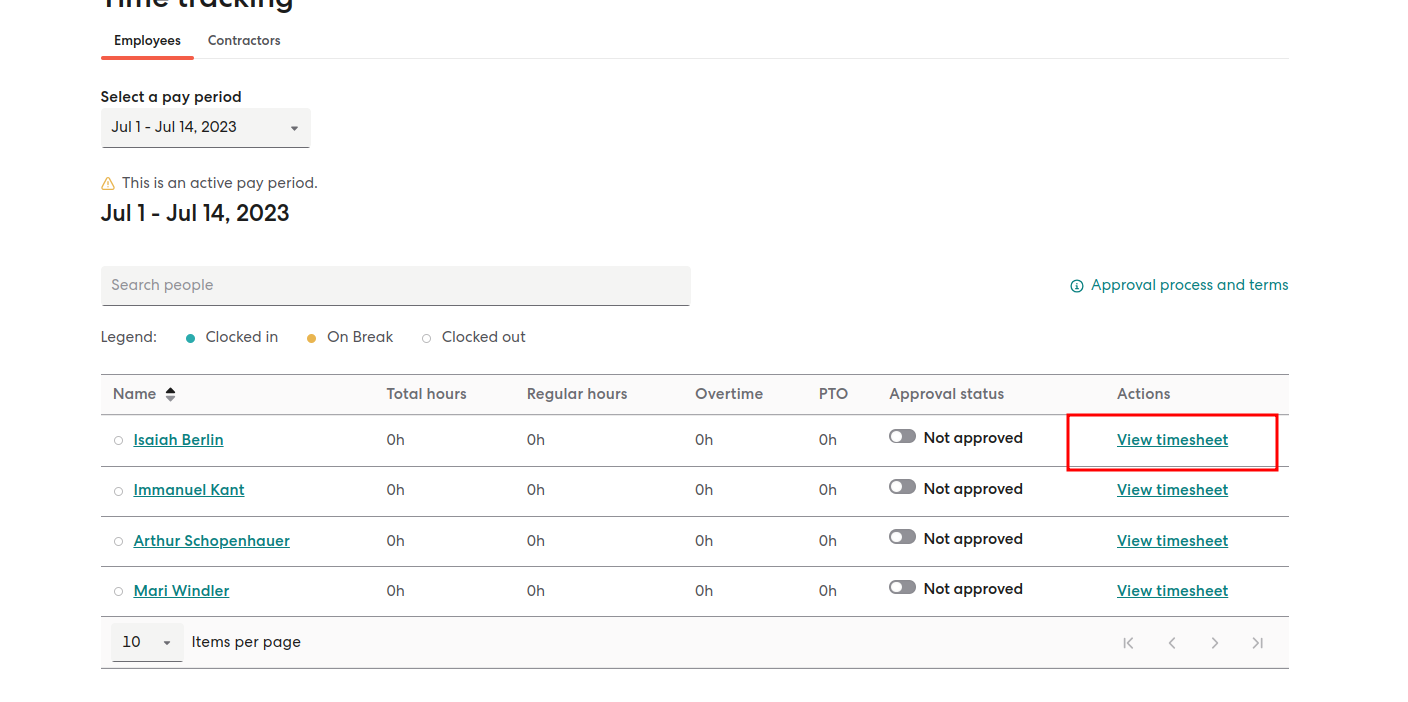

Time Tool Tab

The time tracking feature offers a wide range of customization options – Set Overtime Rules, Track Sick & Vacation Time and General Employee Work Hours. It in short makes it easy to manage employee time and ensure compliance with labor laws and regulations.

- The time clock feature is great for the employees that you pay on an hourly basis. As employees can log in and out of the Gusto web portal or mobile app. It is thus excellent for tracking the working hours of an employee.

- The self-service dashboard of the employees also lets them submit time-off requests, view pay stubs and access important tax documents.

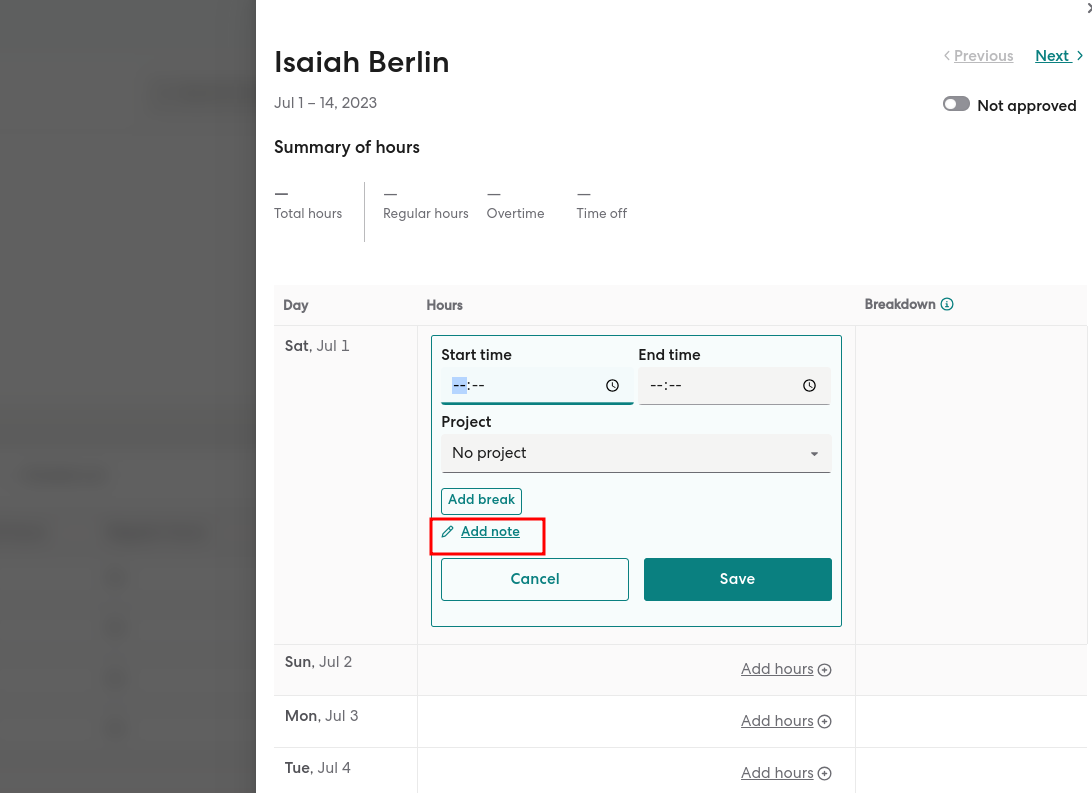

- For special situations, employees can add notes to their time punches to let their employers know, if they forget to clock in or out, were late to work, stayed late to work and covered a shift for some else.

The best thing to note is that the time tracking system is automatically connected to the payroll system, making it easy for the managers to review the hours. Once the hours are reviewed and checked out by the team managers, the report is further sent to the payroll manager.

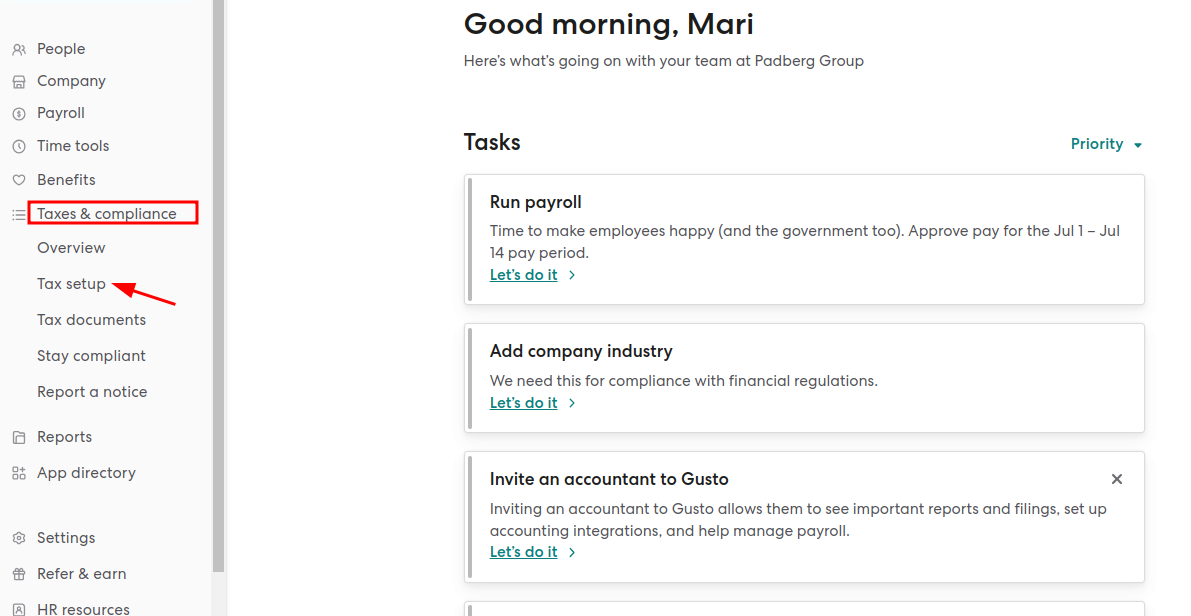

Tax Compliance Tab

Gusto uses advanced technology and automation systems that ensure that your payroll is always in compliance with all the taxes applied.

It automates the payroll, taxes and the tax filings of the employees –

All the payroll taxes – local, state and federal are calculated, filed and paid through automation.

Gusto issues and files the employees W-2s and 1099s and then sends it to the employees and the contractors.

Gusto automatically reports the government about the new employee in the organization.

We handle the filing of all federal, state, and local payroll tax forms for your company in a fully automated and paperless manner. This includes the following processes:

Submitting tax forms like (Form W-2, Form 940, Form 8974, Form 1099, Form 941, State and Local Tax) electronically to the respective authorities.

Utilizing electronic signatures for required documents.

Sending and receiving faxes electronically.

With these technologies, your payroll tax filing becomes seamless, efficient, and environmentally friendly.

Reports Tab

Gusto’s reporting feature provides valuable insights for your business by offering a combination of powerful custom report building and a diverse range of pre-made reports. Here are the key highlights:

- User-friendly report building: Gusto offers a user-friendly interface for creating reports.

- Flexibility: You have the flexibility to create various types of reports to suit your business needs.

With Gusto’s reporting capabilities, you can gather crucial information and generate reports tailored to your specific requirements.

These reports provide valuable insights and information to help you effectively manage your business processes.

Customer Support Tab

Gusto’s customer support team is available to assist you through phone and email. Phone support operates from 12pm to 5pm EST, Monday through Friday. Email responses typically require a few business days.

In addition to customer support, Gusto provides a range of valuable secondary resources. These include business calculators, checklists, a help center, and an accountant directory. These resources are designed to provide practical assistance and support your company’s growth.

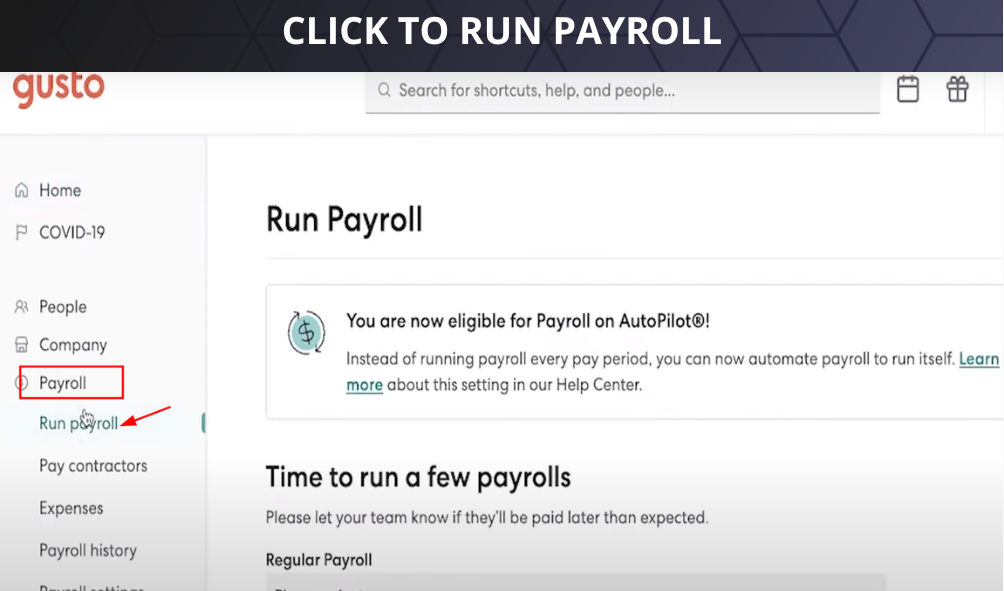

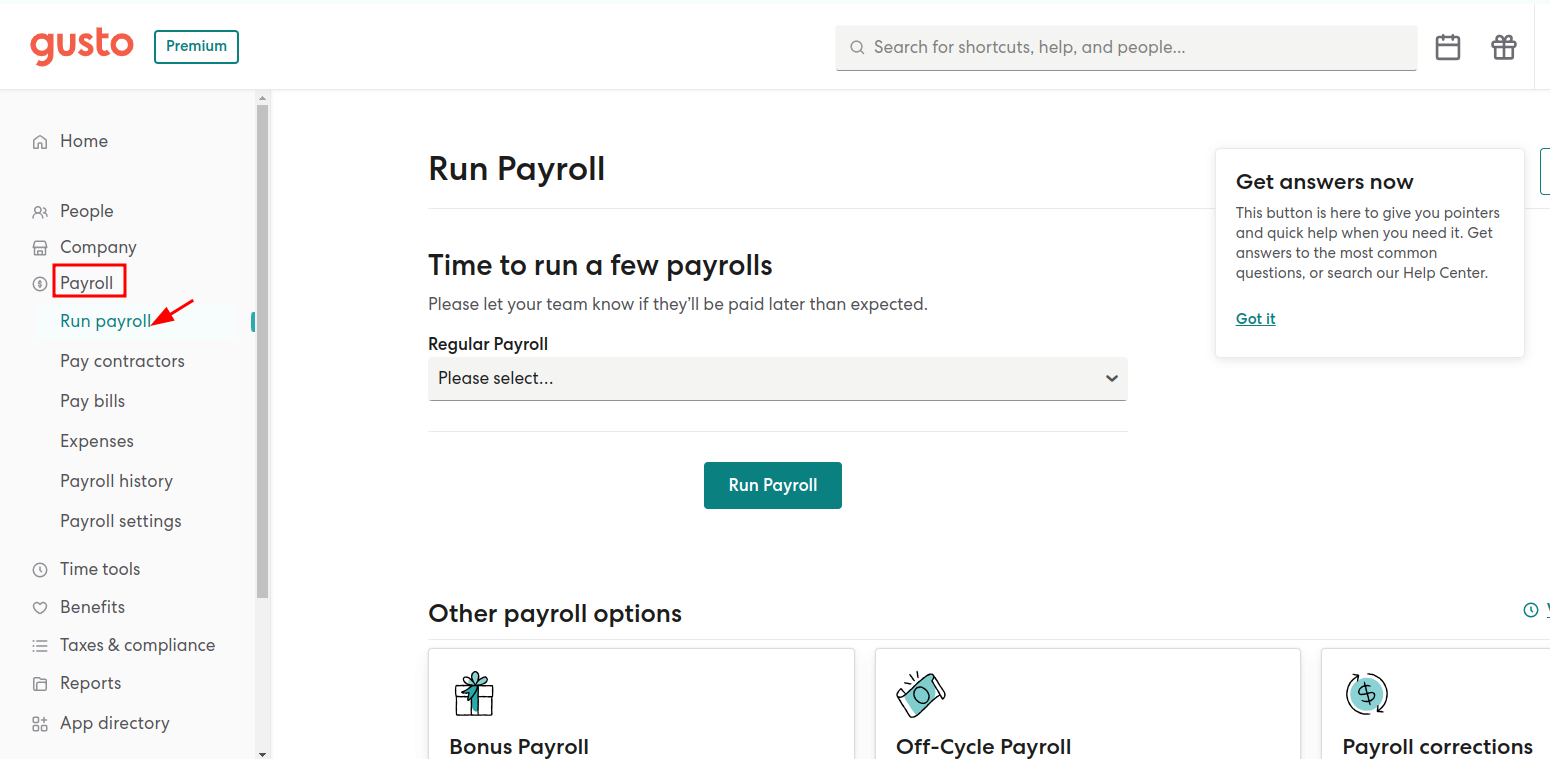

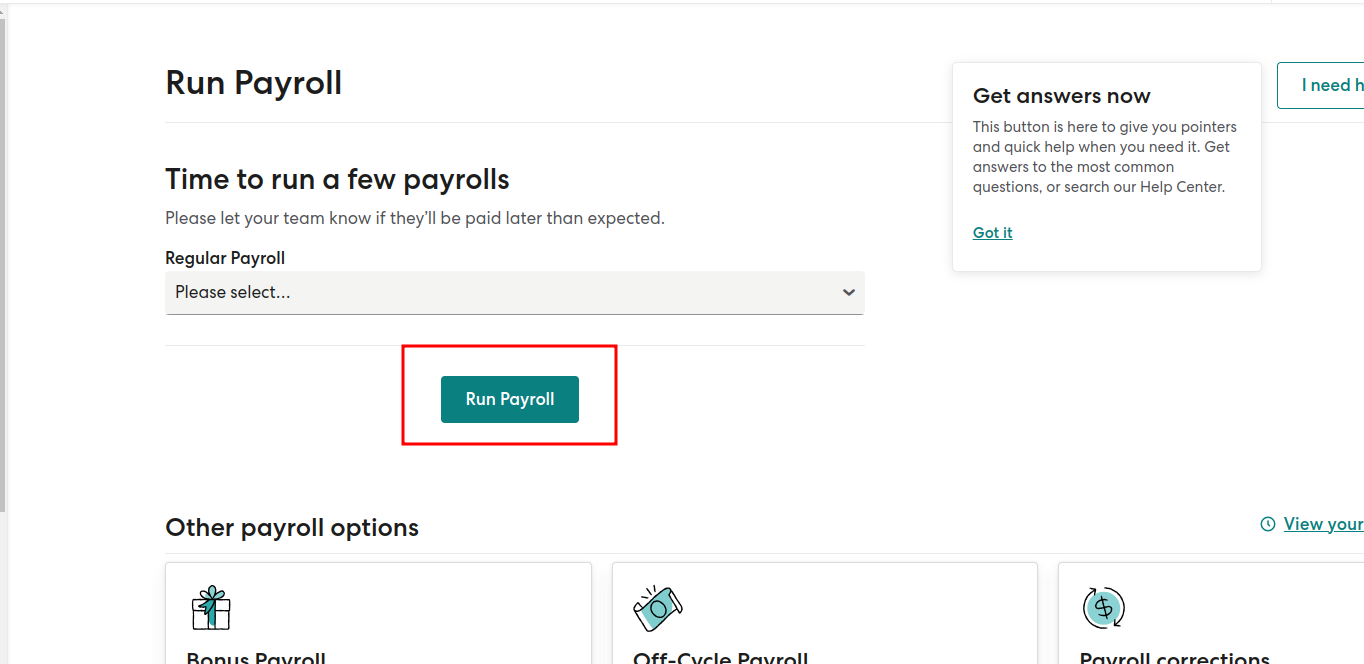

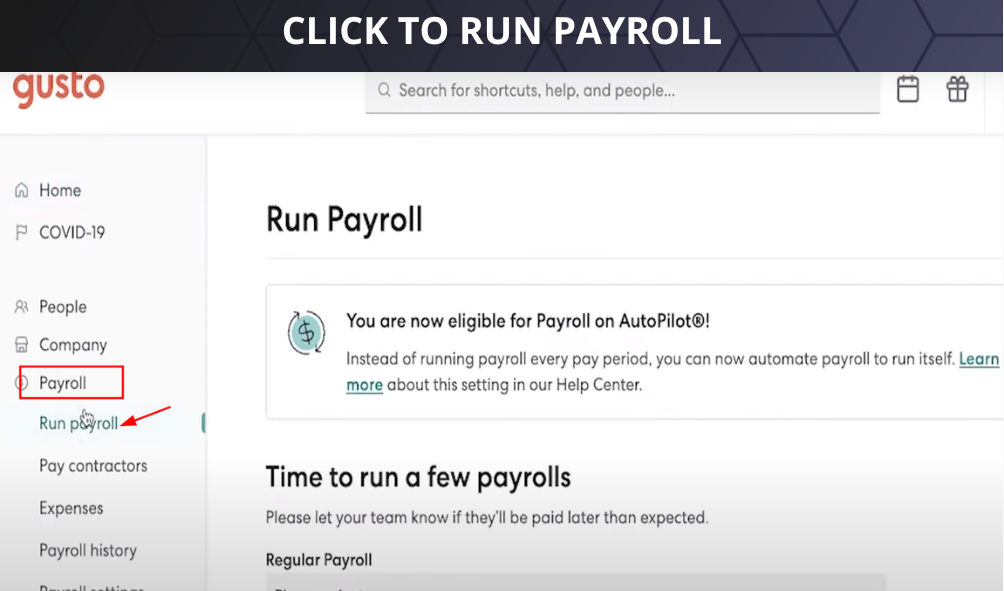

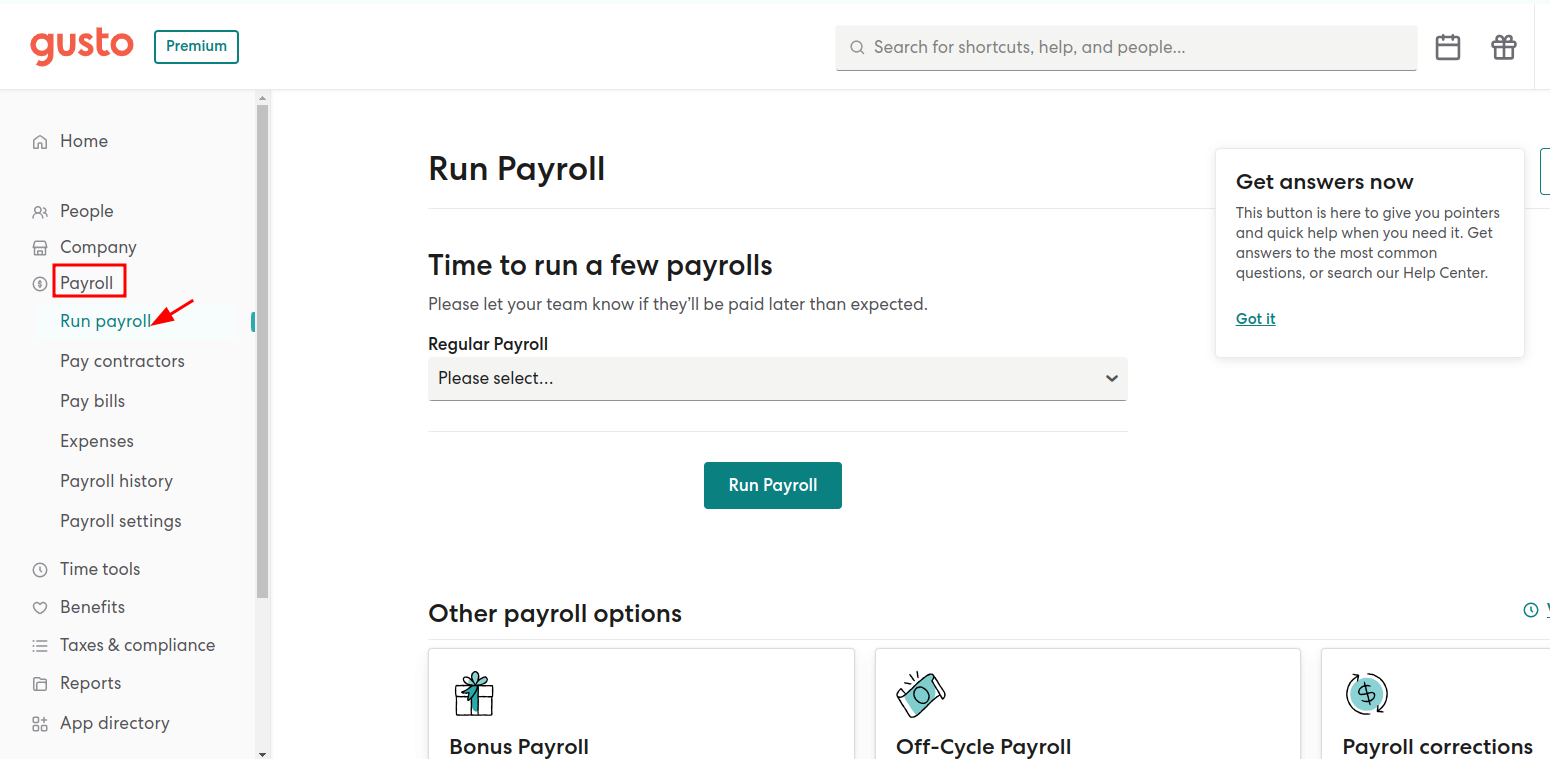

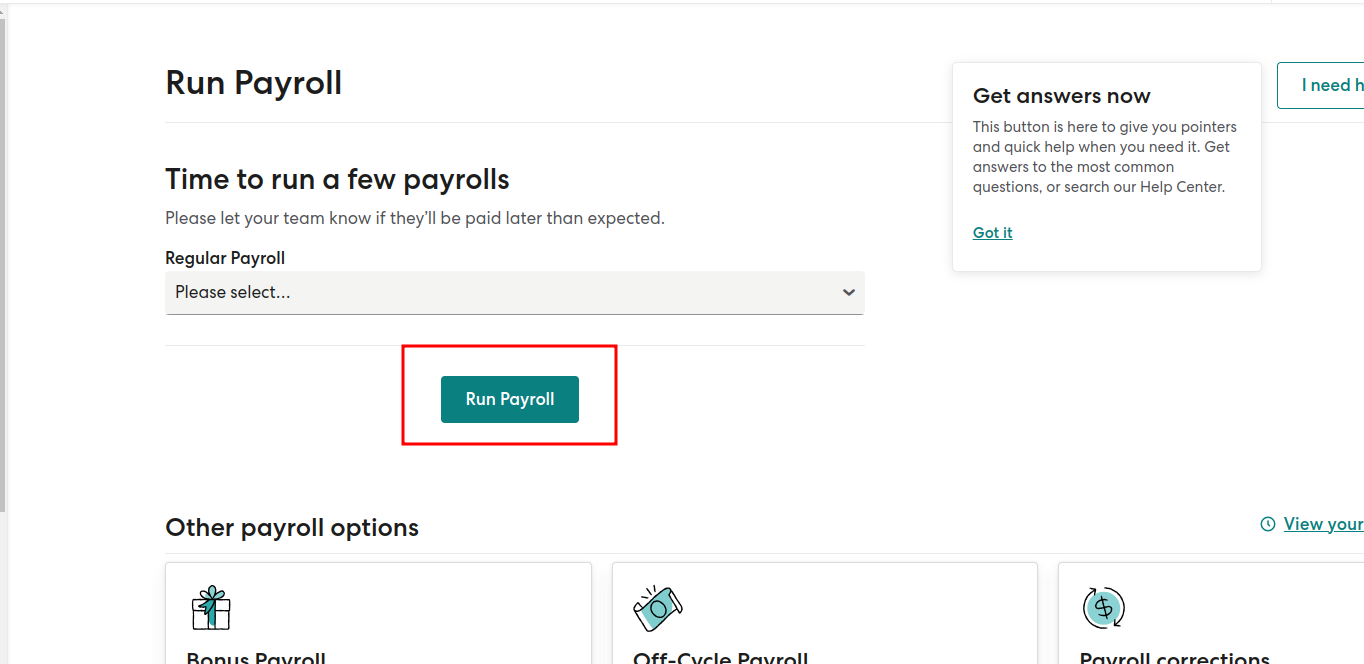

How To Run Payroll In Gusto?

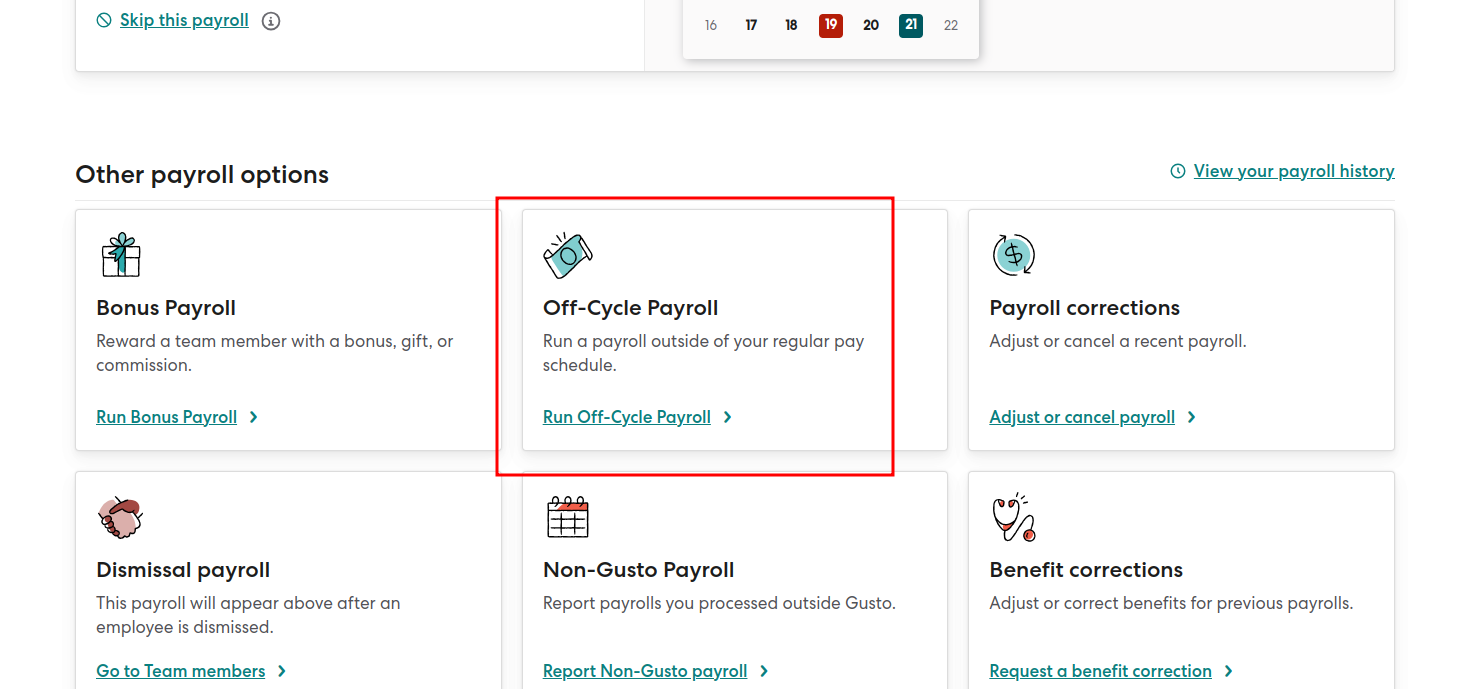

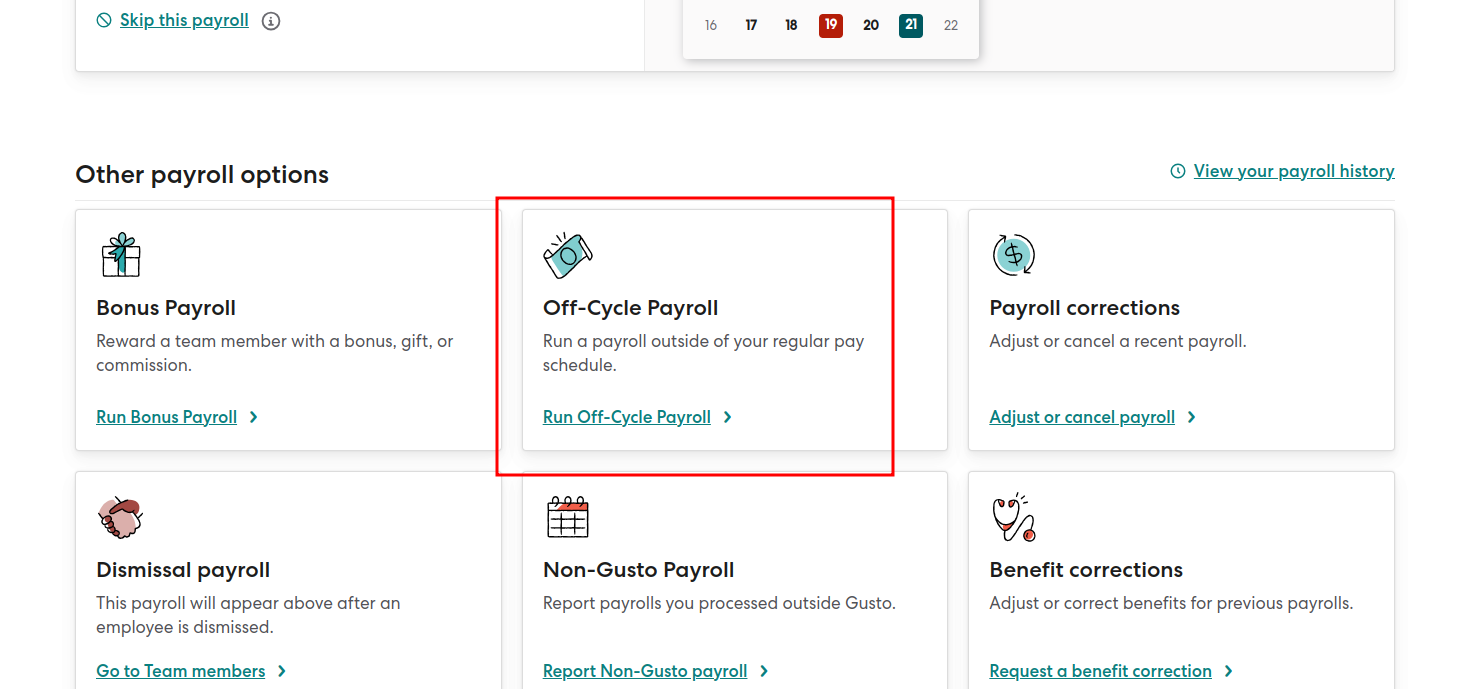

If you find yourself in a situation where you need to modify the dates of your company’s pay period or run multiple payrolls simultaneously with your regular payroll, the solution is to opt for an off-cycle payroll. This allows you to make the necessary adjustments without disrupting your regular payroll process. On the other hand, if you need to alter your pay schedule for the regular payroll, you can proceed in the blog to learn to make the necessary changes.

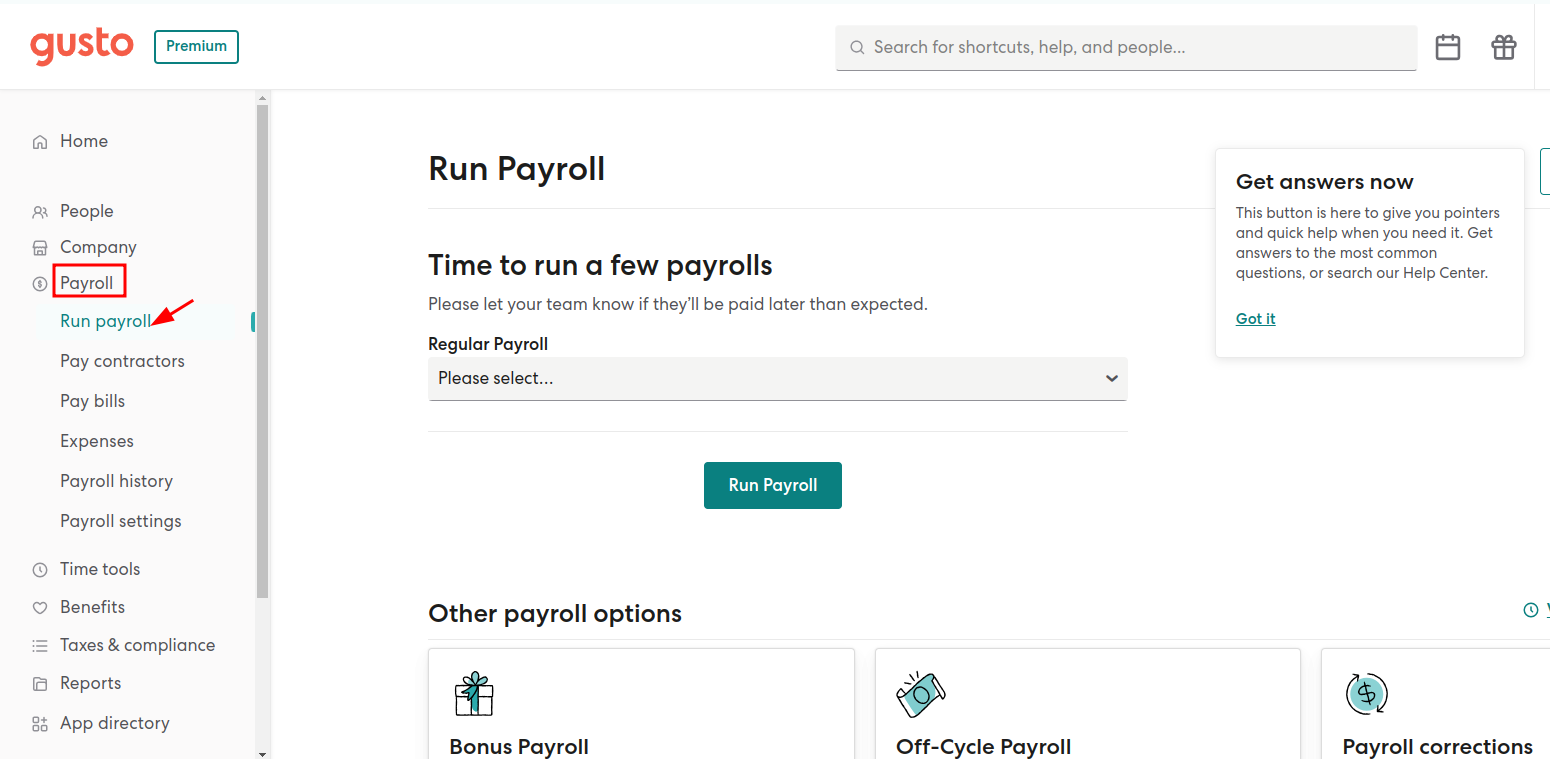

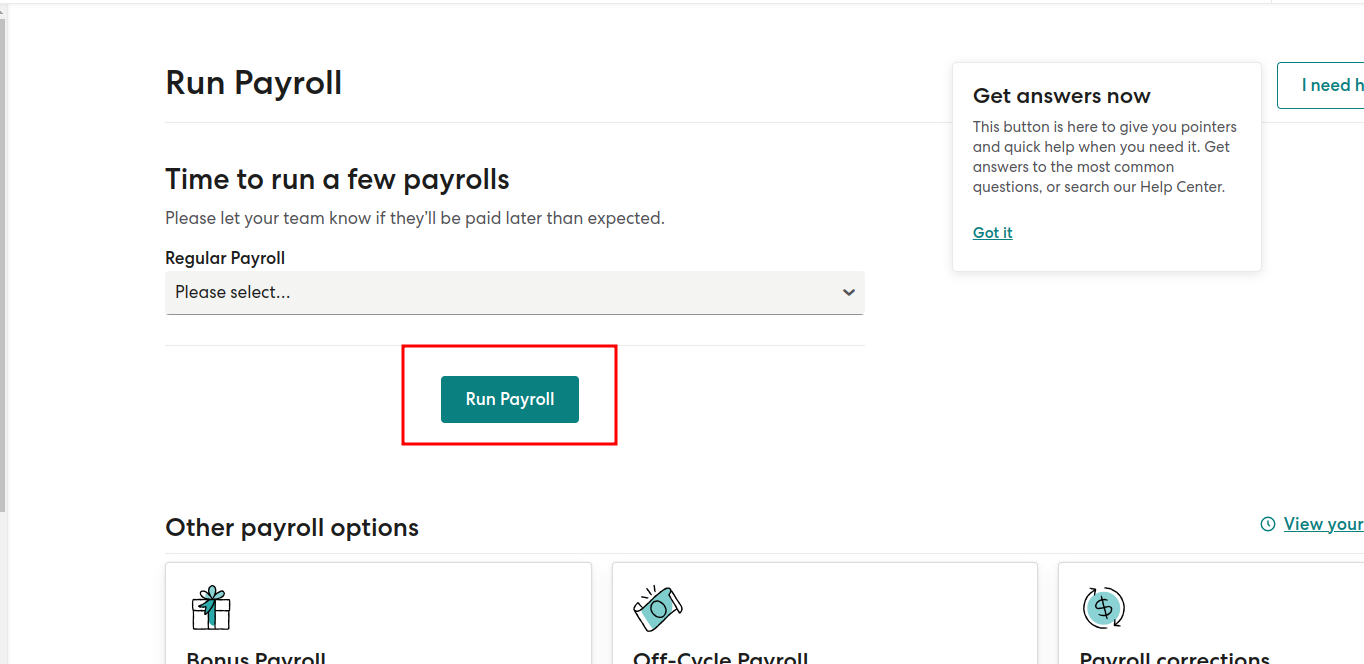

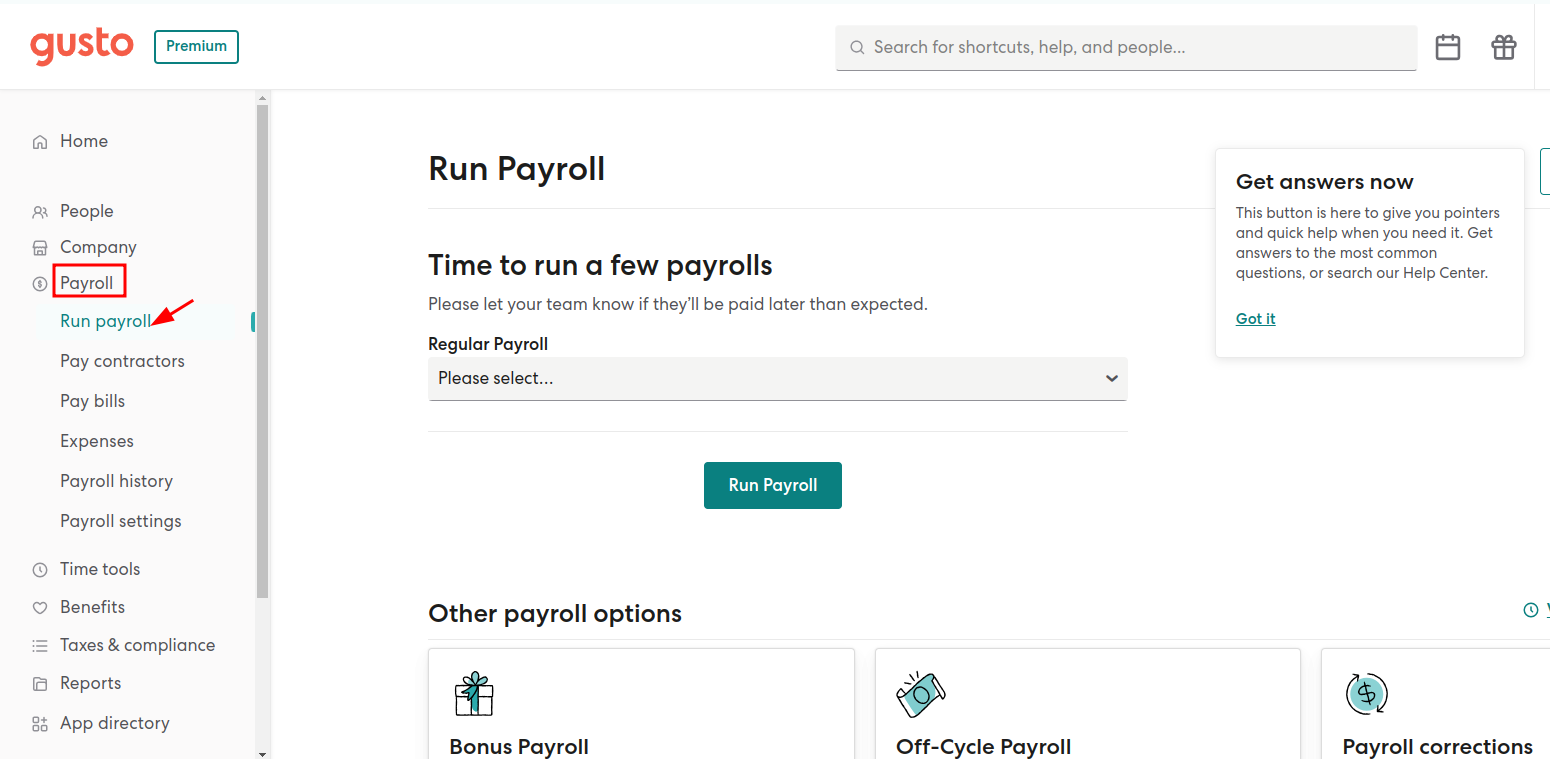

Run A Regular Payroll

To automate your company’s payroll according to the established pay schedule, simply enable Autopilot. Follow these steps:

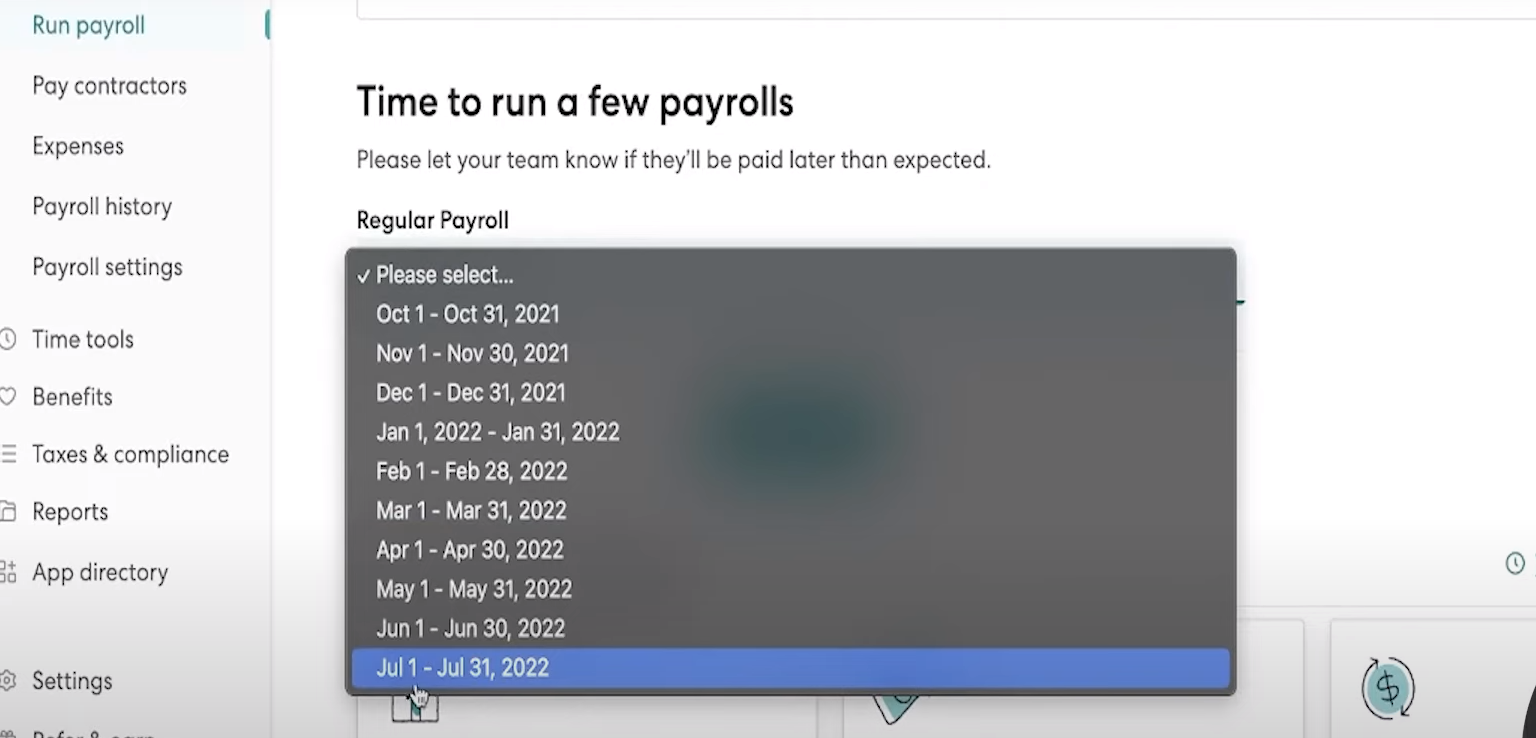

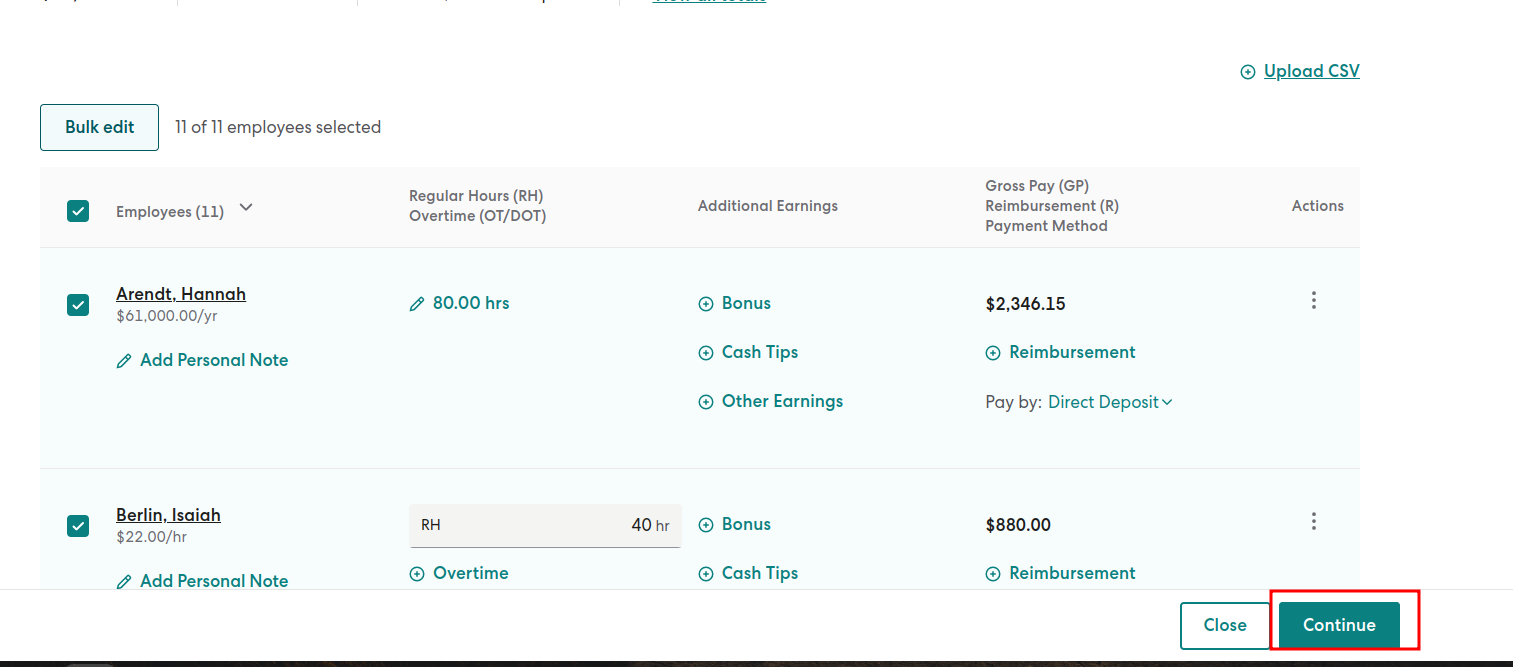

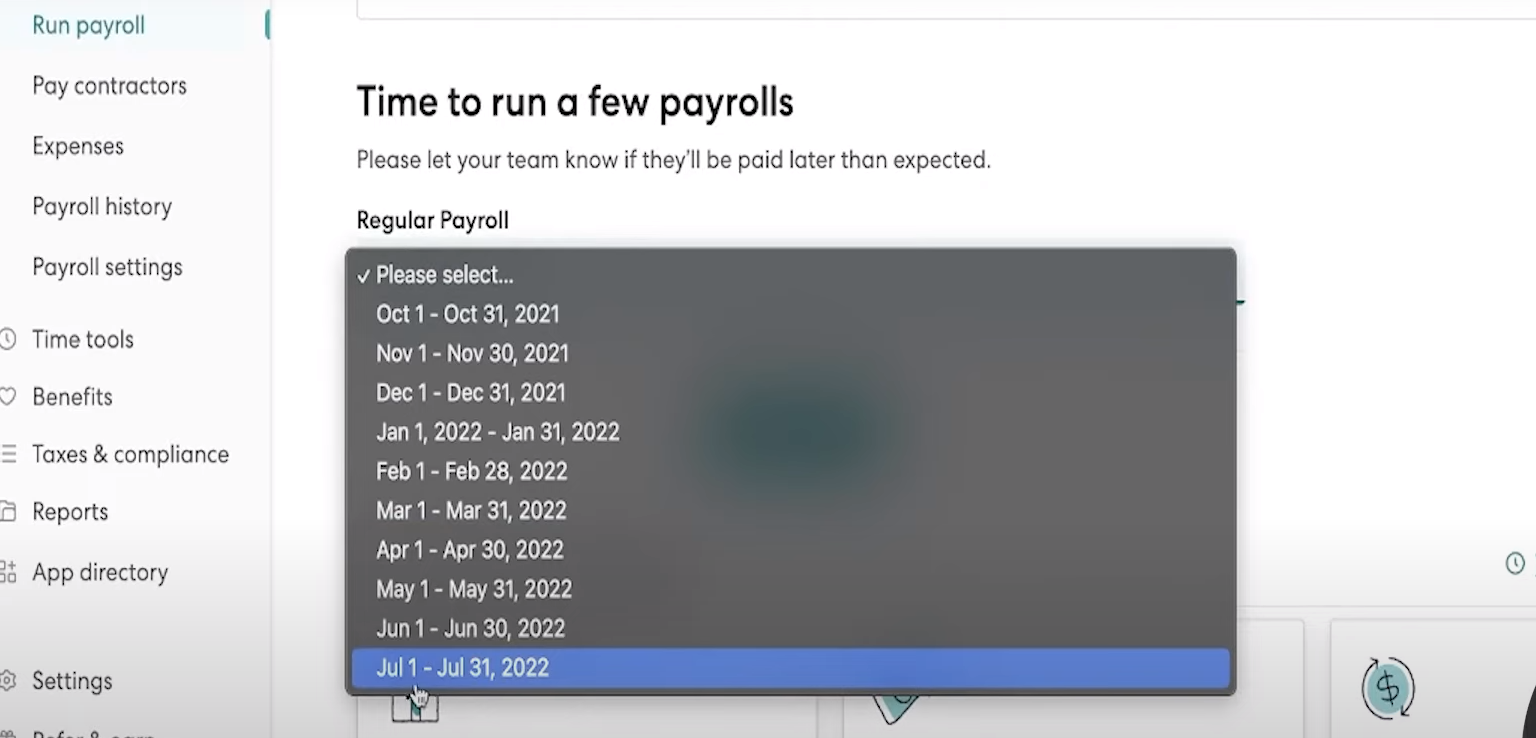

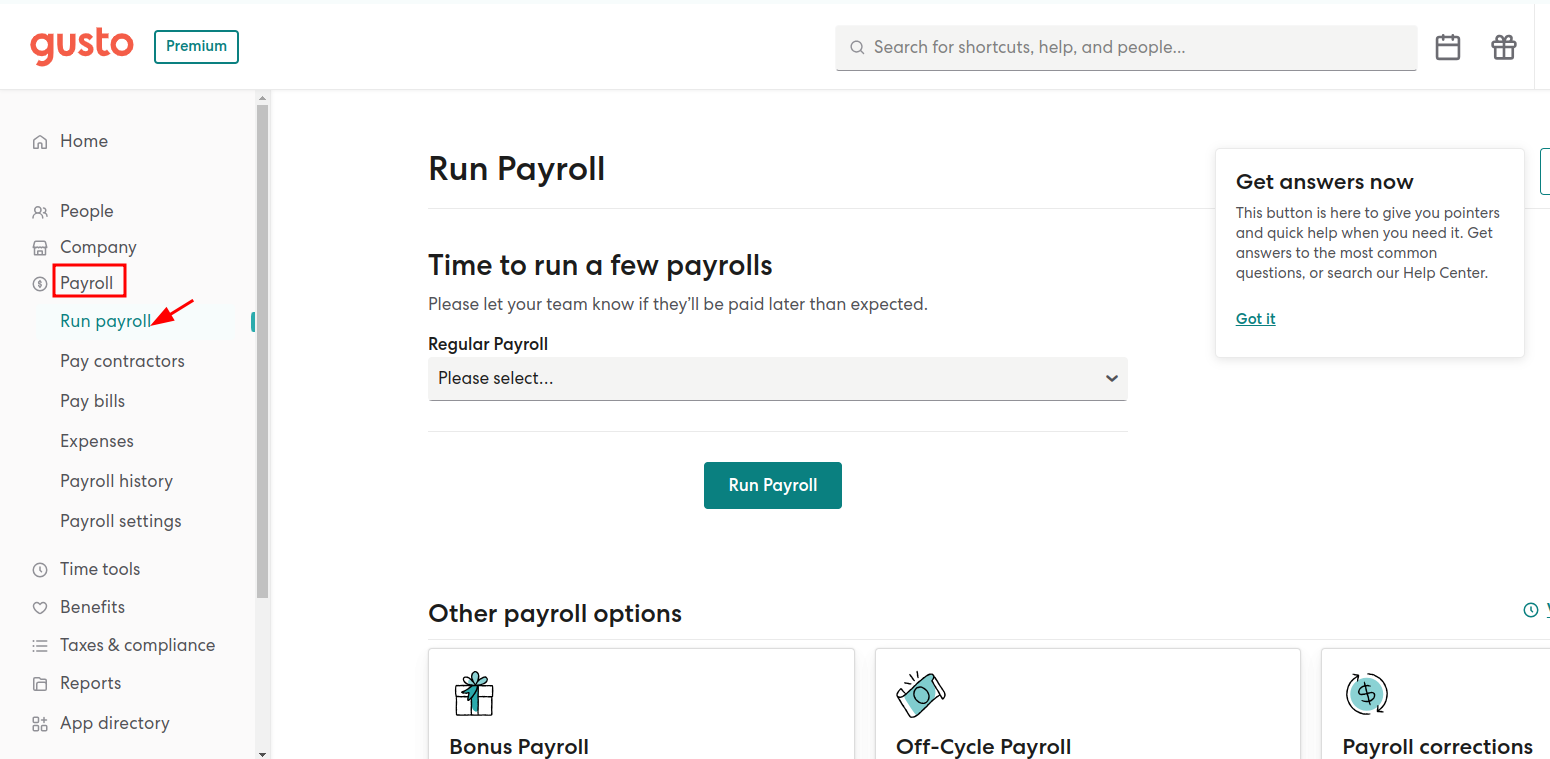

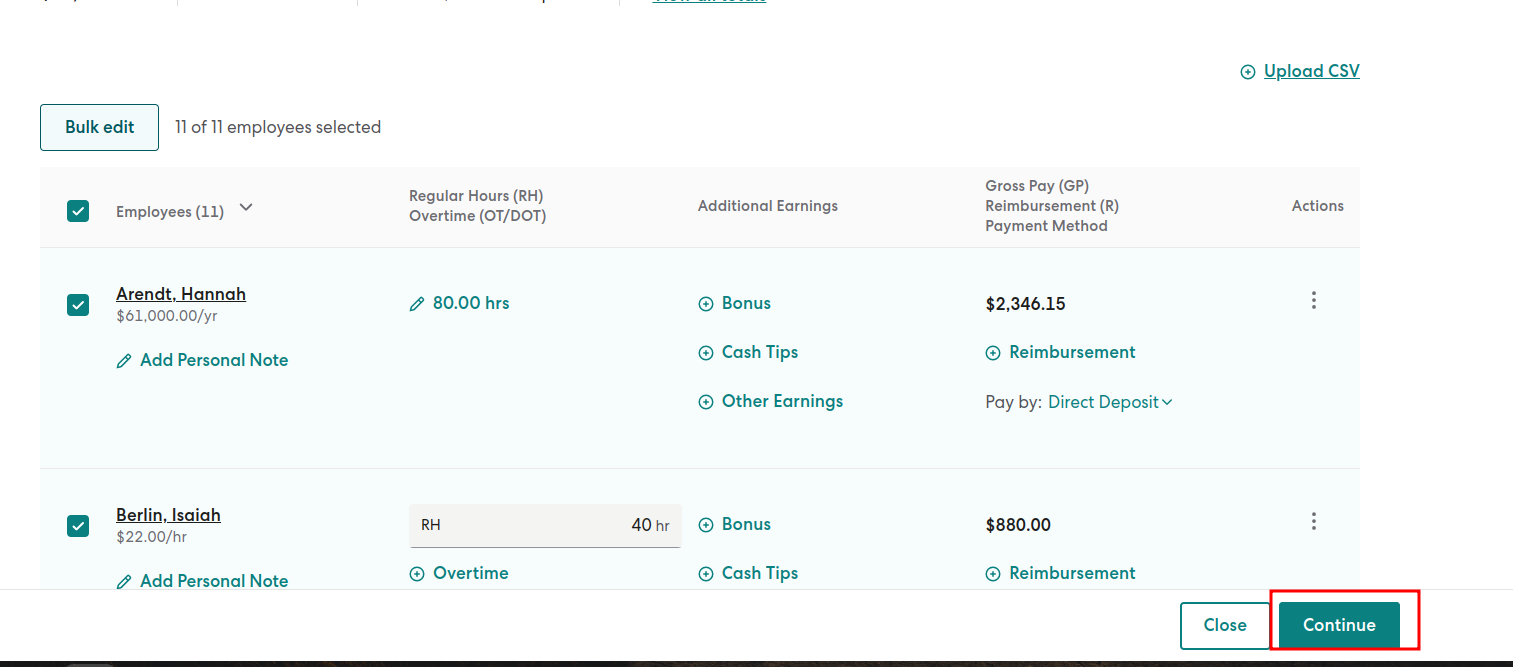

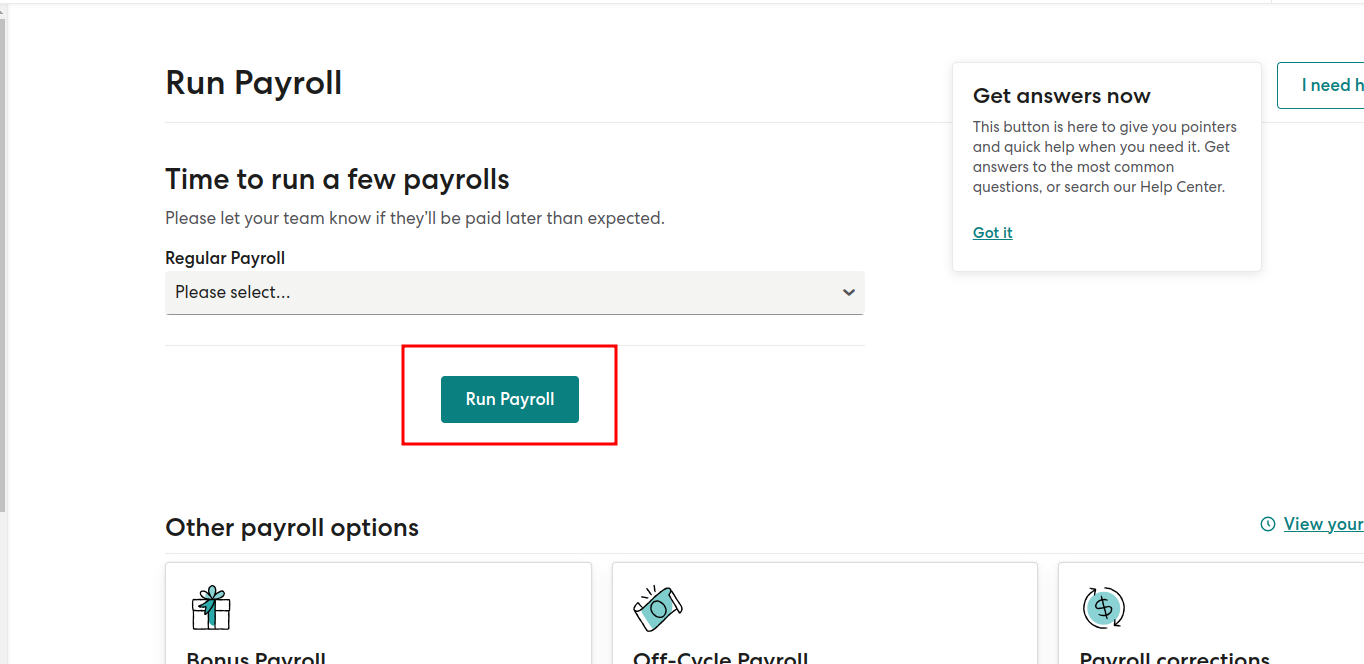

- Navigate to the Payroll section and click on “Run payroll.”

- Select the desired pay period and click “Run payroll.

- The check date displayed at the top corner of the screen indicates the expected date for direct-deposit payments.

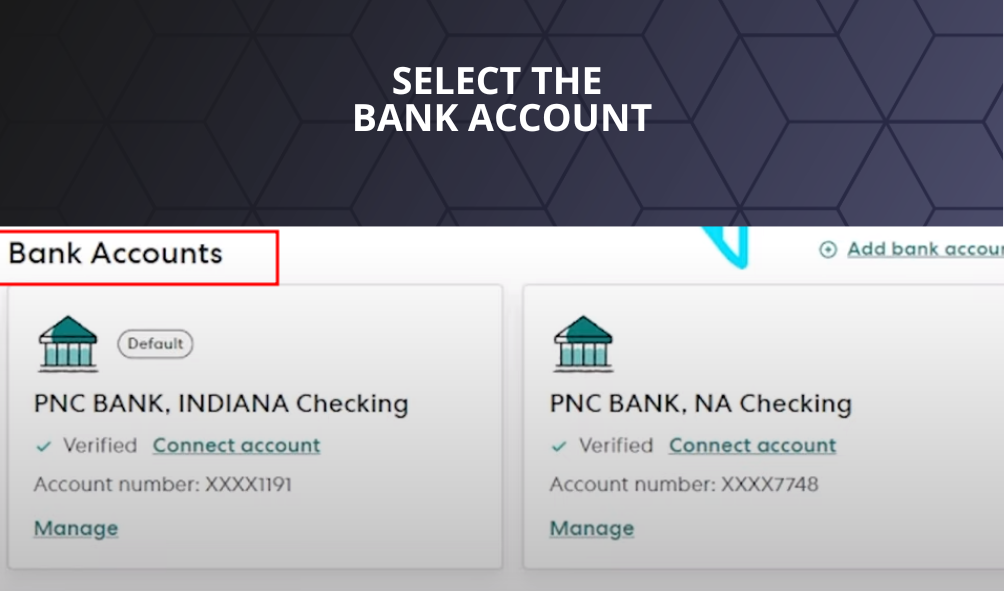

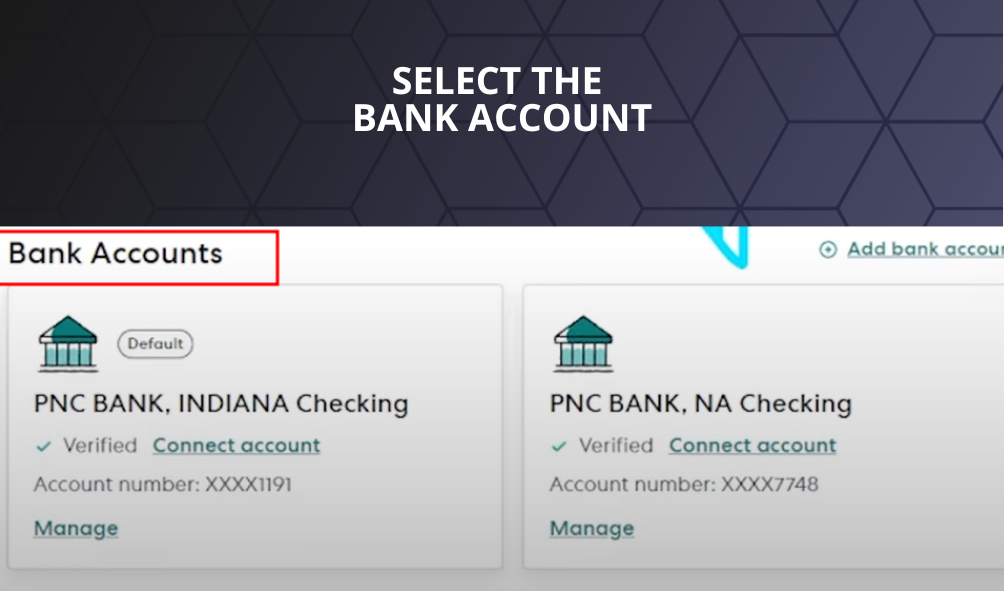

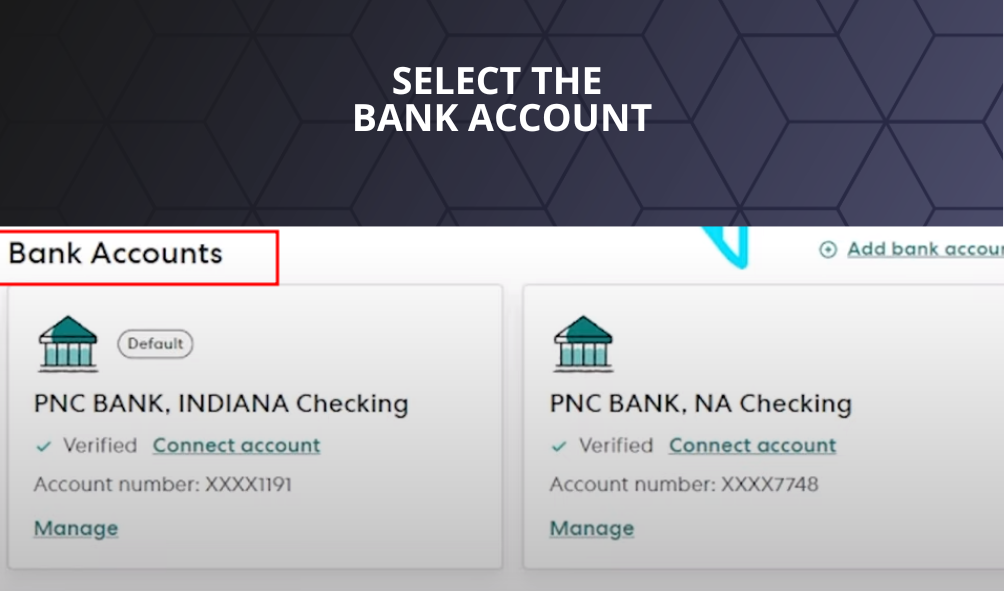

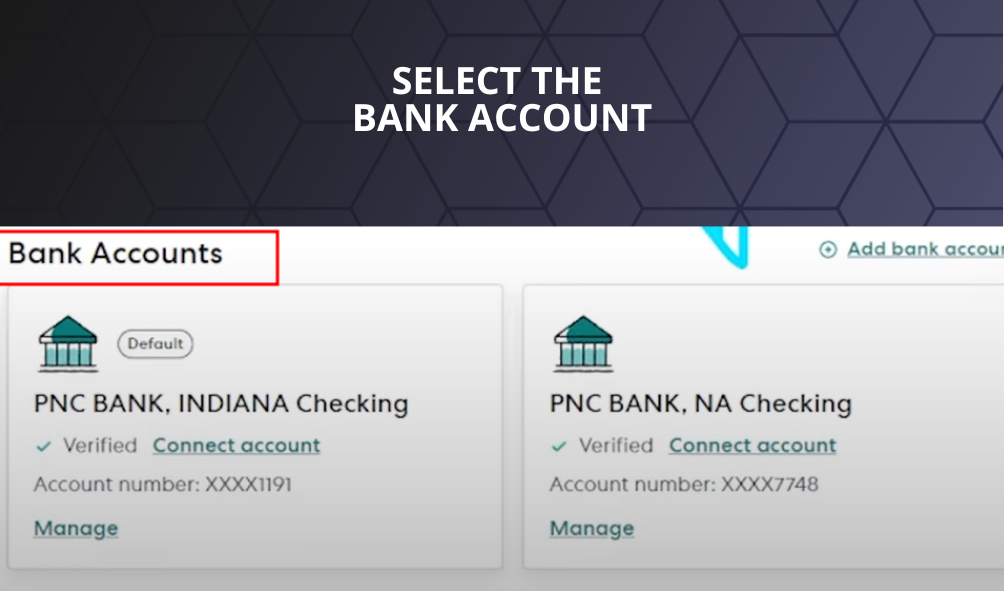

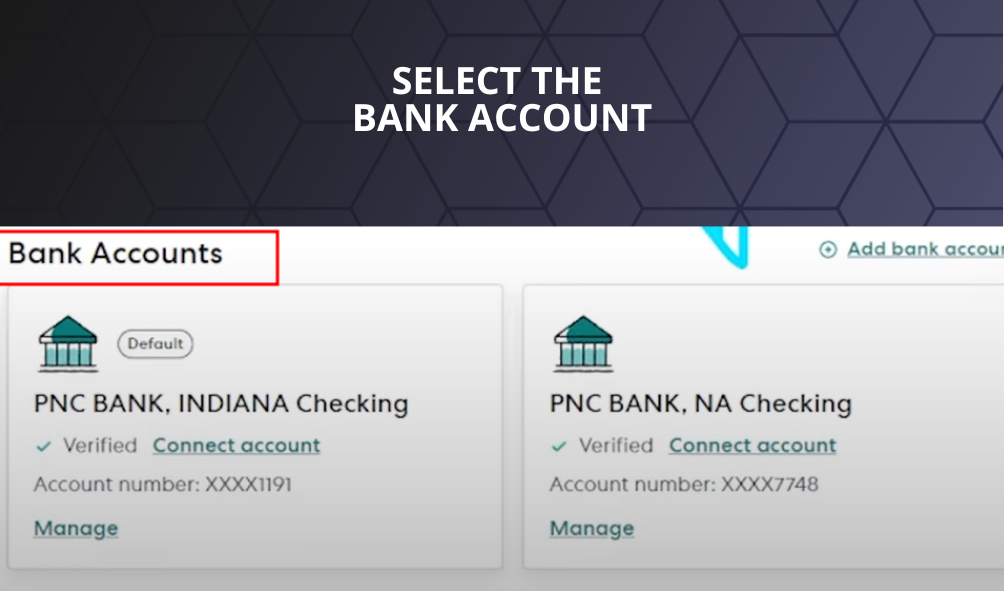

- If you use multiple bank accounts at the same time, choose the account from which you wish to process payroll.

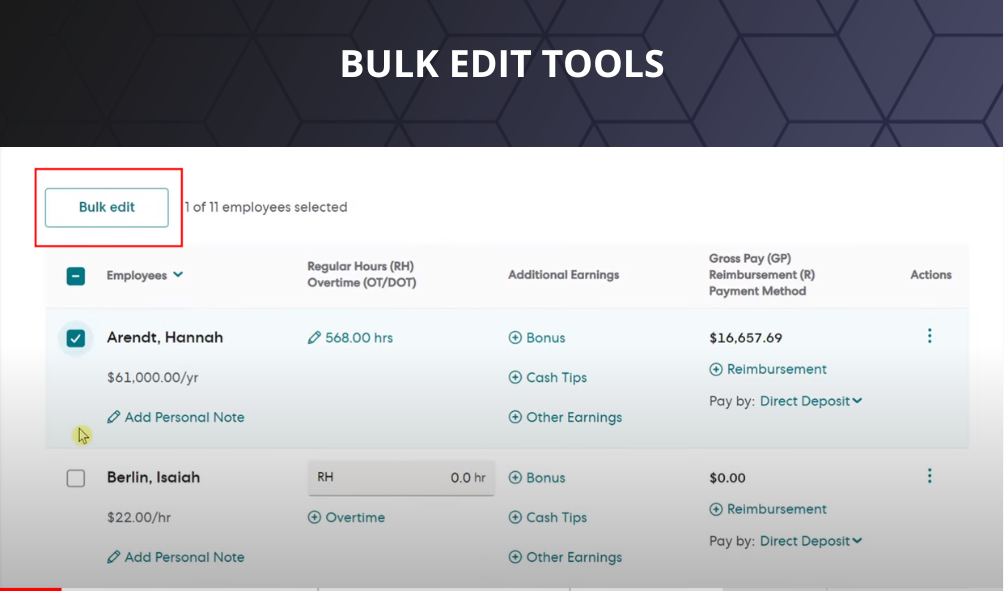

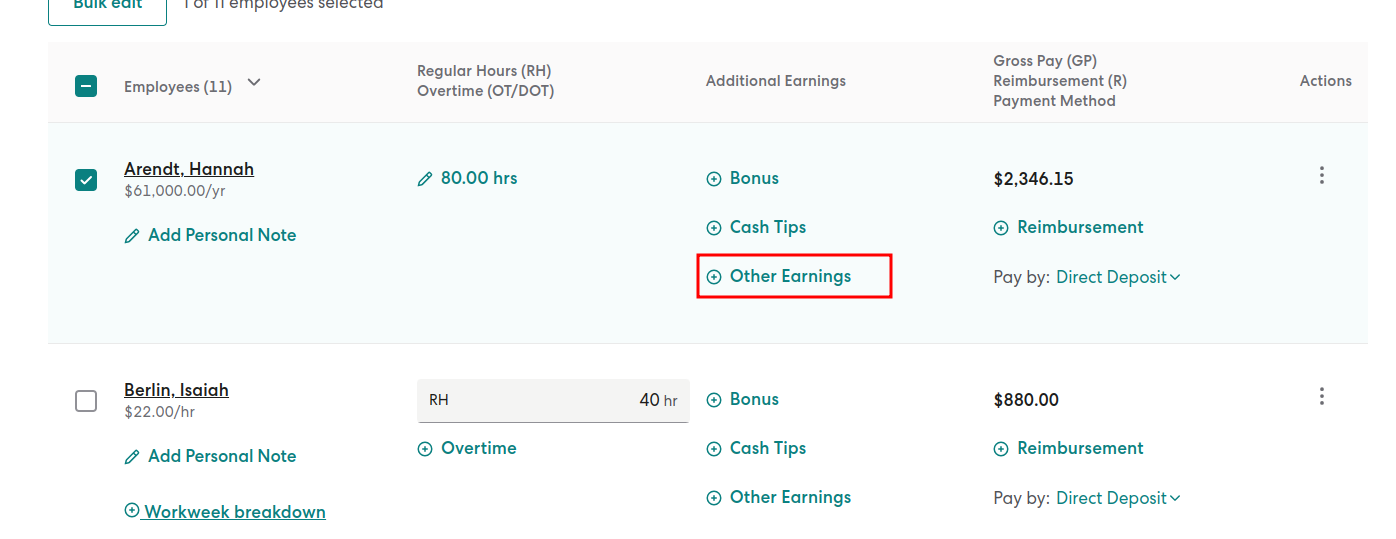

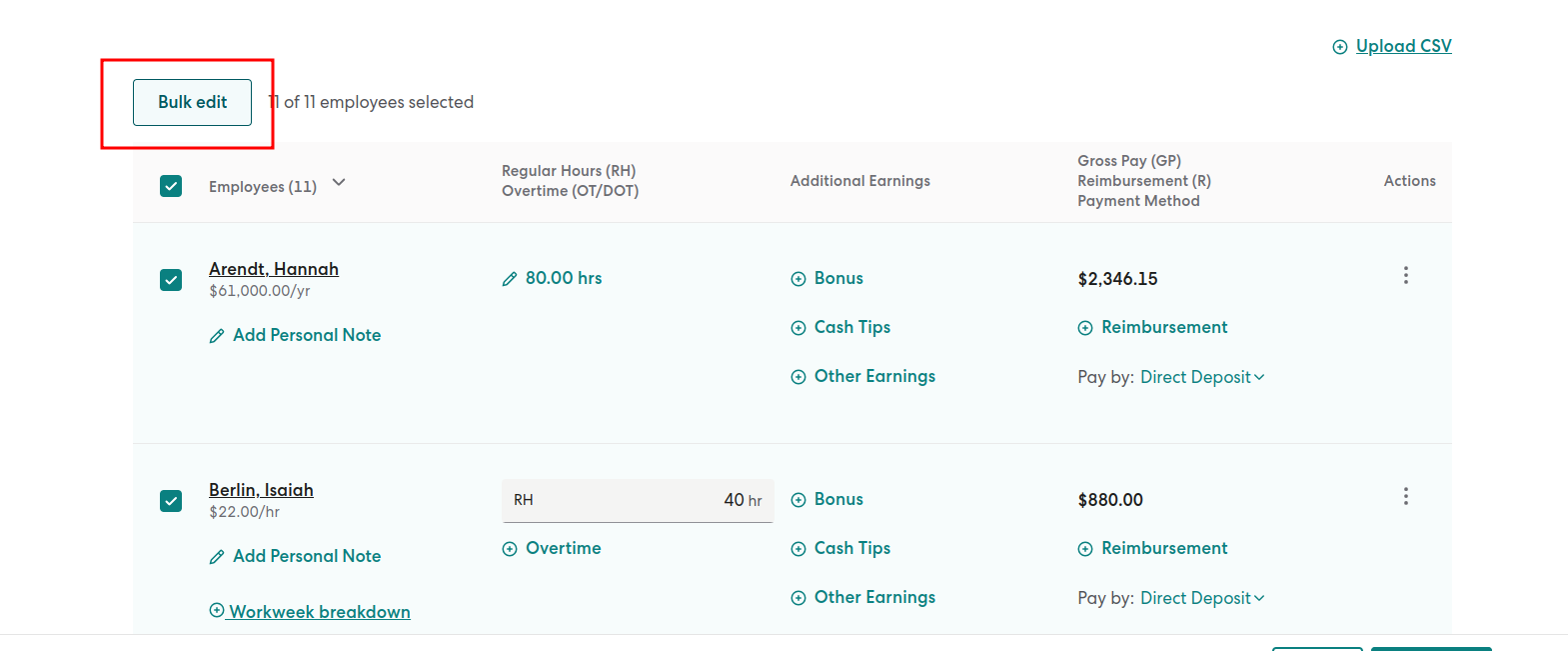

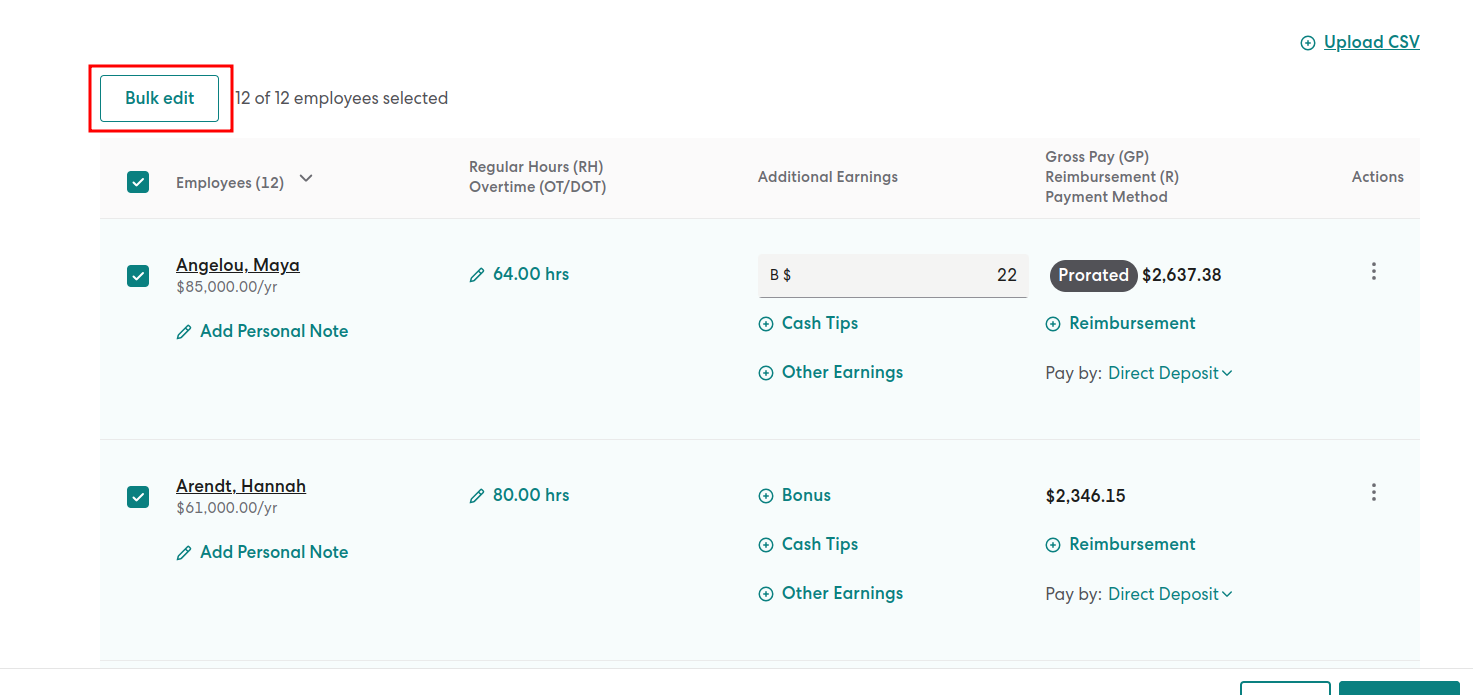

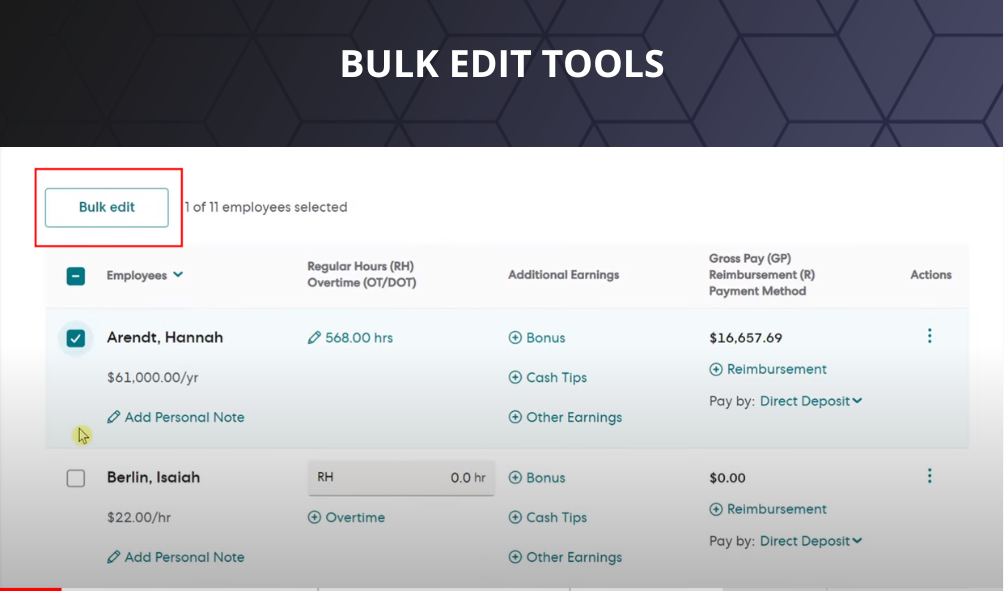

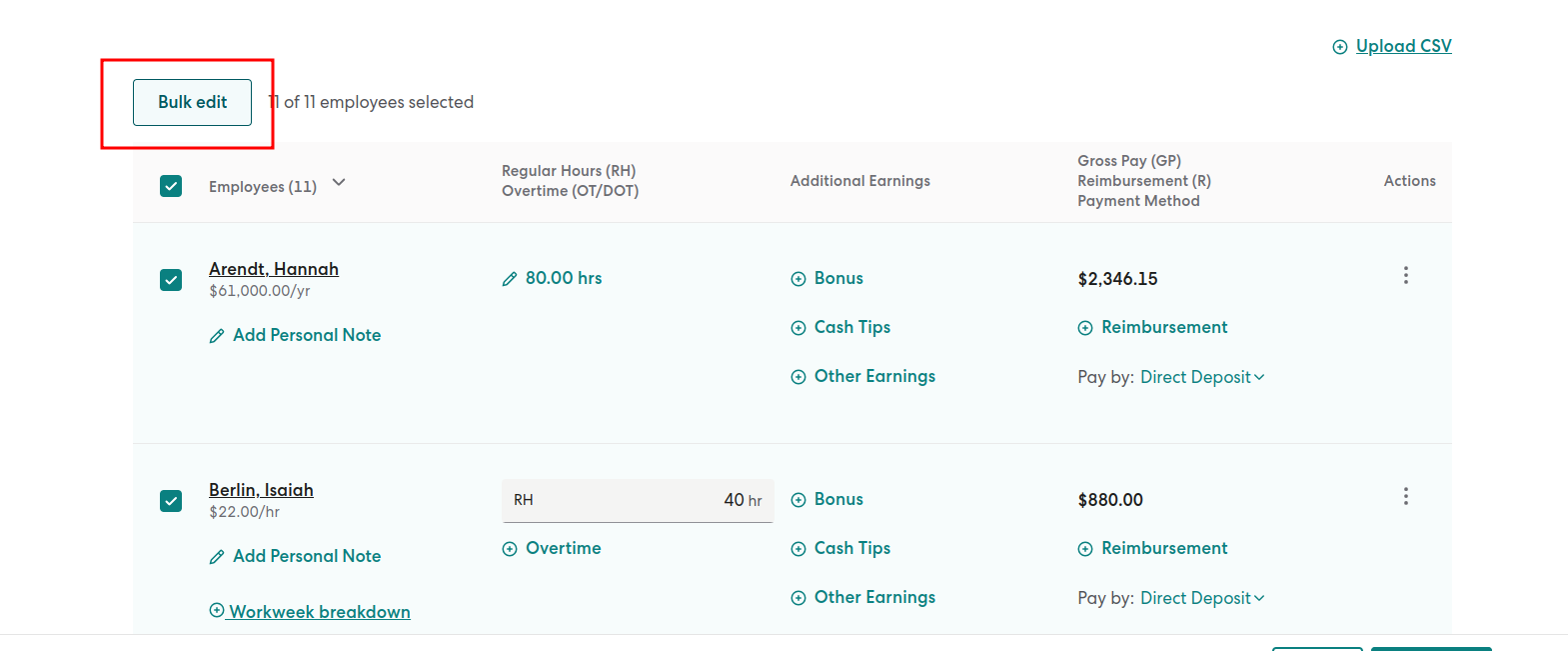

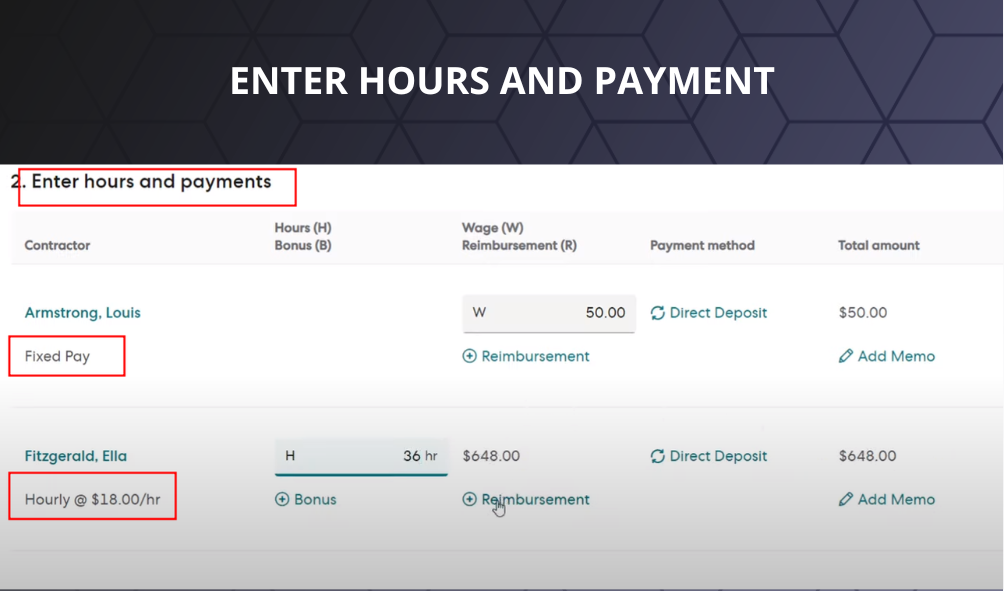

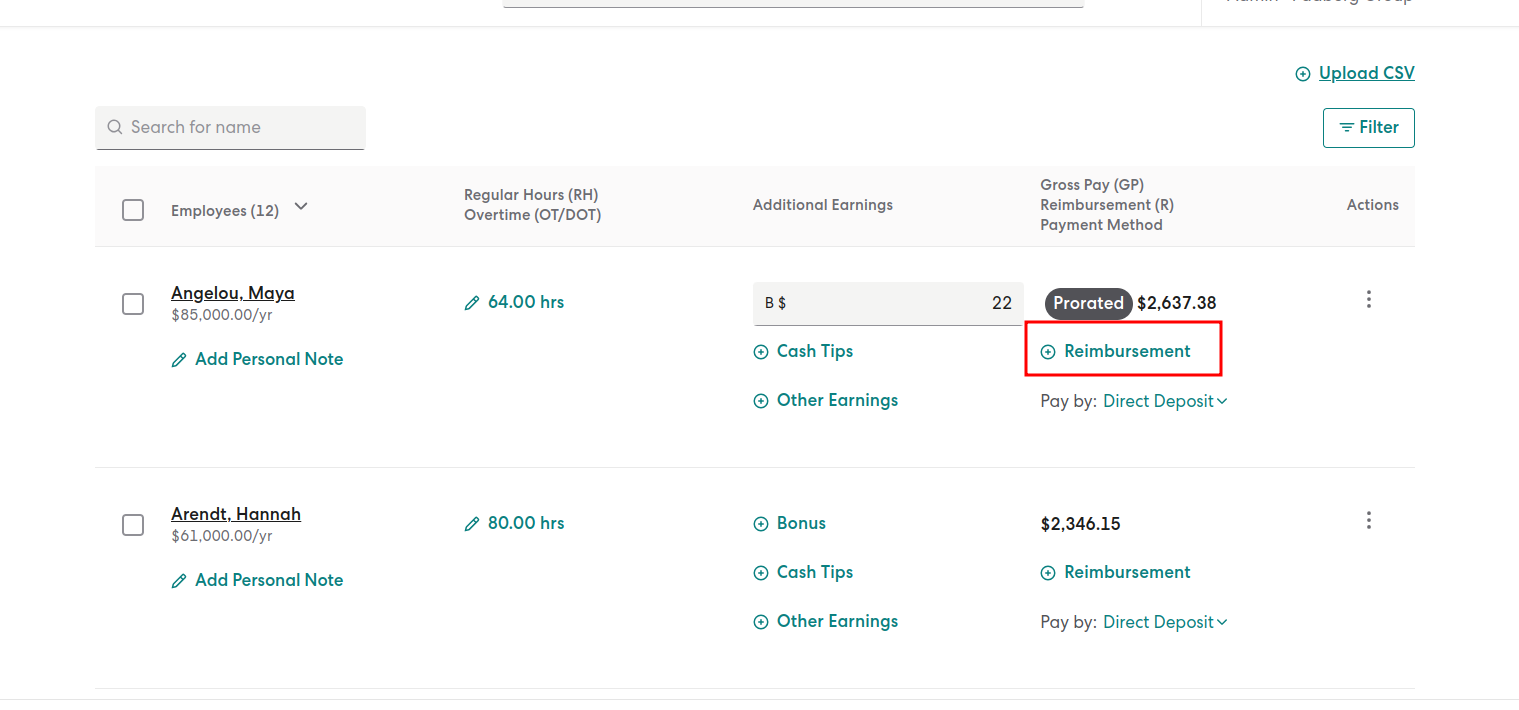

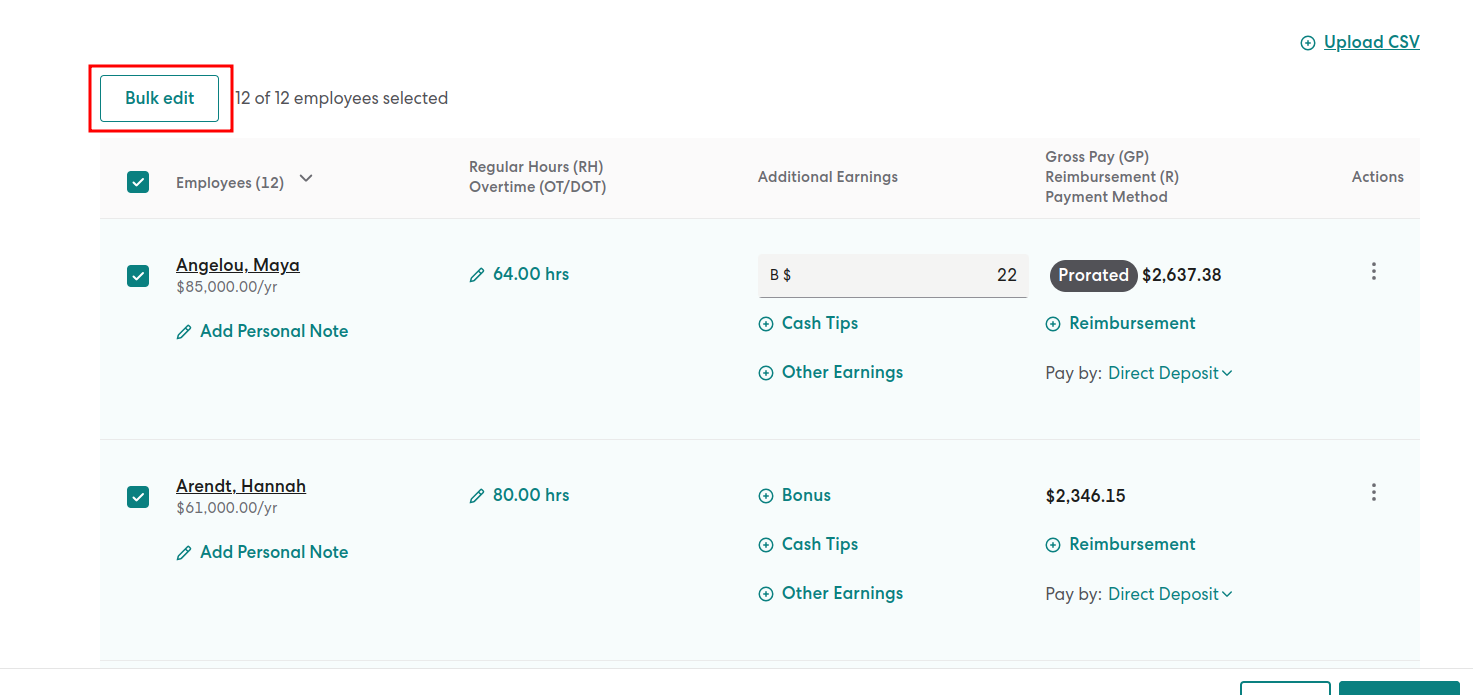

- If needed, make adjustments to salaries or hours worked using our search, sort, filter, and bulk edit tools, particularly if you have multiple employees.

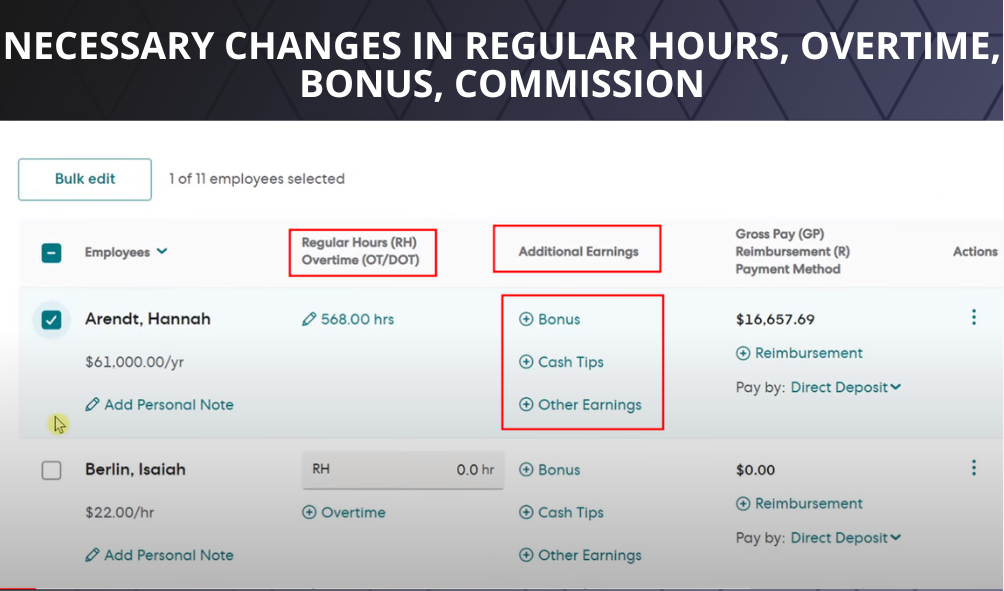

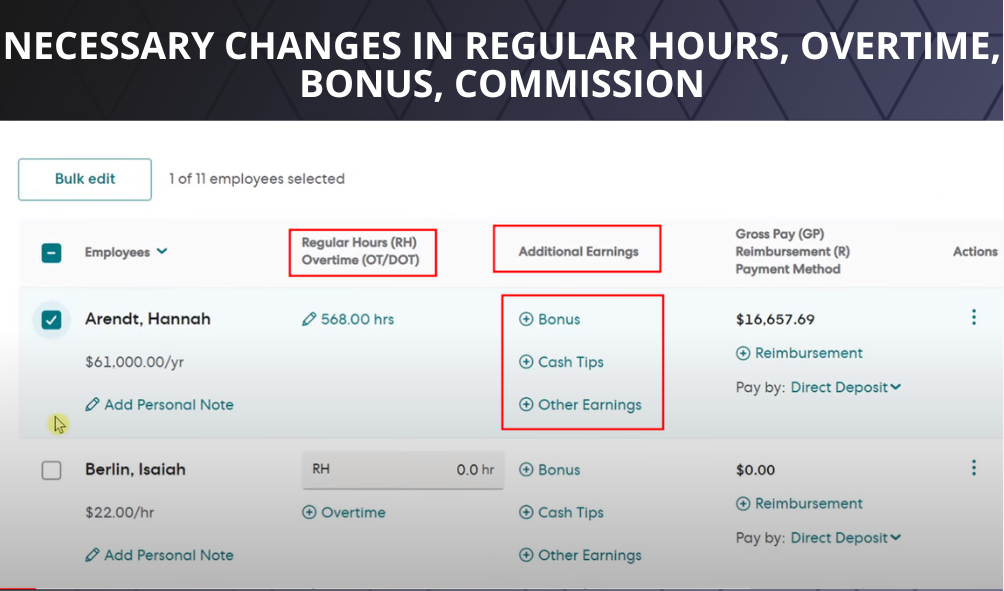

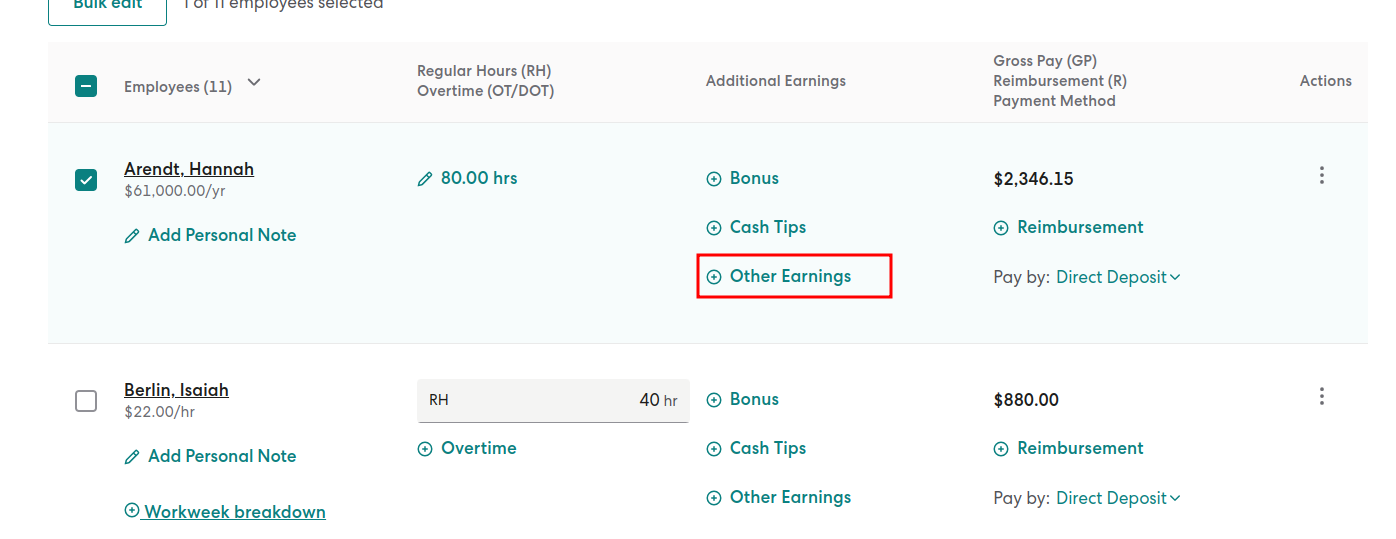

- Click on the respective fields for regular hours, overtime, bonus, commission, or other earnings to make any necessary changes.

- Pay rates are sourced from the employee’s People page.

- If the pay rate appears different during the Run Payroll process compared to the employee’s pay settings, it is likely that the pay rate is not configured as hourly but rather per week, month, or year. In such cases, the system will prorate the amount, for example, converting $15/week to $0.37/hr.

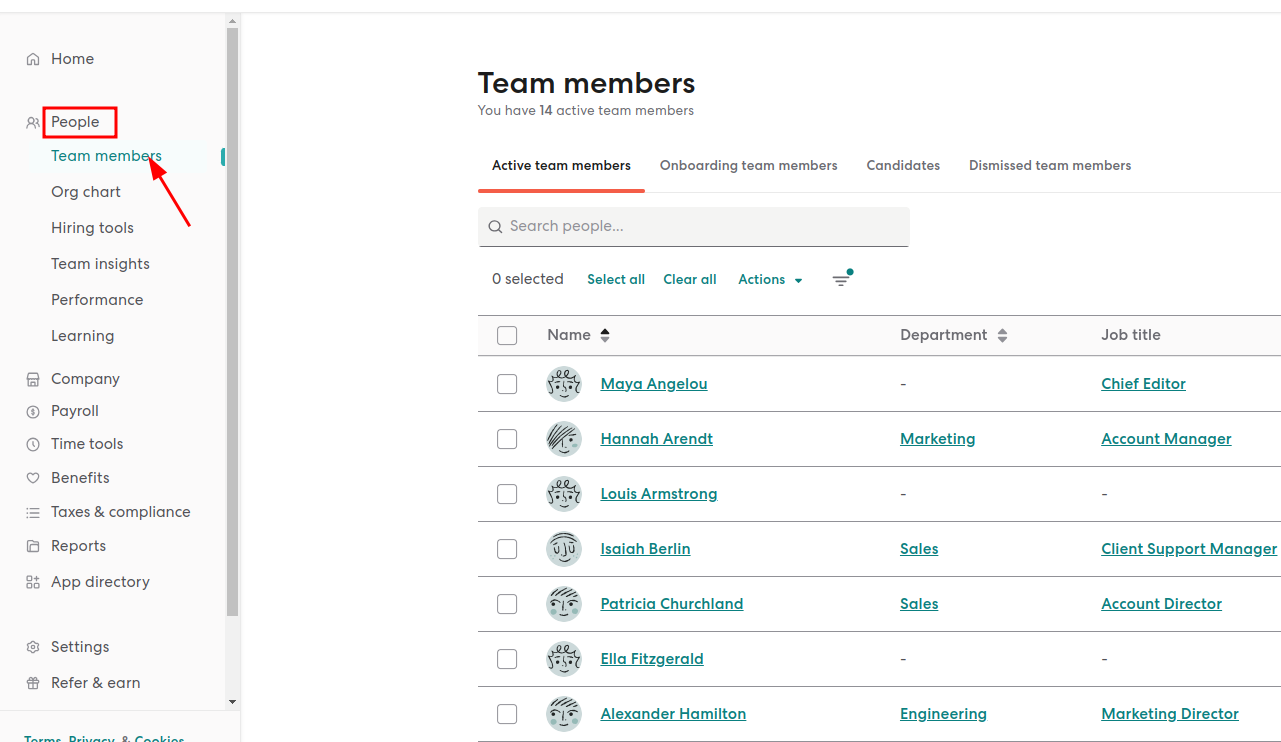

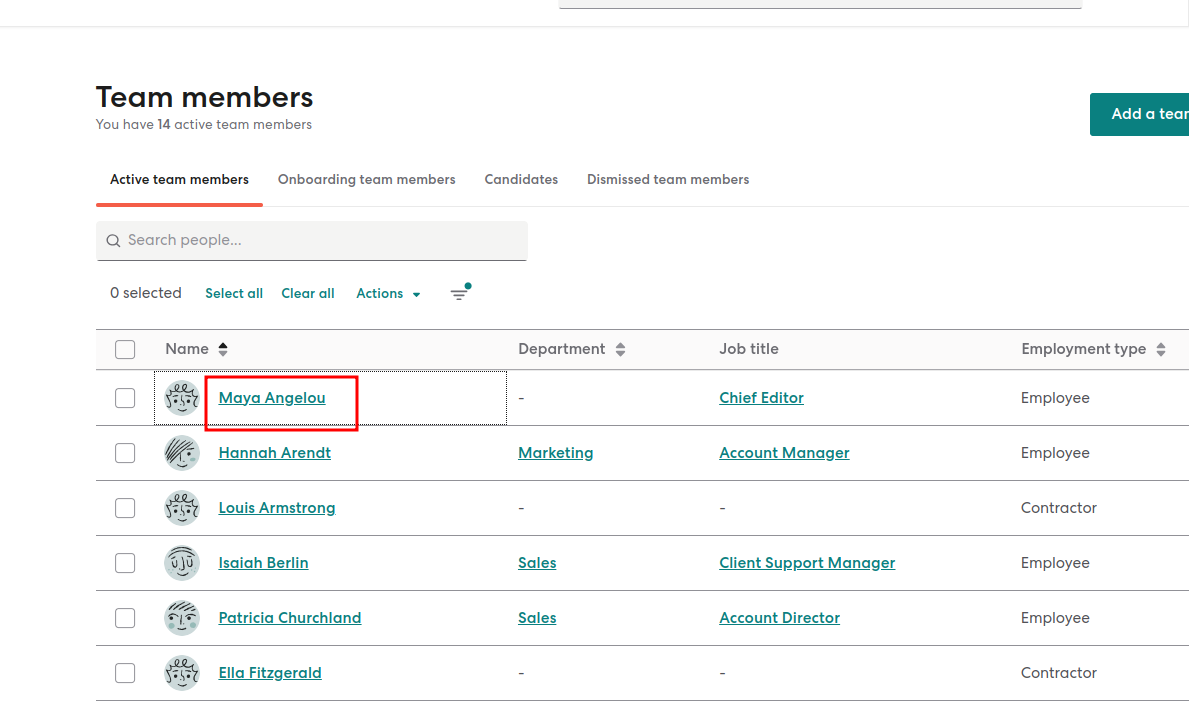

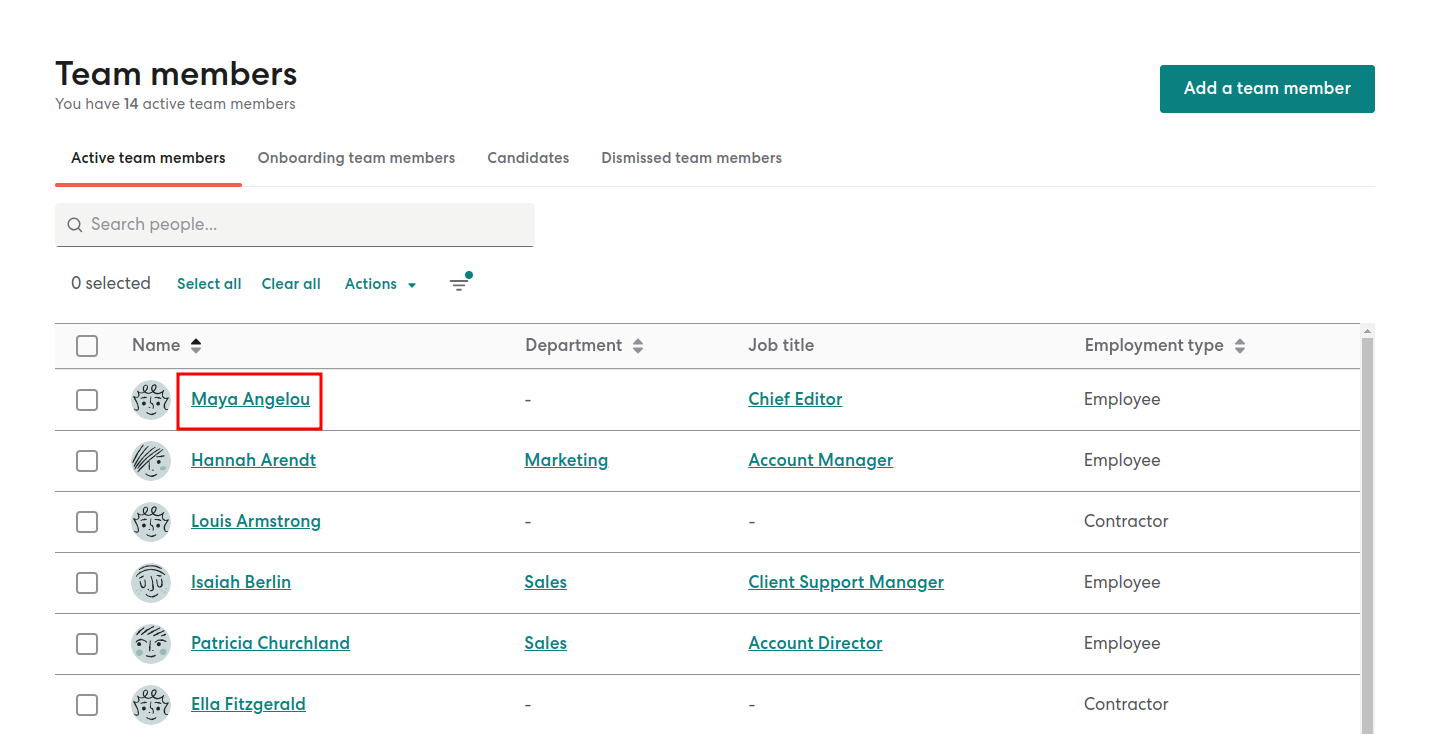

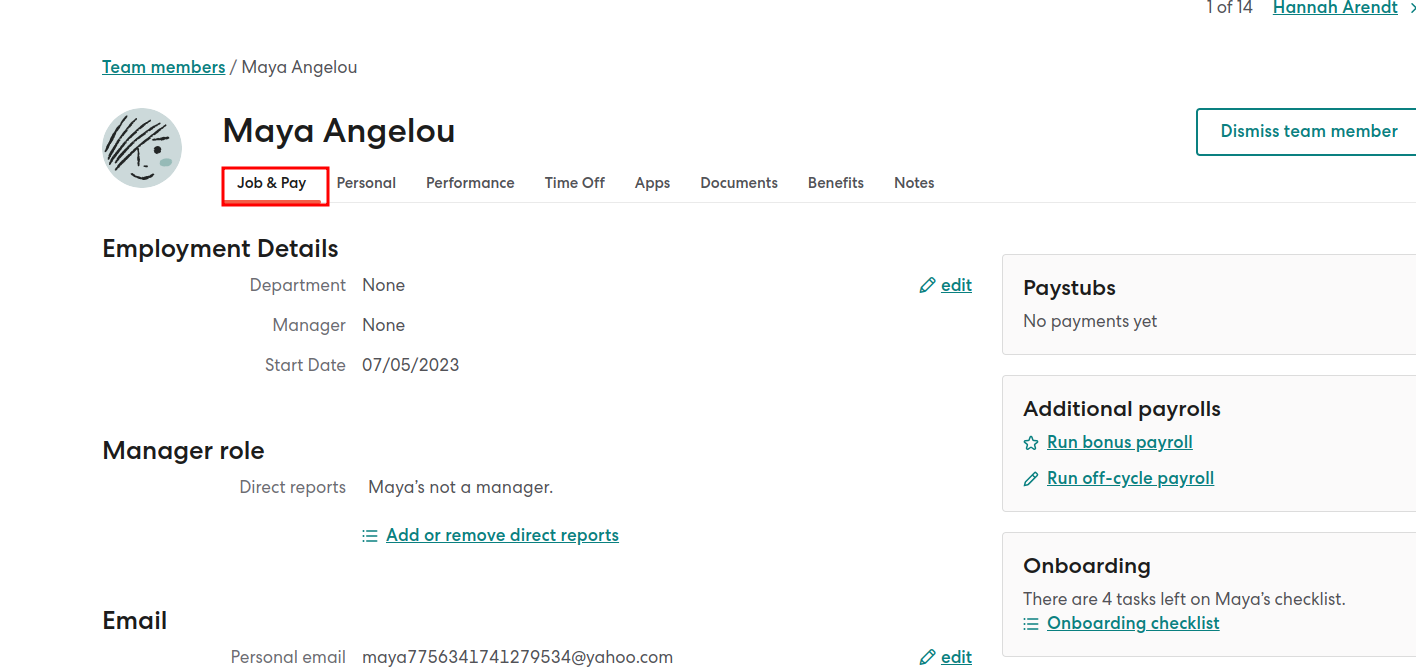

- To modify an employee’s compensation, go to the People section, select Team members, and choose the employee’s name.

- If required, click on Direct Deposit or Check to change the employee’s payment method for this payroll. If only the option to pay by check is available, it means the employee has not set up a bank account for direct deposit.

- Leave a personalized message on your employee’s pay stub by clicking “Add personal note.”

- Use the “Actions” menu to add or edit one-time deductions (post-tax).

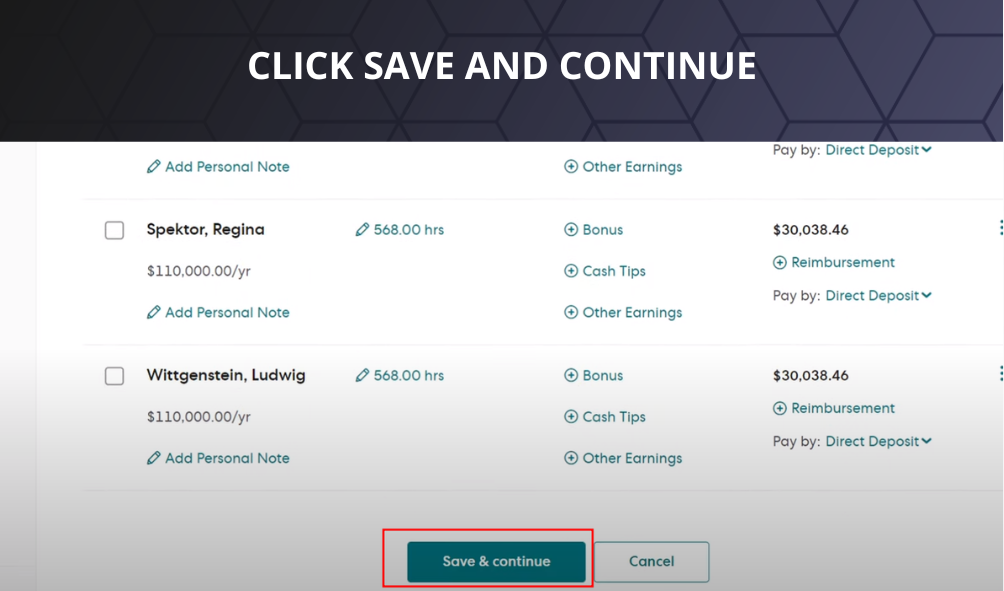

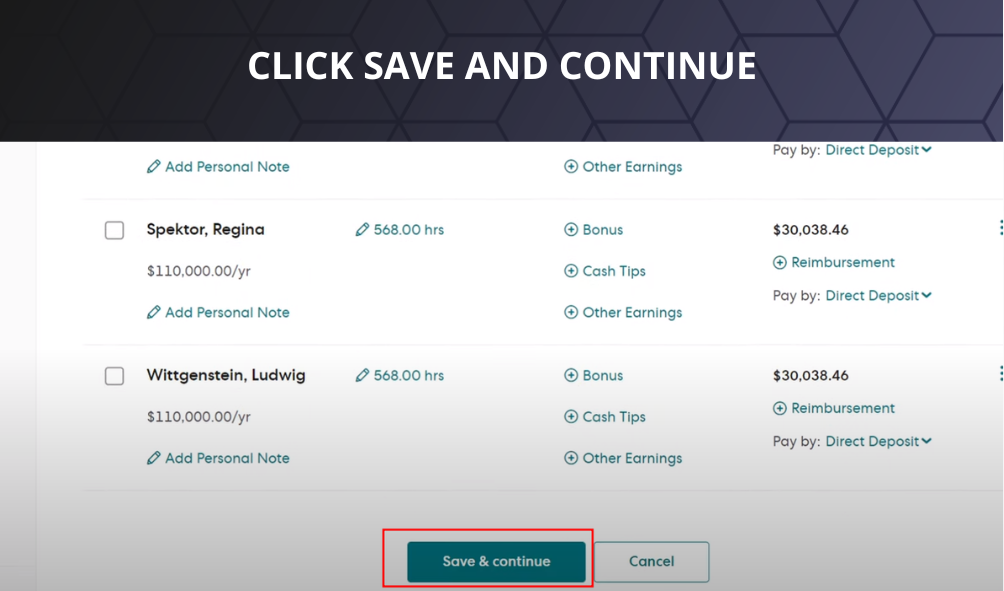

- Click “Save and Continue” to proceed.

- All changes made to the payroll will be automatically saved. The indicator at the bottom of the page will show real-time updates of the last-saved work, and any unsaved changes due to errors will be indicated.

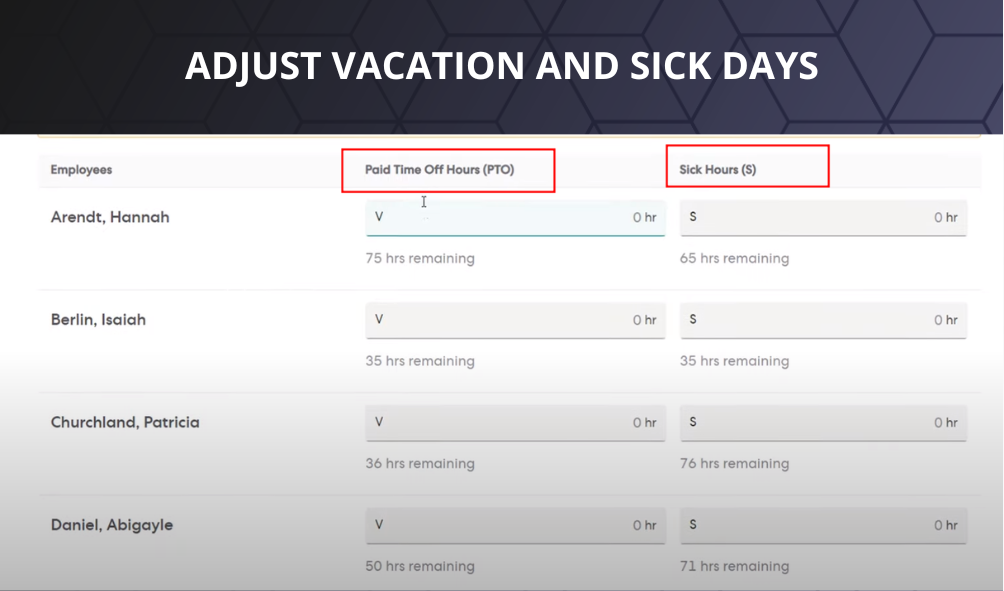

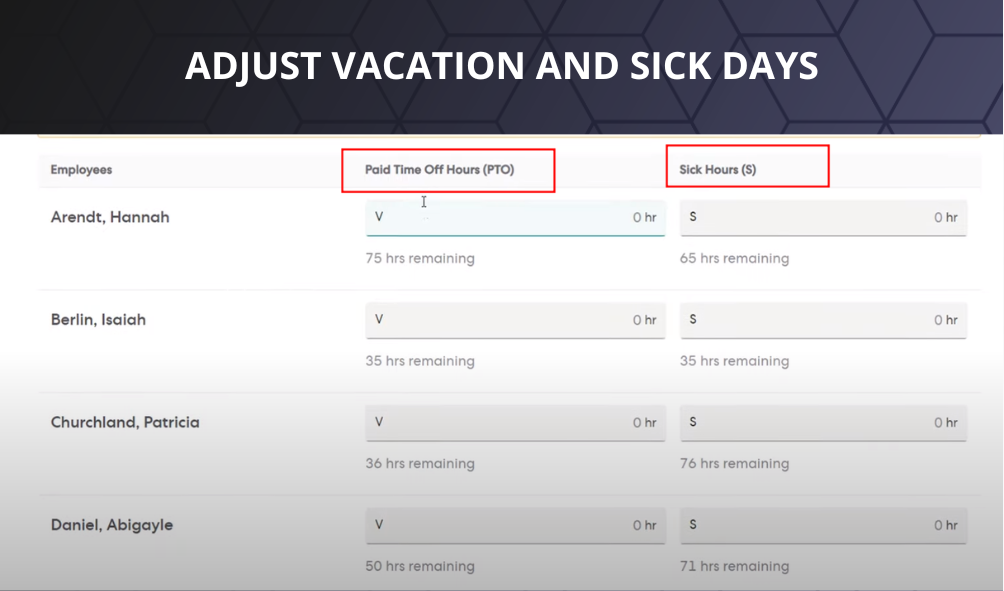

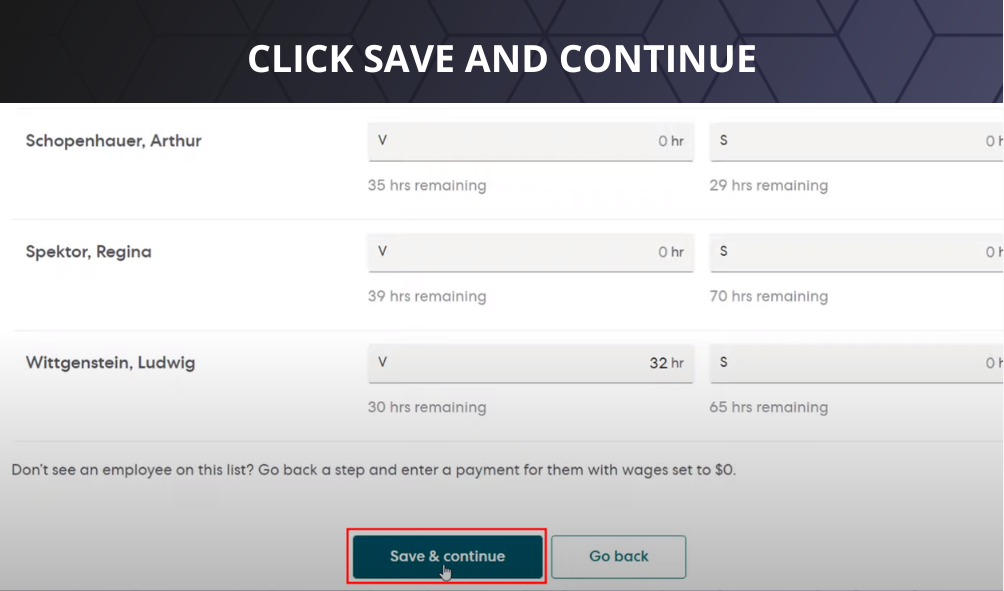

- On the next page, adjust vacation and sick days by entering the corresponding hours used by employees during the pay period.

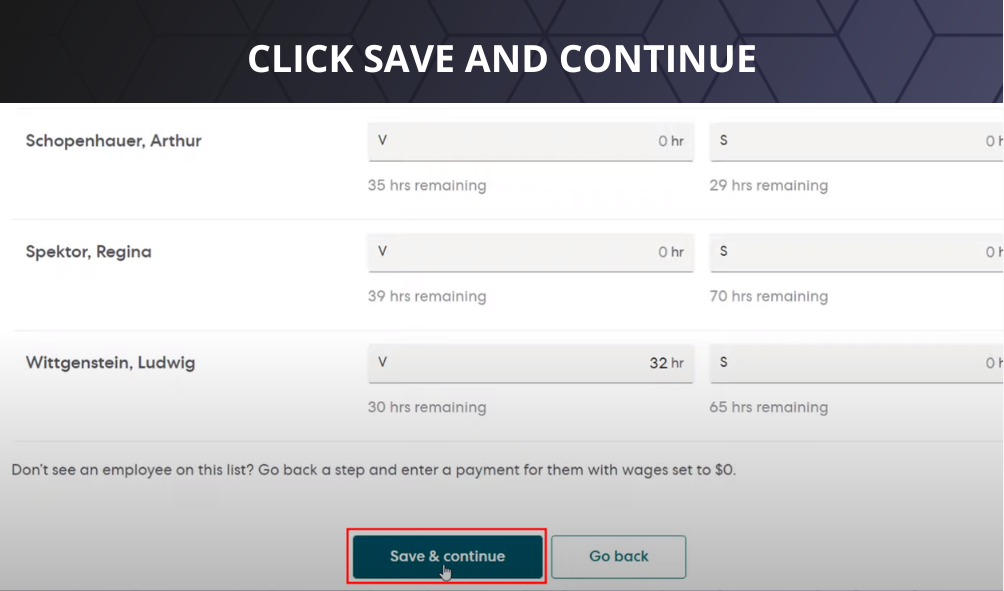

- Click “Save and Continue” to move forward or “Go Back” to make further adjustments to salaries if needed.

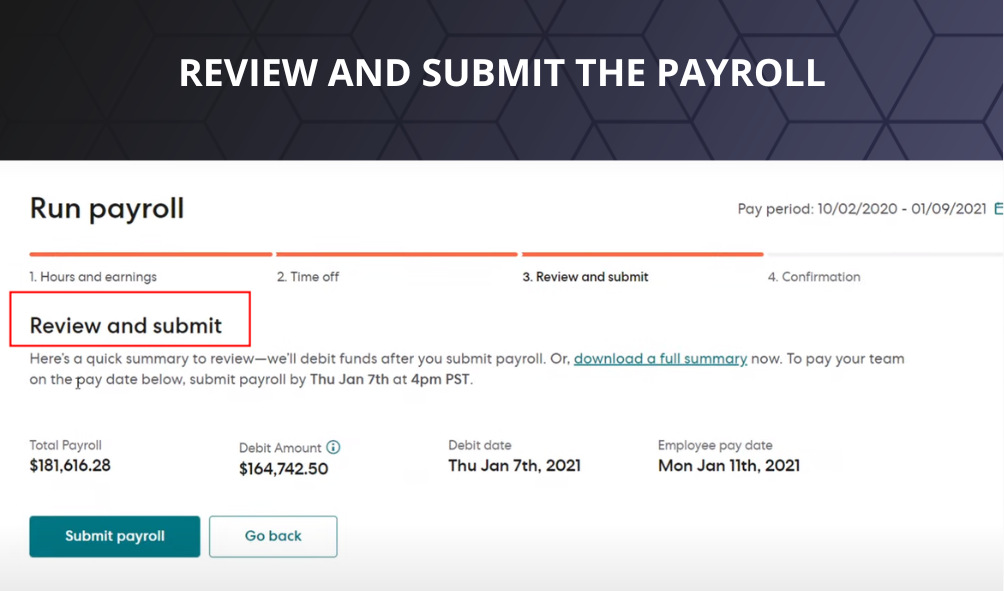

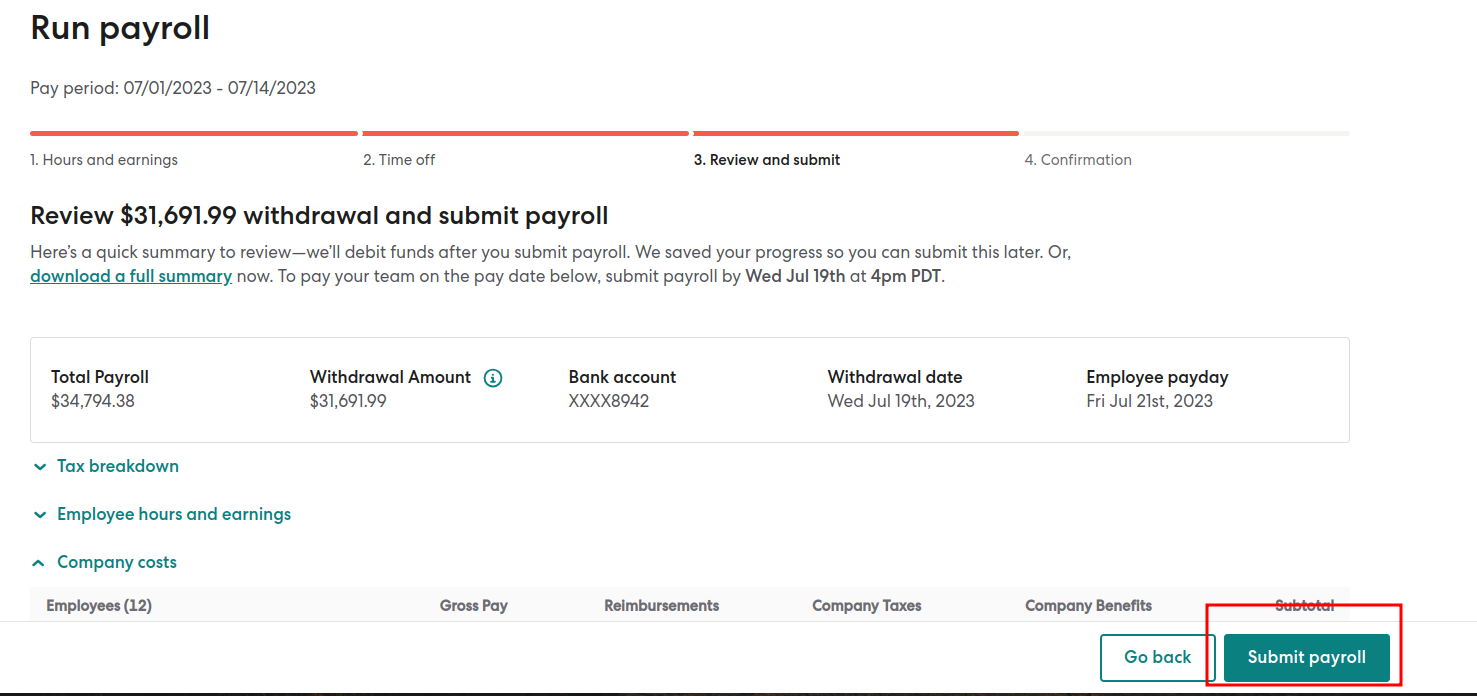

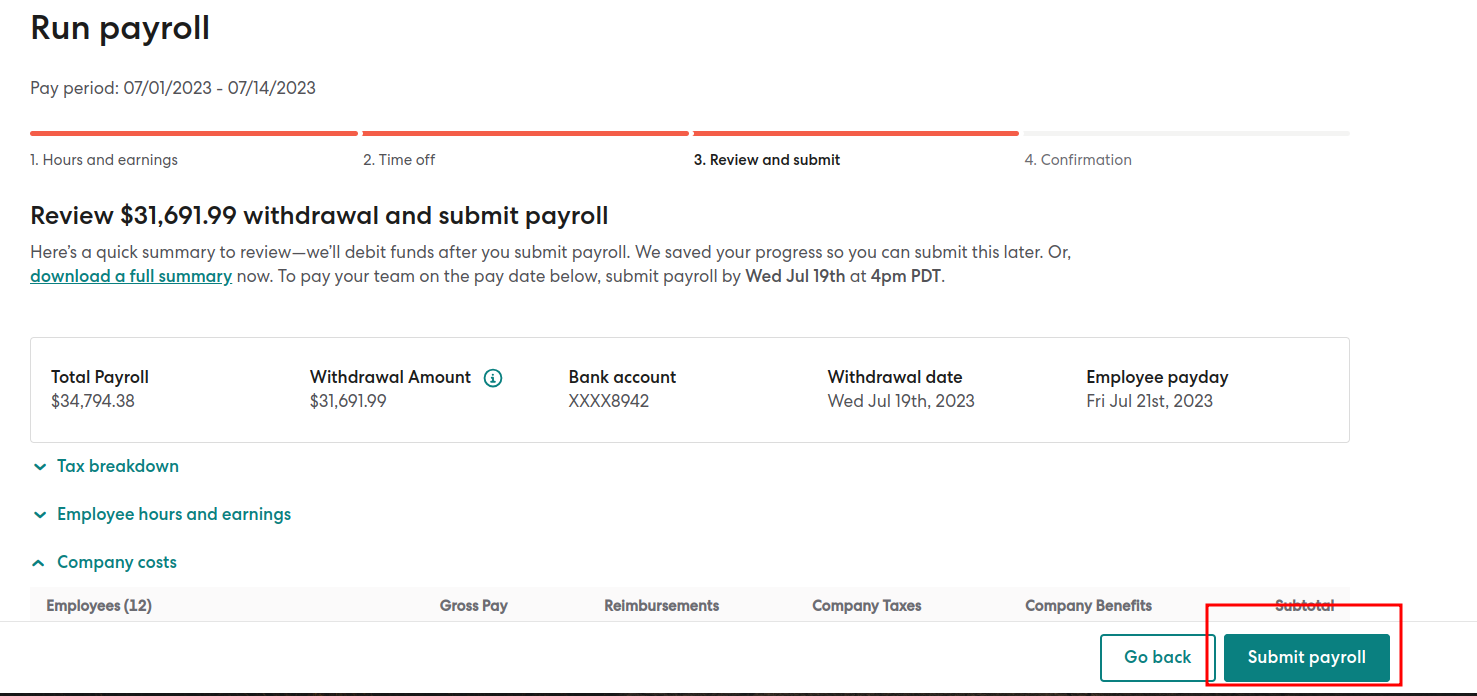

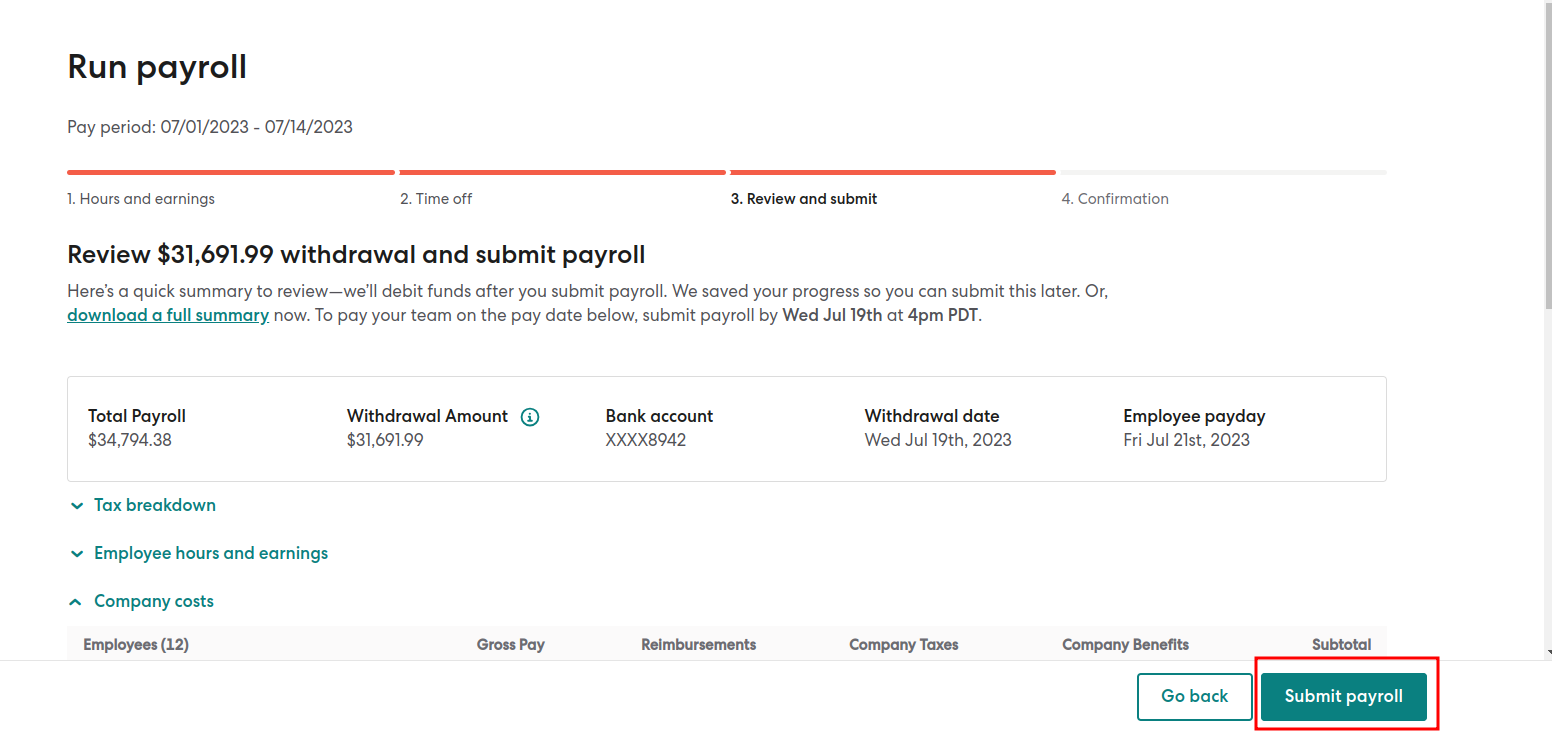

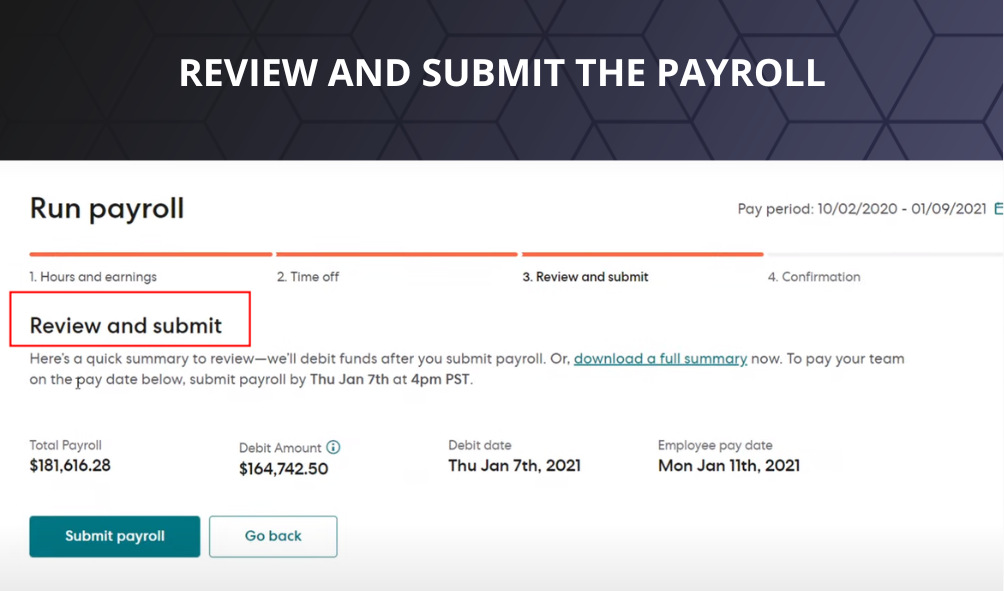

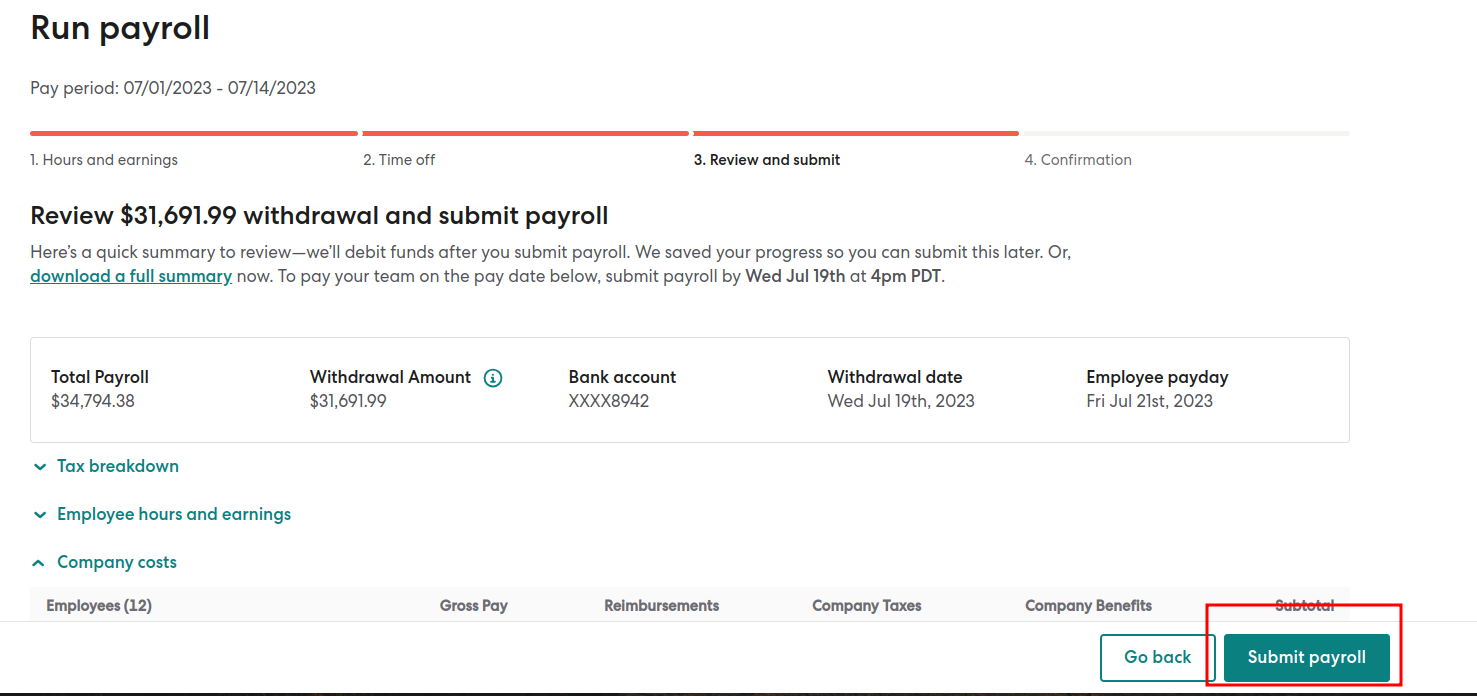

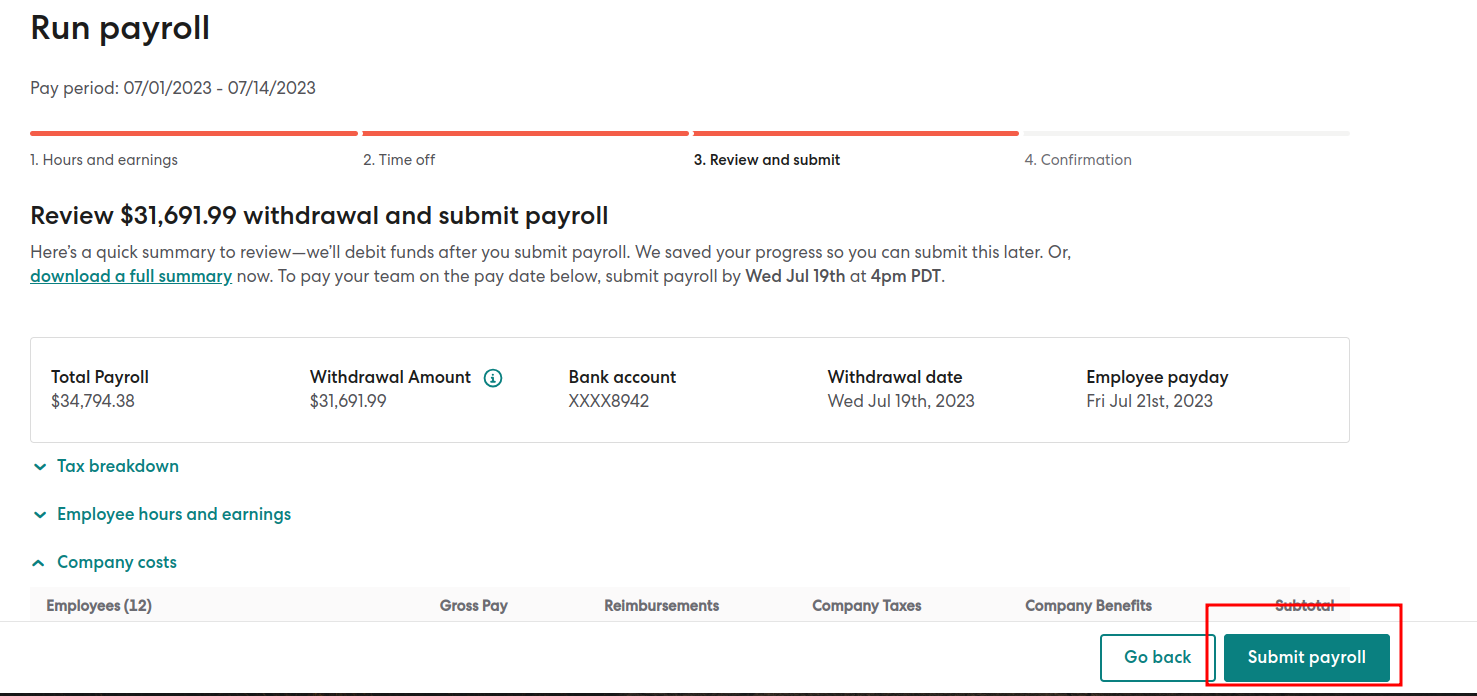

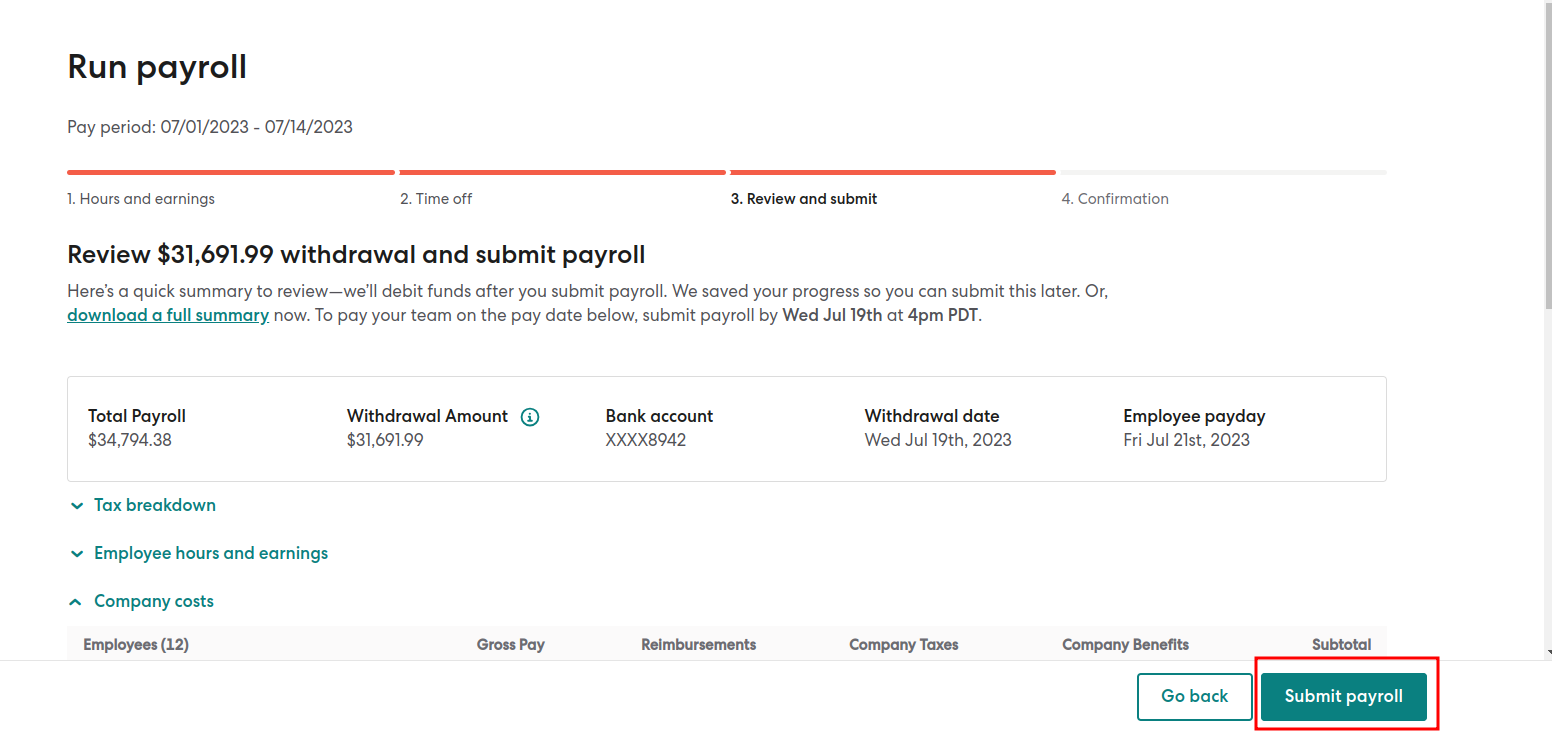

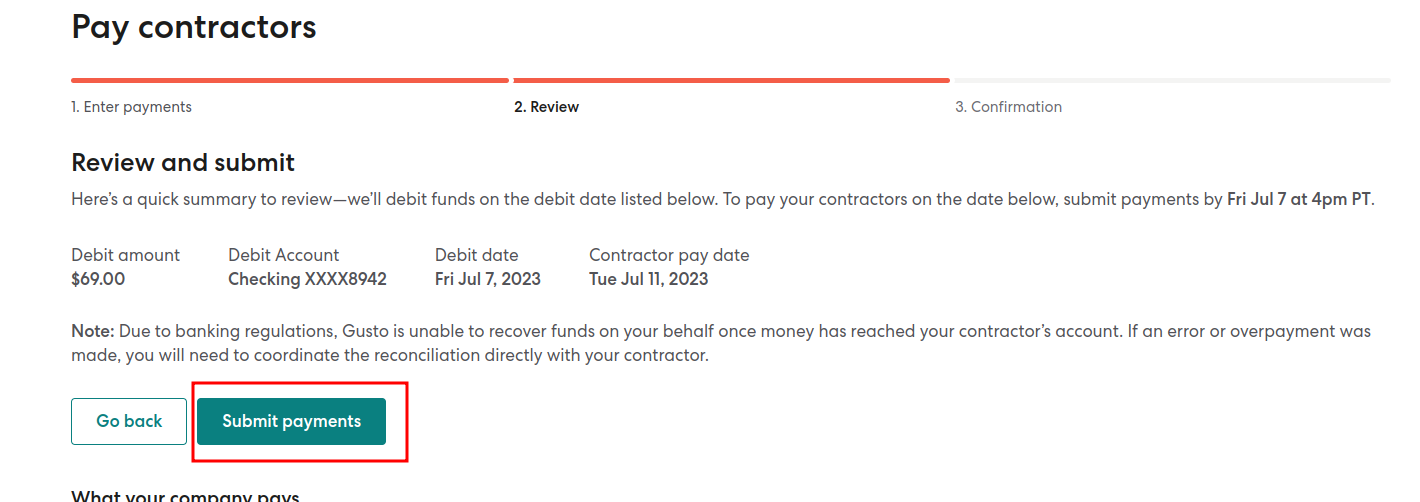

- Review and Submit the payroll.

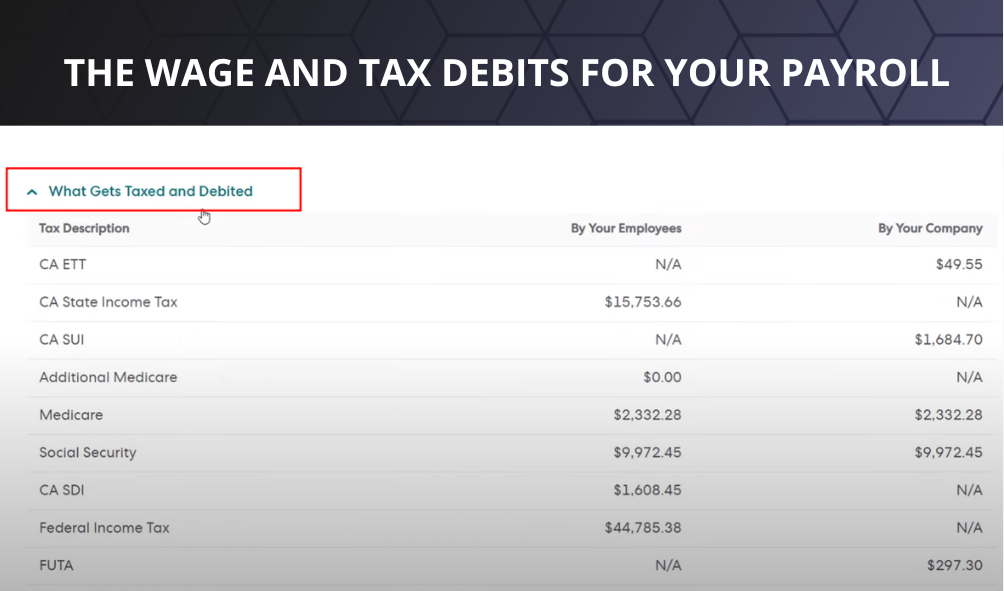

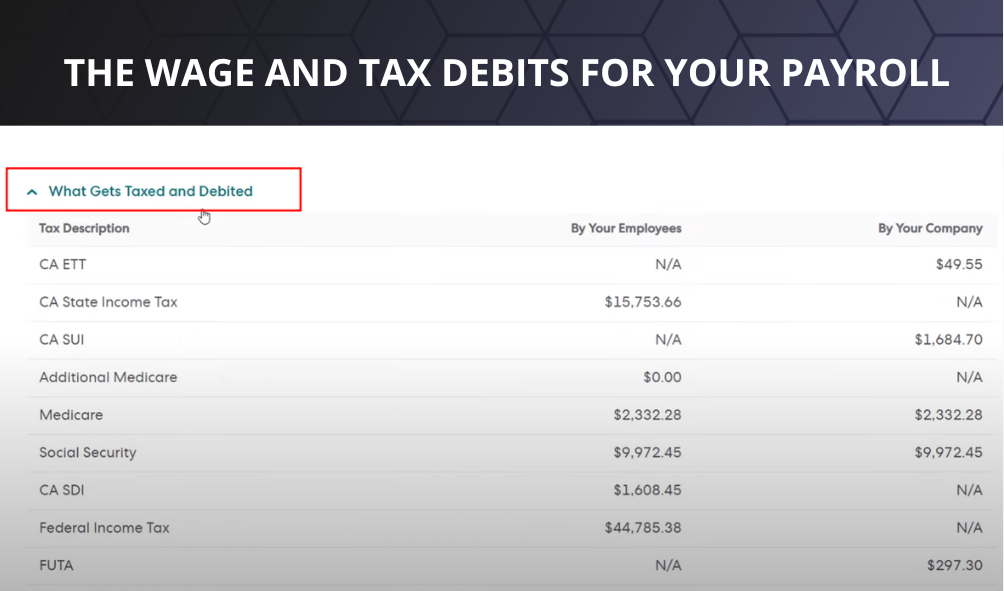

- Preview the wage and tax debits for your payroll.

- If adjustments are required, click “Go Back.” If you’re ready to proceed, click “Submit Payroll.”

- You will receive a confirmation email once your payroll has been processed successfully.

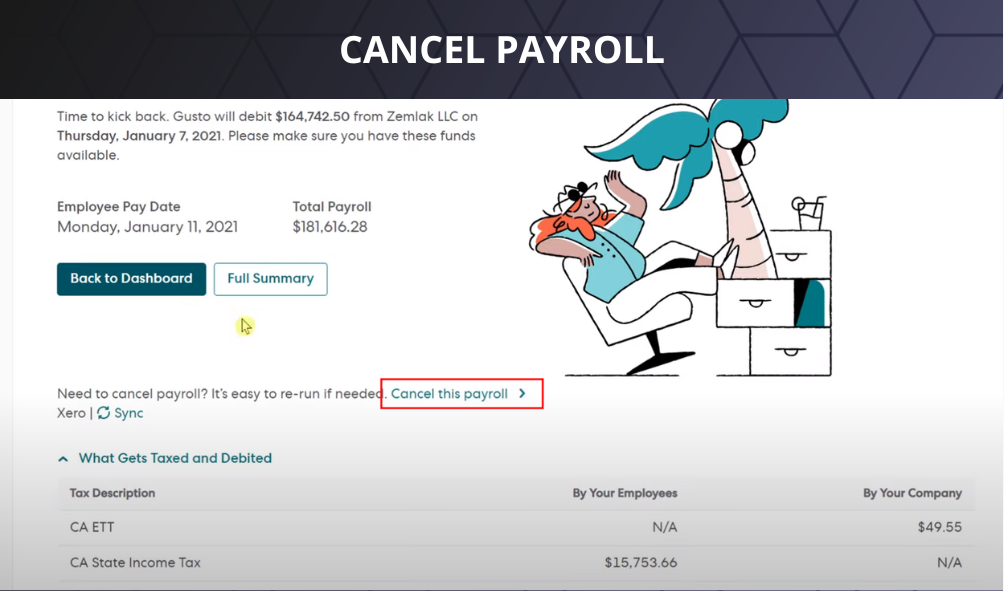

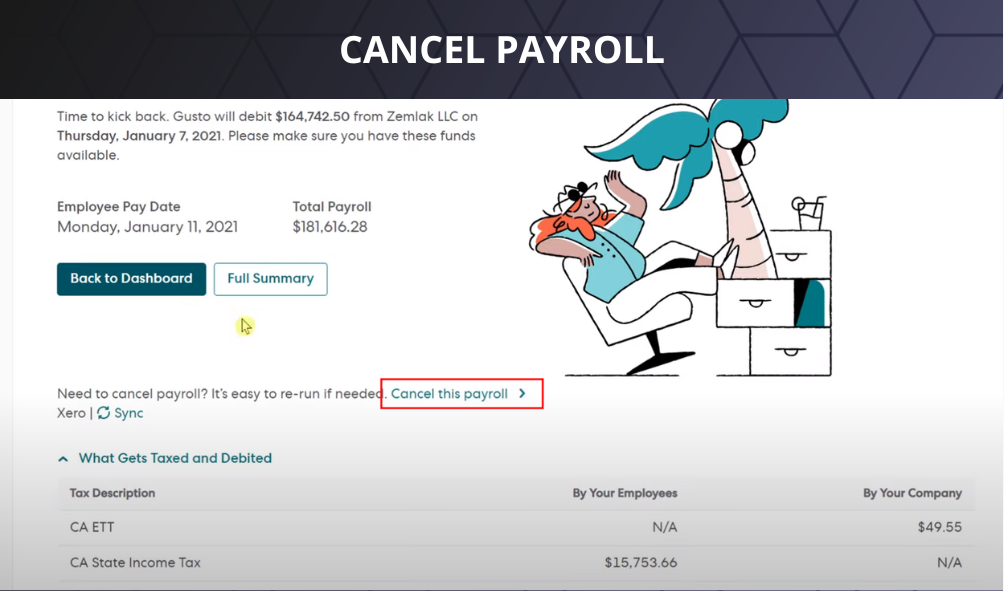

- To cancel the payroll, click “Cancel Payroll.”

- If applicable, you can view a list of employees being paid by check.

- Confirm your preferred delivery method for checks:

- Handle it yourself.

- Have Gusto create and mail the checks.

- Click “Confirm.”

- If you chose to handle checks yourself, click “View printable checks.”

- Write or print the checks as needed.

- Click “Done.”

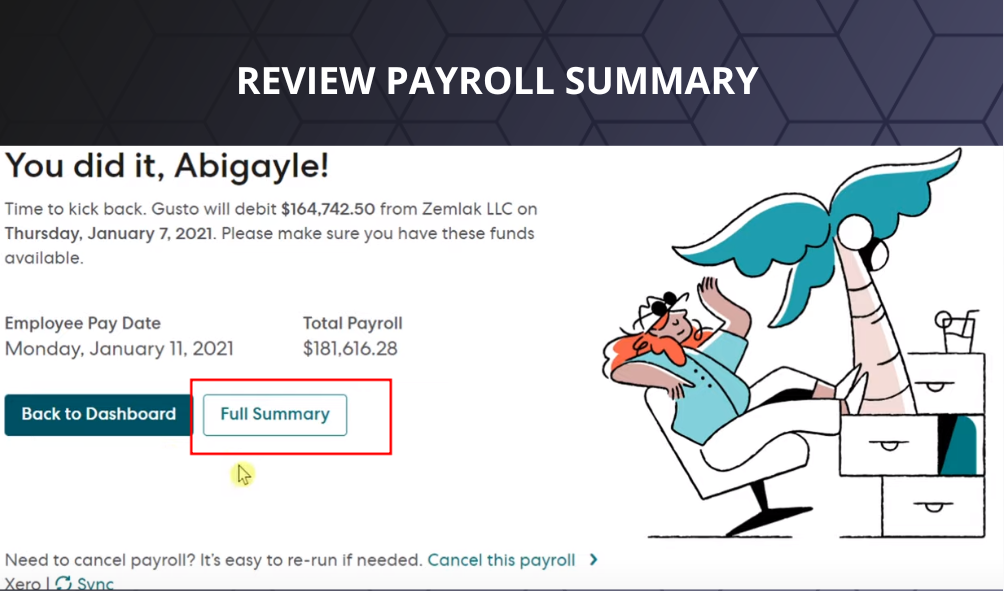

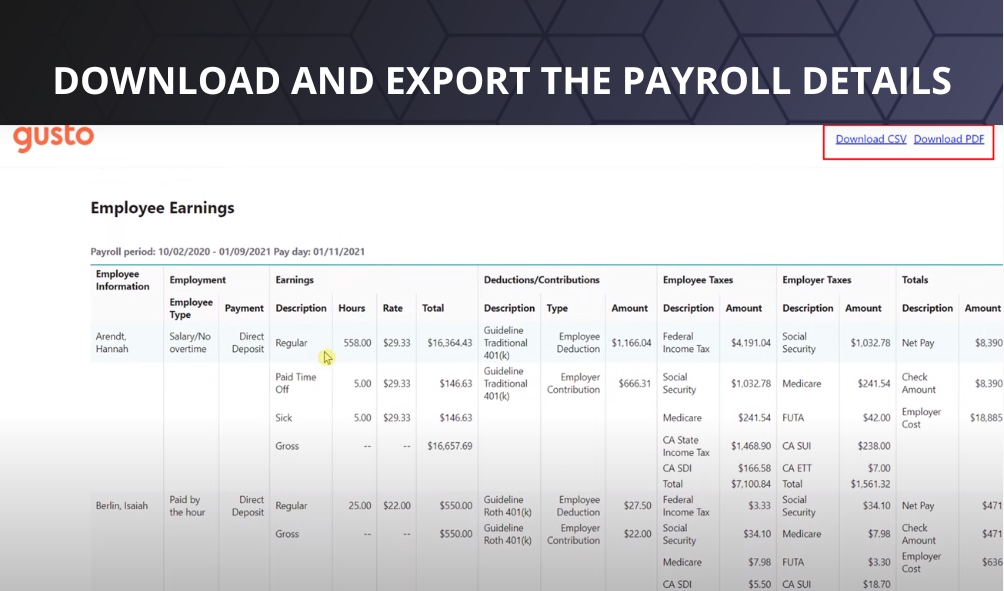

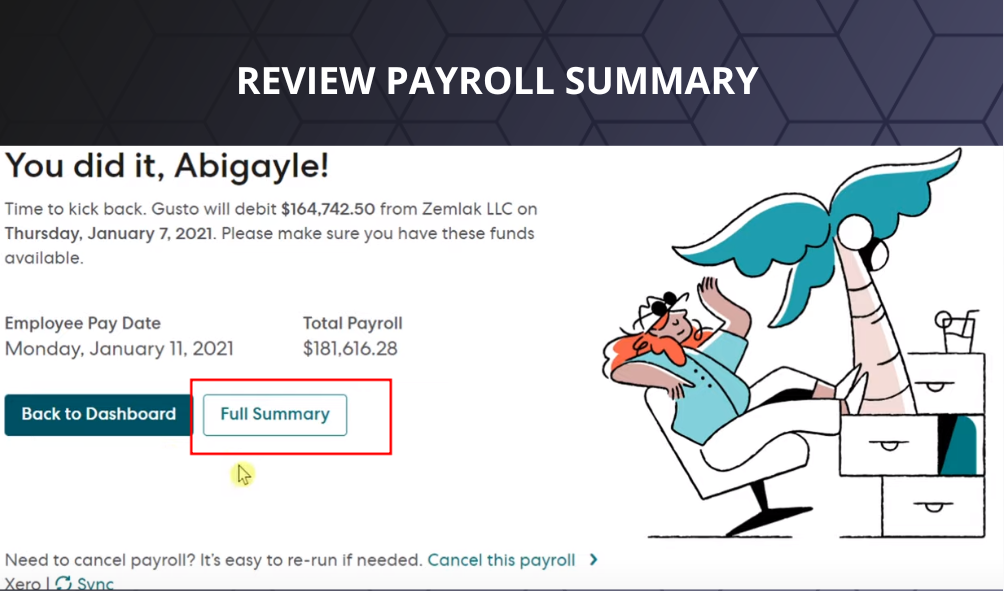

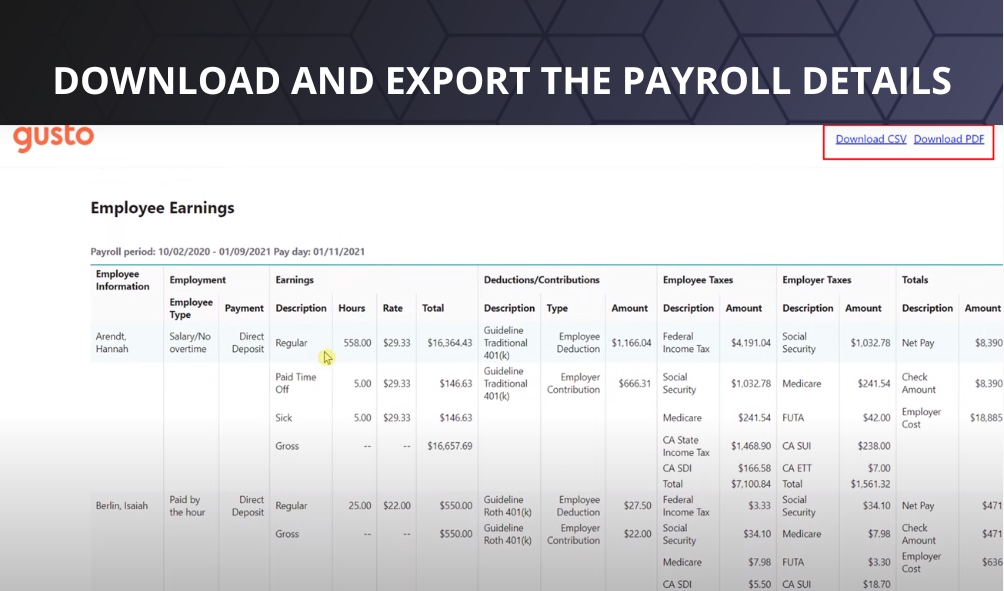

- Review the payroll summary and the monetary breakdown. From the payroll summary, you can perform the following actions:

- Download all employee pay stubs.

- Export payroll details.

- Print checks again if necessary.

If a pay rate appears different in the Run Payroll flow compared to the employee’s account settings, it means that the pay rate is not set up as hourly but rather per week, month, or year. Ensure that the correct format (per hour, per week, etc.) is used for the pay rate in the employee’s profile.

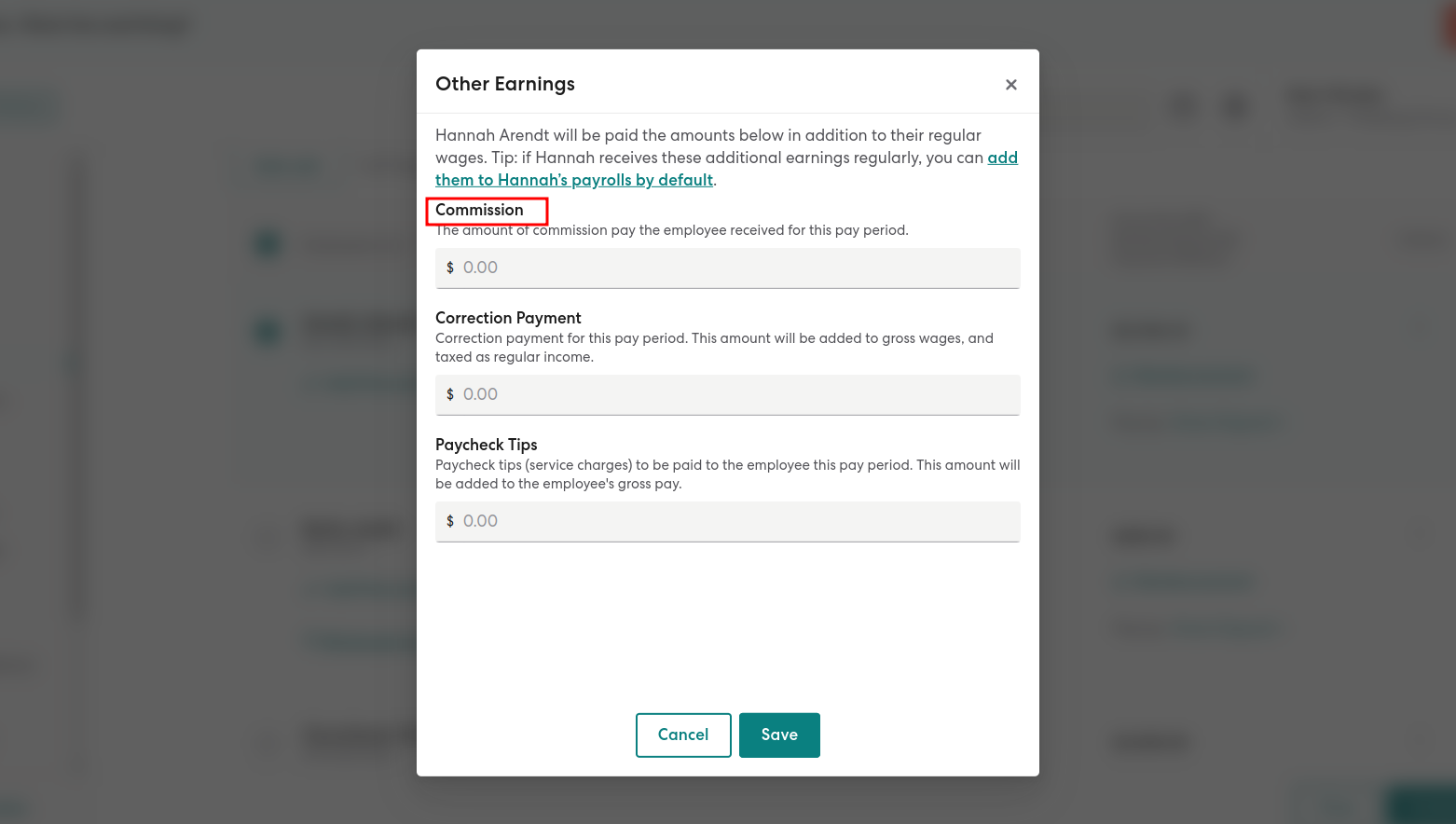

How To Add Commission In A Regular Payroll?

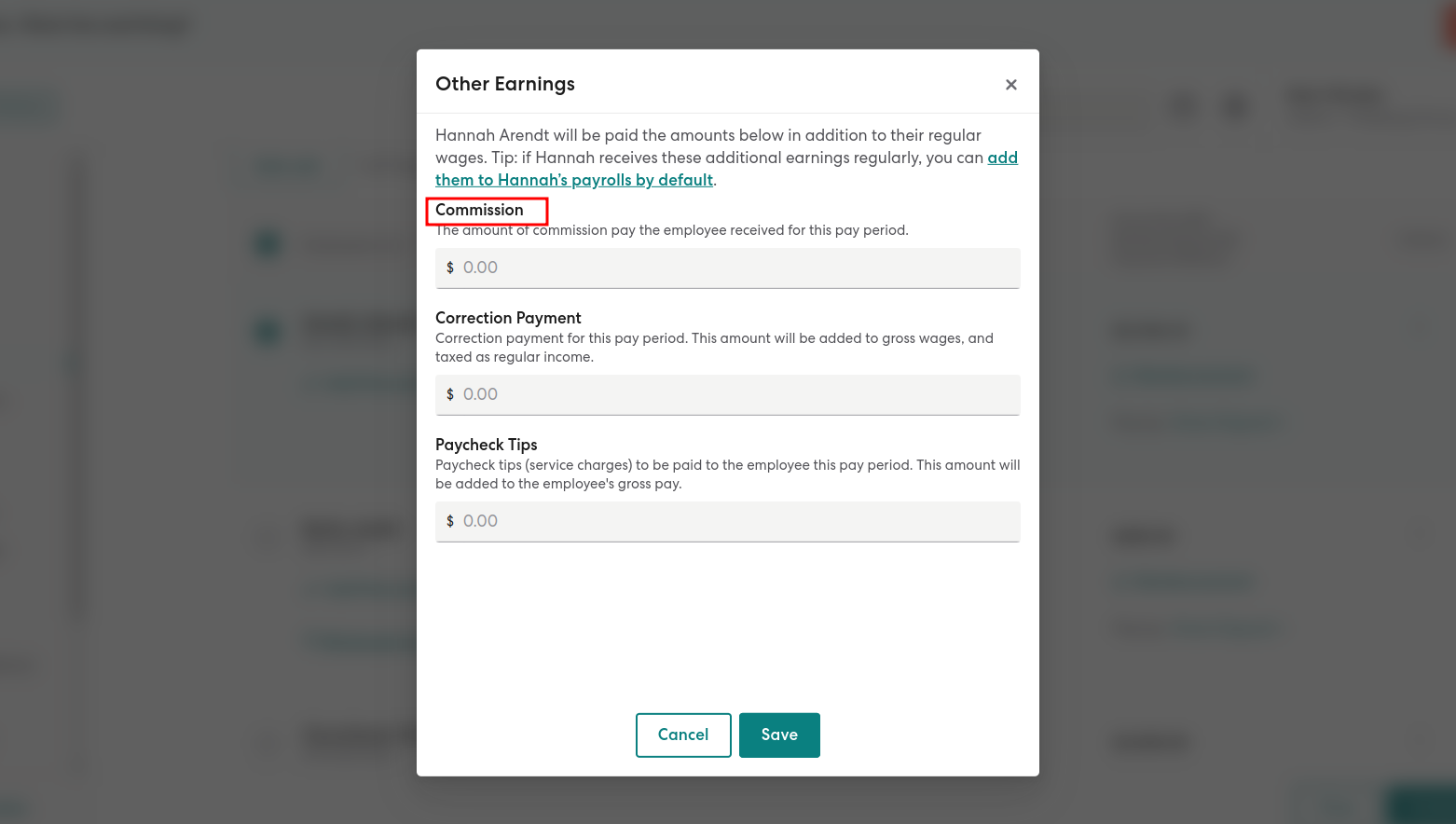

Adding a one-time commission amount for an employee in regular payroll is a straightforward process. However, please note that Gusto does not support commission draws. Let’s find out how to do it:

- Go to the Payroll section and select “Run payroll.”

- If you have multiple bank accounts set up, choose the desired account for processing payroll.

- Next to the respective employee, click on “+Commission.”

- If the option for Commission is not available, click on “+Other Earnings.”

- If you want to assign the same commission amount to multiple employees, utilize the bulk edit tool.

- Enter the dollar amount for the commission next to the Commission field.

- Proceed with completing the payroll run.

The commission amount will be taxed as regular wages and will appear as a separate line item for commission on the employee’s pay stub.

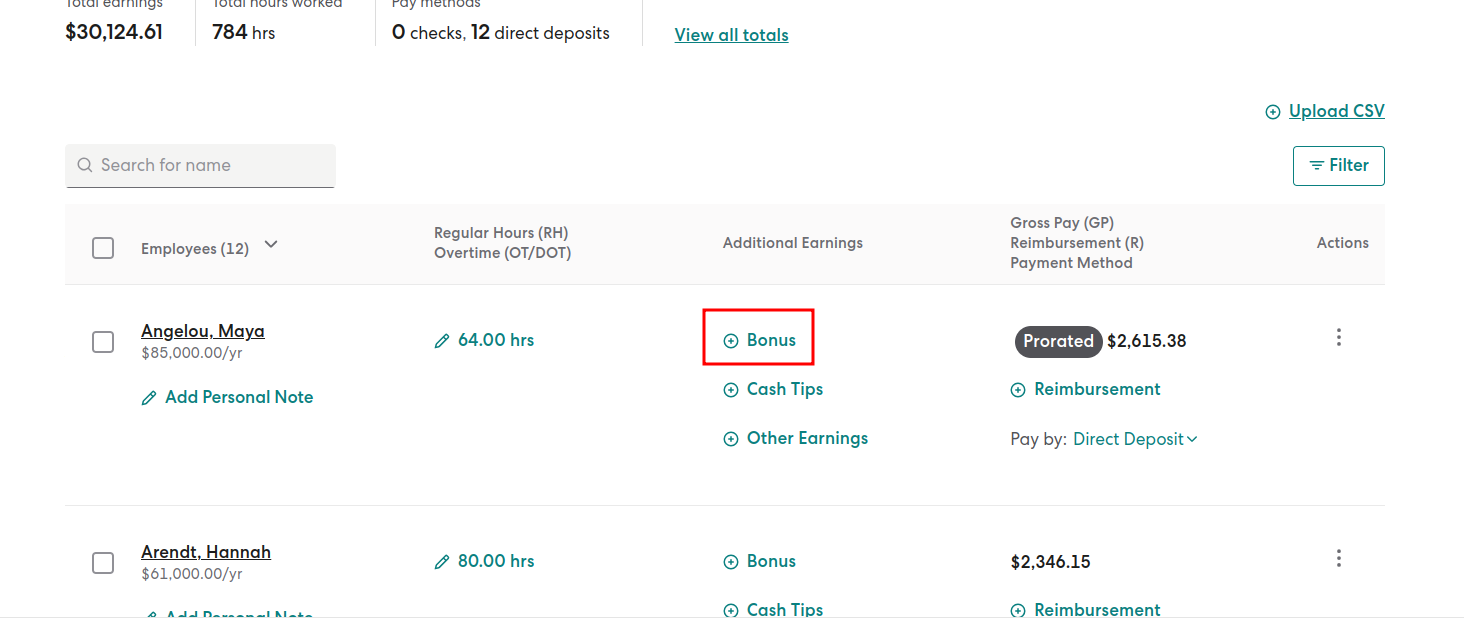

How To Add A Bonus In A Regular Payroll?

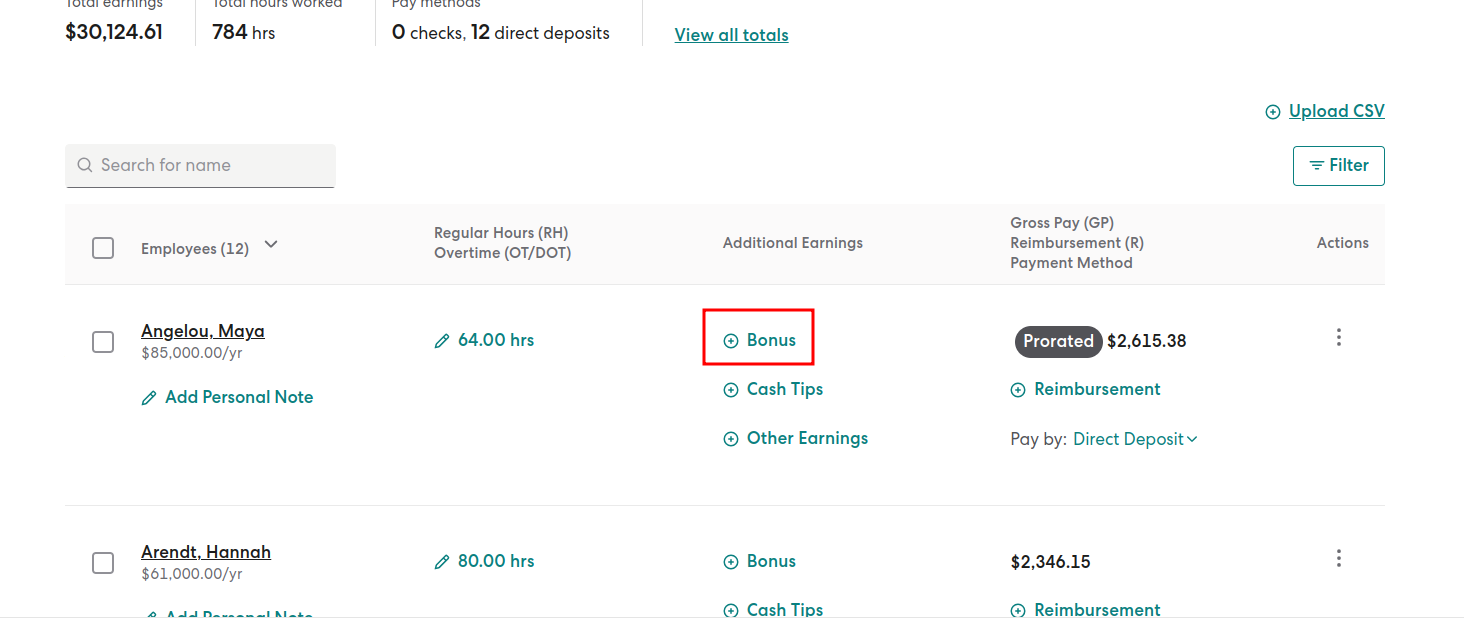

If you prefer to include the bonus amount within the regular wages, you can add it to the upcoming regular payroll. With the following, the bonus and other taxable wages will be combined for the calculation of Federal Income Tax. It’s important to note that higher gross pay results in higher taxes. Thus, depending on the bonus amount, the employee may end up paying more taxes on this particular payroll due to the bonus.

To aggregate the bonus amount with regular wages, follow these steps:

- Navigate to the Payroll section and select “Run payroll.”

- Click on “Run Regular Payroll.”

- If you have multiple bank accounts set up, choose the desired account for processing payroll.

- If you don’t see this option, refer to this article for further assistance.

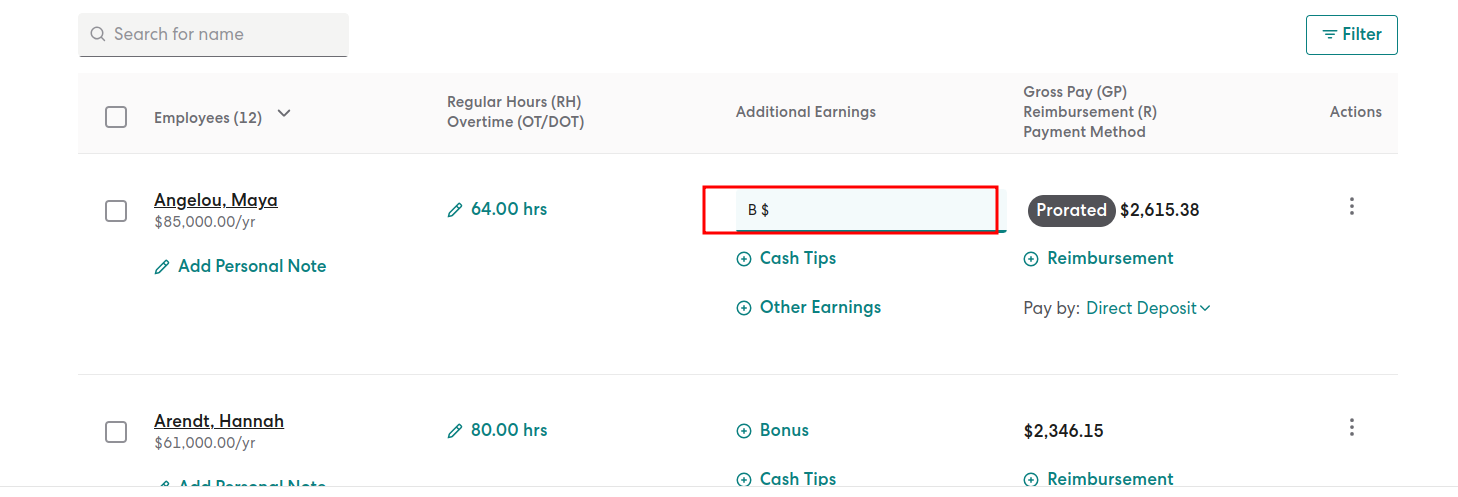

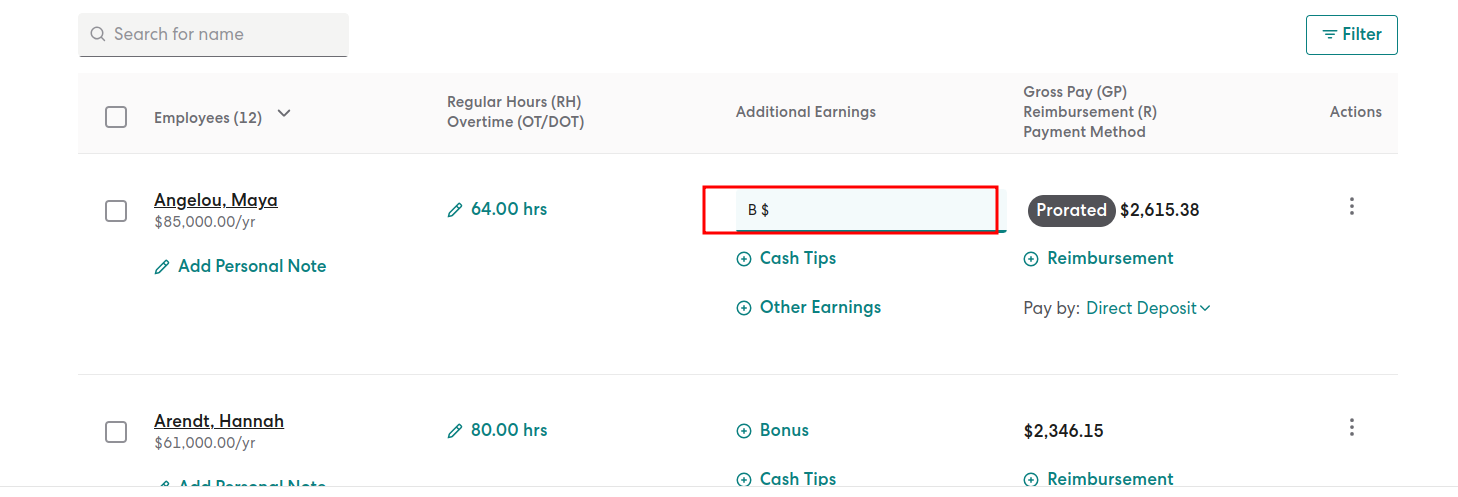

- Next to the respective employee, click on “+Bonus.”

- If you wish to assign the same bonus to multiple employees, you can utilize the bulk edit tool.

- Enter the dollar amount for the bonus.

- For more information about net and gross pay, refer to this resource.

- Complete the process of running payroll.

The bonus amount will be taxed as regular wages and will appear as a separate line item for the bonus on the employee’s pay stub.

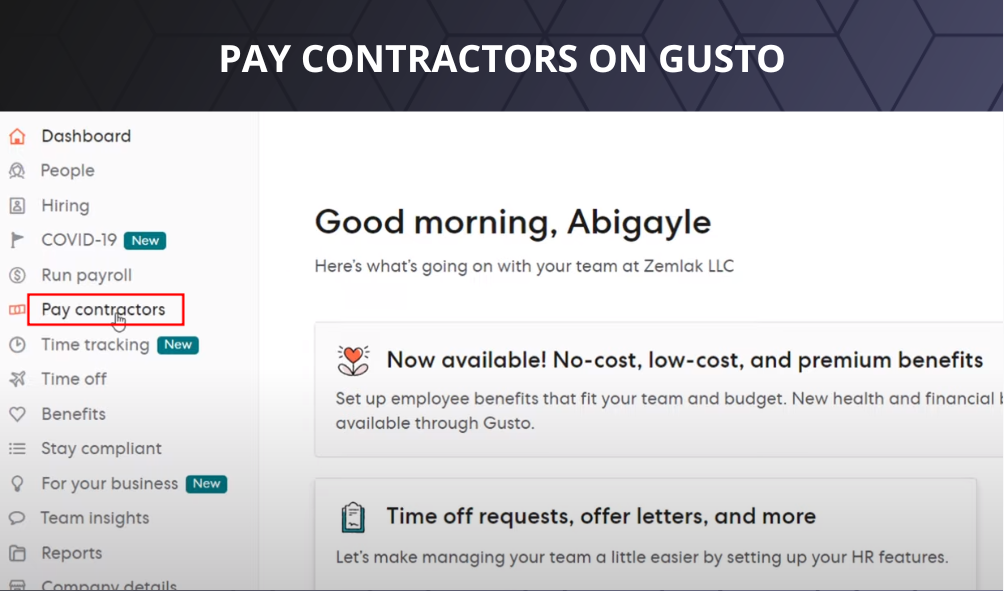

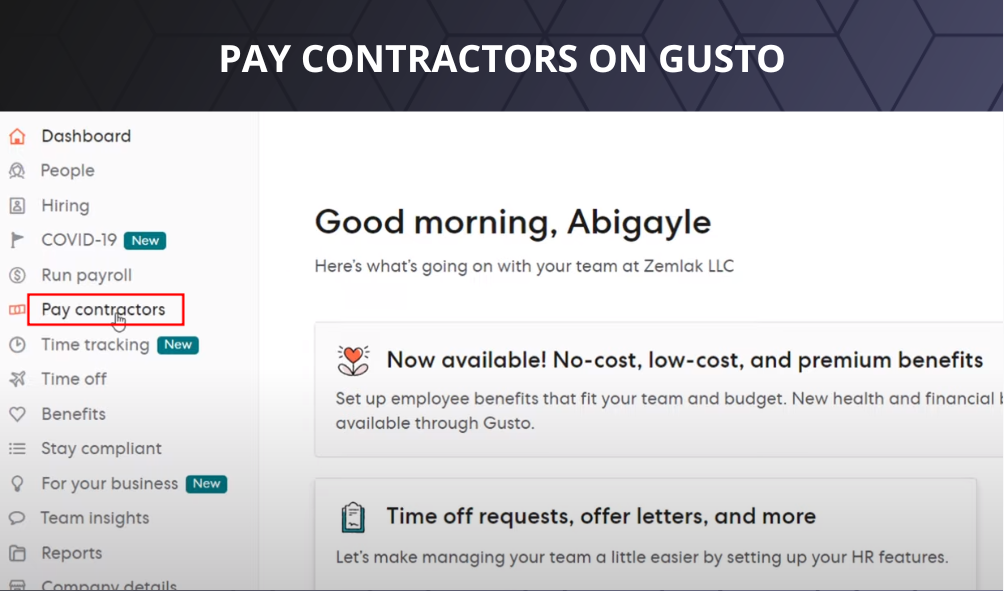

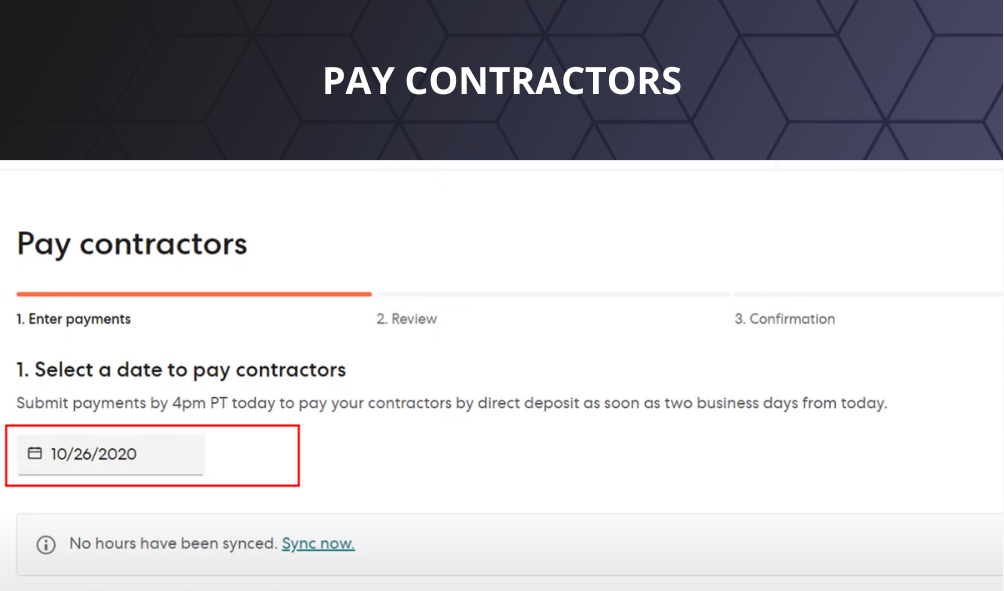

How To Pay Contractors On Gusto?

Currently, Gusto payroll software does not support prepaid debit cards for paying contractors.

Step-By-Step Guide For Setting Up Direct Deposits For Payments:

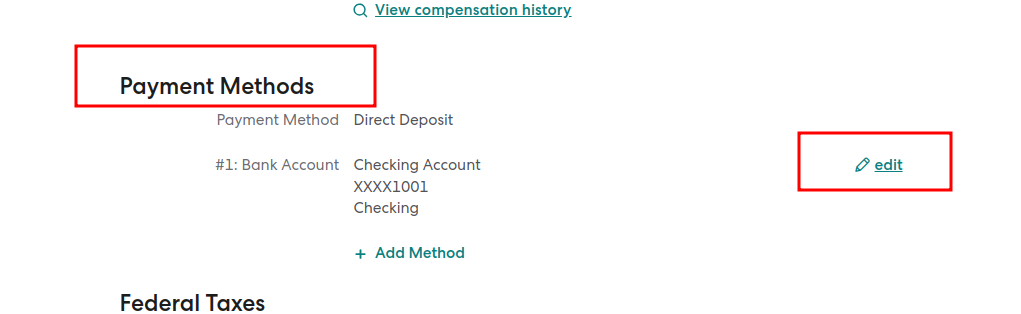

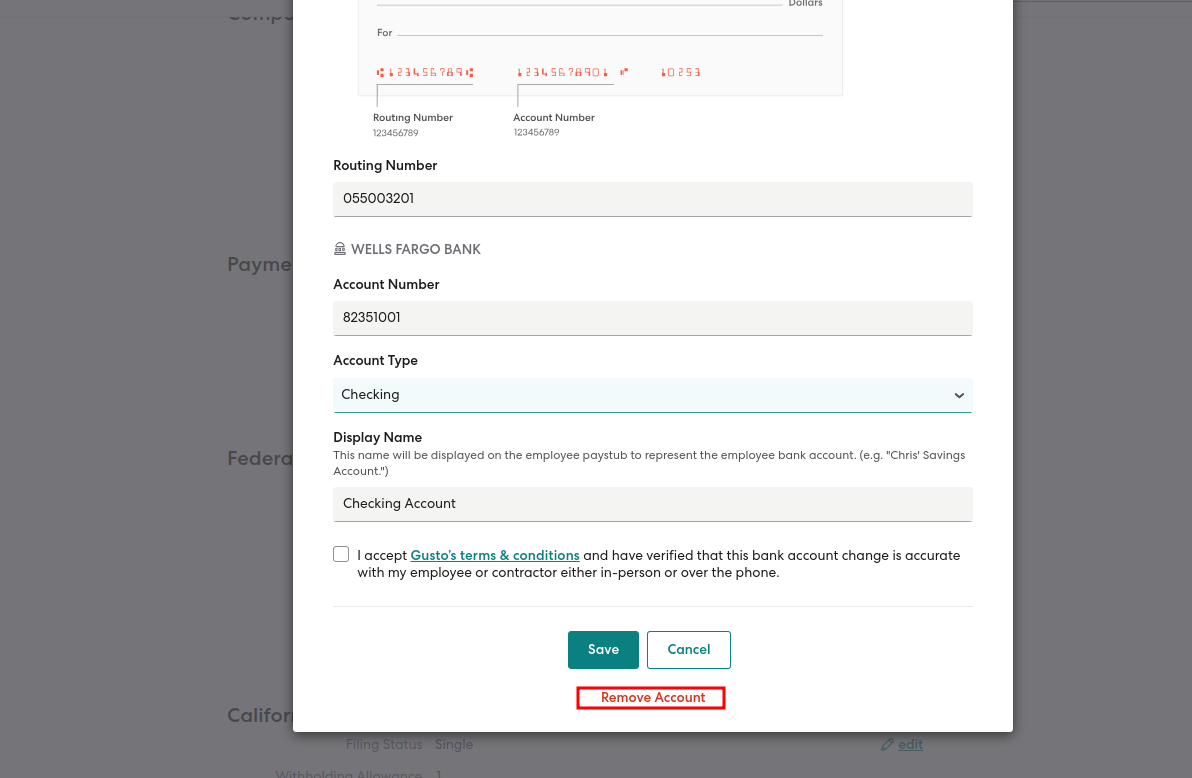

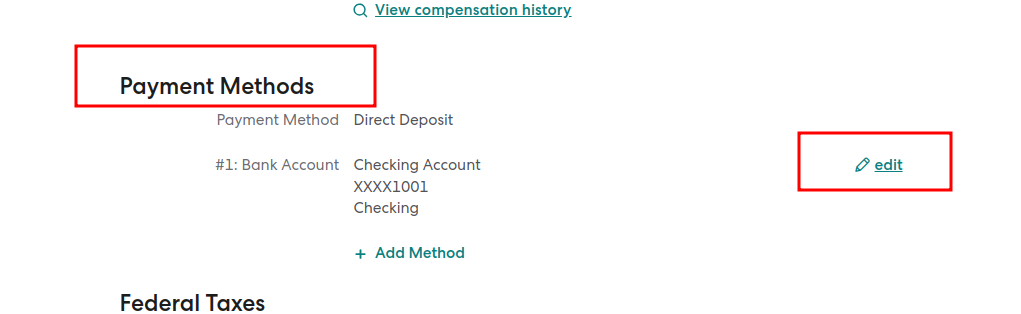

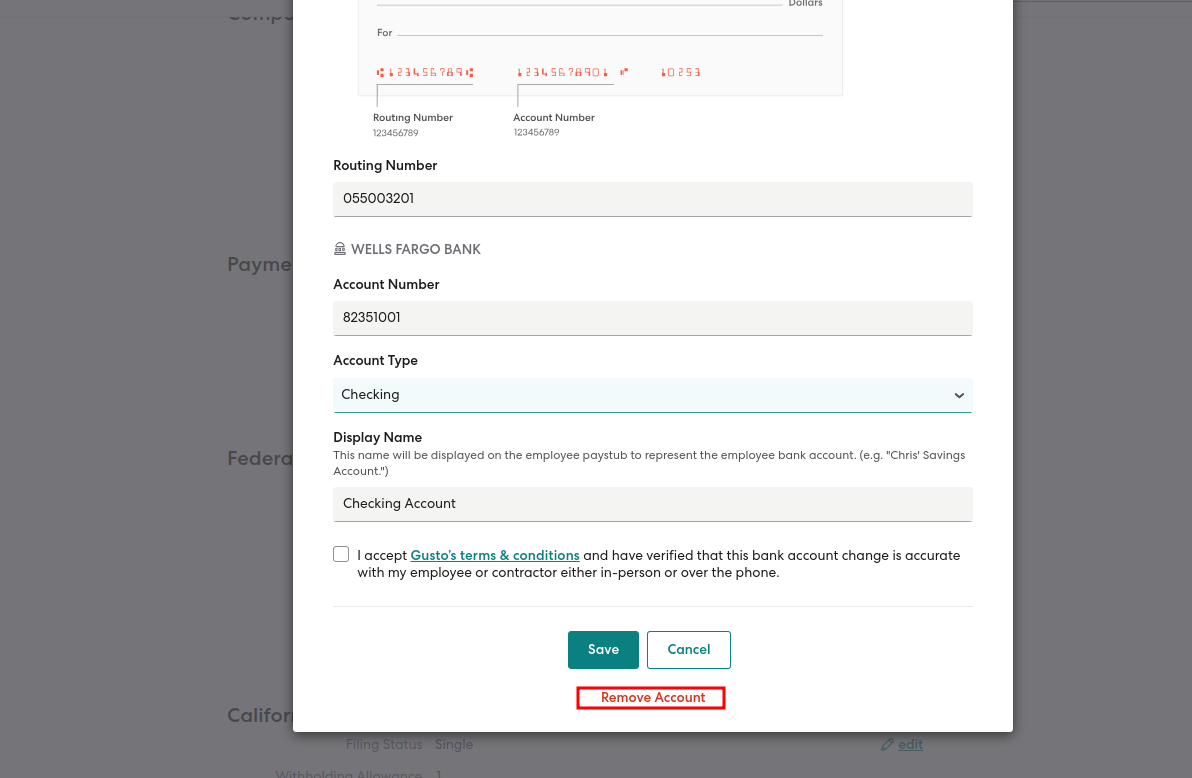

If you currently have a check payment method set up and would like to switch to direct deposit, you can easily make the change from your Gusto account. Here’s how:

- Sign in to your Gusto account.

- Click on the “Personal Details” tab.

- Locate the “Payment Method” section and click on “edit” next to it.

- Enter the required information, including your routing number, account number, account type, and display name.

- Going forward, you will receive your payments via direct deposit for future transactions that have not yet been processed.

Key Point : “Gusto verifies your bank account through a test transaction on their end, and no action is required from the user for this process. You can access the direct deposit authorization form at any time in your account under the “Documents” tab.”

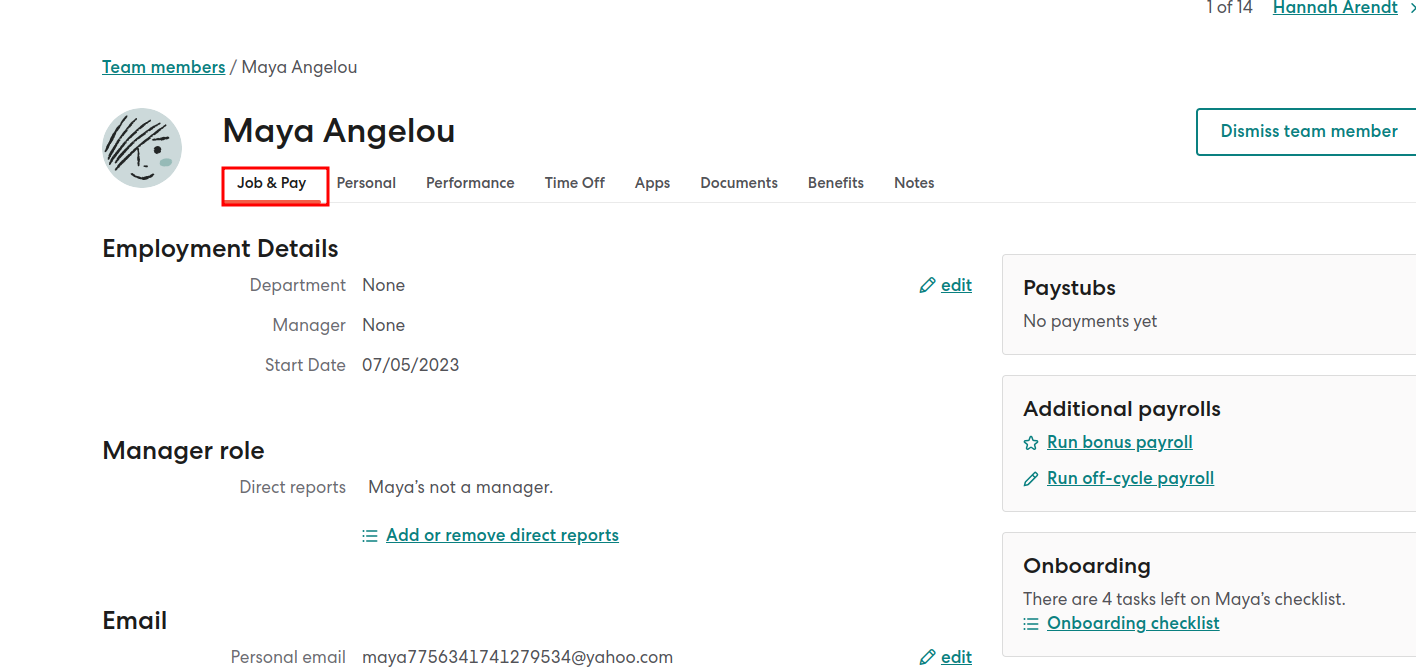

Changing The Payment Method

If you currently have your payment method set to direct deposit and would like to switch to receiving checks, you can make this change directly from your personal Gusto account. Follow these steps:

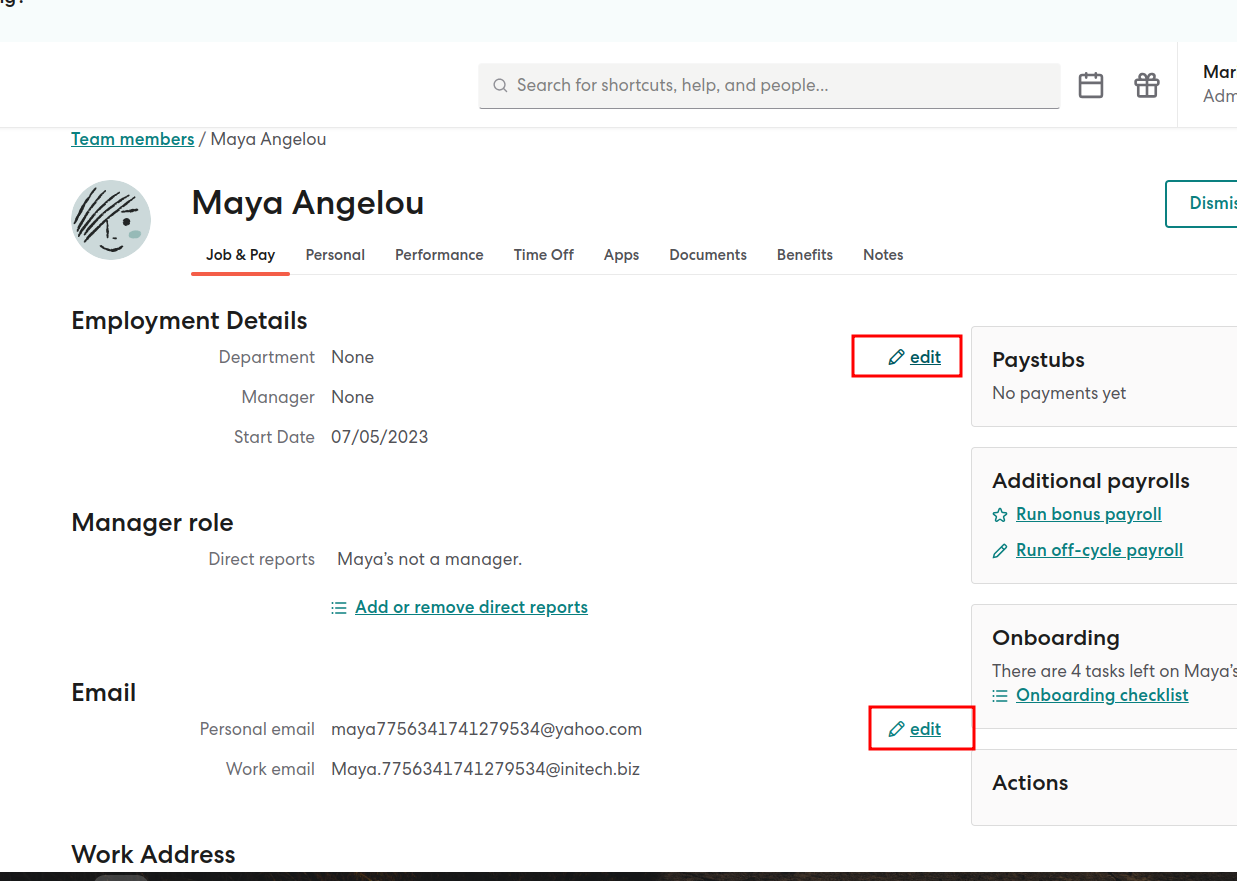

- Go to the People section and select Team Members.

- Click on the employee’s name.

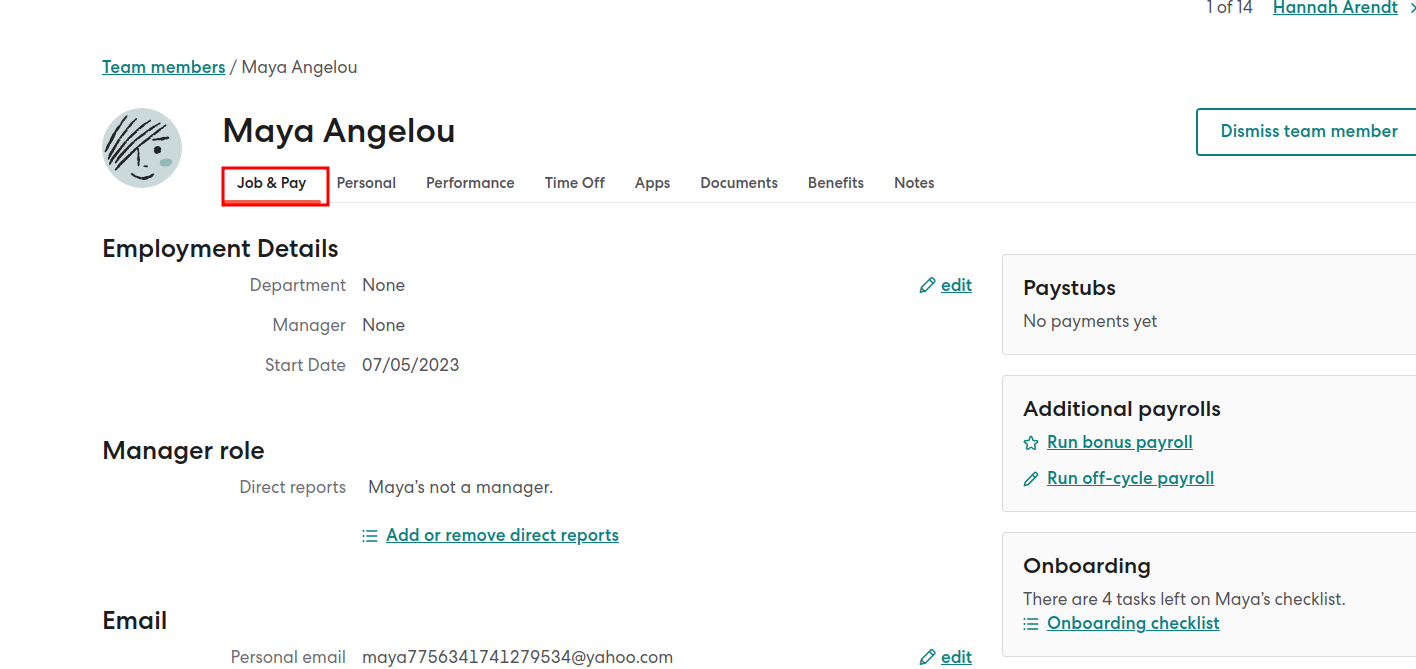

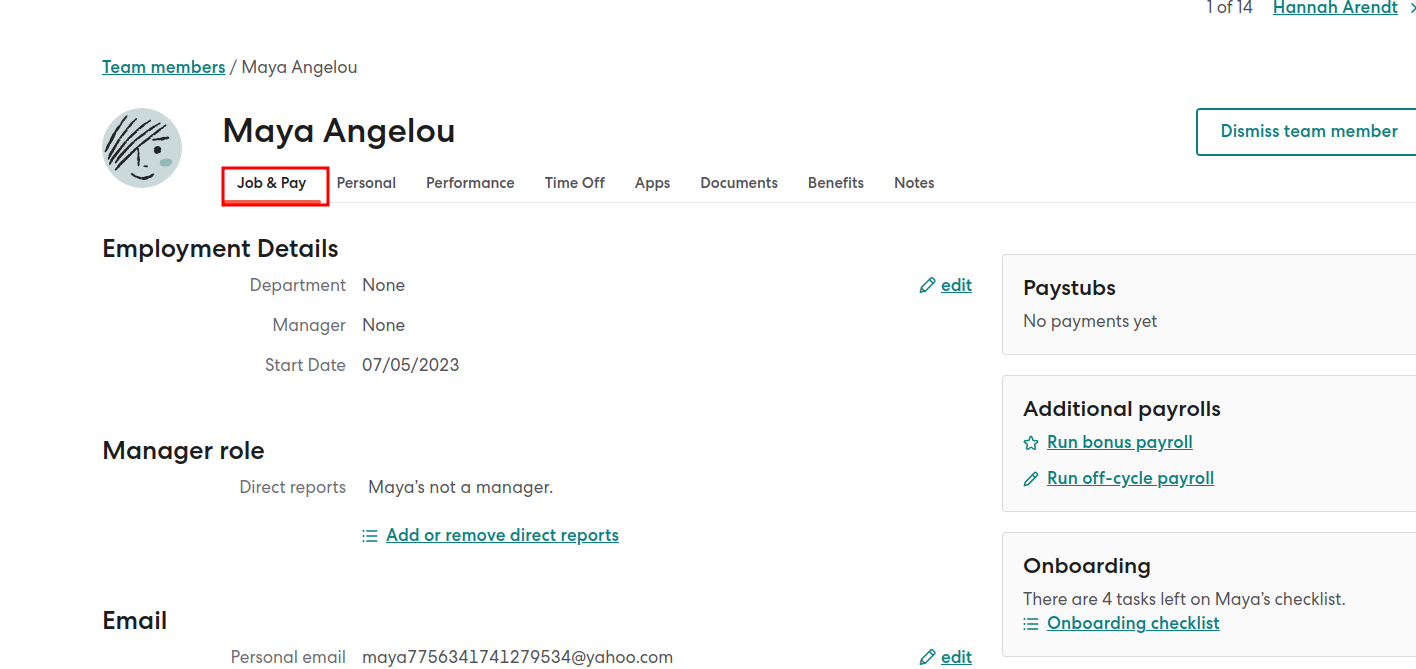

- Go to the Job & Pay section in your employee account.

- Locate the bank account that you are using for direct deposit and click on “Edit” next to it.

- Click on “Remove Account.”

- If you have multiple bank accounts set up for direct deposit and you’re an employee, repeat this process for each account. Please note that at this time, contractors cannot have multiple bank accounts set up.

From now on, you will be paid by check for future payrolls. Your employer will be responsible for distributing the check to you.

How To Pay Bills On Gusto Payroll?

Gusto partners (accountants) have the flexibility to choose from various billing options for their clients. Each client can be assigned a different billing option.

Here Are The Types Of Billing Available:

Bill To The Partner At A Discounted Rate:

- You will receive your client’s invoice, which will include a discount for the payroll services.

Bill To The Client At A Normal Rate And Send Me A Revenue Share:

- Your client will be invoiced at our regular rate.

- You will receive a monthly revenue share payment, and the specific revenue share percentage will depend on your partner level.

Bill To The Client At A Discounted Rate:

- Your client will receive an invoice that includes a discount for the payroll services.

How To Access And Modify Billing Options?

To access and modify your billing options for clients in Gusto, follow these steps:

- To View Or Change Billing Options For Clients:

- Visit your Partner dashboard.

- Navigate to the Billing section.

- Scroll down to locate “Your firm’s active clients.”

- Under the “Bill to” column, click on “Change.”

- Select one of the three available billing options:

- Bill to partner at a discounted rate.

- Bill to the client at the normal rate and send me a revenue share.

- Bill to the client at a discounted rate.

- Click “Save.”

Please note that if you switch a billing option in the middle of the month, the change will take effect on the 1st of the following month.

- To View A Client’s Invoice History If You Bill Directly To The Client:

- Go to the client’s account.

- Access the Settings section from the left menu.

- Click on the “Plan & Billing” tab.

- In the Gusto Billing section, you can view your payment plan and the upcoming invoice.

- Click on “See All Invoices” to review your payment history.

- Select “View Invoice” to examine the invoice for a specific month.

How Do Expenses Work In Gusto?

Within your Gusto admin profile, you have the ability to establish reimbursements for both employees and contractors. However, please note that expenses for contractors are currently not supported.

Key Point – “It’s important to remember that reimbursements and expense reimbursements are not subject to taxes and are not reported as regular wages.”

Let us move forward to get an in-depth explanation:

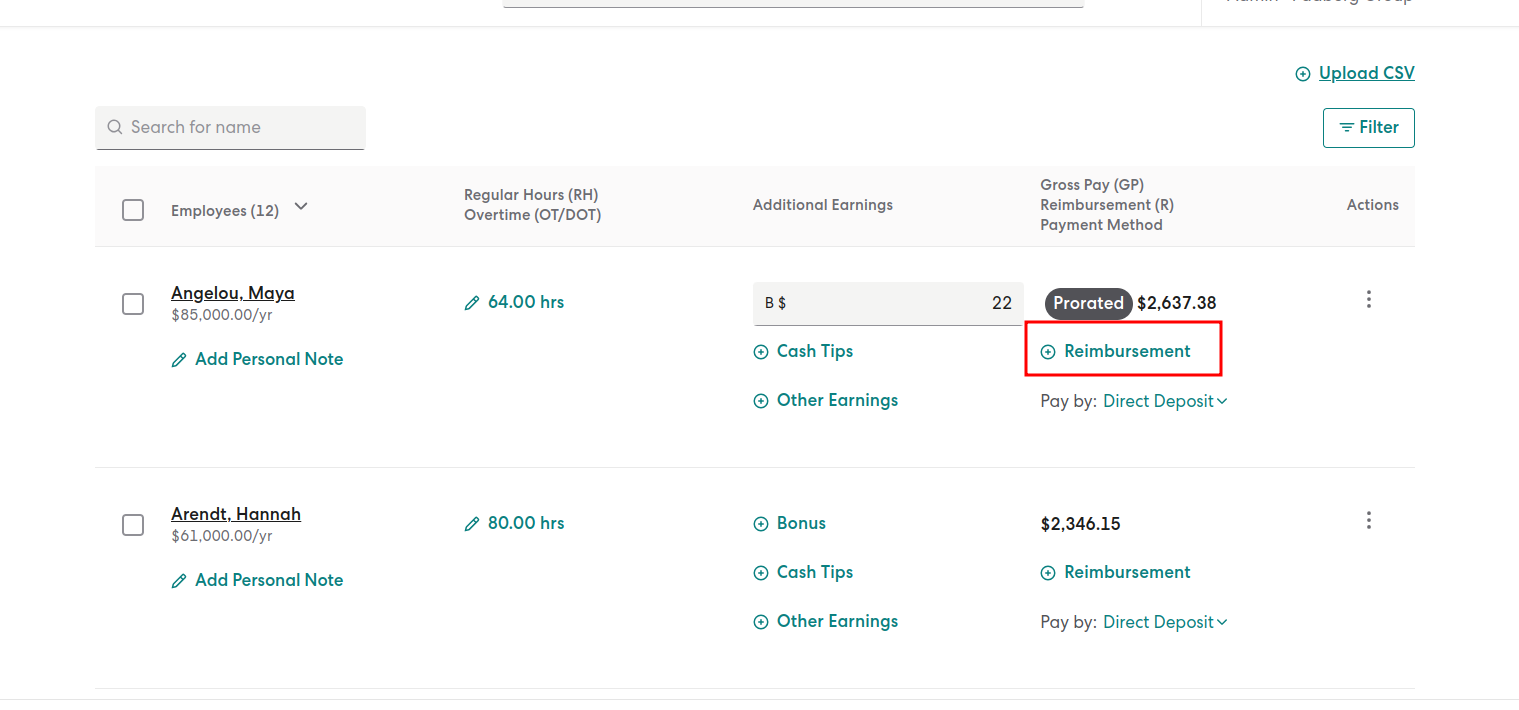

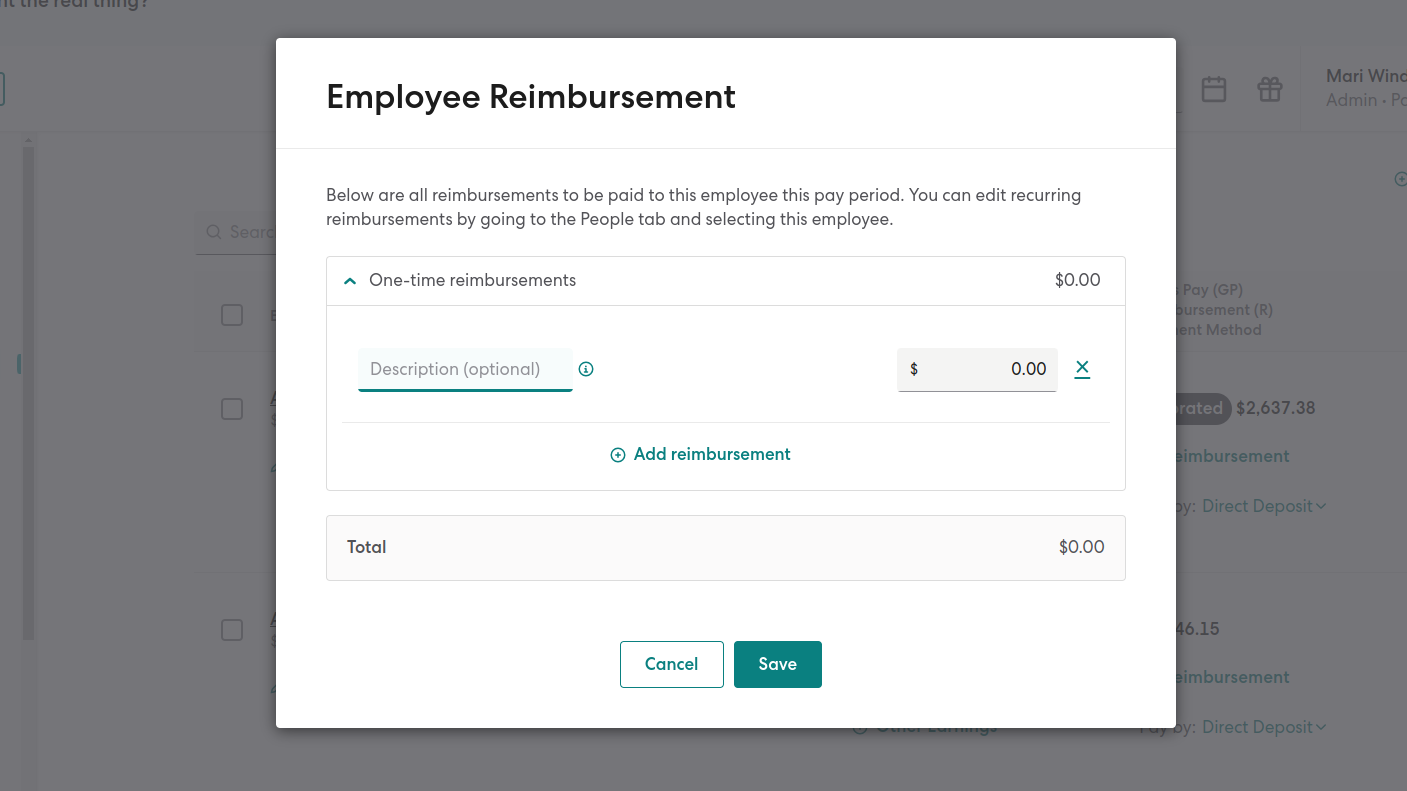

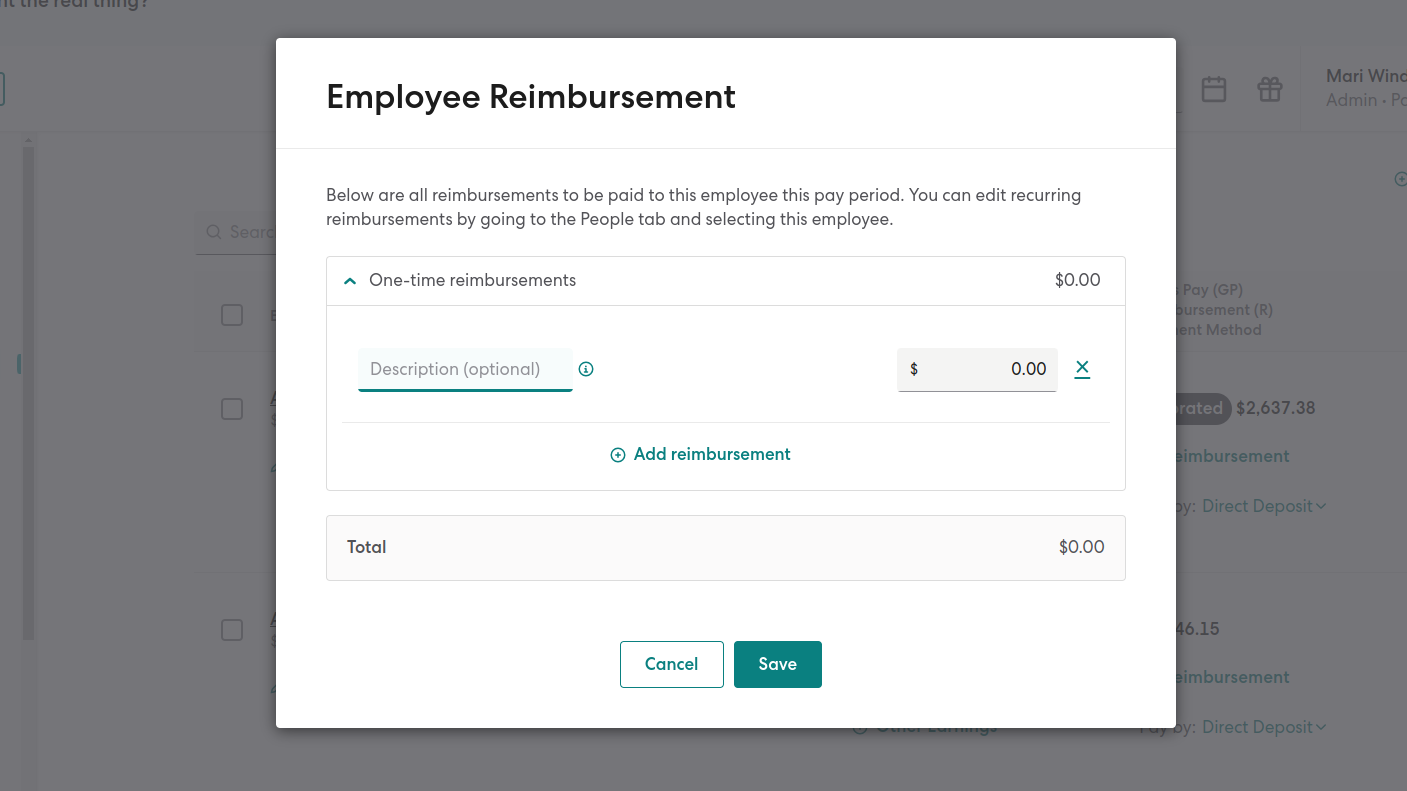

Providing A One-Time Reimbursement:

For Employees:

- Go to the Payroll section and select Run Payroll.

- Choose between Run Regular Payroll to pay them within their regular pay period or Off-cycle Payroll to pay outside of the regular pay period.

- Click on Off-cycle Payroll

- Click on the employee’s name and select +Reimbursement.

- To give multiple employees the same one-time reimbursement, utilize the bulk edit tool.

- Enter the desired dollar amount for reimbursement.

- Complete the payroll process.

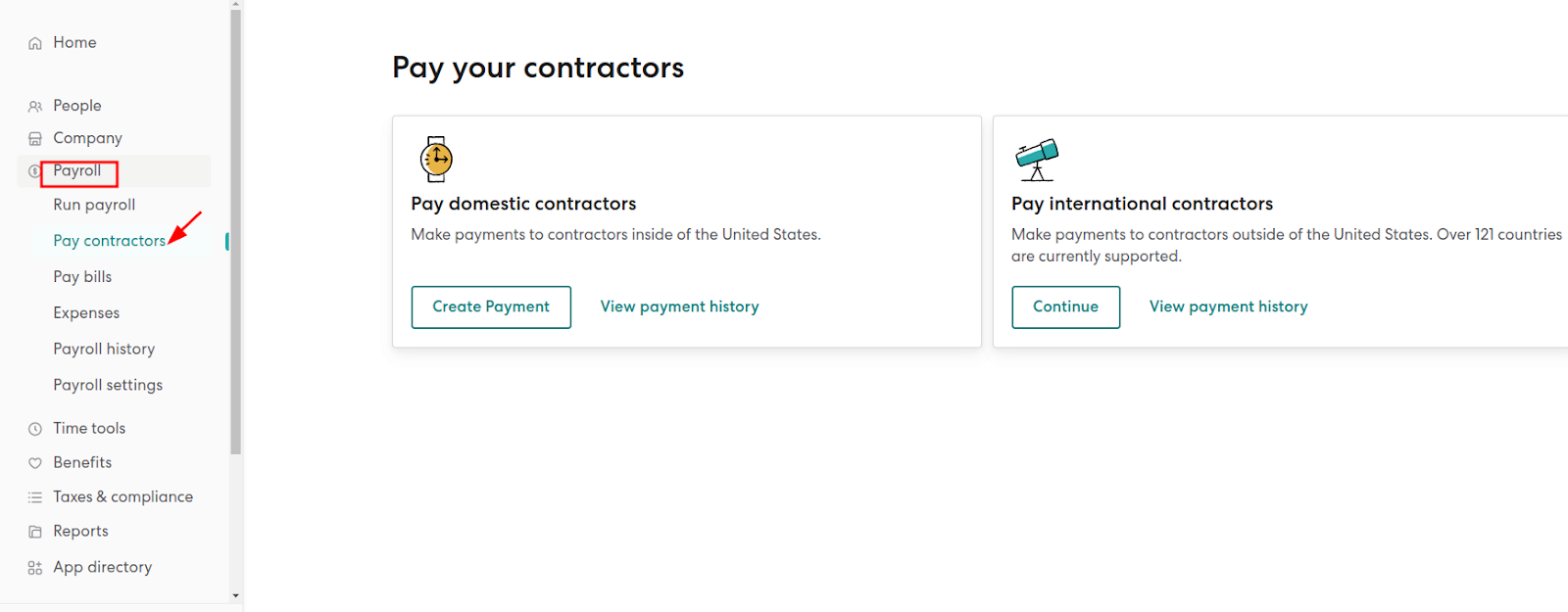

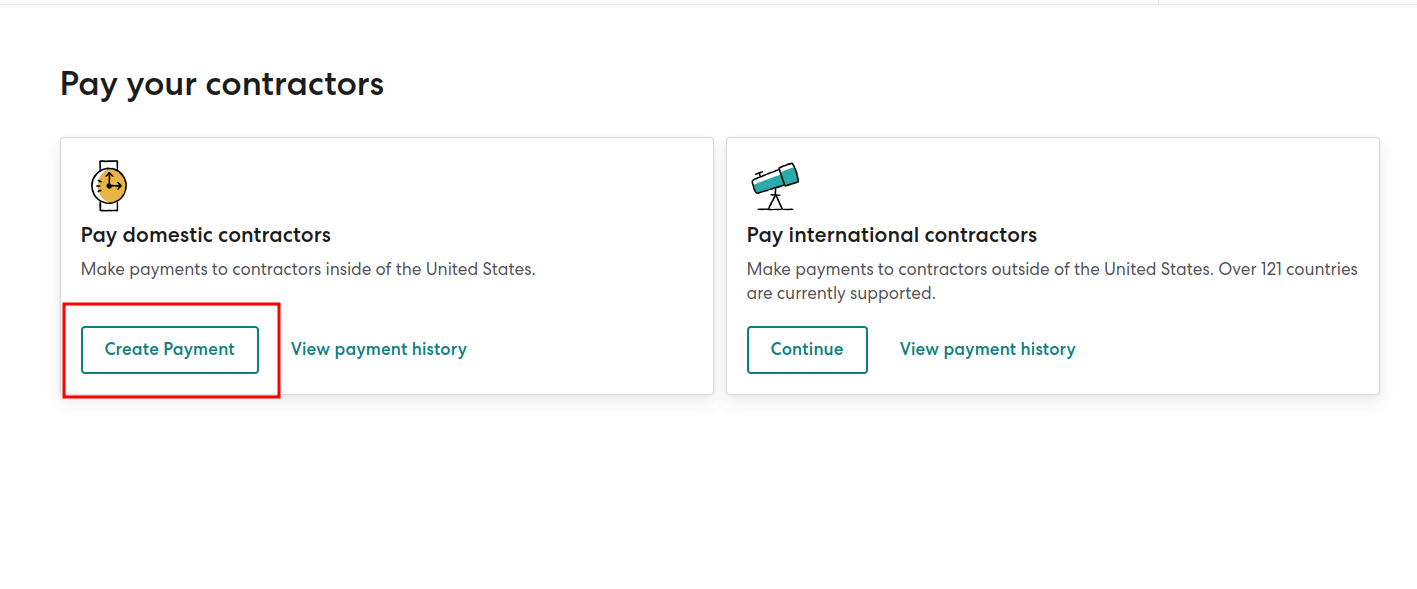

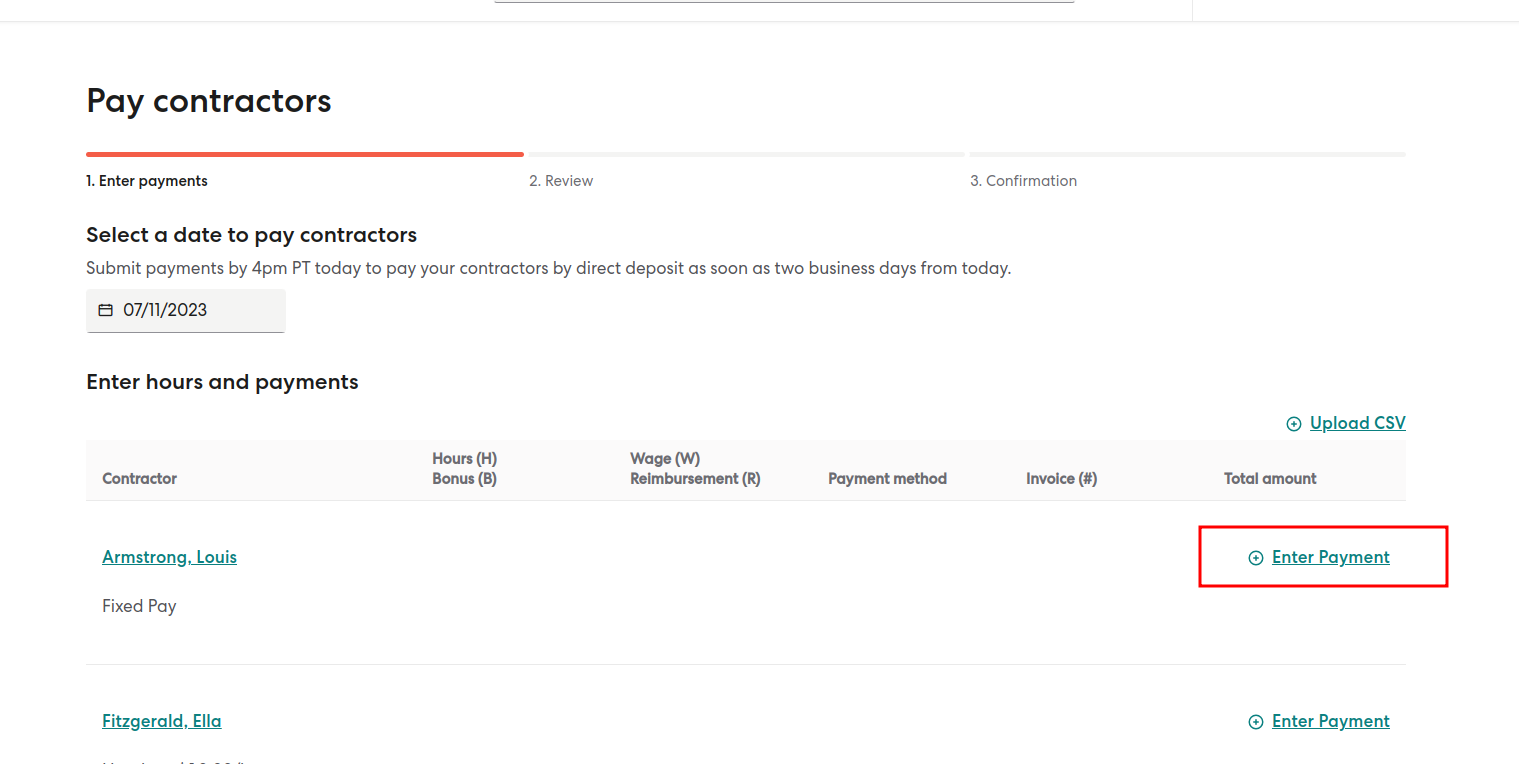

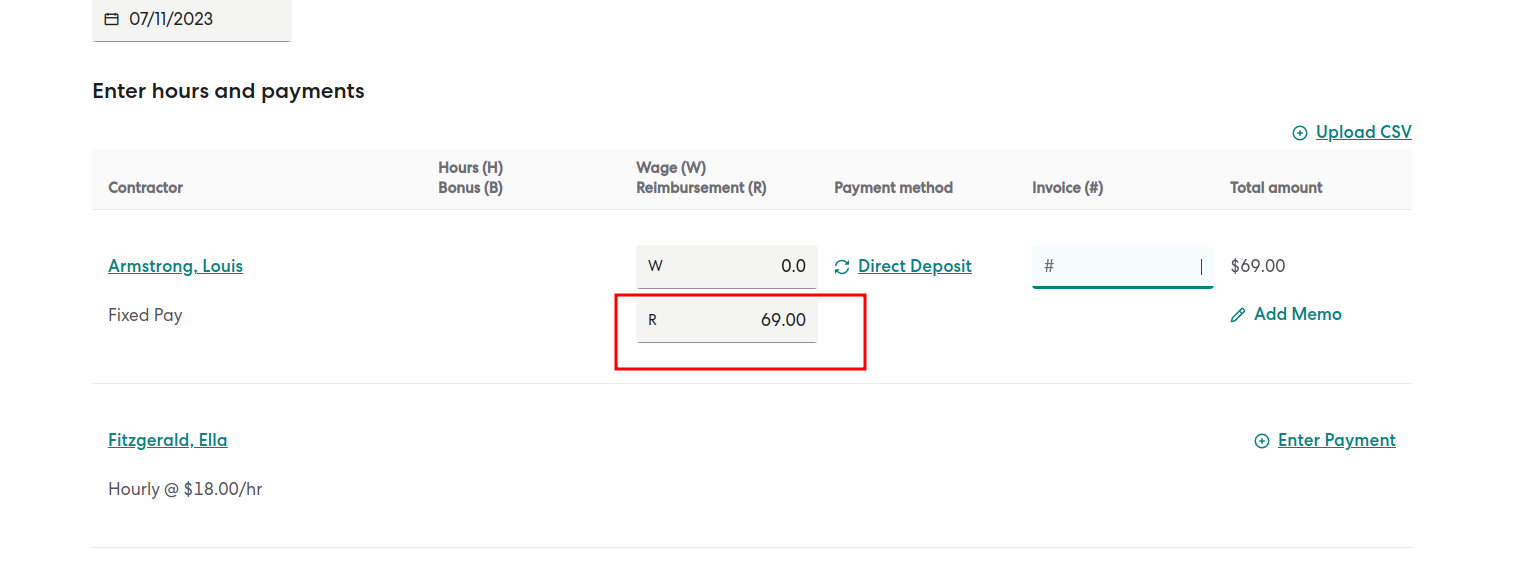

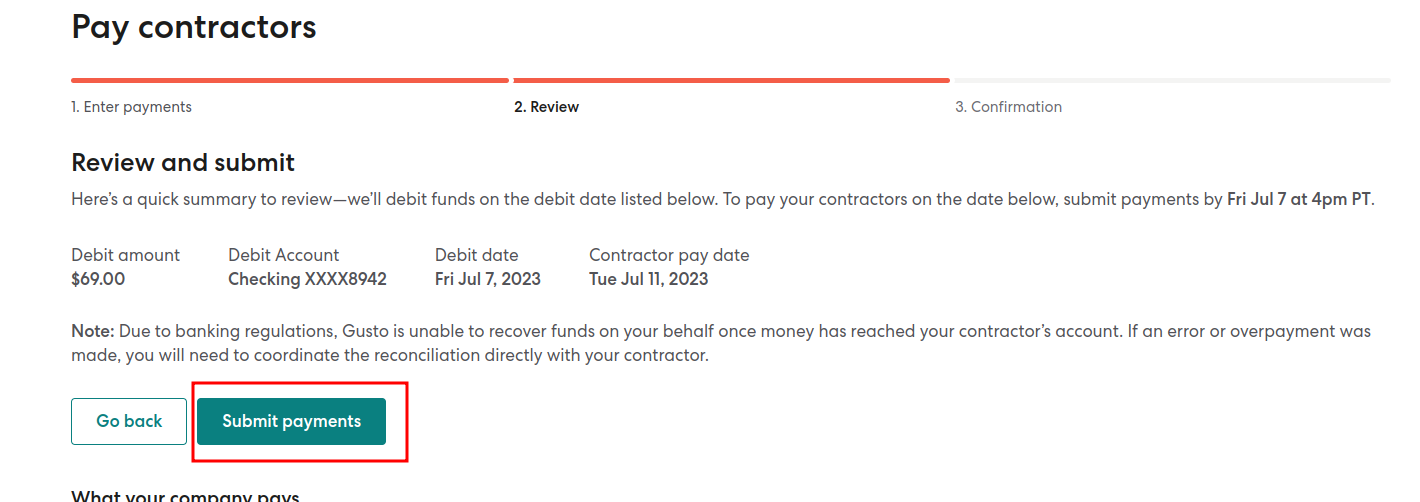

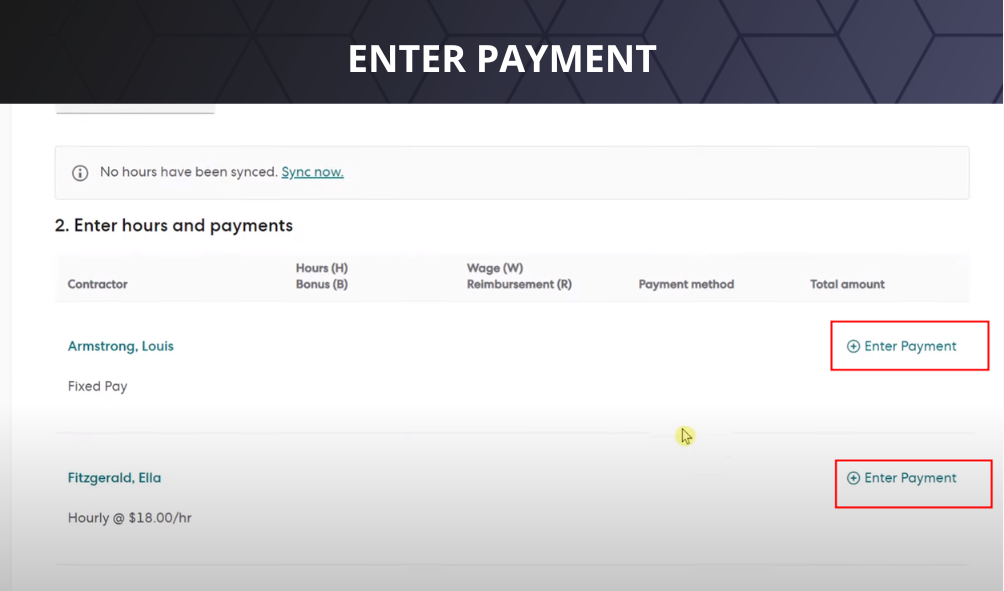

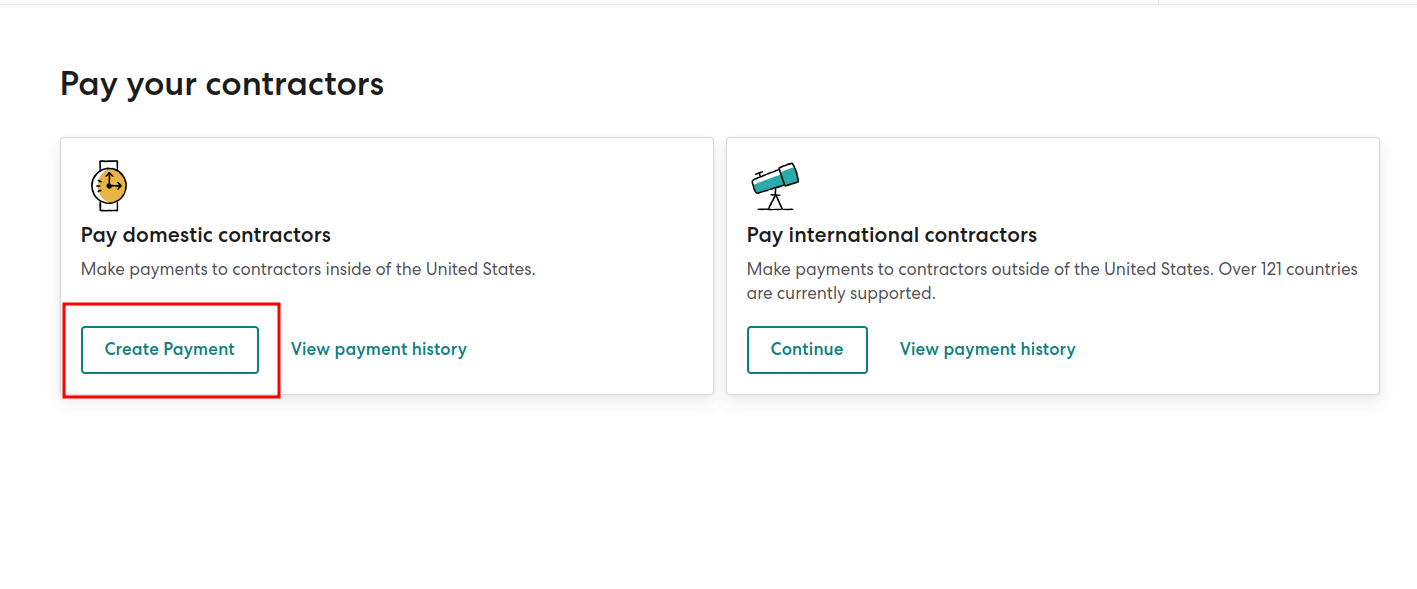

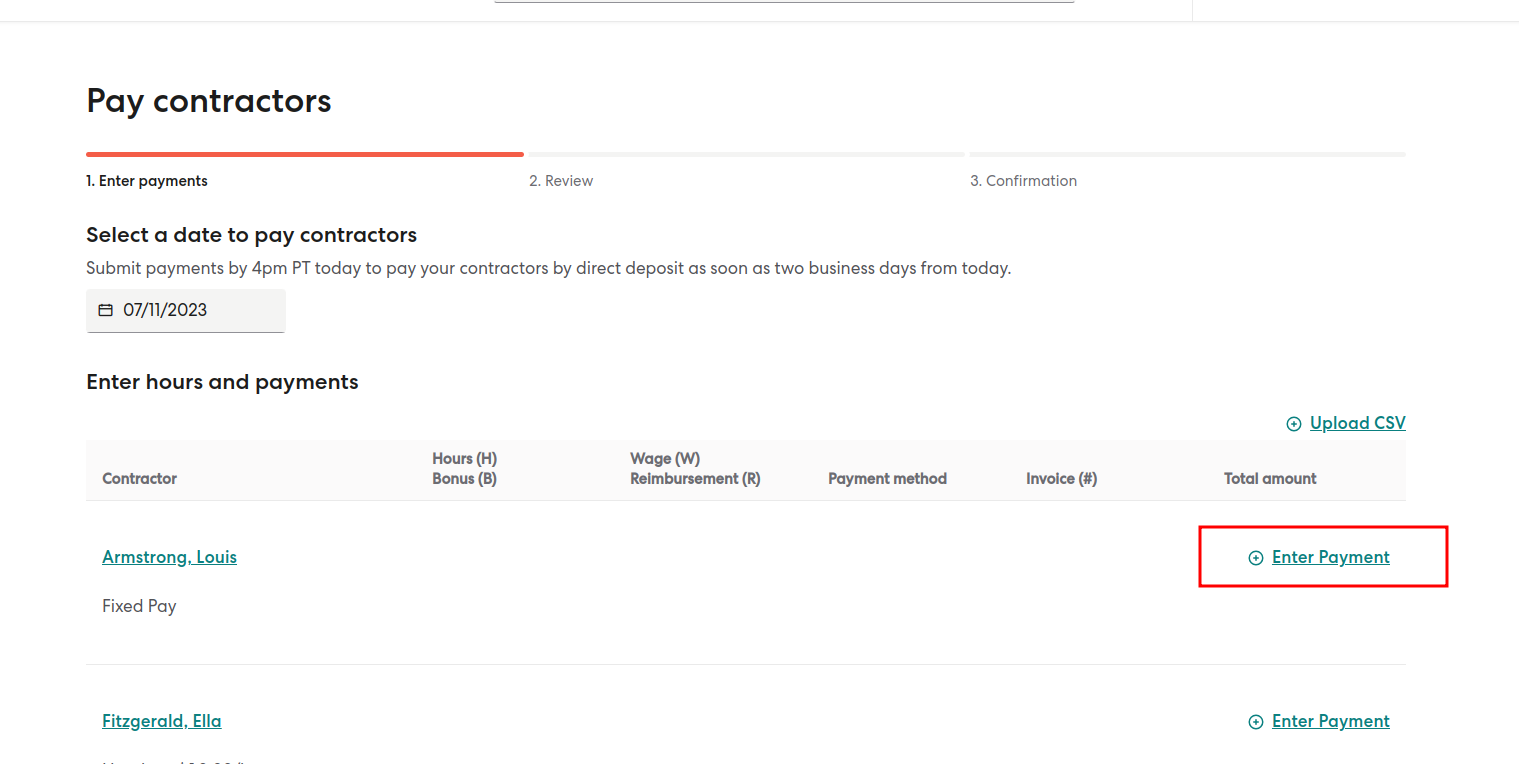

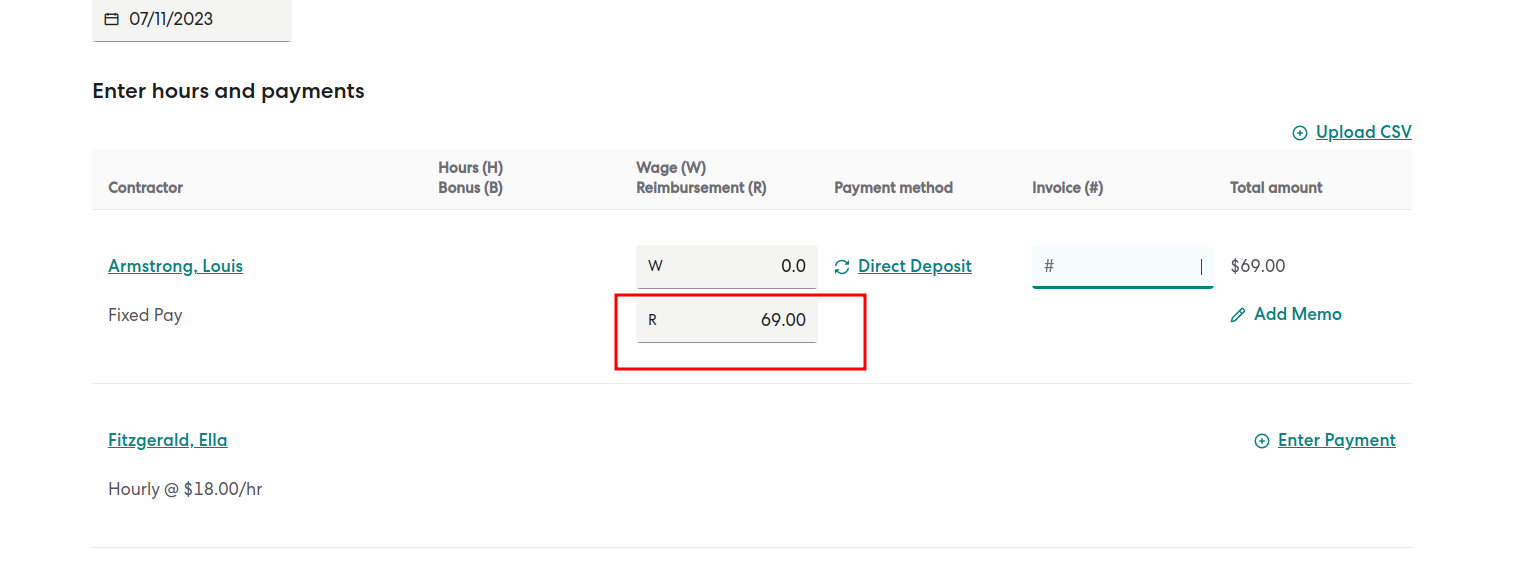

For Contractors:

- Navigate to the Payroll section and select Pay Contractors.

- Next to the contractor’s name, click on +Enter Payment, and then select +Reimbursement.

- Specify the dollar amount for reimbursement.

- Finalize the payment process.

Once the reimbursement has been processed, it will be displayed as a separate line item on the employee’s or contractor’s paystub. If you wish to provide additional details about the reimbursement, you can add a personal note on the paystub.

Key Point: “If you have AutoPilot enabled for your payroll, you will need to run the payroll manually to add a one-time reimbursement by following the above instructions. Alternatively, you can approve all expenses before AutoPilot runs.”

Managing Recurring Reimbursements:

To provide reimbursements to contractors, follow the steps for giving a one-time reimbursement.

Key Point: “Recurring reimbursements for contractors are currently not supported.”

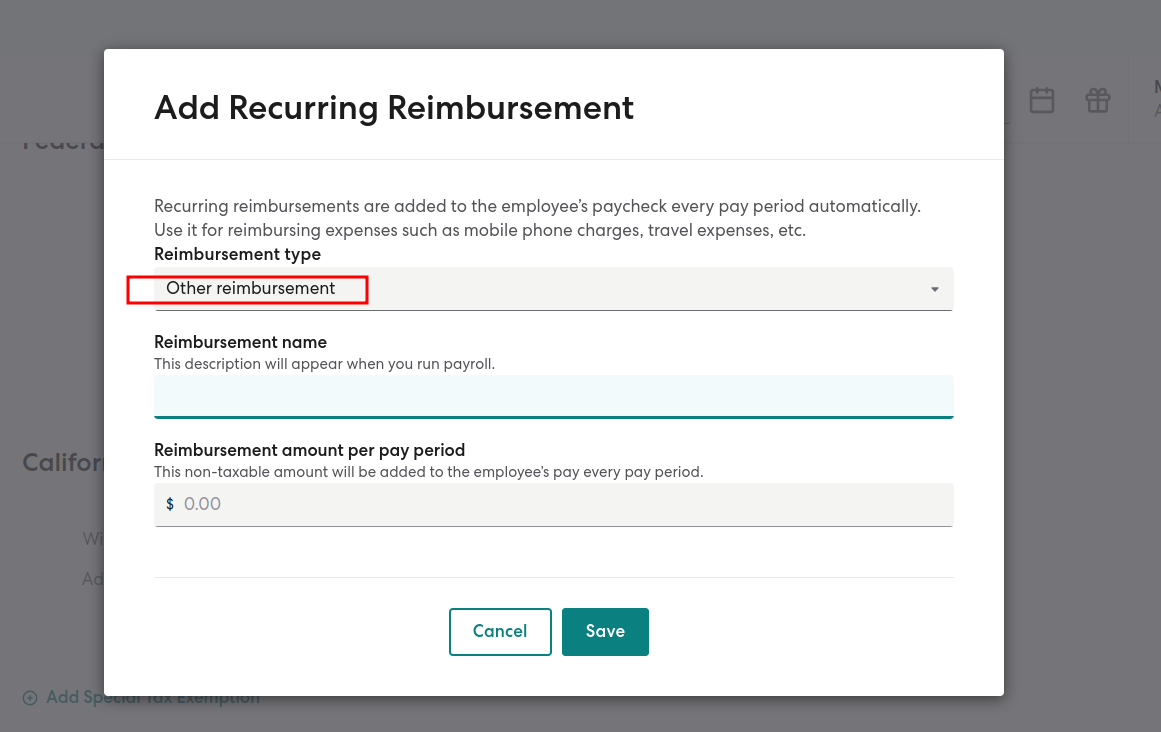

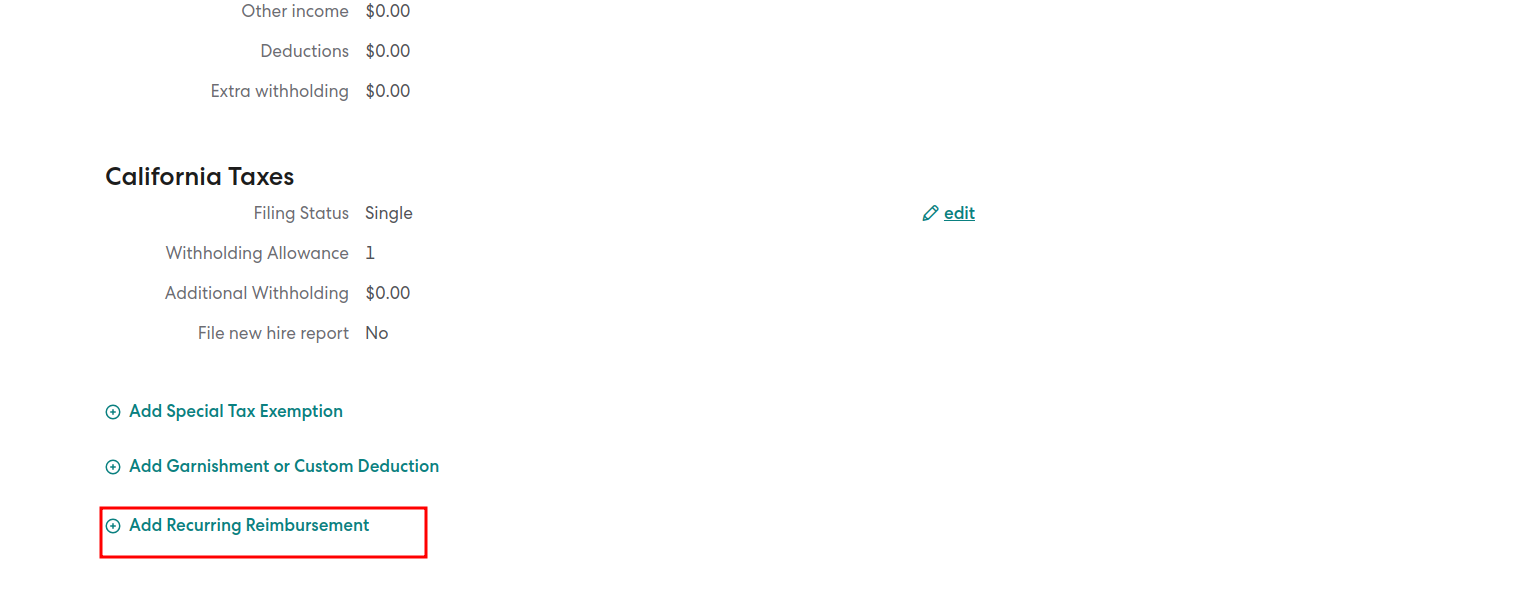

Setting Up A Recurring Reimbursement:

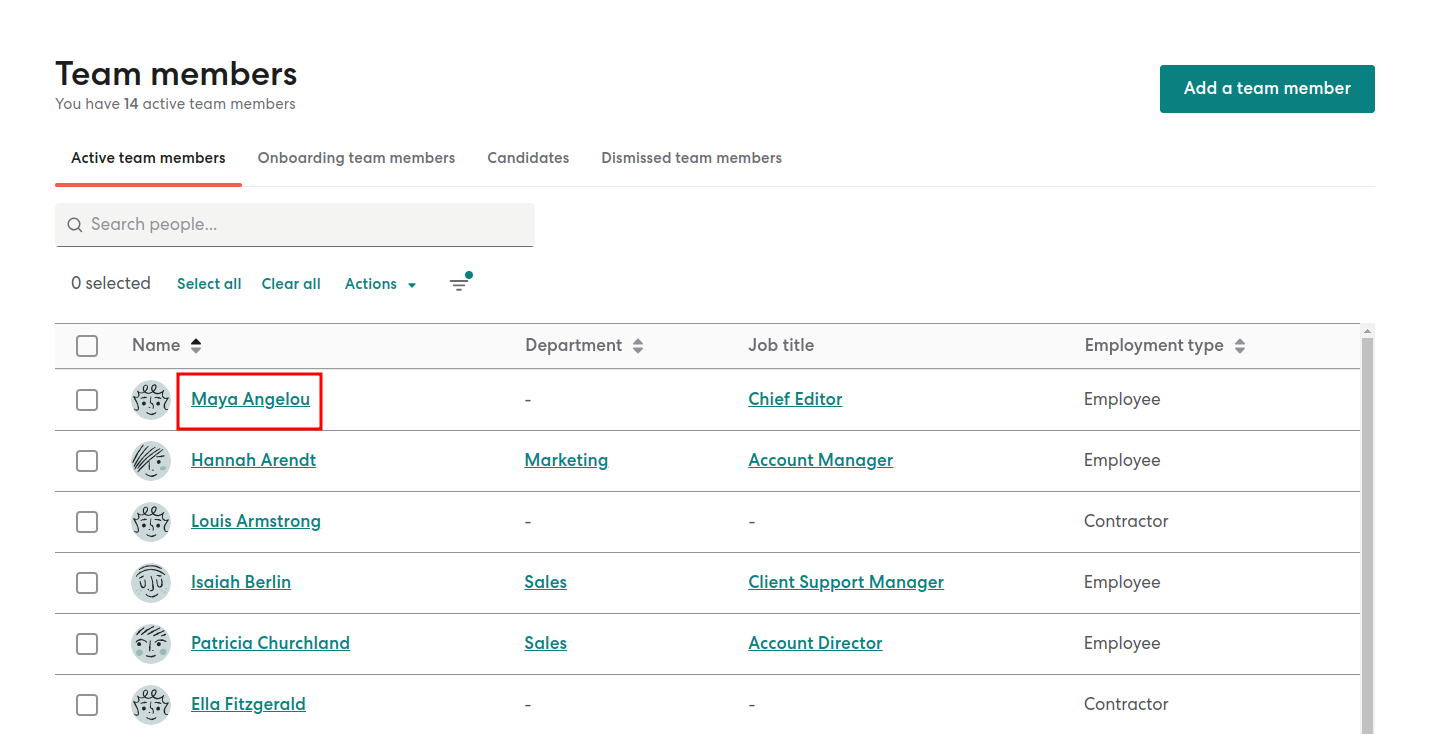

- Go to the People section and select Team Members.

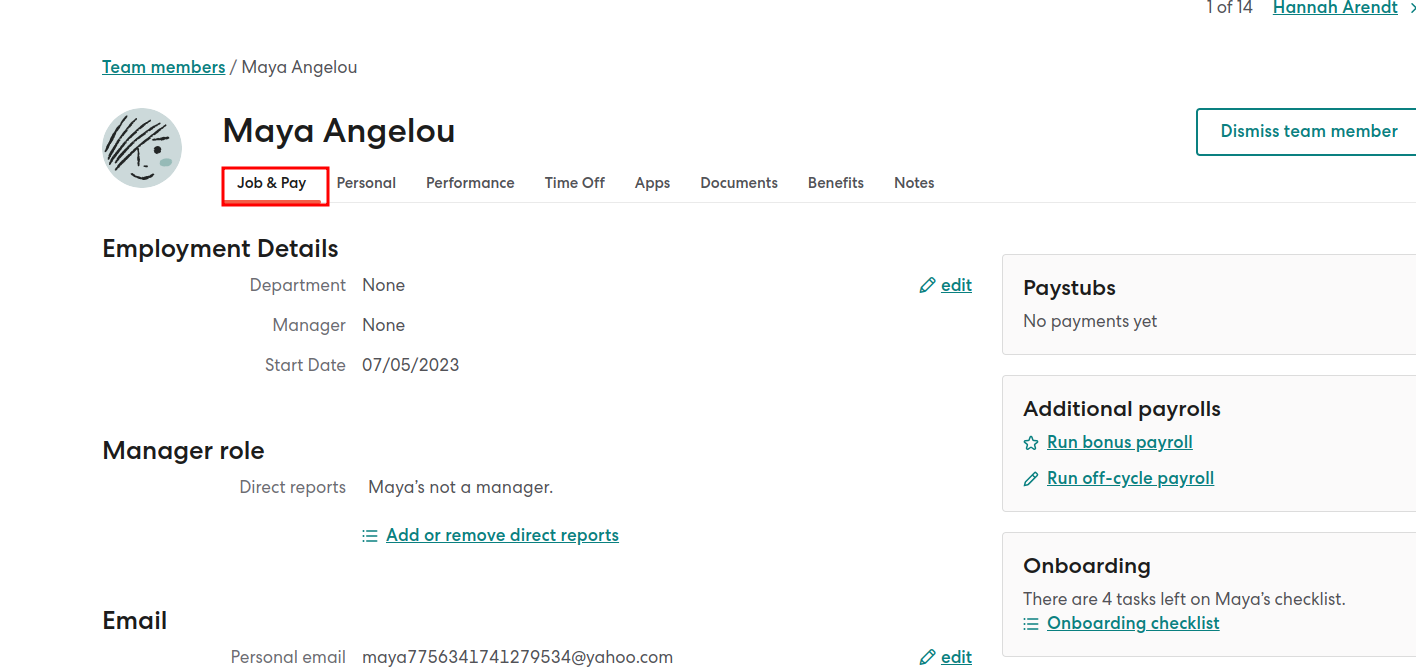

- Choose the employee’s name.

- Scroll down to the Job & Pay tab.

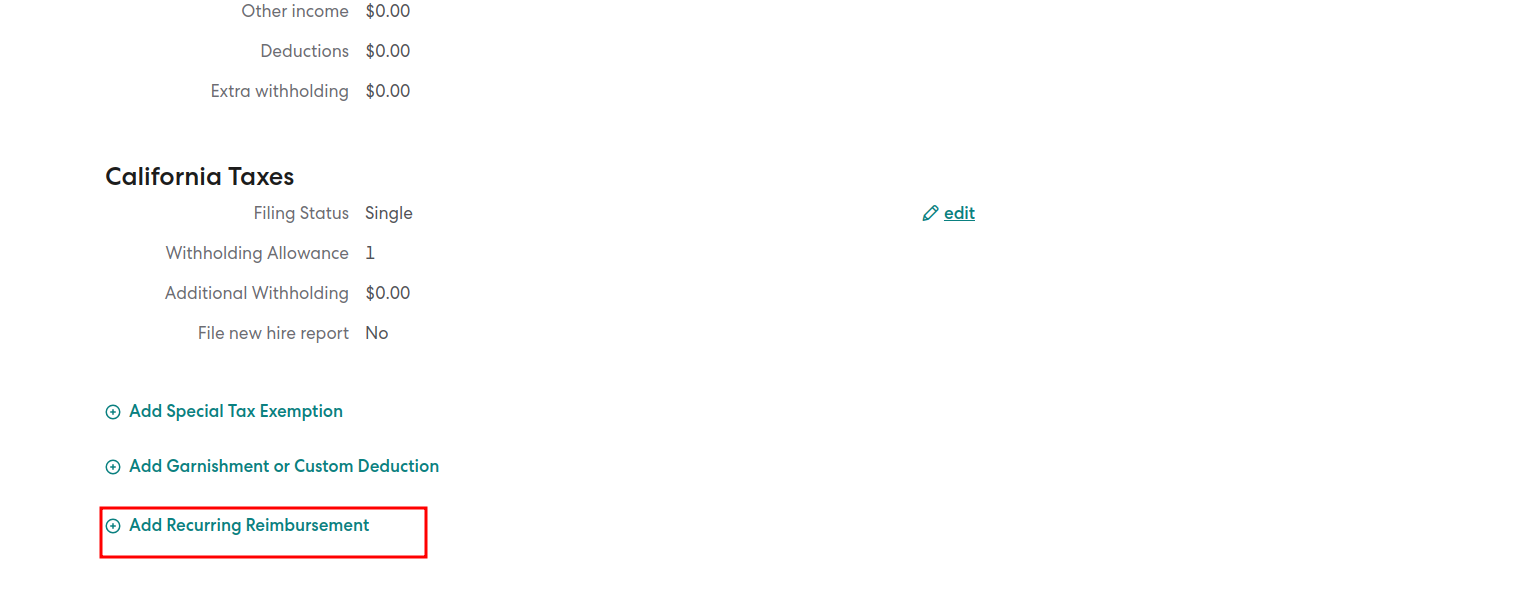

- Click on Add Recurring Reimbursement.

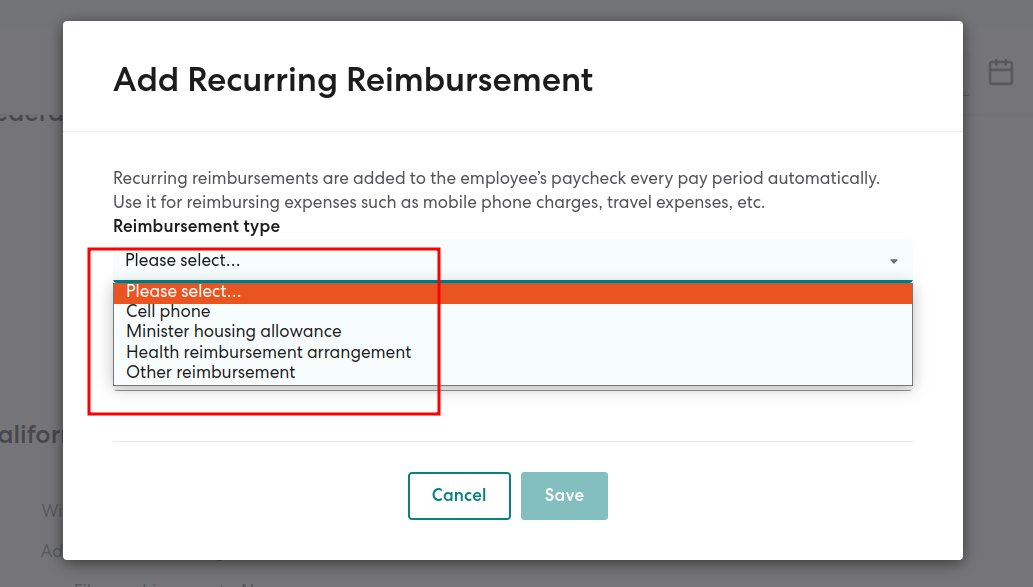

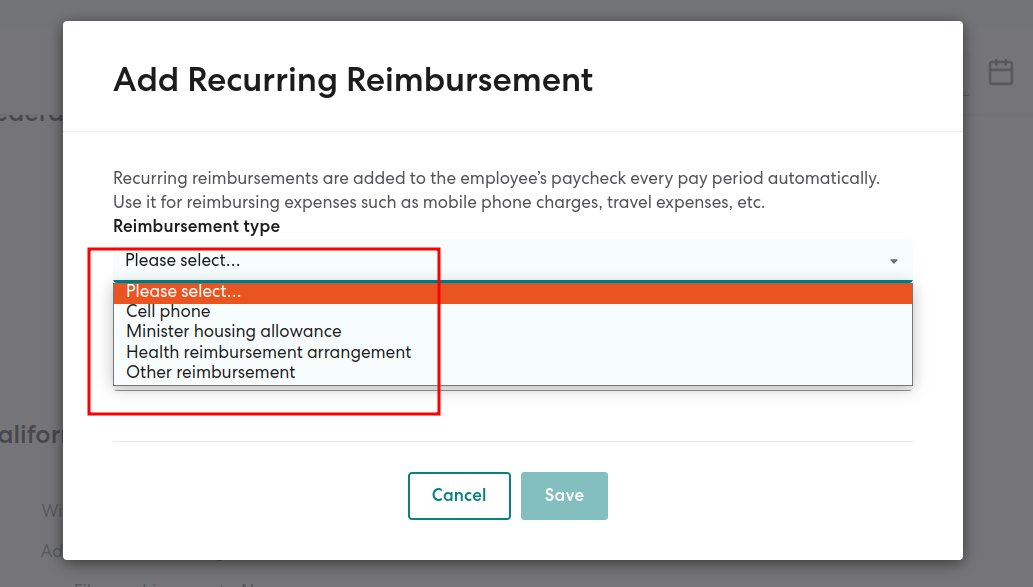

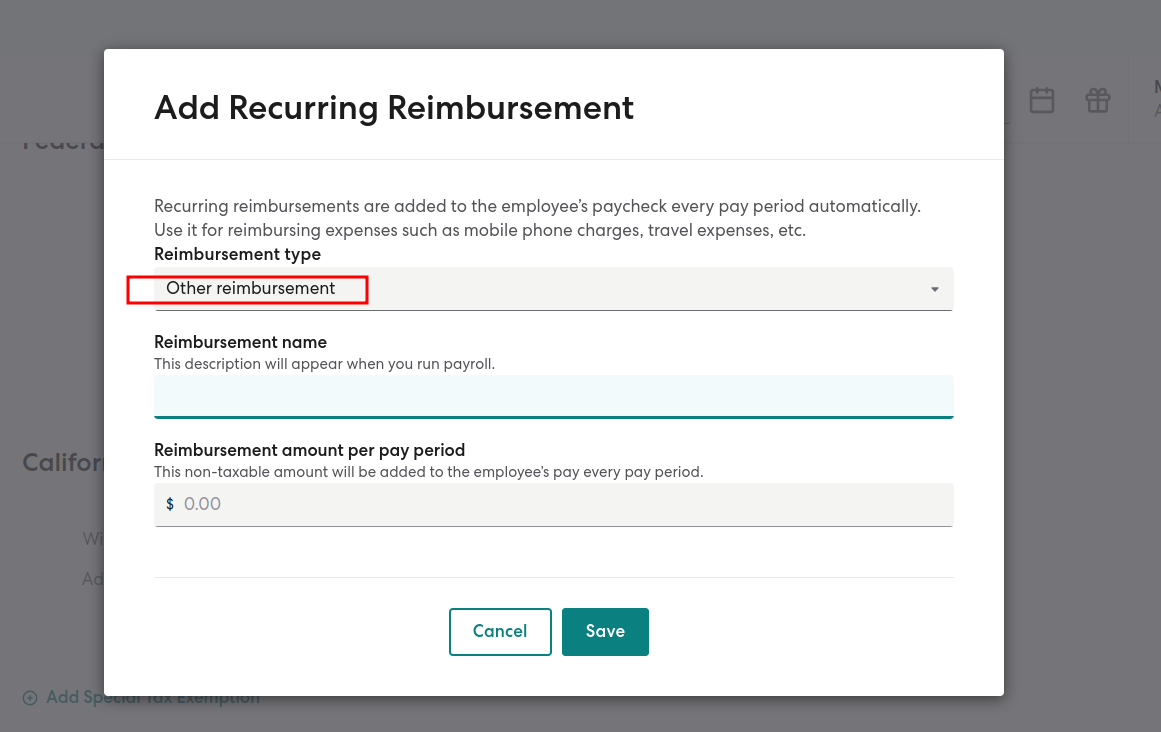

- Select a reimbursement type from the drop-down menu, or choose Other Reimbursement to create a new reimbursement type.

- If you select “Other reimbursement,” enter the reimbursement name (e.g., office lunches).

- Enter the reimbursement amount that will be added to each regular payroll.

- Click Save.

- The reimbursement amount will appear in the reimbursement field when you run the next payroll. You can edit the amount if necessary before processing the payroll.Editing A Recurring Reimbursement:

- Navigate to the People section and select Team Members.

- Click on Edit next to the reimbursement you want to modify.

- You can make changes to the reimbursement type, name, or amount.

The updated reimbursement details will be reflected in the reimbursement field during the next payroll. You can adjust the amount if needed before processing the payroll.

Deleting A Recurring Reimbursement:

- Visit the People section and select Team Members.

- Choose the employee’s name.

- Scroll down to the Job & Pay tab.

- Click on Edit next to the reimbursement you wish to delete.

- Click on Delete this reimbursement.

Reimbursing The Team For Their Expenses

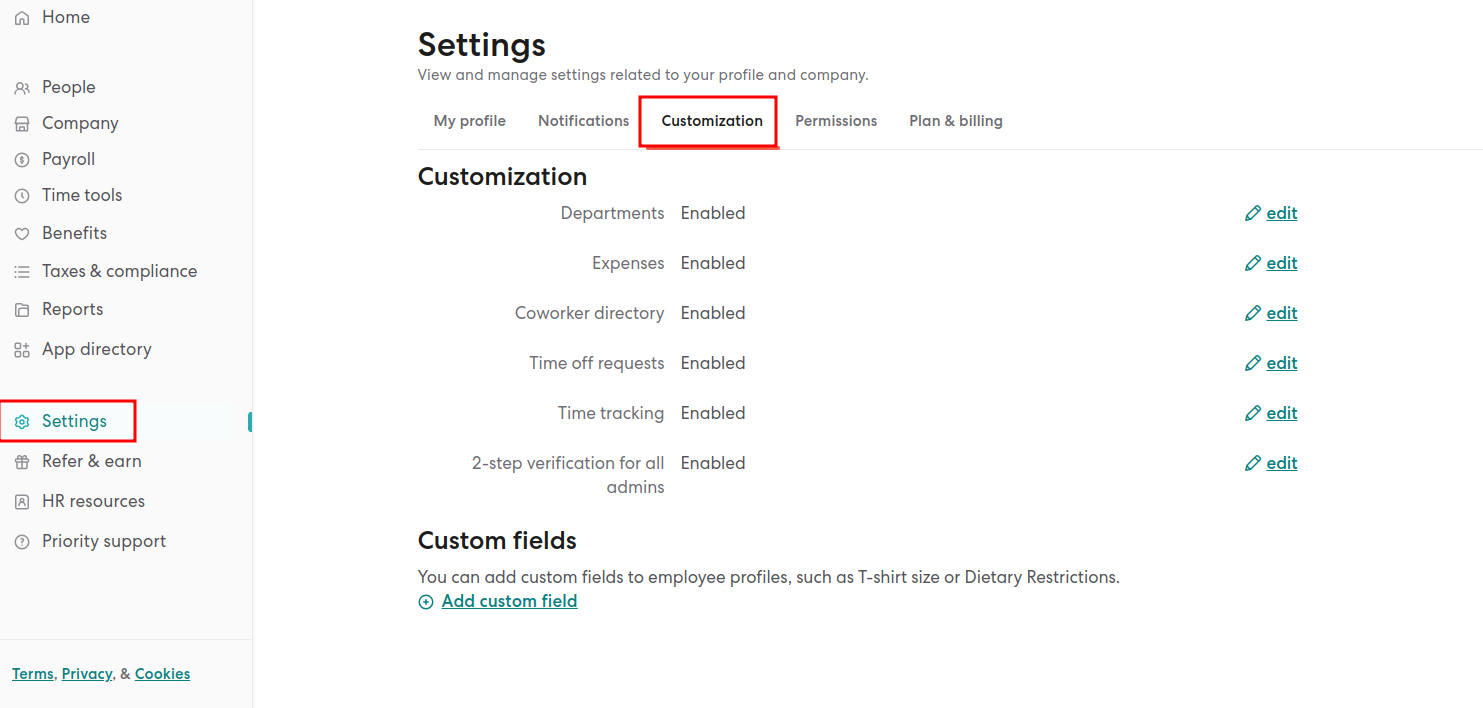

If you are a Plus or Premium customer of Gusto, you have the ability to reimburse employees for their expenses using the Expenses feature. However, if you don’t see this feature available, you have two options. You can upgrade your plan to either Plus or Premium to access the Expenses feature, or you can opt for a one-time reimbursement setup instead.

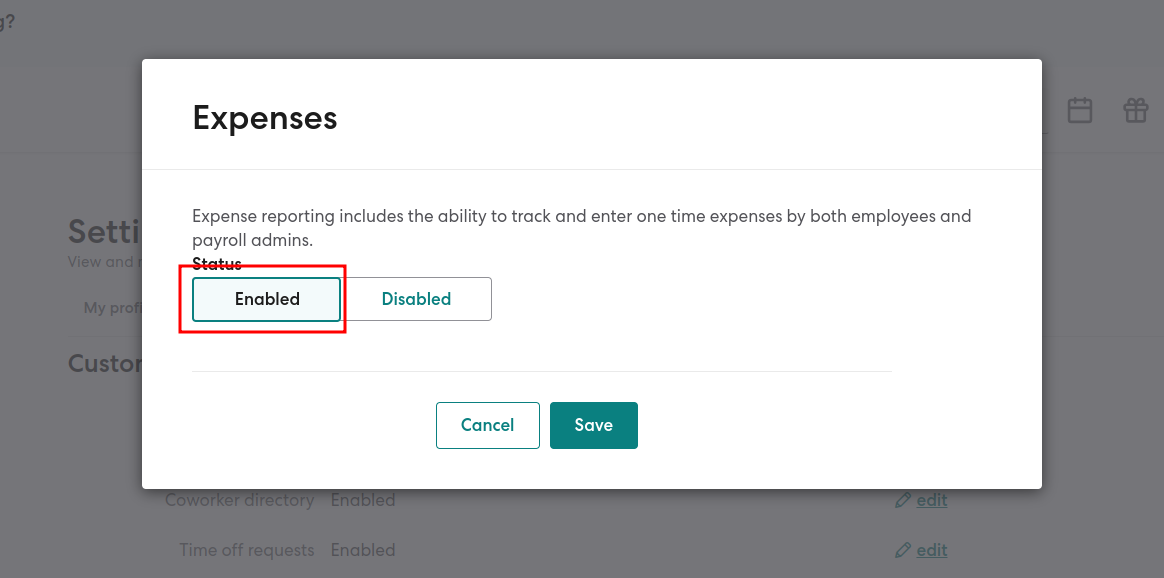

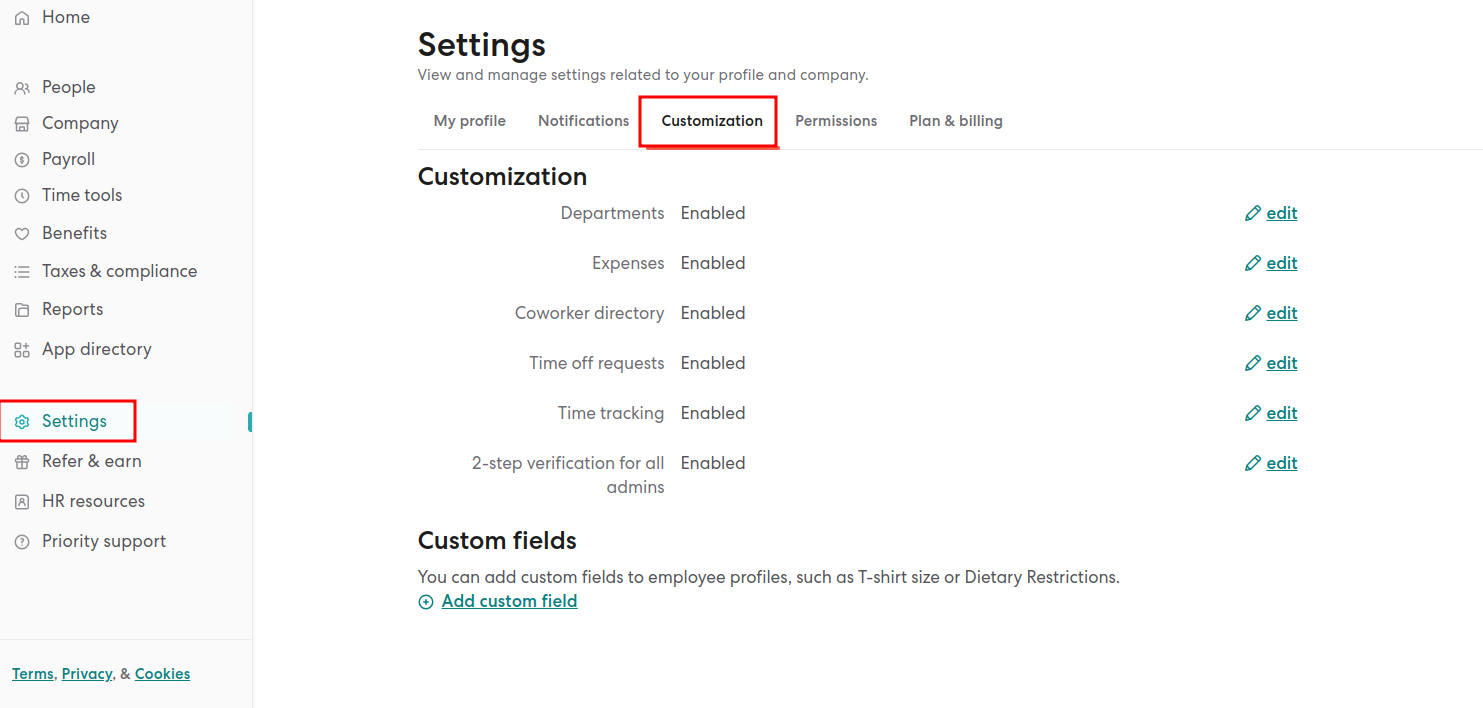

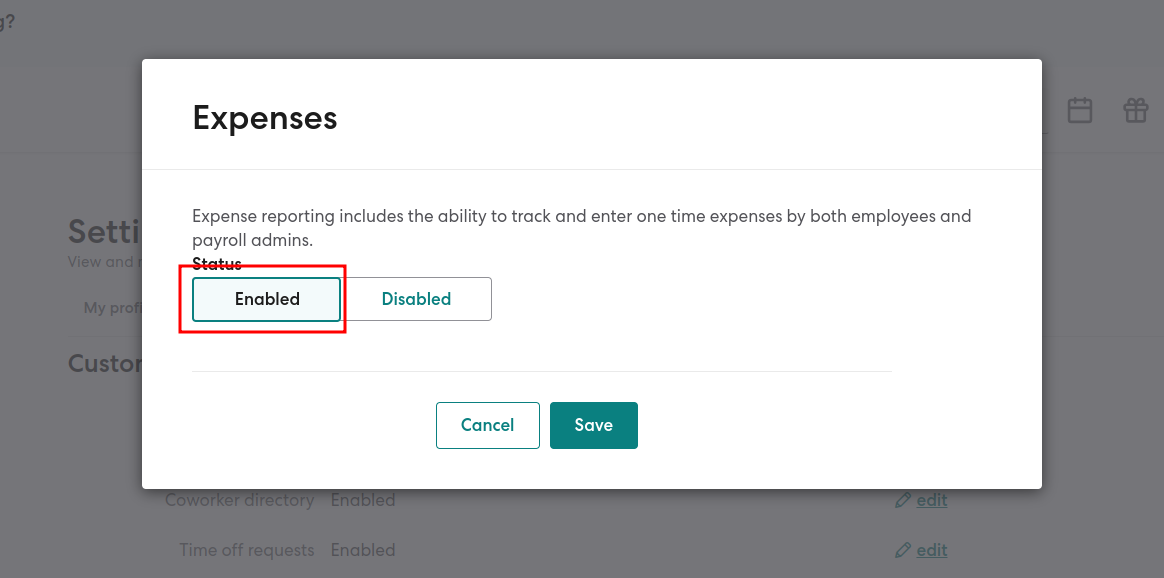

Enable Expenses:

- Sign in to your Gusto account.

- Go to the Settings section and select the Customization tab.

- Click on “Expenses” and toggle it to Enabled.

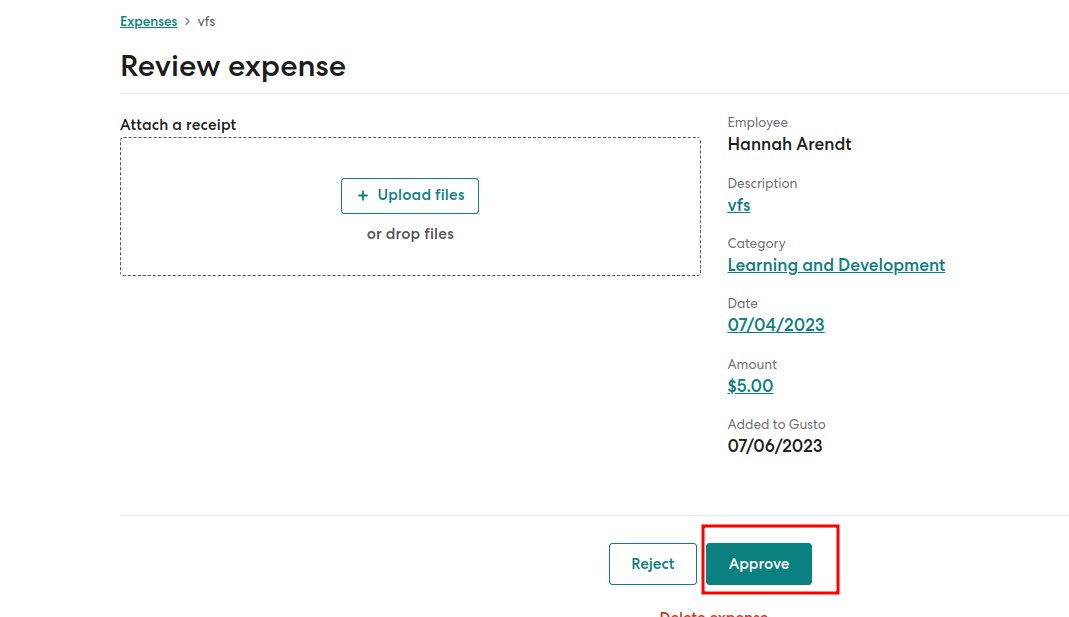

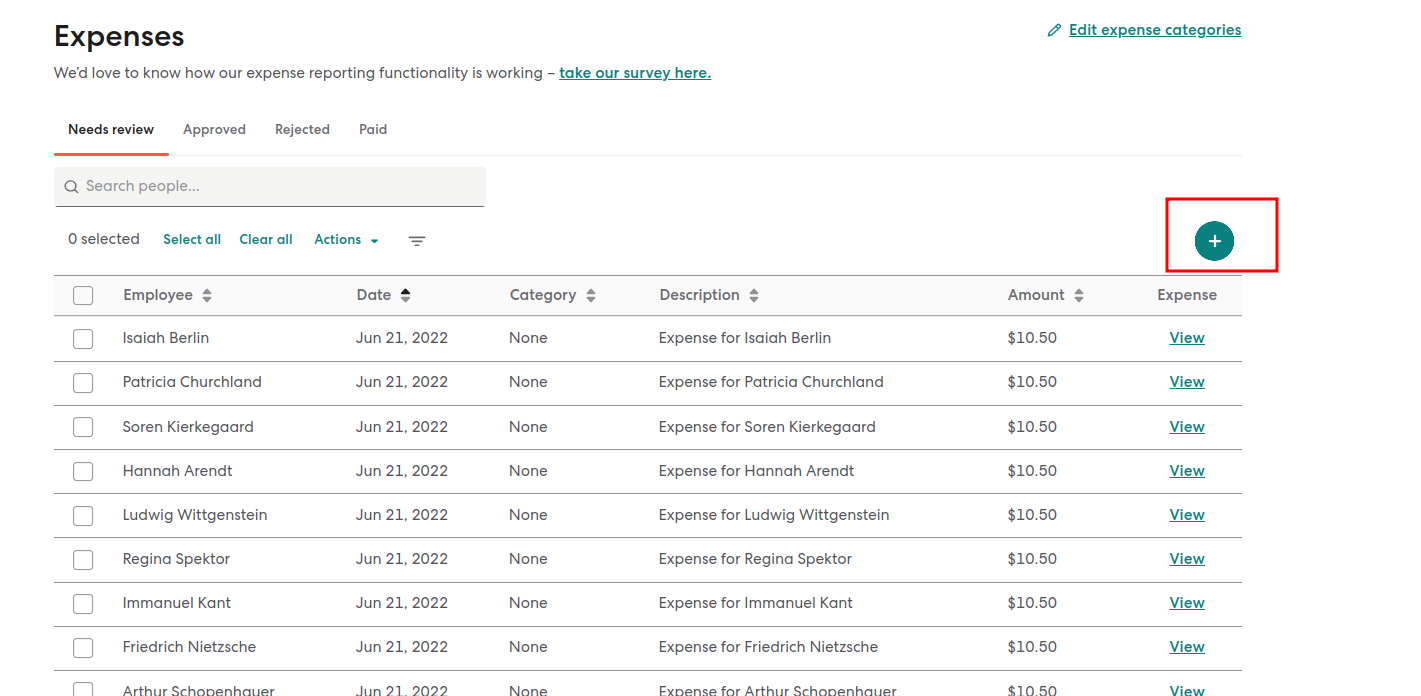

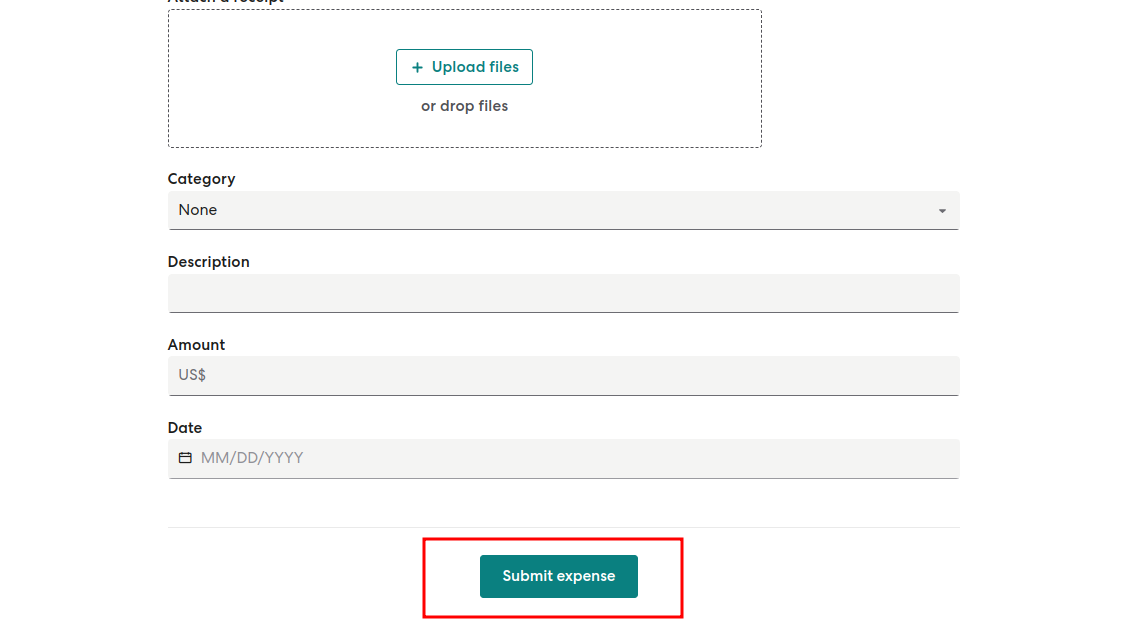

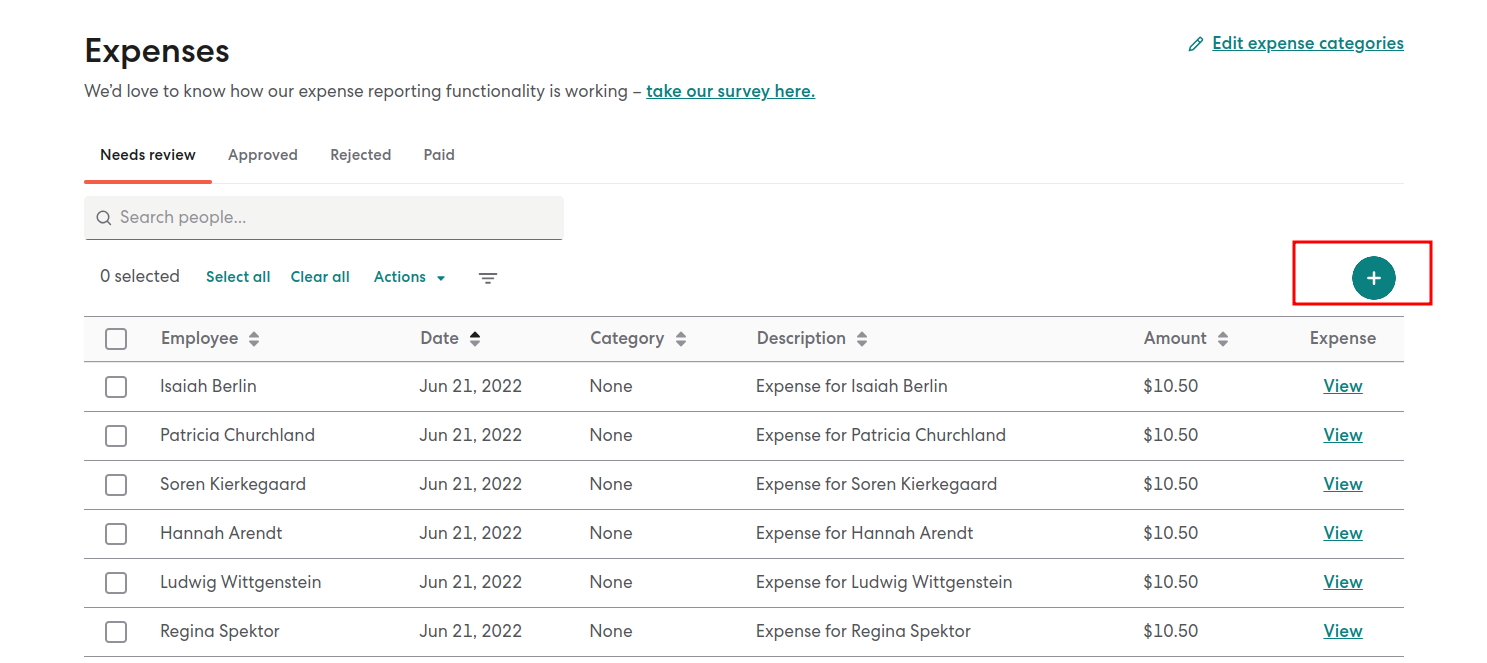

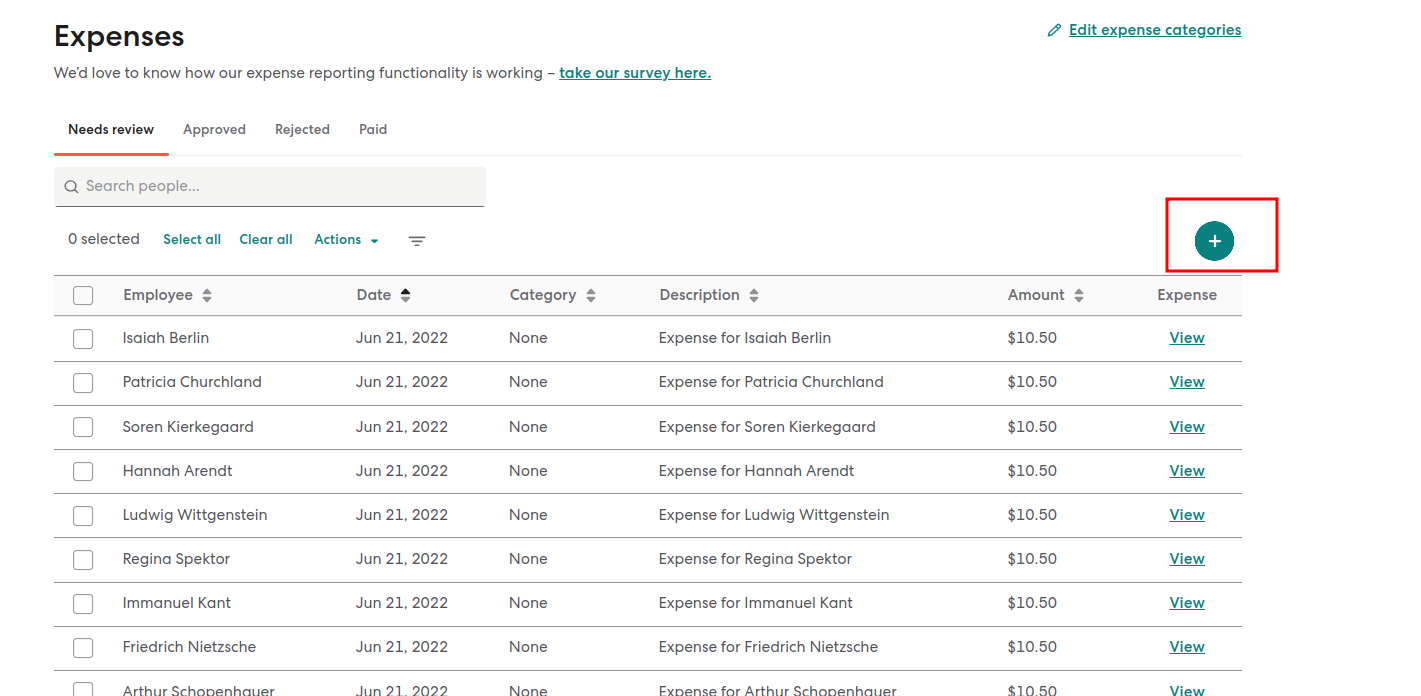

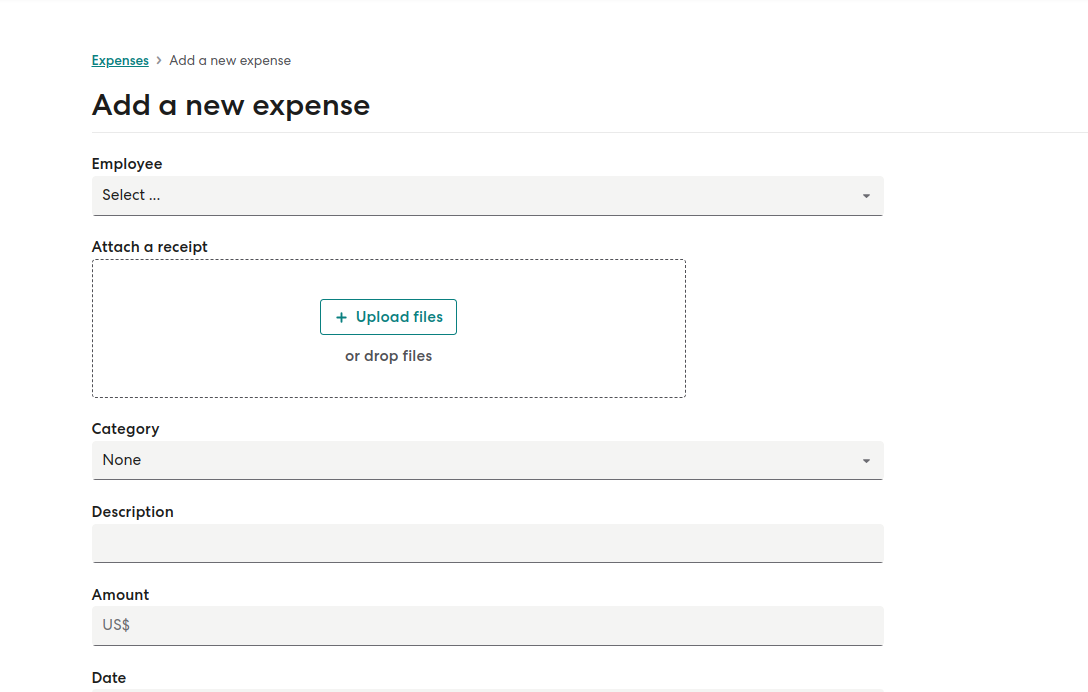

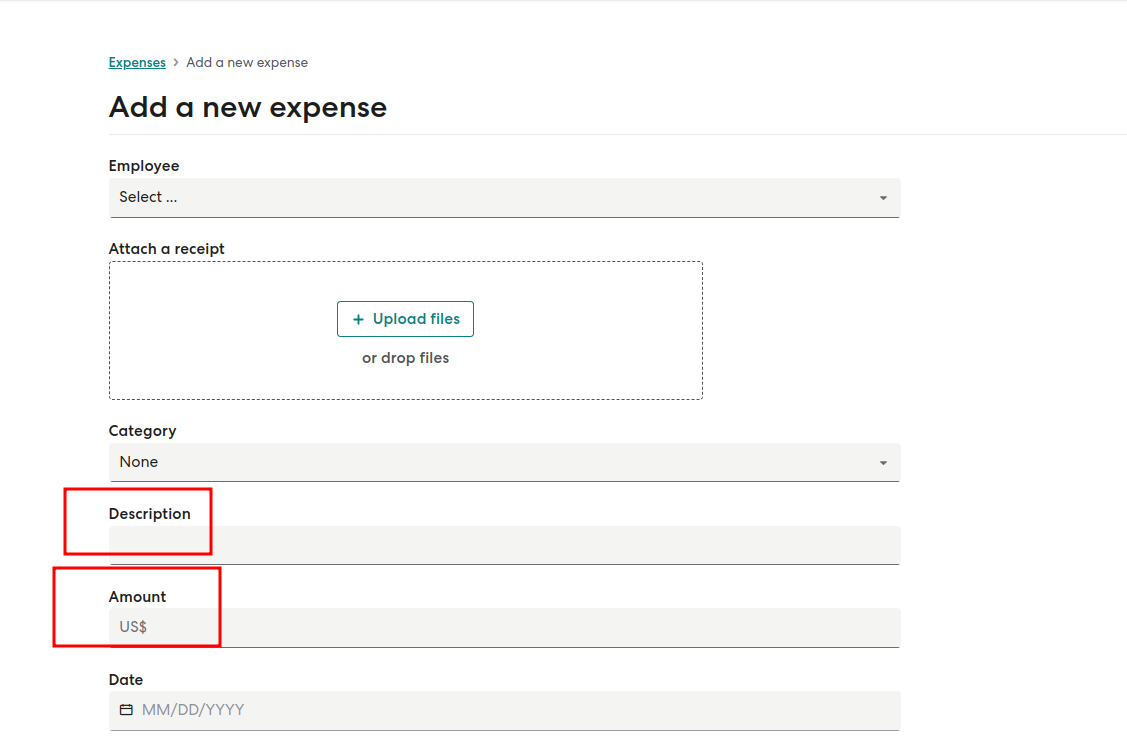

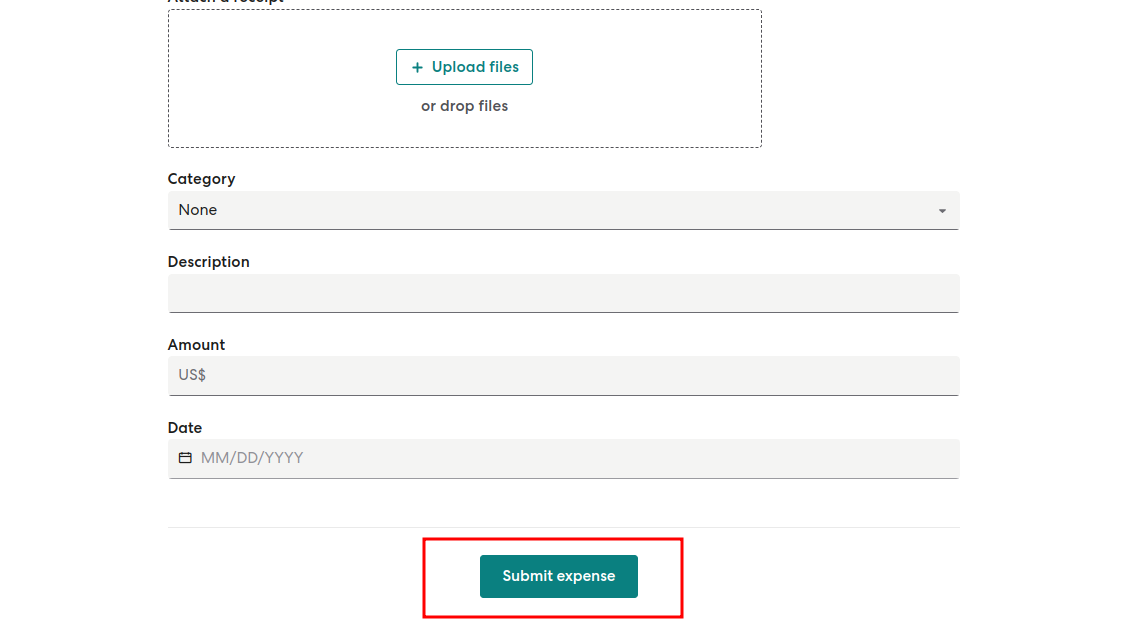

Reimburse Employees for a One-Time Expense:

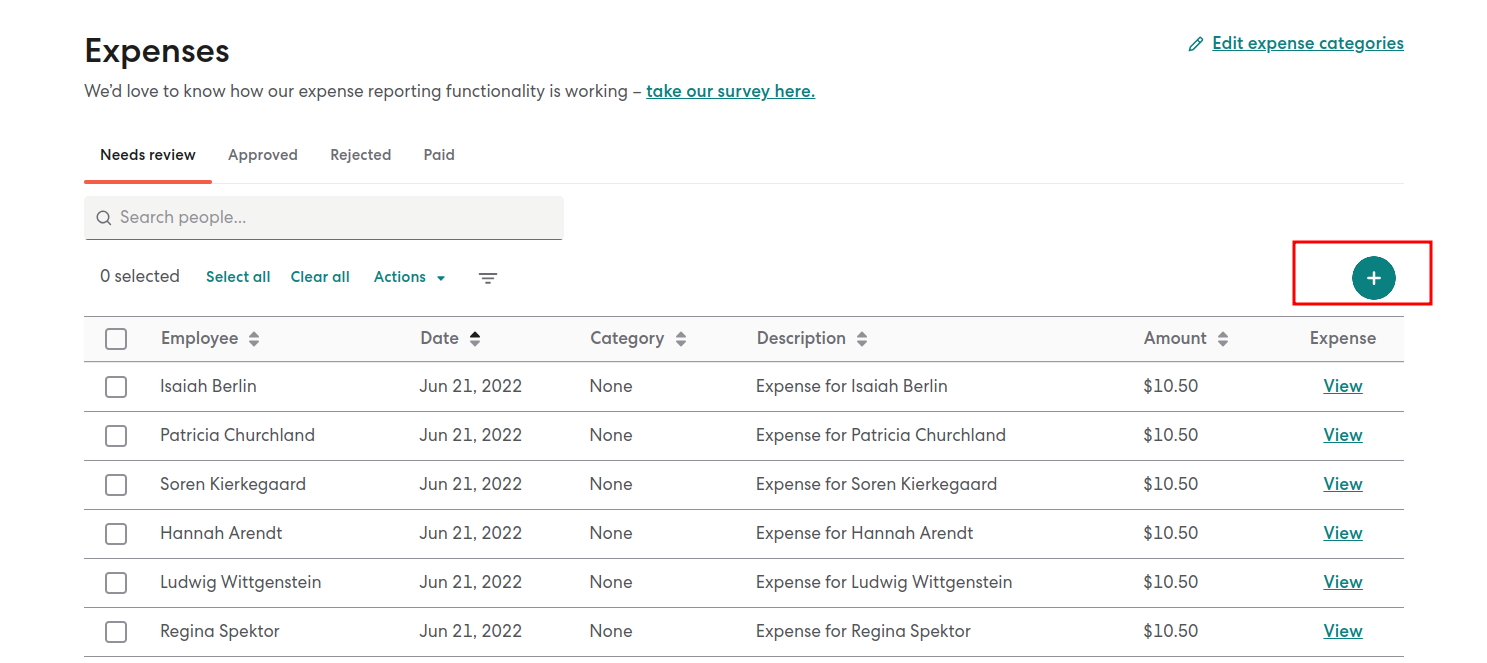

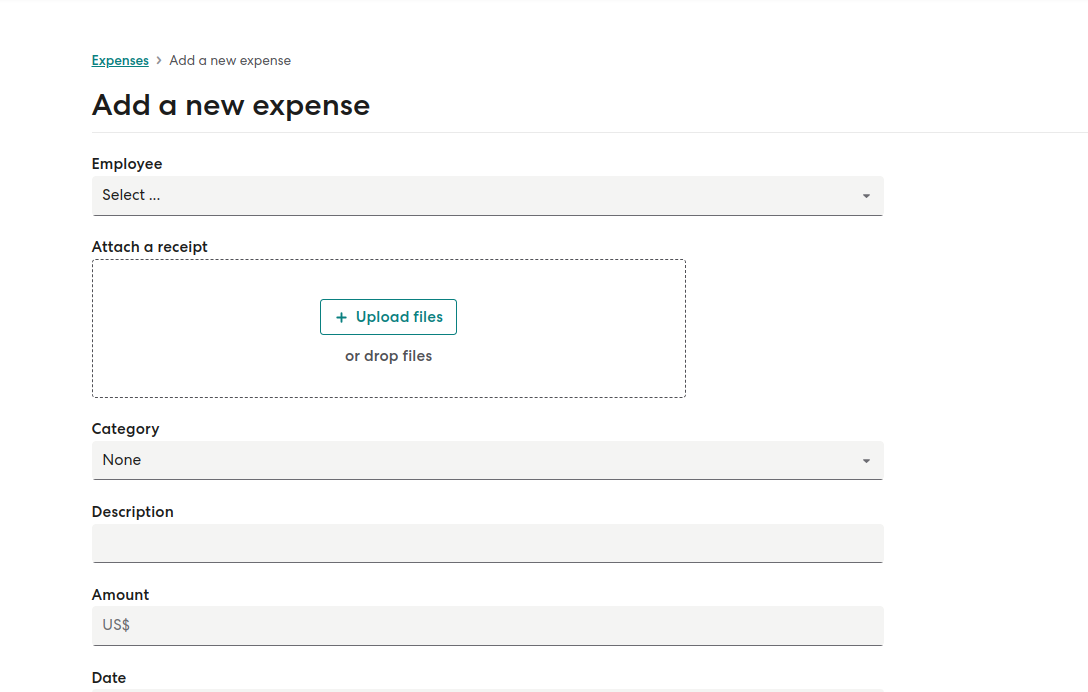

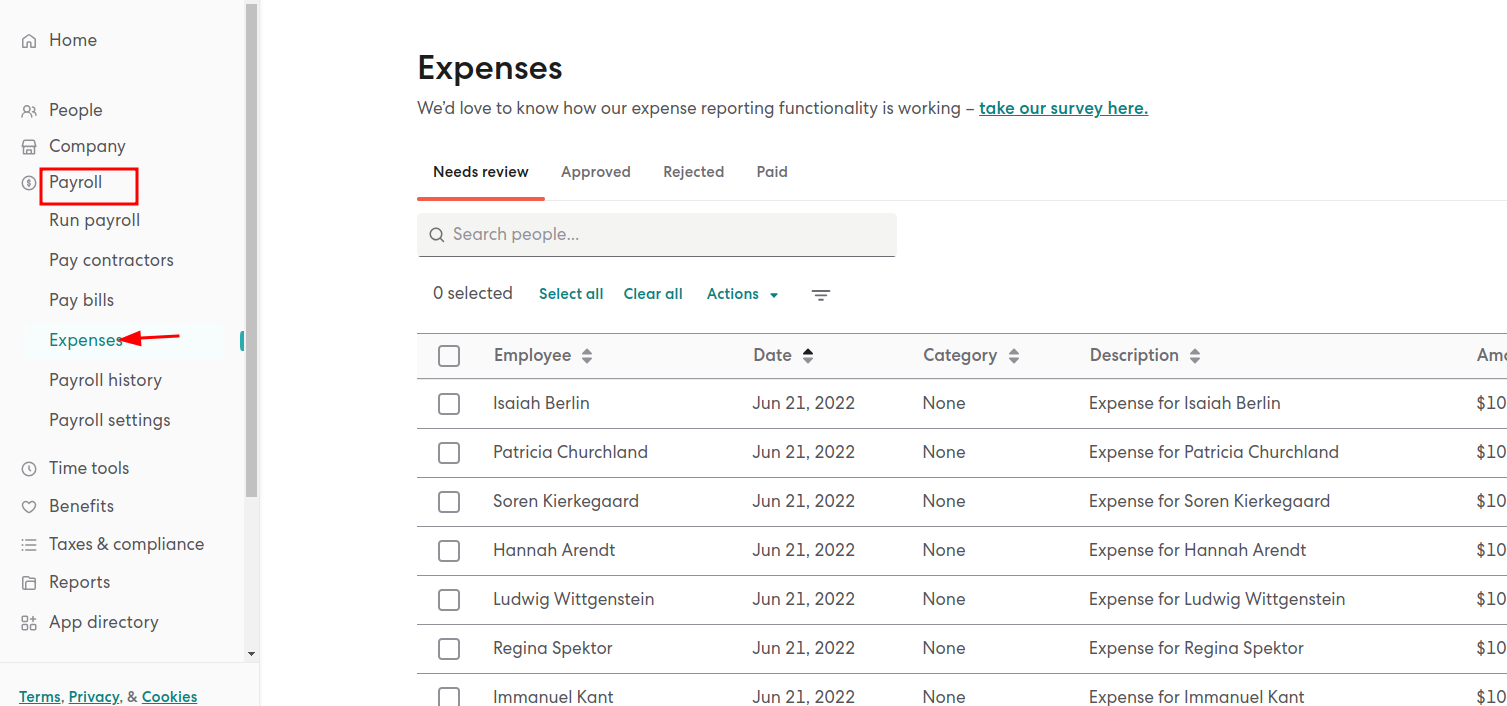

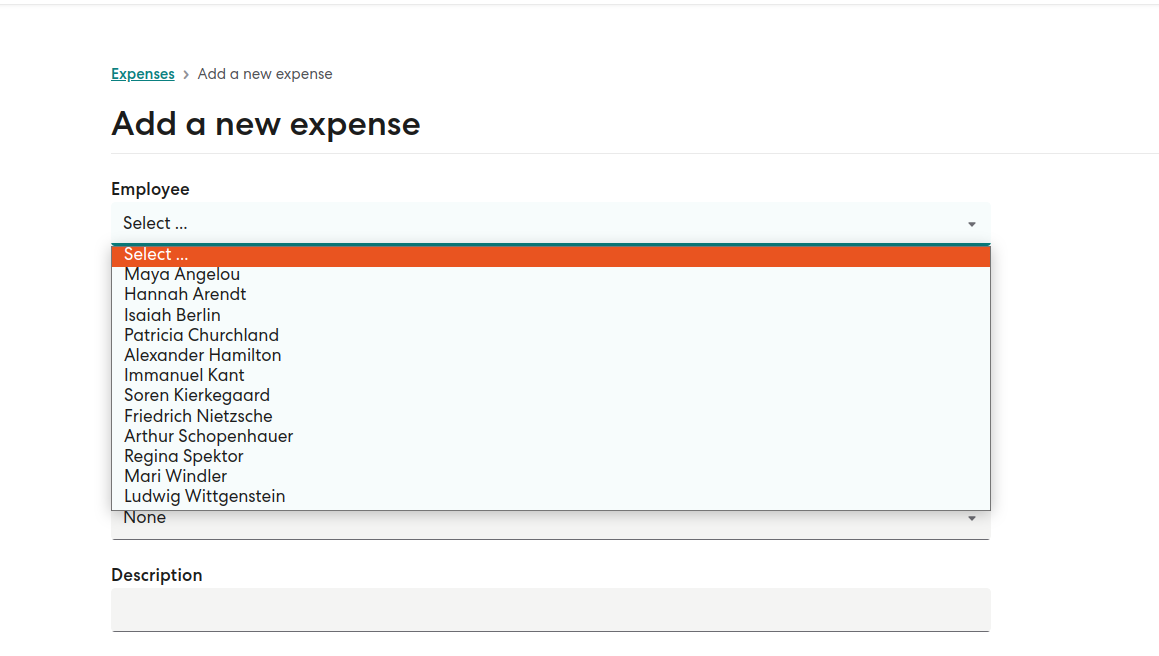

- Go to the Payroll section and select Expenses.

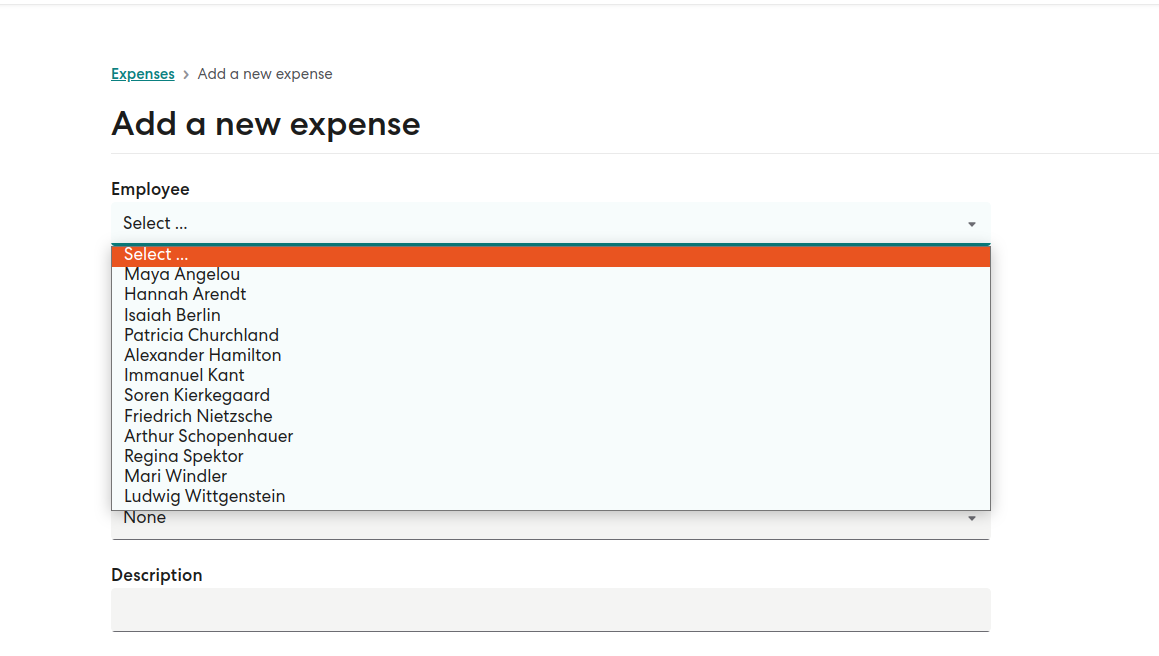

- Click the green “+” button.

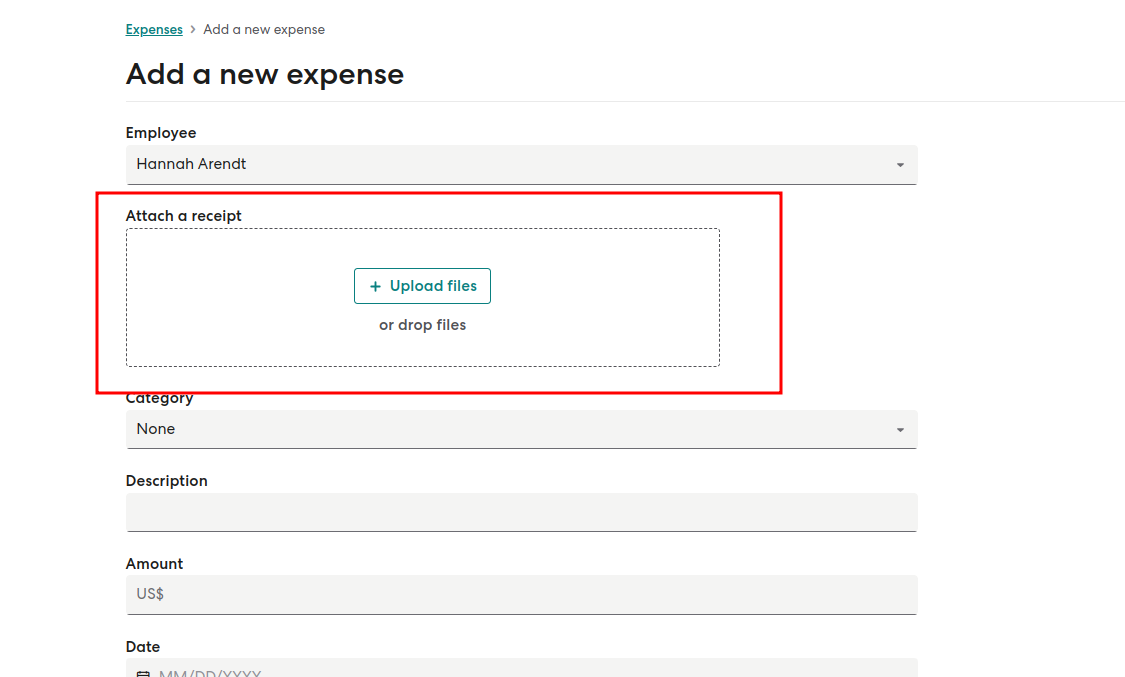

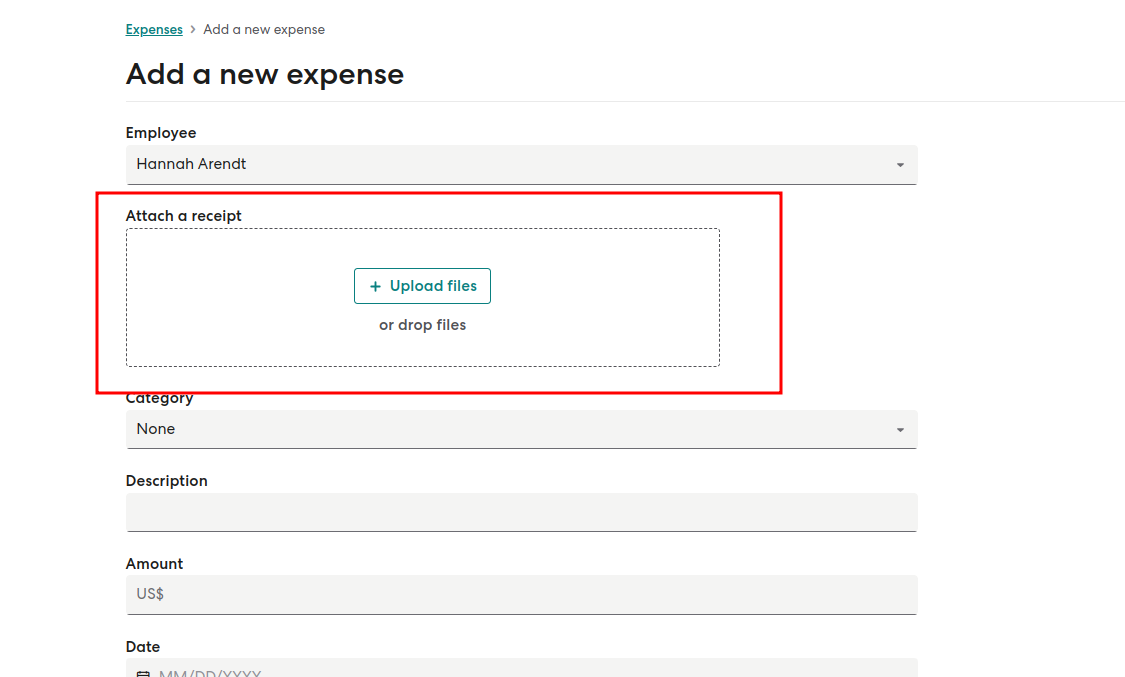

- Choose an employee from the dropdown list.

- Add a photo of the receipt or purchase confirmation.

- Enter the expense name and amount to be reimbursed.

- Click Submit expense.

- Approved expenses will be paid out on the next regular payroll and shown as a separate line item on the employee’s pay stub.

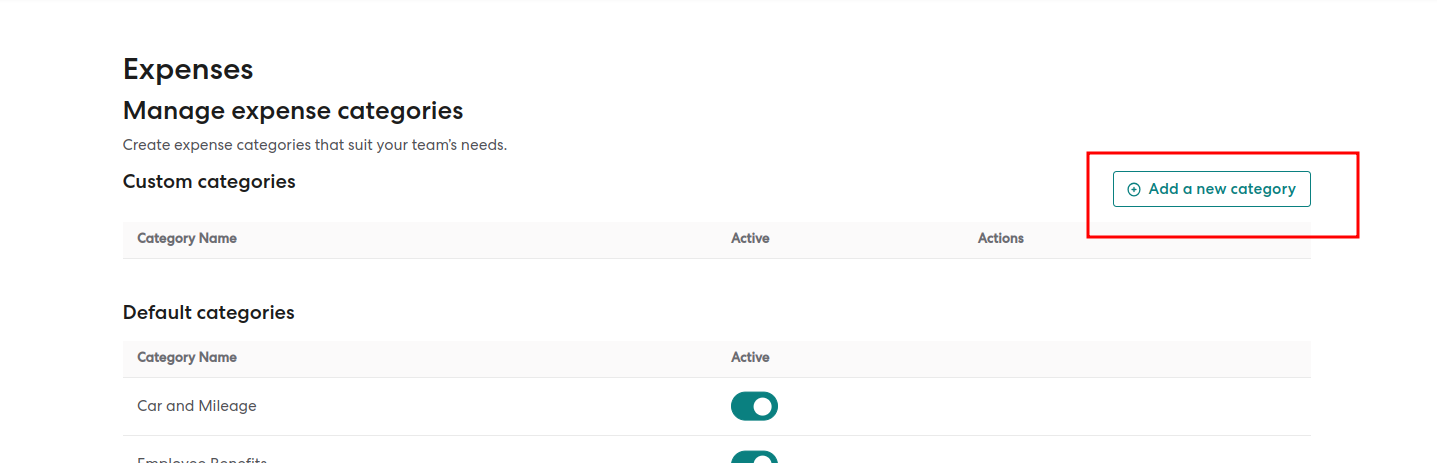

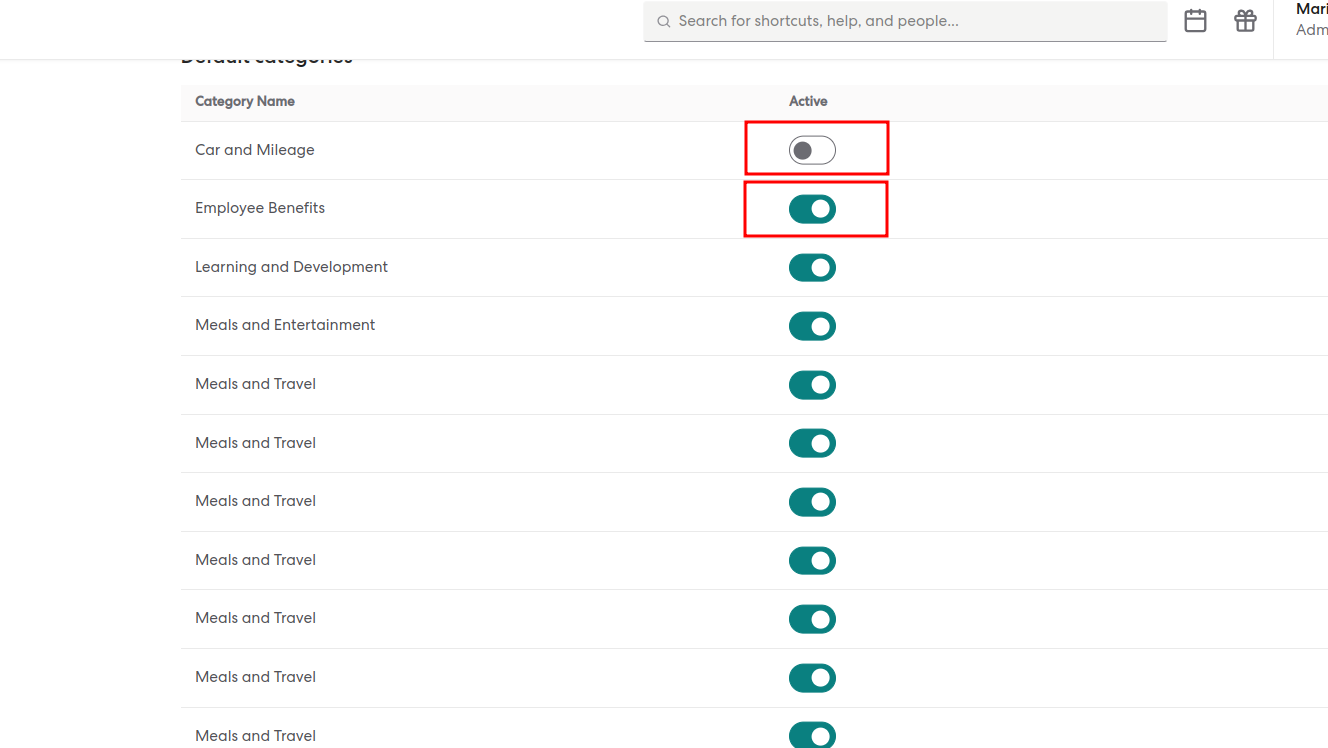

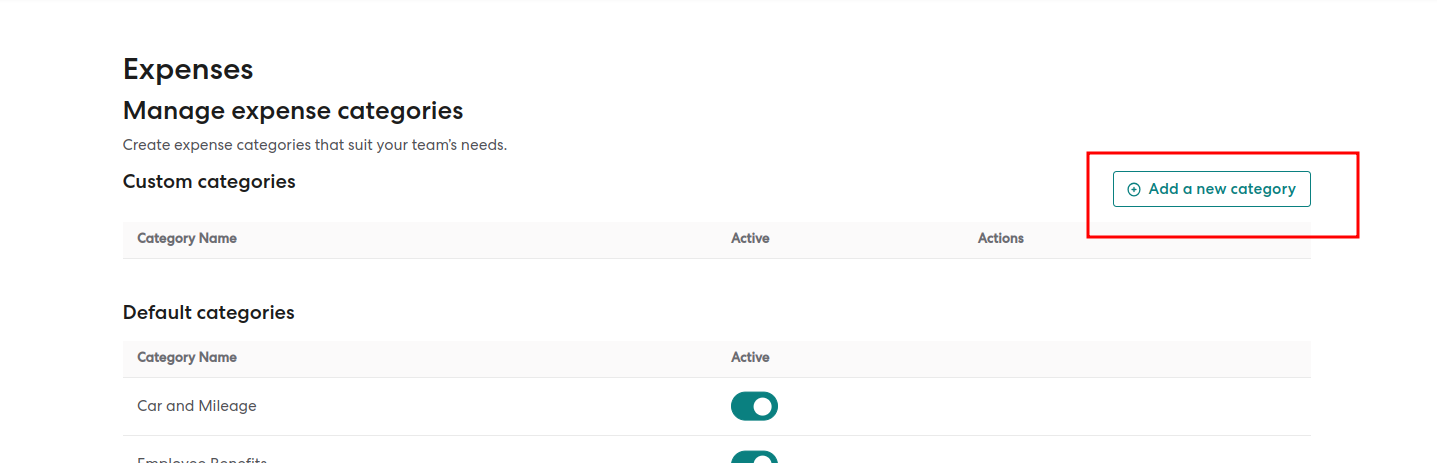

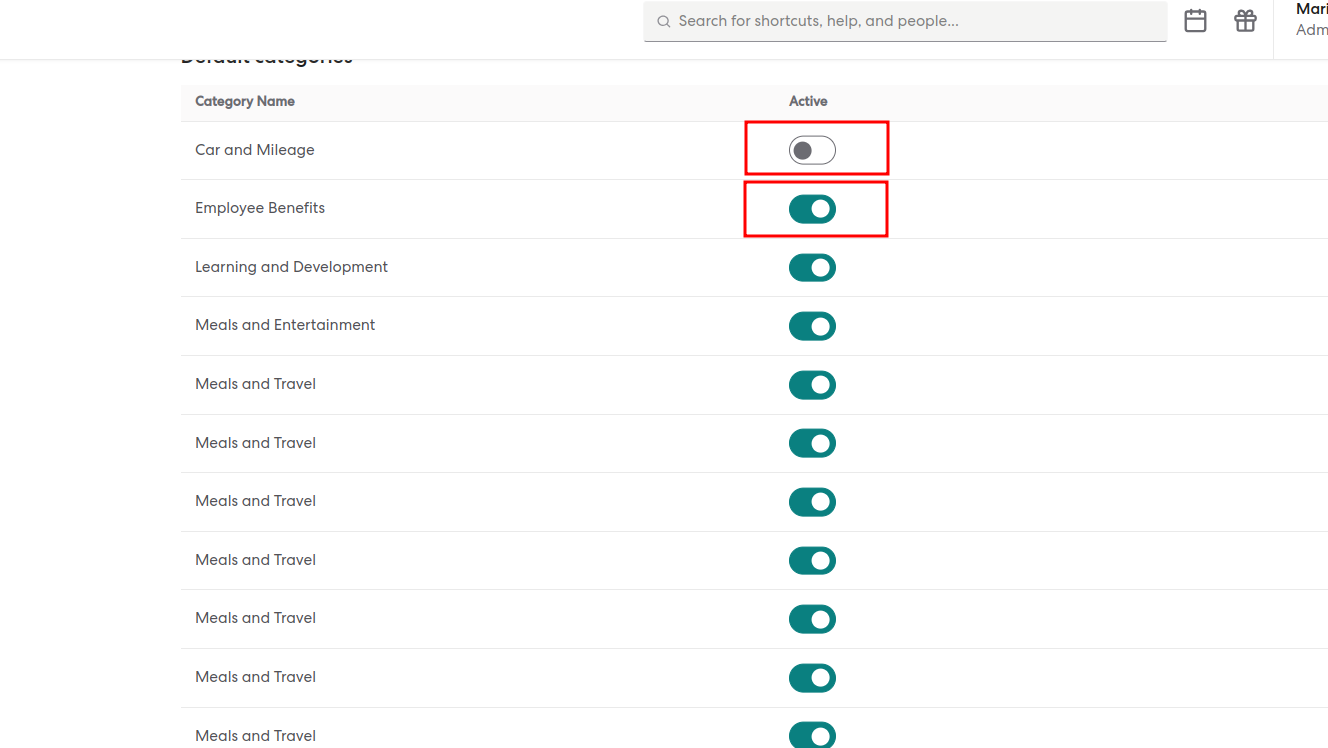

Customize Expense Categories:

- In the Payroll section, select Expenses and click on Manage expense categories.

- To add a new category, click “Add a new category” and enter the category name.

- To edit or delete a category, find it in the list and make the desired changes.

- You can also disable any expense category by toggling its status.

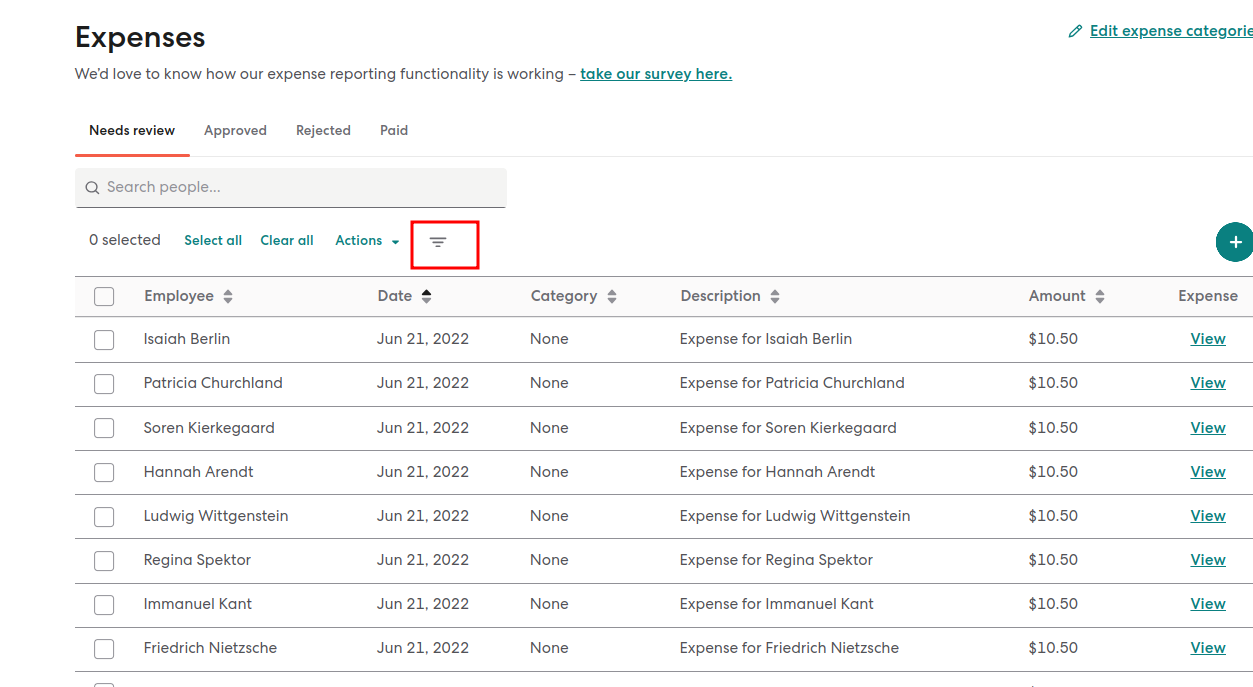

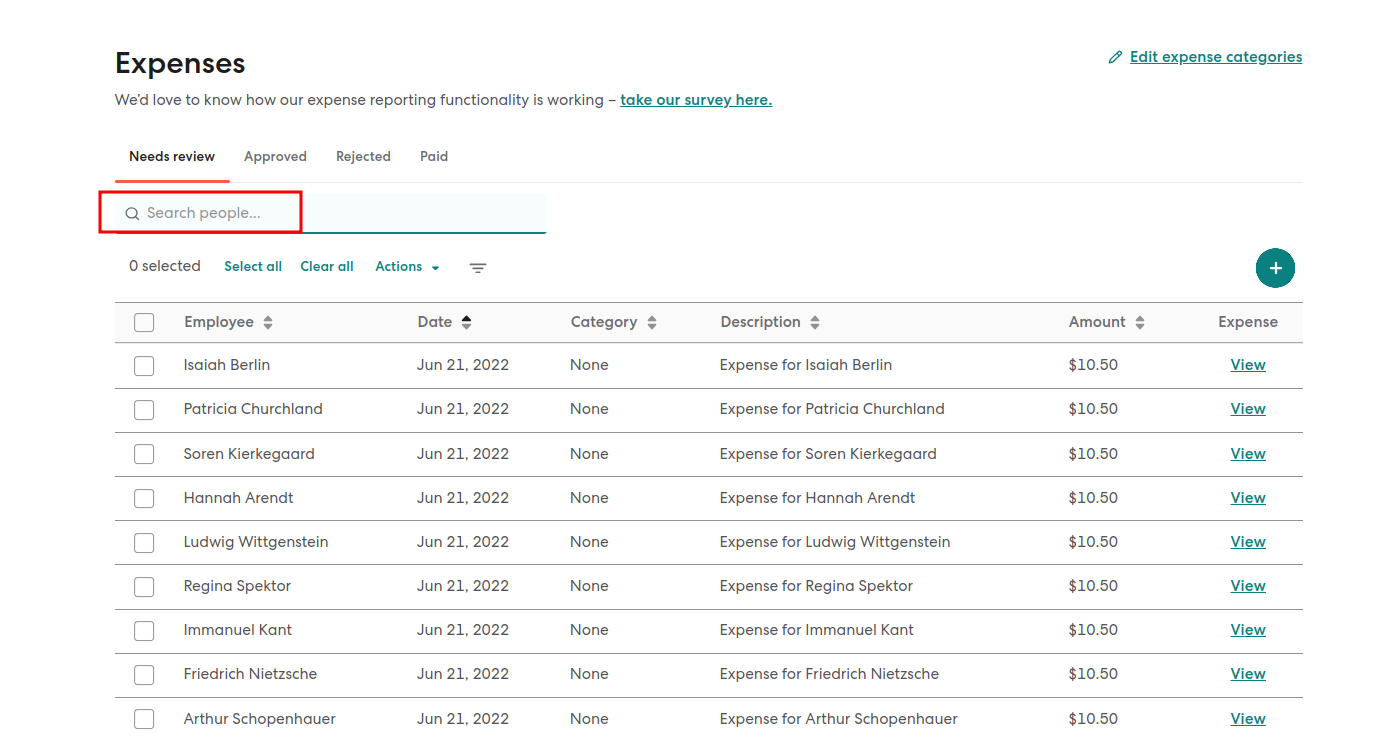

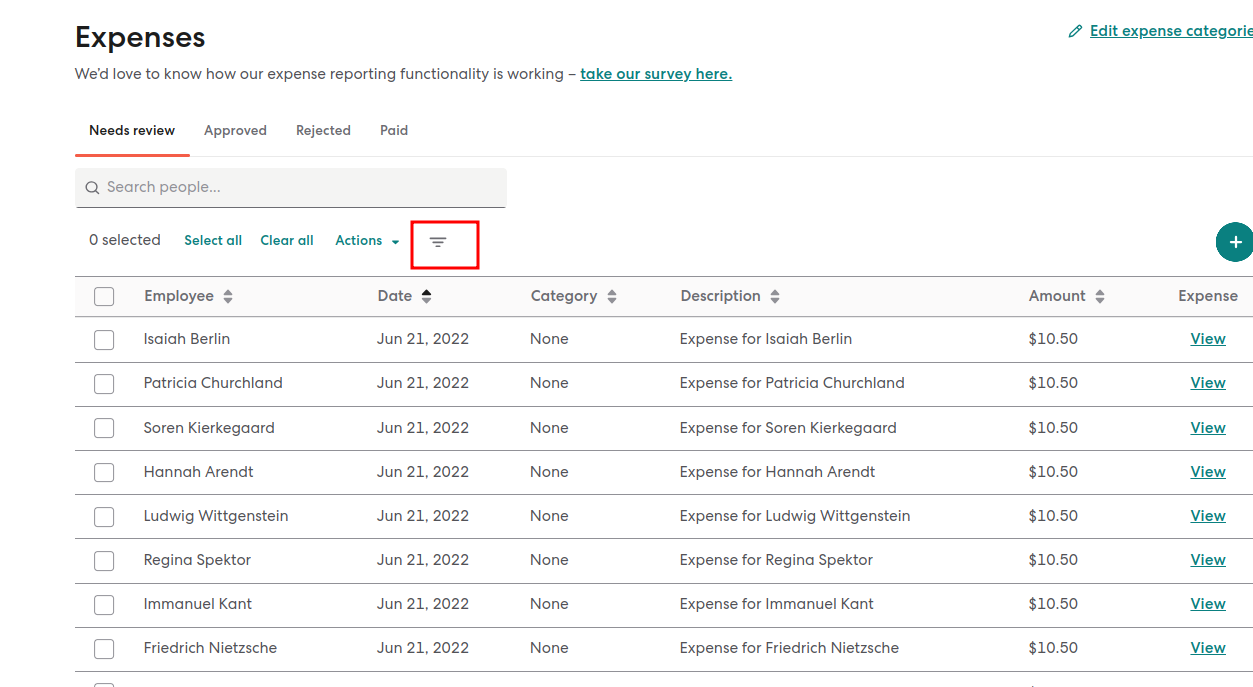

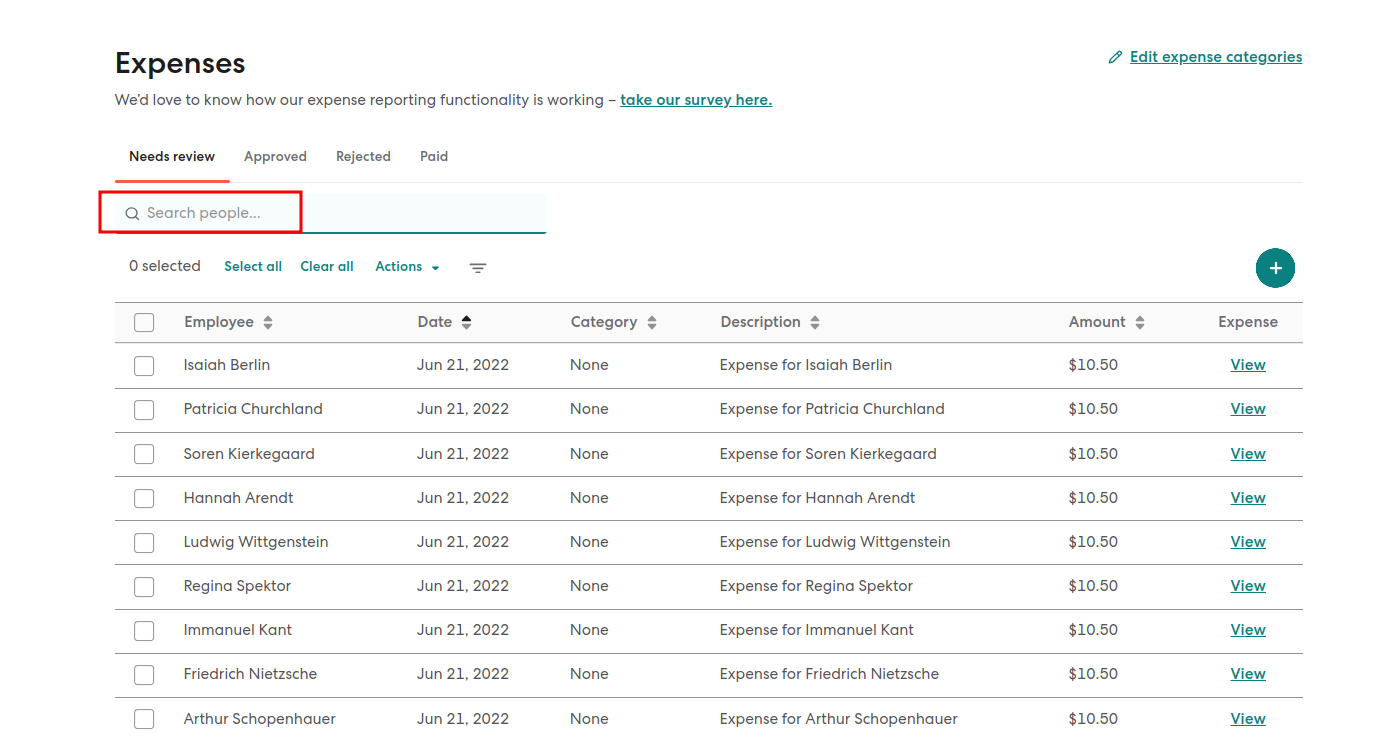

Filter Expenses:

- In the Payroll section, select Expenses.

- Use the filter button to filter expenses by category.

- Use the search box to filter expenses by employee name.

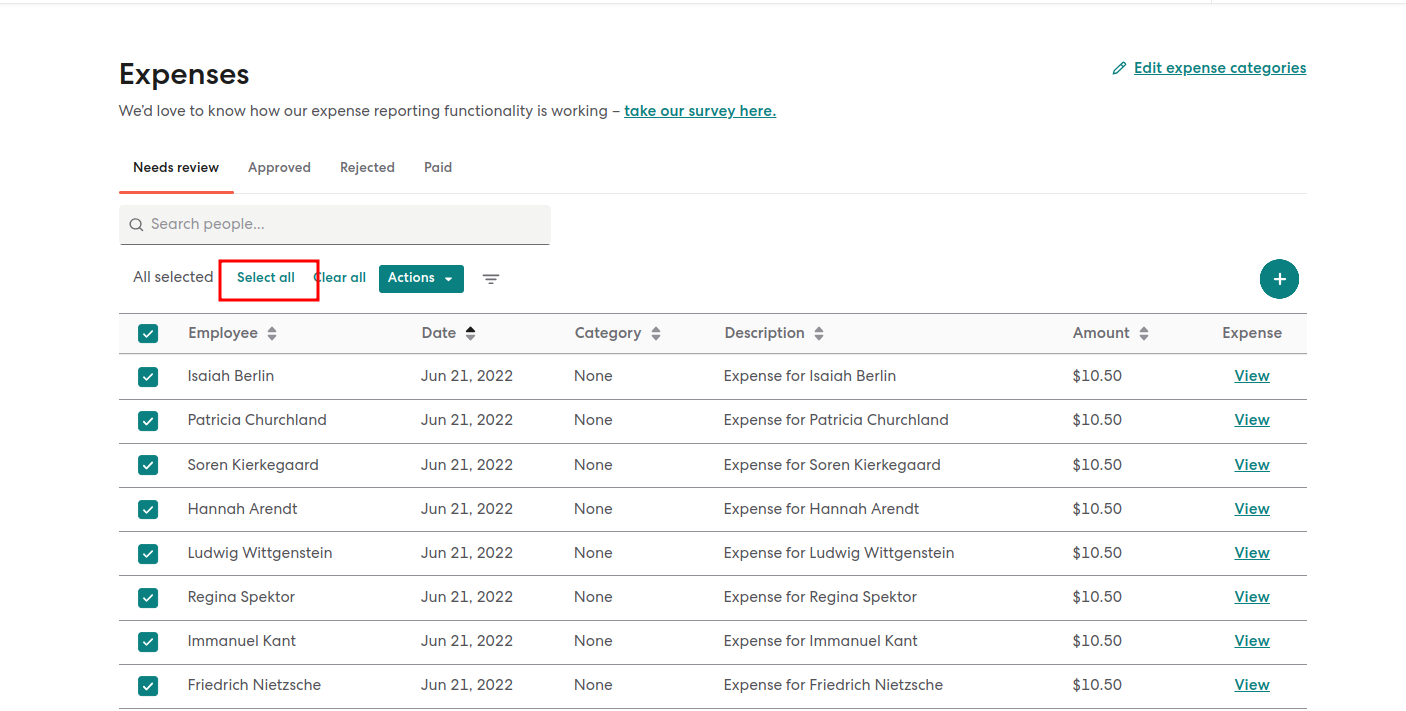

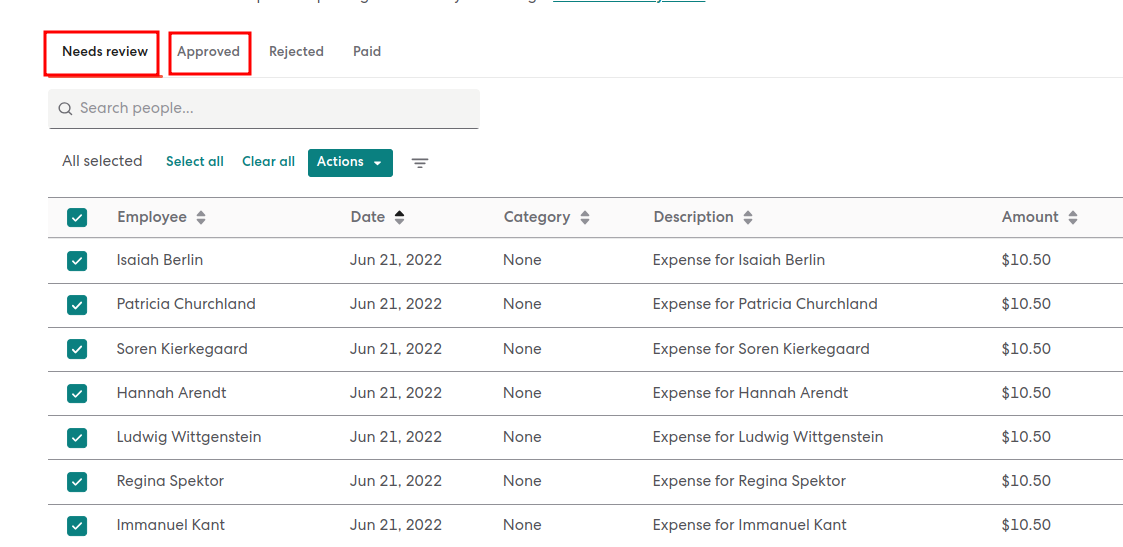

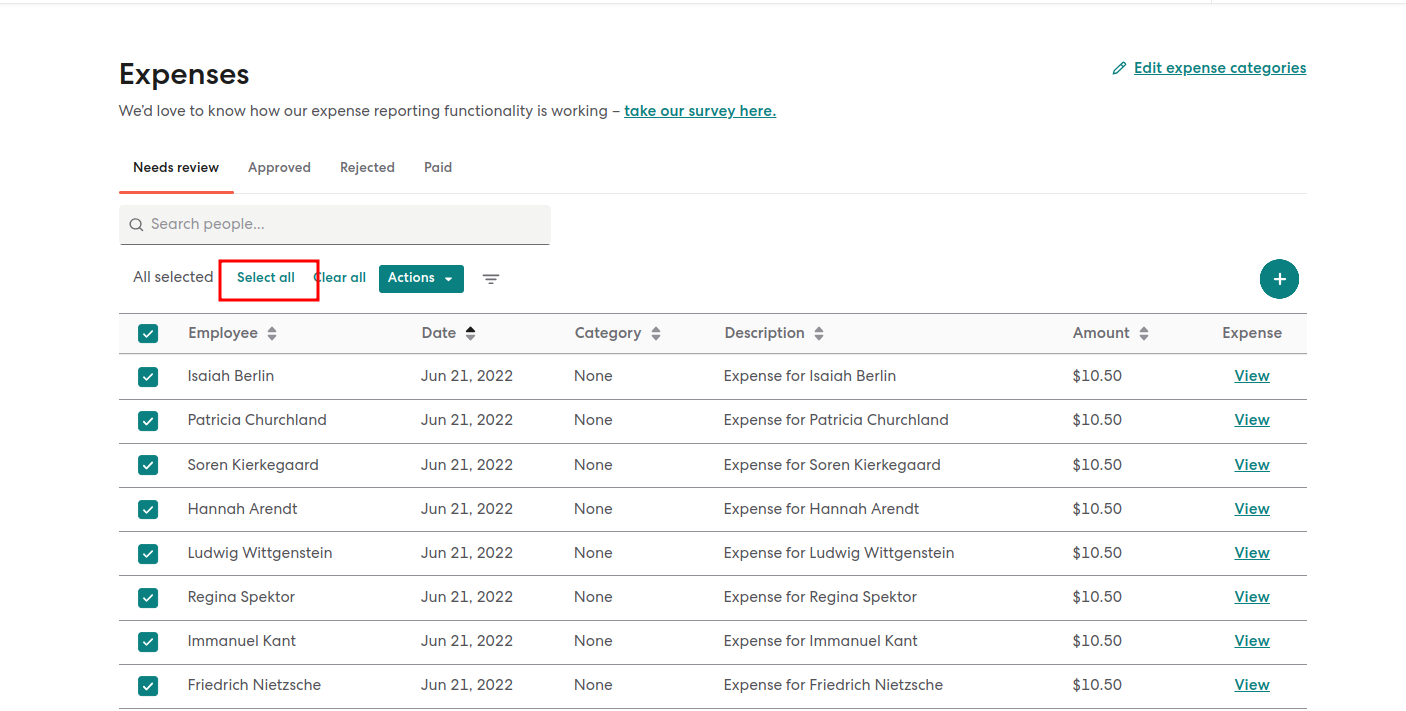

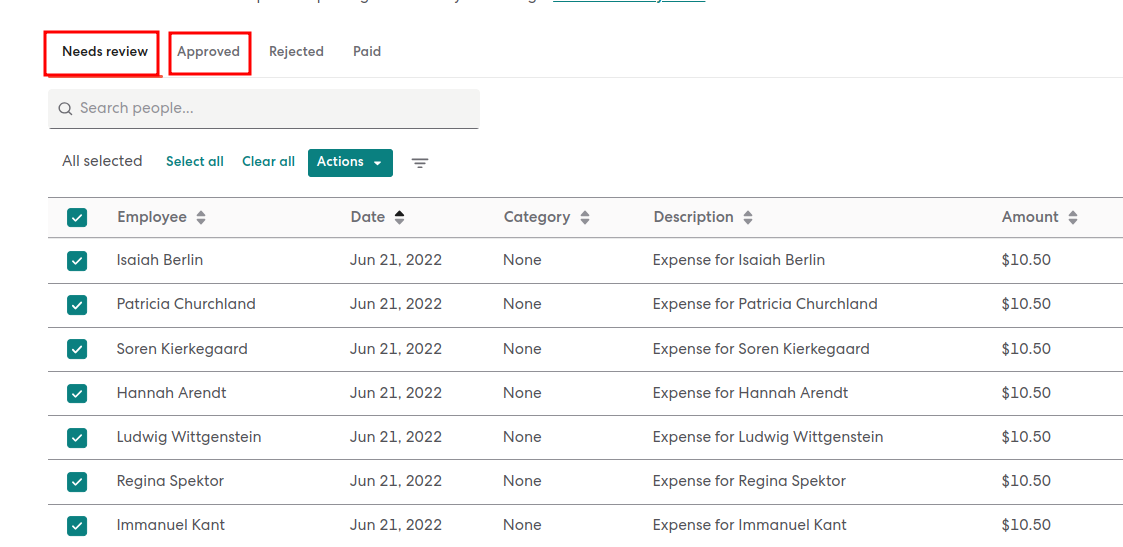

Perform Bulk Actions:

- In the Payroll section, select Expenses.

- Select multiple expenses by checking the checkboxes.

- Click the Actions button to perform bulk actions based on the selected expenses’ status (Needs Review or Approved).

- Available actions include Approve, Reject, Edit, and Delete.

By following these steps, you can easily reimburse teams/groups for their expenses using Gusto Payroll Software. Remember to review and approve expenses before processing payroll to ensure accurate reimbursement.

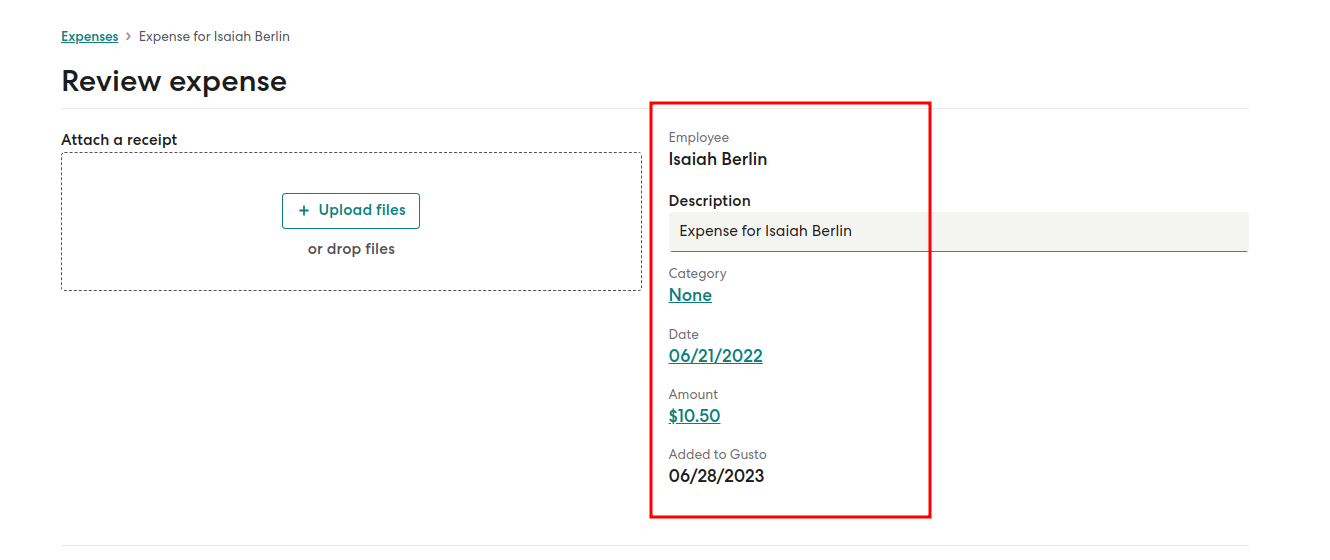

How Do I Enter An Expense In Gusto?

To submit expenses for reimbursement through Gusto, please follow the steps provided below. However, please note that if you cannot find the Expenses section, it means that your employer may not have enabled this feature in Gusto.

Key Point: “Gusto Wallet mobile app currently does not support expenses, so you’ll need to use the web platform for this feature. Also, the contractors do not have access to this feature.”

To Submit An Expense For Reimbursement, Please Follow These Steps:

- Go to the Expenses section located in the menu on the left-hand side.

- Click on the “+” icon to create a new expense.

- Attach a photo of the receipt or purchase confirmation that you wish to be reimbursed. You can upload it in PDF, JPG, or PNG format.

- Provide a name for the expense and enter the dollar amount to be reimbursed.

- Enter the date of the purchase or transaction in the “date” field.

(The date displayed for the expense on the Expenses Page will reflect the transaction date, not the date of submission. You can view the submission date by clicking “View” under the Expense column.)

- Click “Submit expense” to submit your expense for review.

Once your employer processes payroll, the reimbursed amount will appear as a separate line item on your paystub as a one-time reimbursement.

Key Point: “If you have additional expenses to add, simply repeat the same process. You can add as many items as needed. Your expenses awaiting review, approved, rejected, and paid will be displayed in their respective tabs on your Expenses home page.”

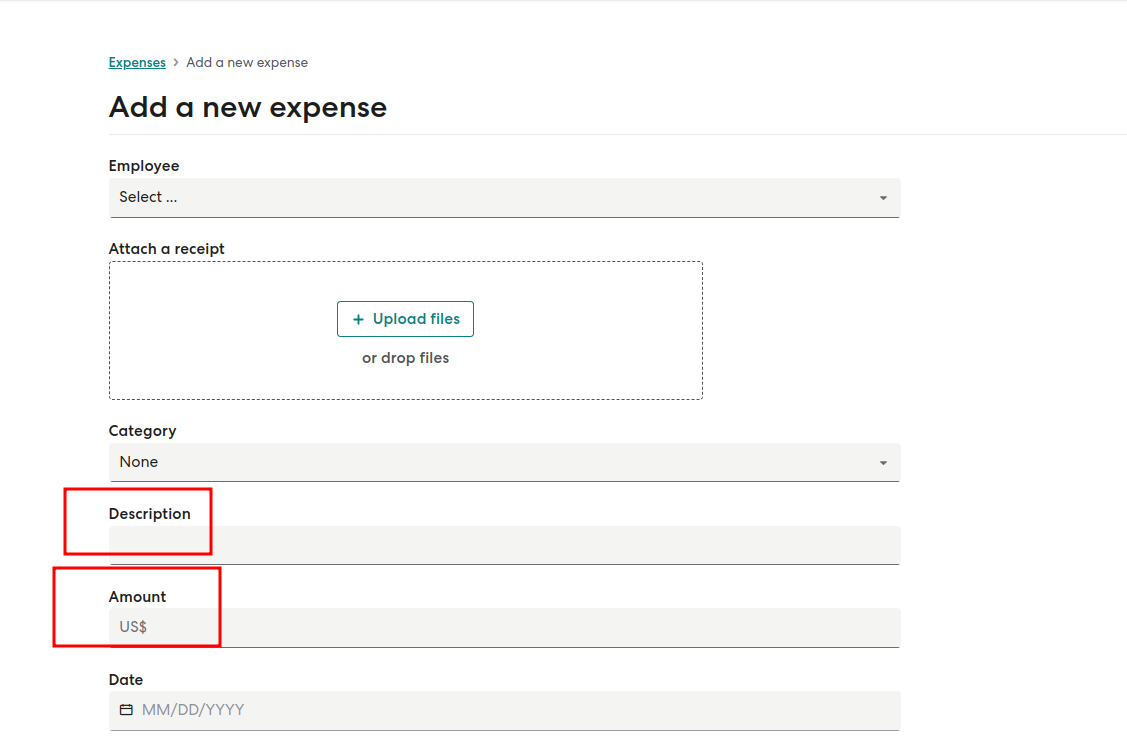

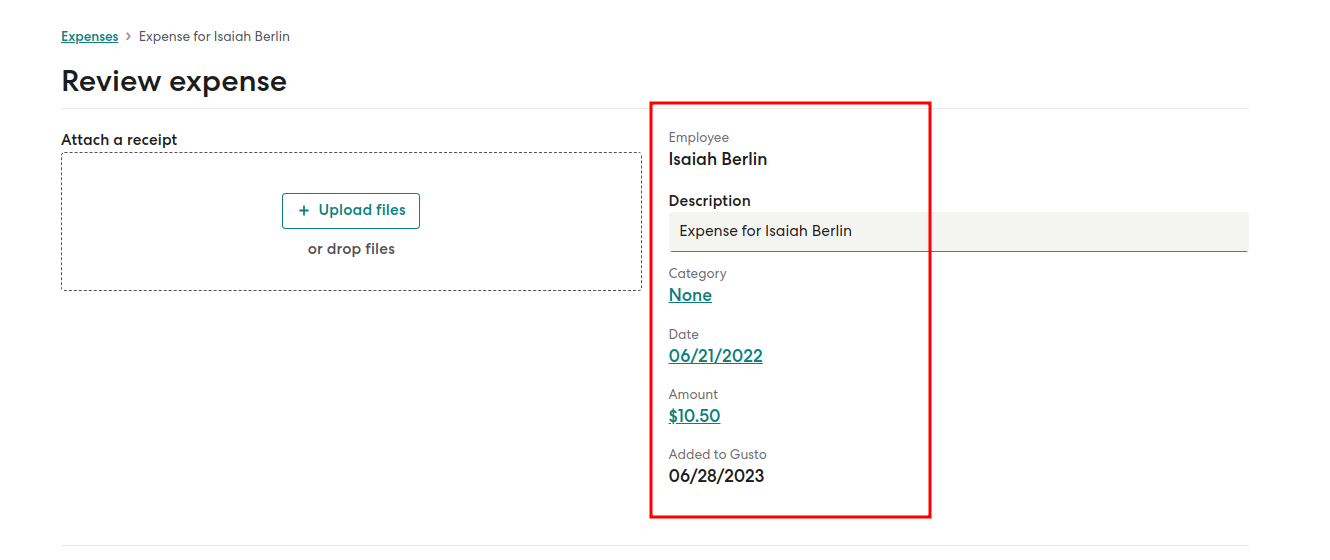

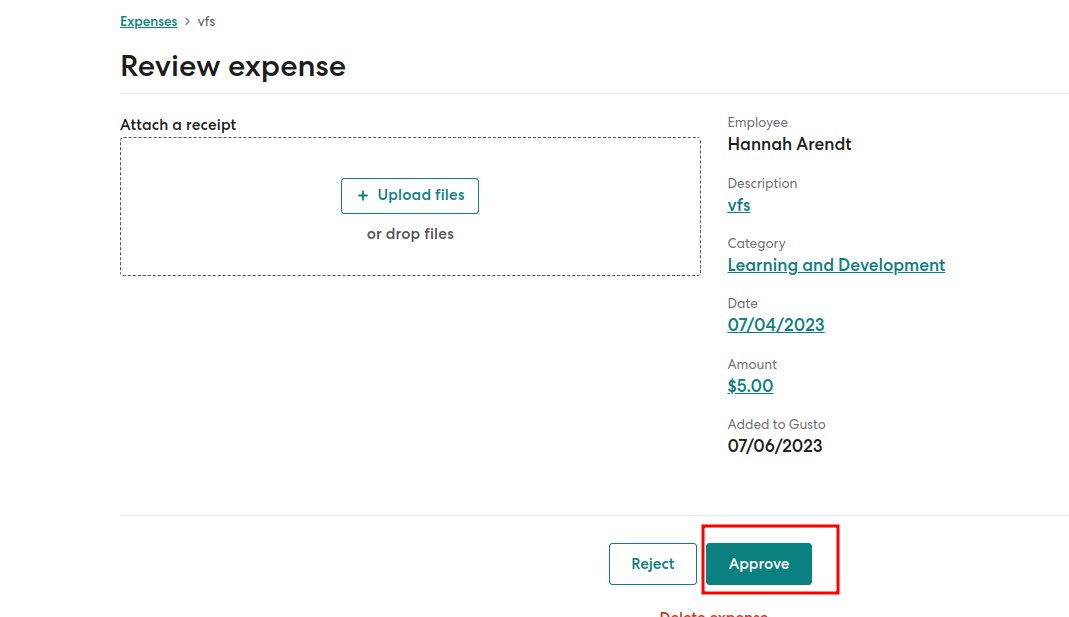

To Modify An Expense, Follow These Steps:

- Go to the Expenses section located in the left-hand side menu.

- Select the “View” option next to the expense that requires modification.

- By clicking on the respective elements, you can make changes to the following details:

- Description

- Category

- Date

- Amount

- After making the necessary adjustments, click on “Save.”

In case you need to update the receipt for an expense, you’ll have to delete the existing entry and create a new one, ensuring the correct receipt is attached.

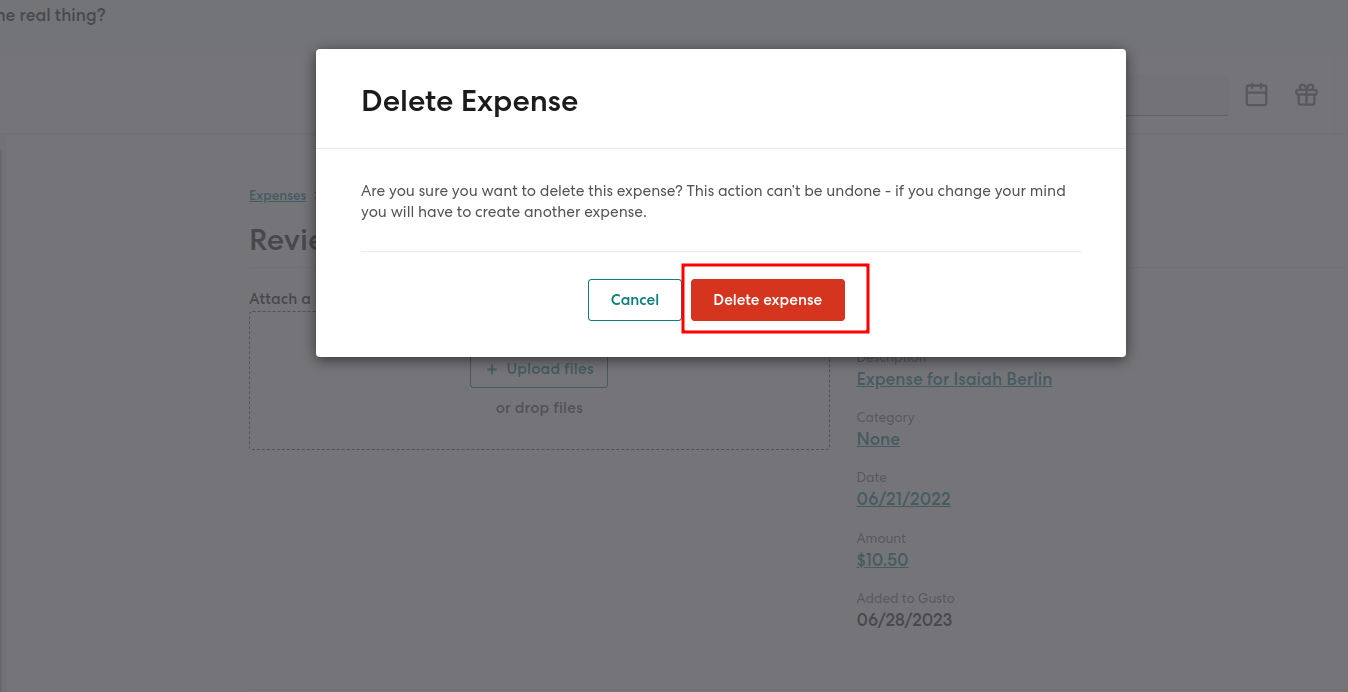

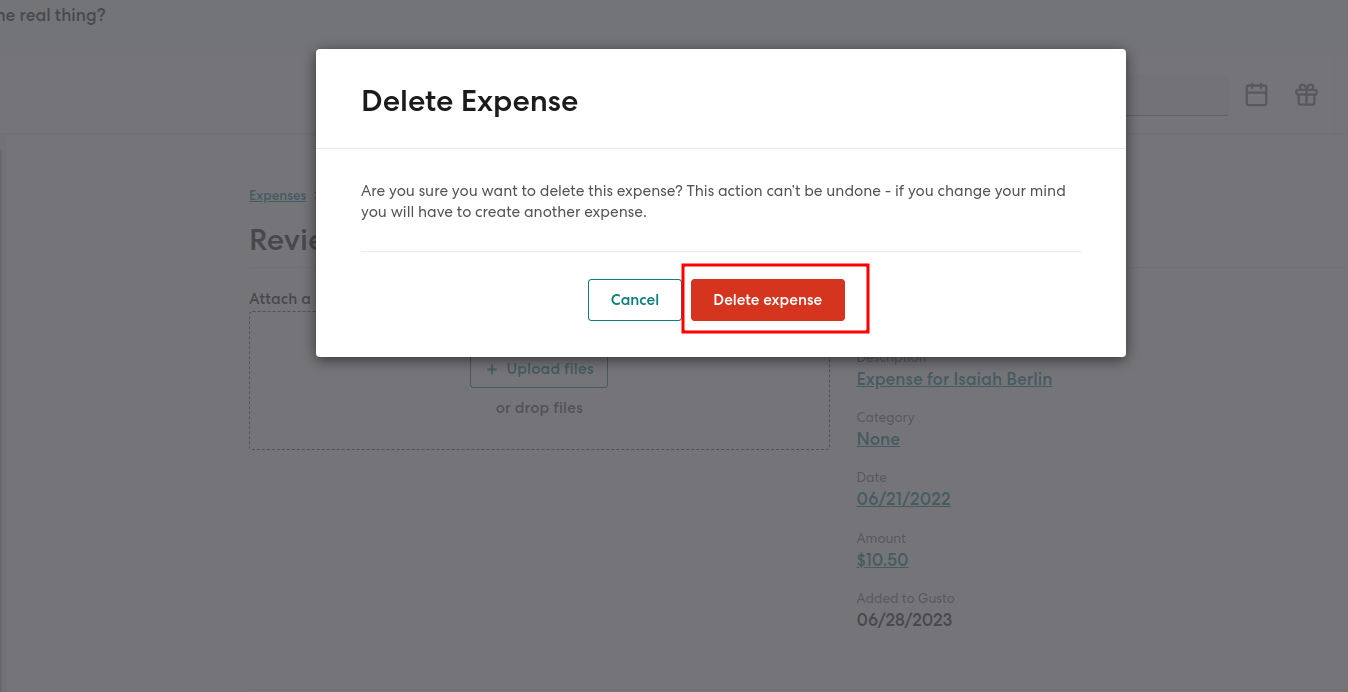

To Remove An Expense, Follow These Steps:

- Go to the Expenses section located in the left-hand side menu.

- Select the “View” option next to the expense that you wish to delete.

- Click on “Delete expense.”

- Confirm your decision to remove the expense by selecting “Delete expense.”

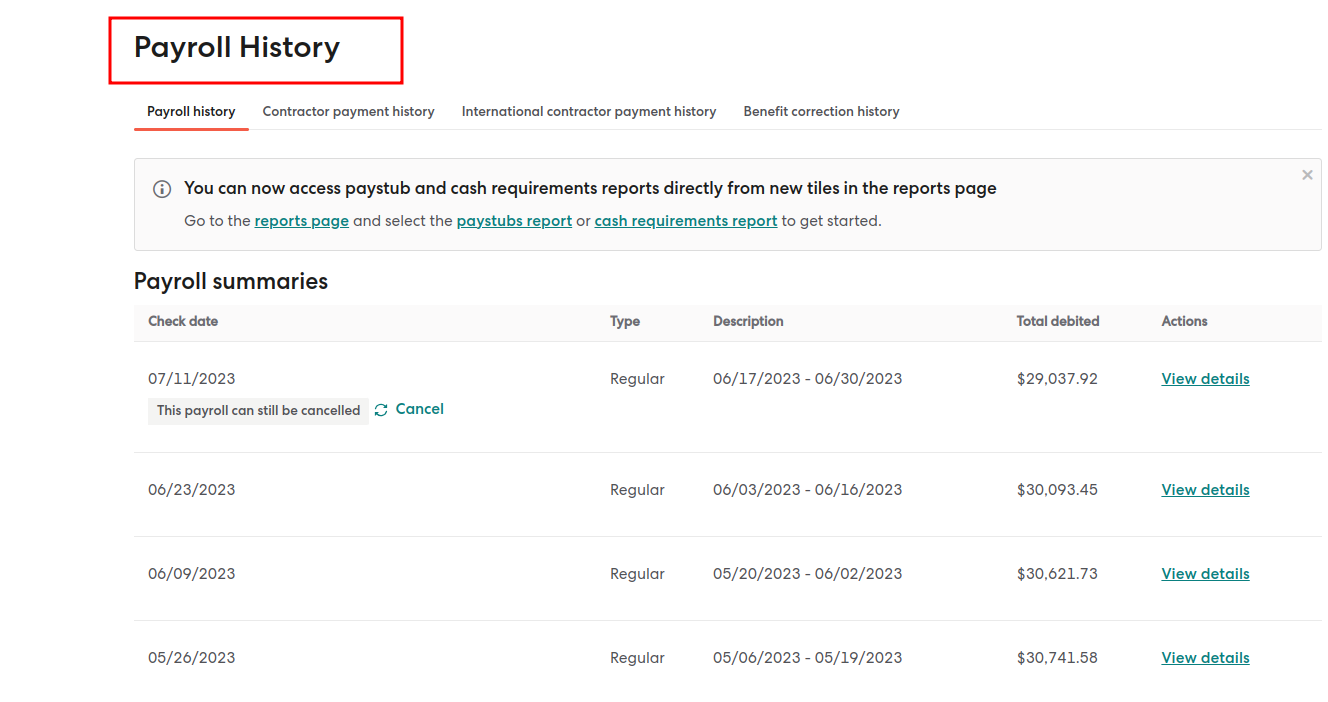

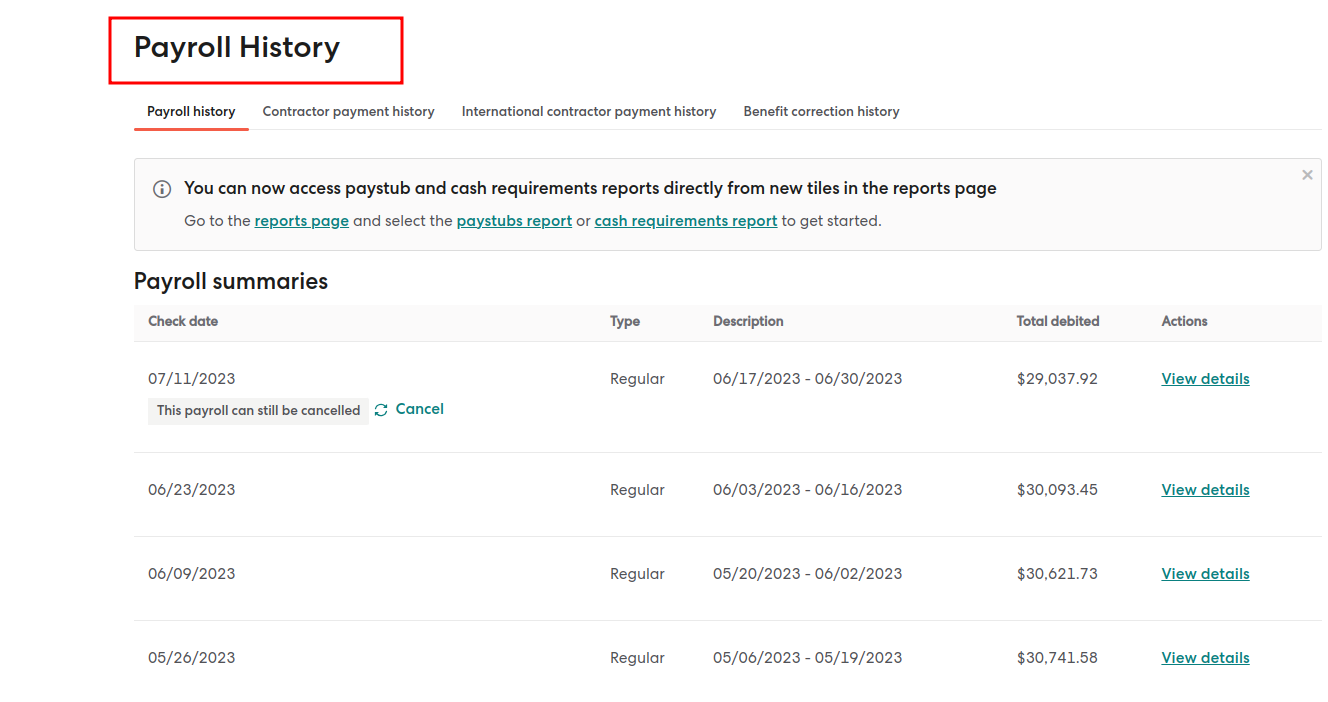

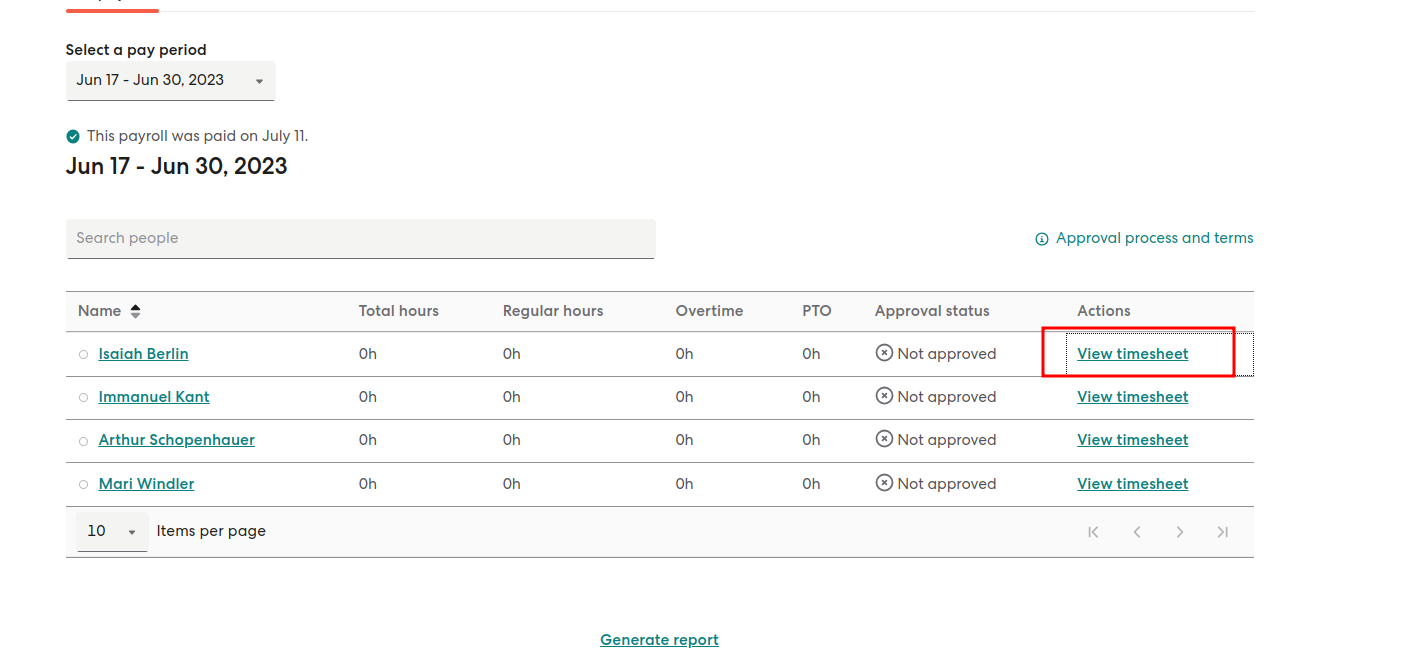

How To View Employee Payroll And Contractor Payments In Gusto Software?

Administrators who possess the necessary permissions have the ability to access comprehensive information regarding all payrolls and contractor payments processed through Gusto. This includes various reports containing detailed data. On the other hand, employees and domestic contractors can view their individual pay stubs and specific payment details by logging into their Gusto accounts.

Let’s get into the detailed explanation:

Steps To Access Employee Payrolls

Prior to submitting the payroll in the final step, you will have the opportunity to preview it.

- Navigate to the Payroll section and select Payroll History.

- Ensure that you are on the Payroll history tab.

- Hover over the payroll check date and click on “View Details.”

On the summary page, you will be able to see a comprehensive overview of taxes, payments, paystubs, and employees included in the payroll. The gray Payroll details box on the right-hand side will also indicate the bank account from which the payroll was processed.

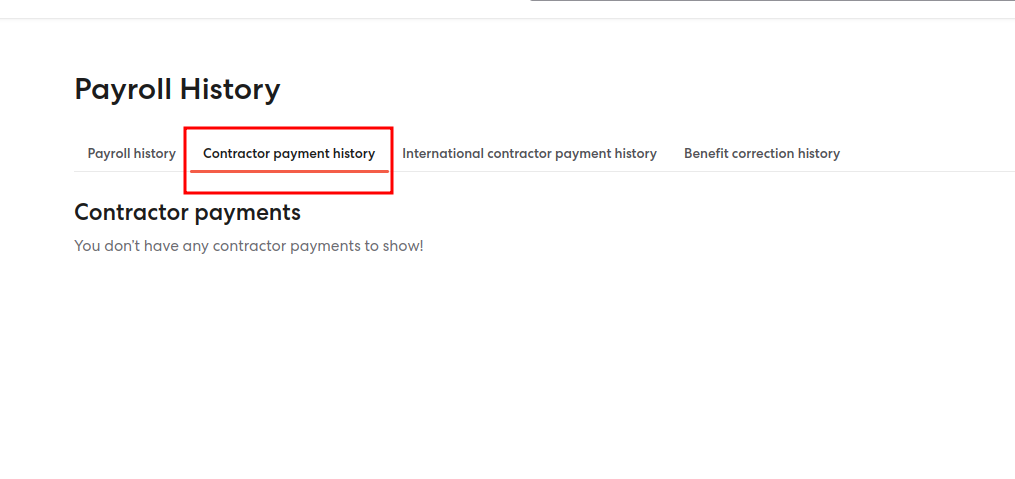

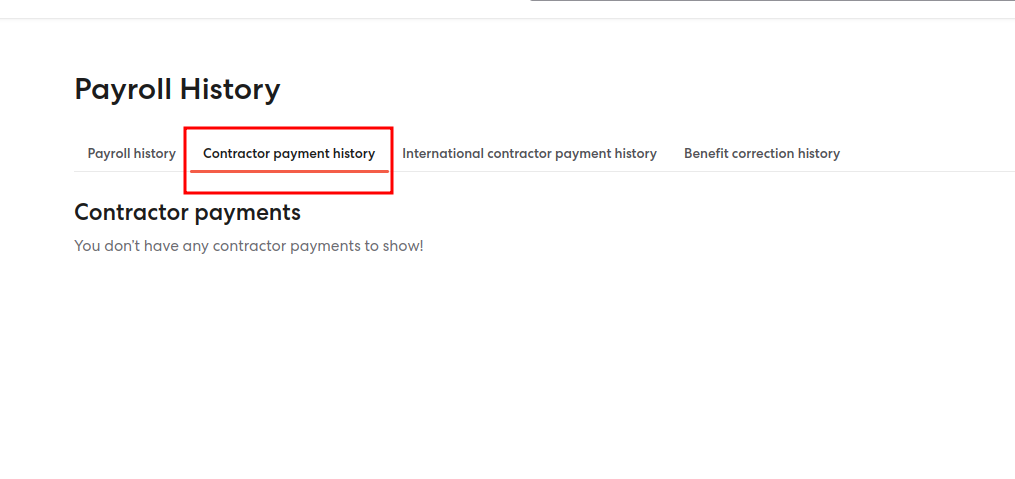

Steps To Access Contractor Payments

- Go to the Payroll section and choose Payroll History.

- Switch to the Contractor payment history tab.

- Hover over the payment check date and select “View Details.”

On the summary page, you can observe the payment amount and date. Additionally, the bank account from which the payment was processed will be displayed under the Paid From section, adjacent to the payment amount.

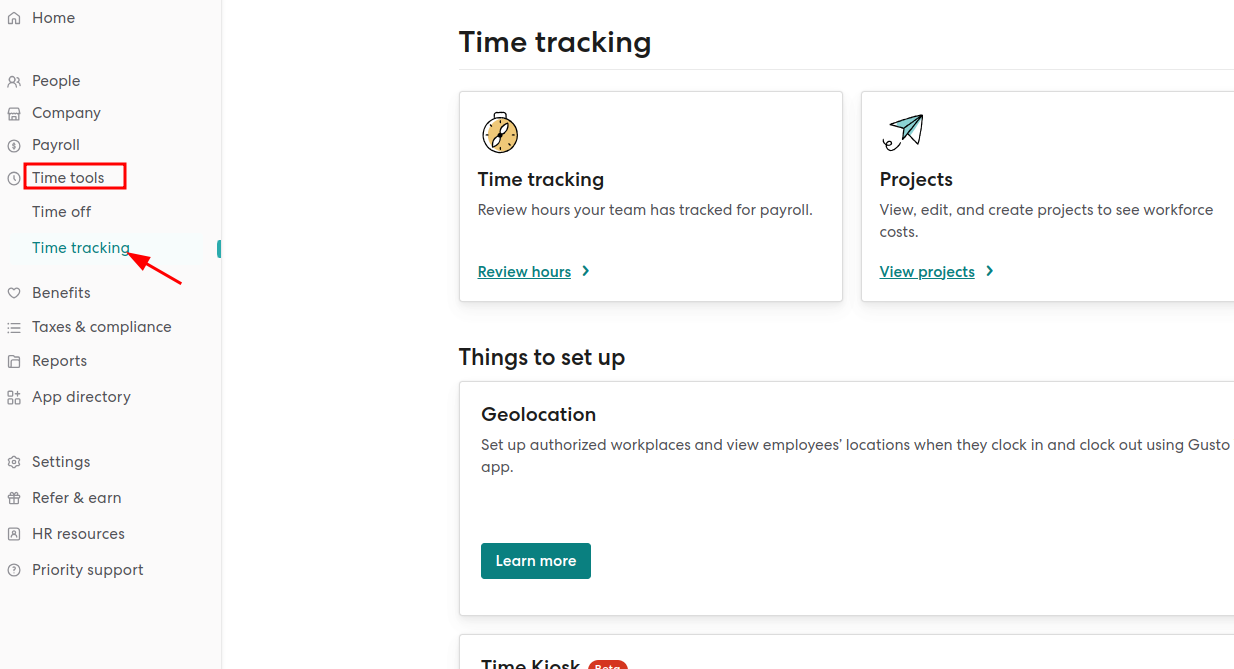

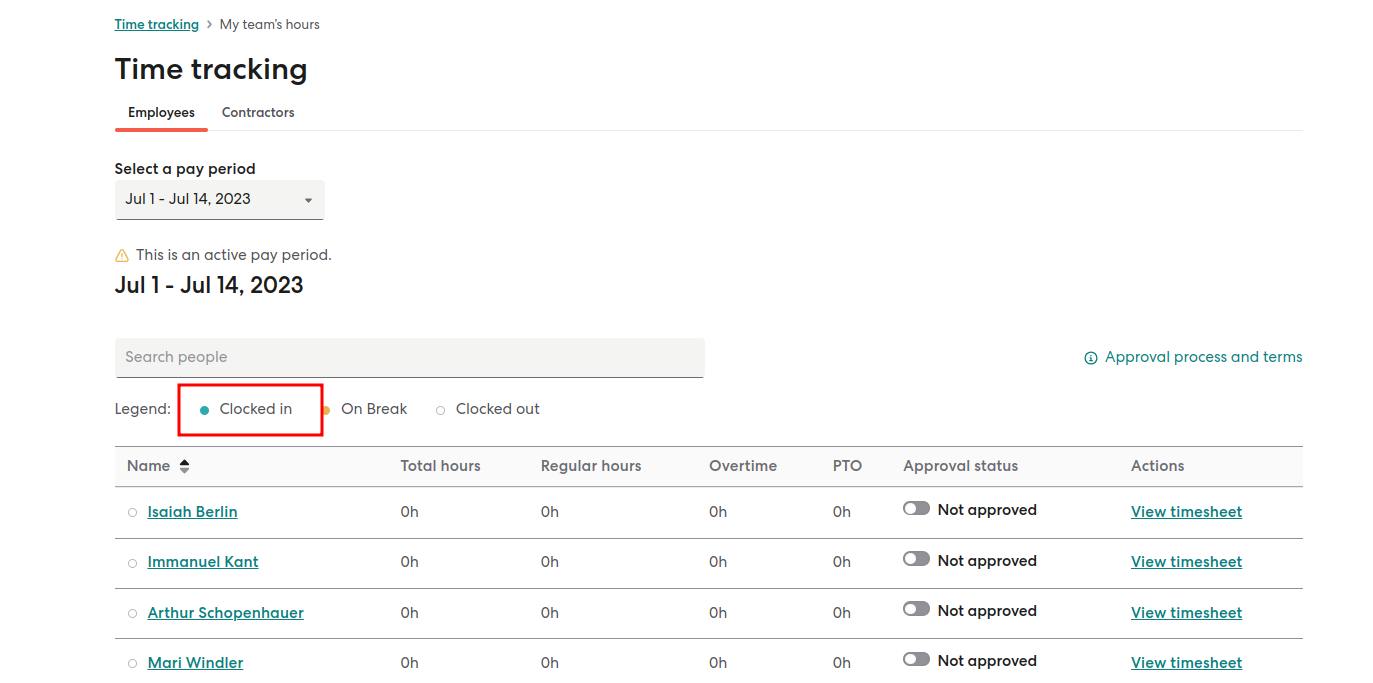

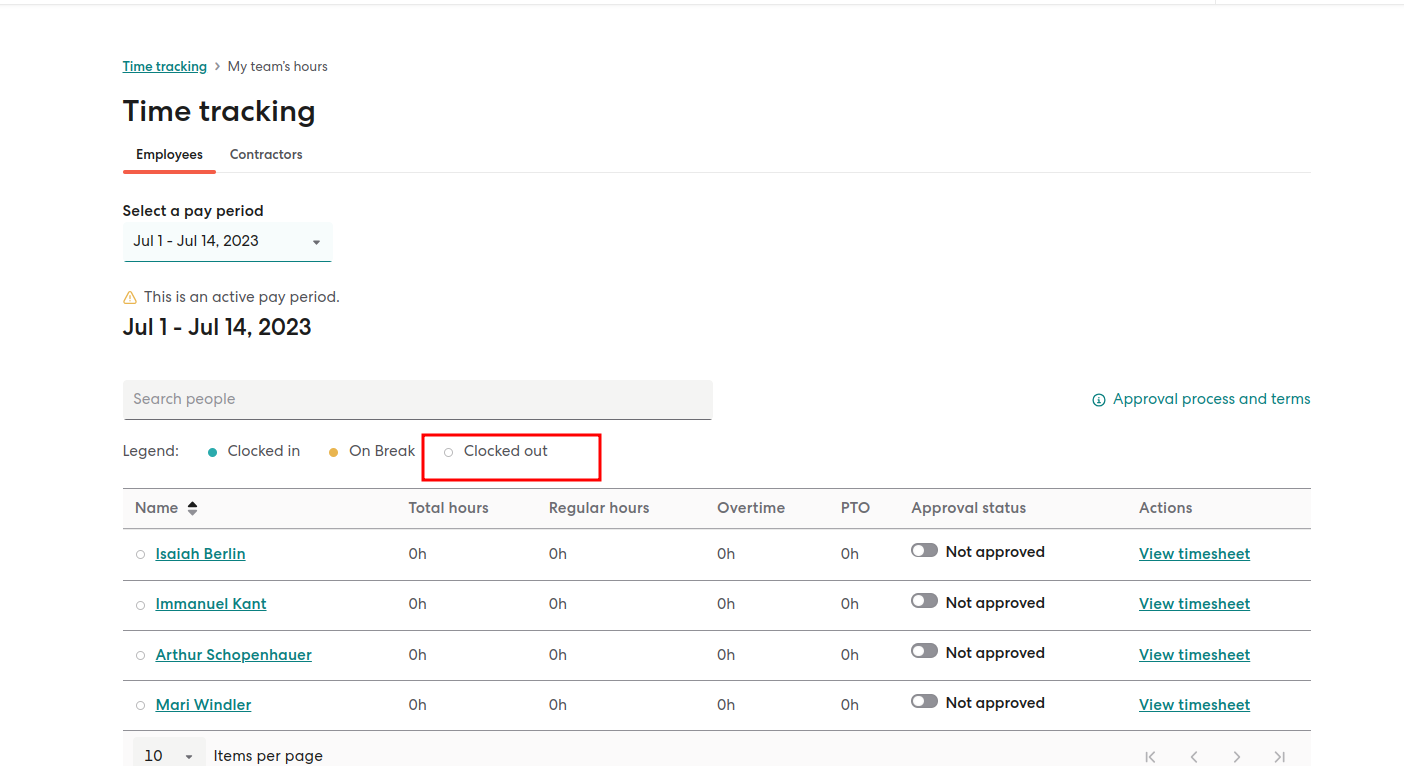

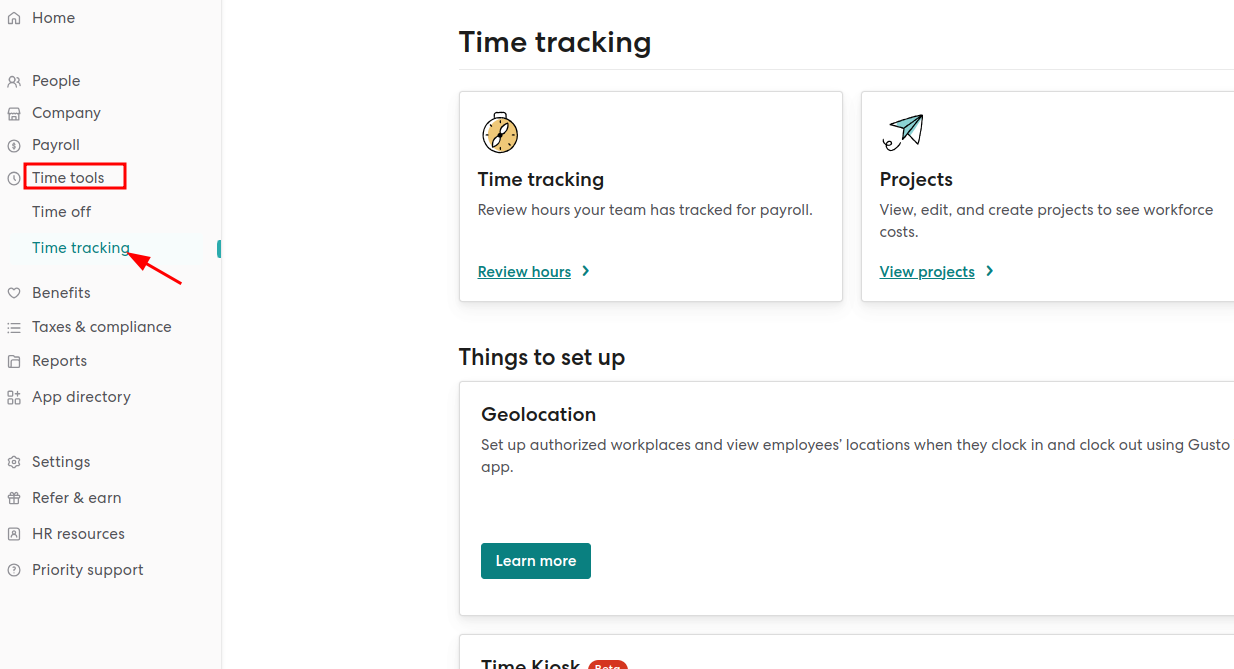

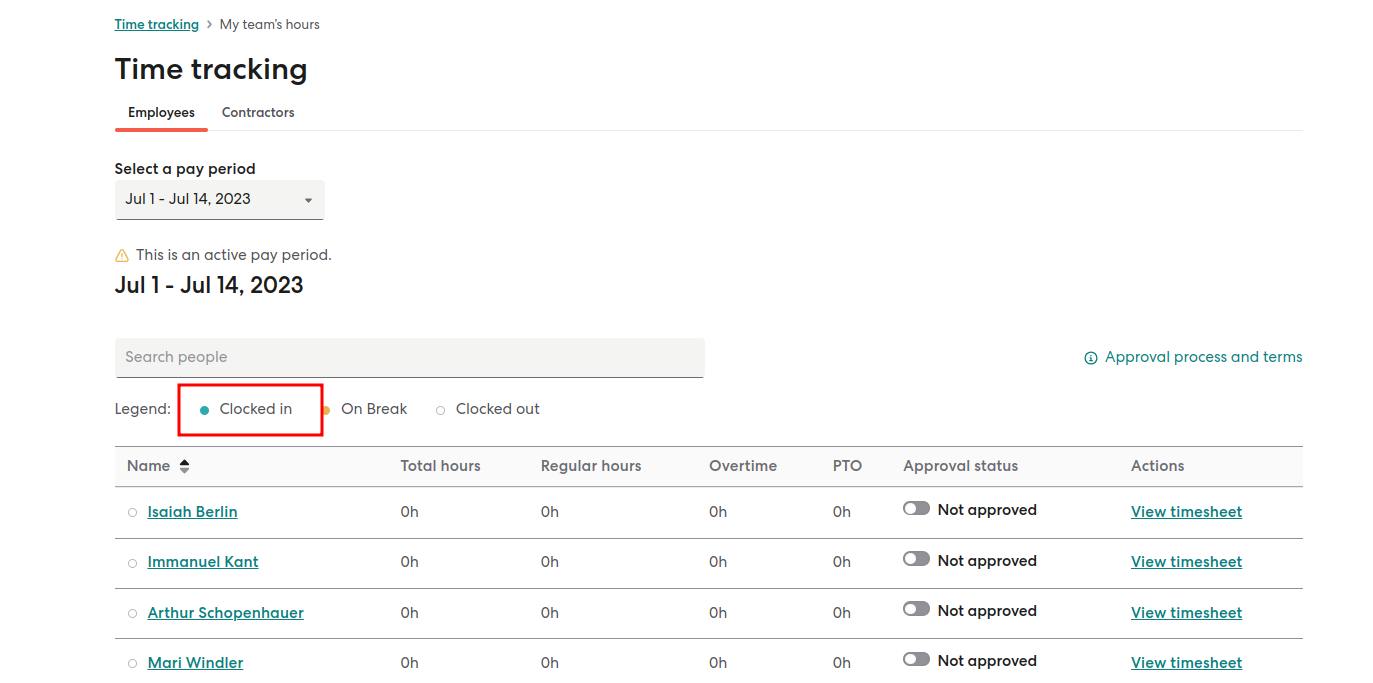

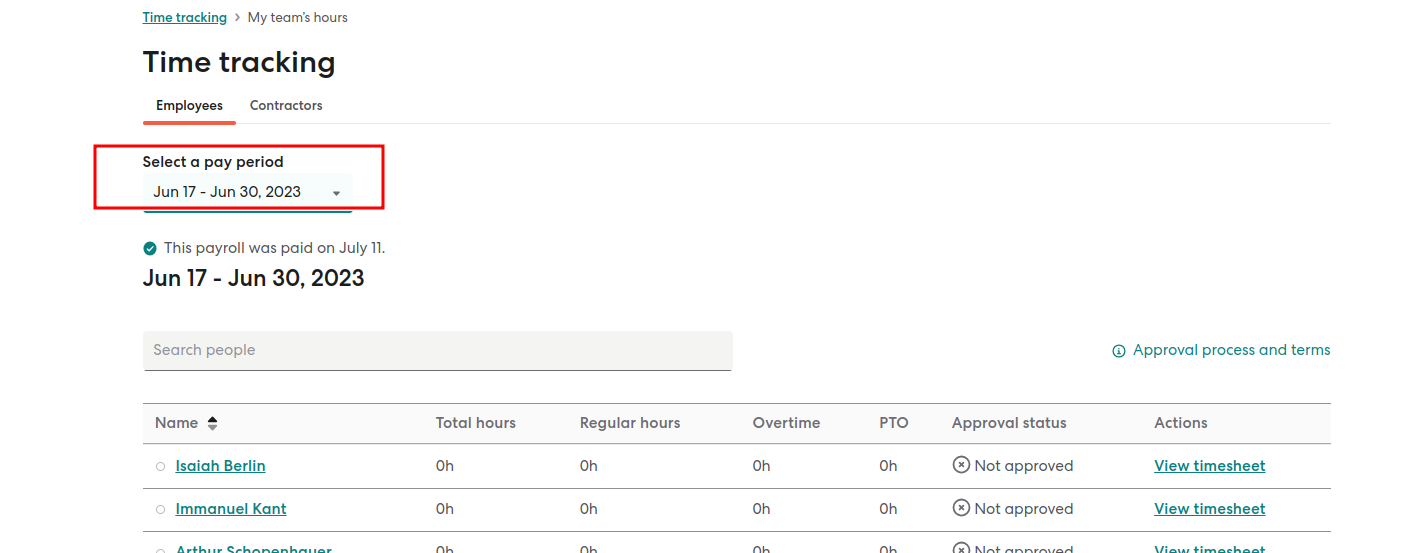

How To Use The Gusto Time Tracking Tool?

In order to access the Time Off section of your account, it is necessary for your payroll administrator to enable this feature. If you do not see this option, kindly contact your employer for assistance.

Key Point: “Hourly W-2 employees who have a Gusto account can utilize the feature to clock in and out for each shift or manually record and modify hours worked on a daily basis.”

Steps To Keep Track Of Your Working Hours

- Access your Gusto account by signing in.

- On your dashboard, locate the Time Tracking tile and choose the role or pay rate you are clocking in for, if applicable.

- Click on “Clock In” within the Time Tracking tile.

- When your workday starts, click on “Clock in”

- When your workday or shift is finished, click on “Clock Out.”

- If you prefer to manually add your hours for the day, select “Add Hours” and indicate the specific clock-in and clock-out times for each period.

- You will also have the option to include a note for each time block if desired.

- If your employer mandates it, you may be required to provide a note when manually adding hours and/or indicate whether you took a break.

Gusto will automatically calculate your total hours worked for the day and record them in the Time Tracking tab.

Key Point: “You can track your hours until they are approved or until the payroll administrator processes the payroll for the corresponding pay period. If you need to track hours for a past pay period, kindly reach out to your payroll administrator for assistance.”

Quick Steps To Review, Edit Or Remove Tracked Hours

To manually adjust your worked hours, follow these simple steps without the need to clock in or out. Your employer will be notified of the changes made.

- Access the Time Tracking feature by clicking on “View Pay Period” in the Time Tracking tile on your Dashboard or by navigating to the Time Tracking tab.

- Make sure the selected pay period is the one you want to review.

- To make changes, click on the pencil icon next to the respective day of the week.

- From there, you can add, edit, or delete any inaccurately reported hours as necessary.

If required by your employer, you may need to provide a note when modifying your hours and/or indicate if you took a break.

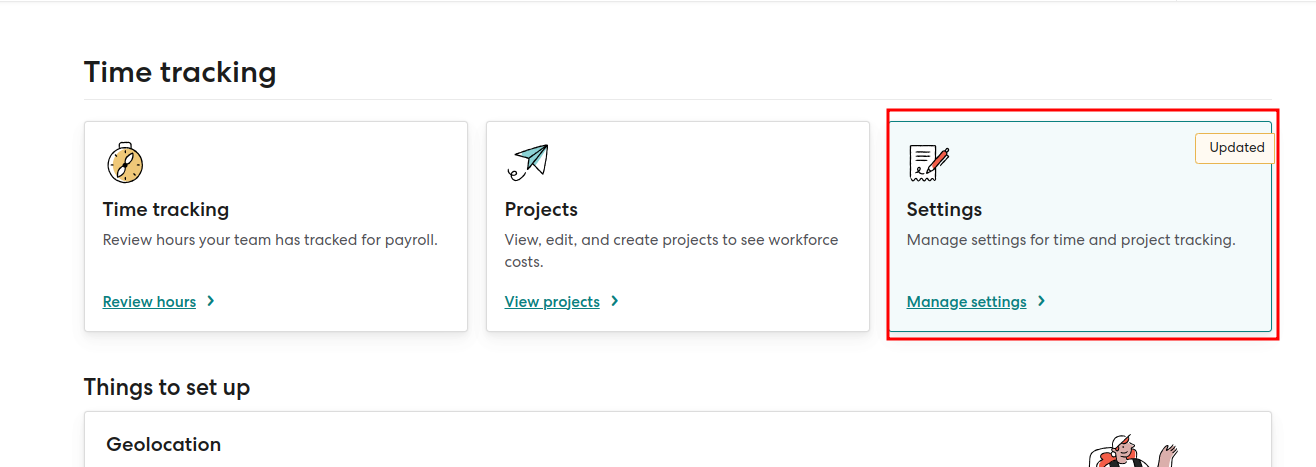

Quick Steps To Update The Timezone

To update the time zone for your tracked hours, follow these steps:

- Navigate to the Time Tracking section of your account.

- Click on the Settings tab.

- Look for the “Current timezone” option and click on Edit next to it.

- From the dropdown list, select the correct time zone.

- Save the changes by clicking on the Save button.

Quick Steps To Record The Meal And Rest Breaks

To record a meal or rest break using Gusto Time Tracking, simply follow these steps:

To add a break to your worked hours –

- Click on the Time Tracking tab.

- Access the My Hours tab on the Time Tracking page.

- Click Edit next to the specific day/shift where you need to record a meal or rest break. (A red exclamation point will indicate a ‘missing break’ based on your employer’s rules.)

- When entering your time, you will be prompted to provide the following details if a break was required:

- Type of break (meal or rest break)

- Duration of the break

- Start time of the break

- Click Submit to save the changes.

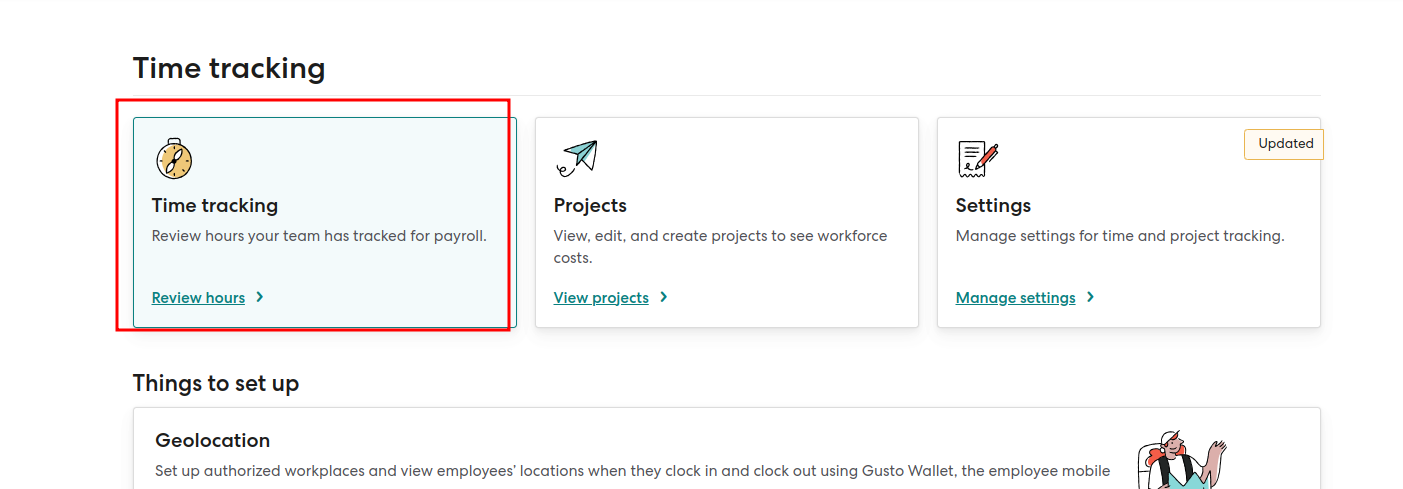

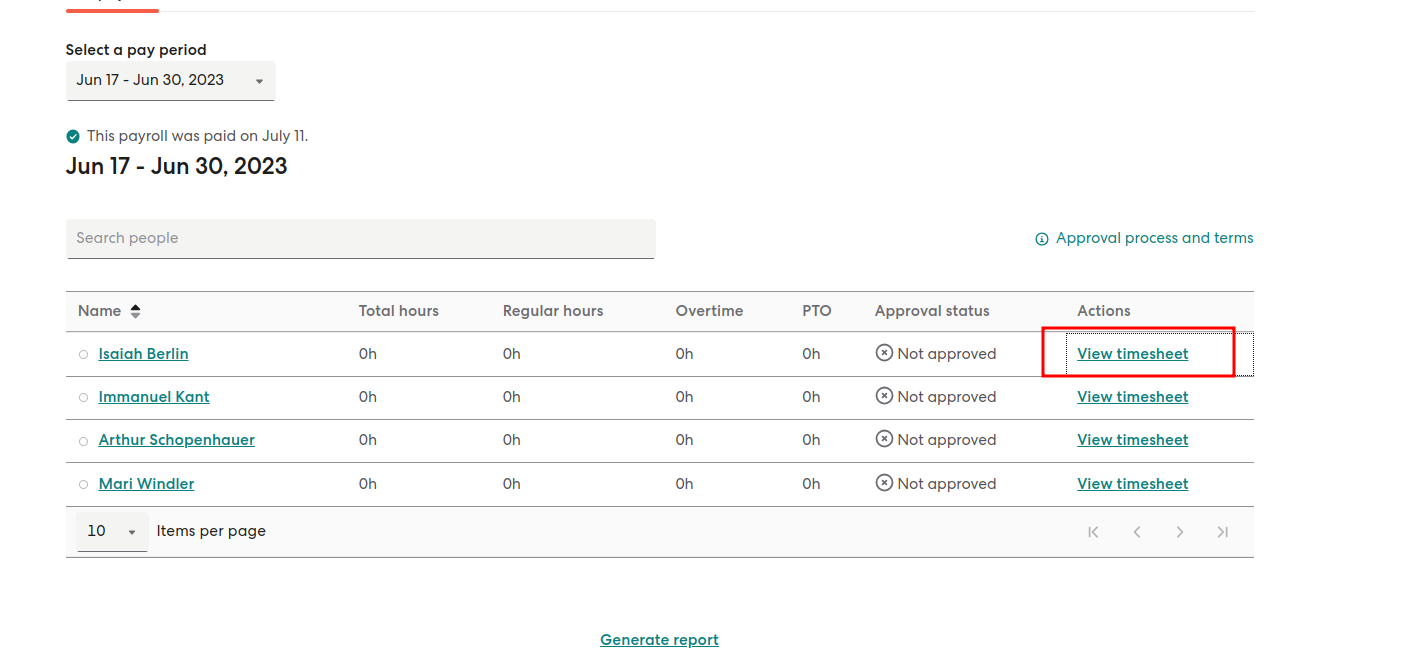

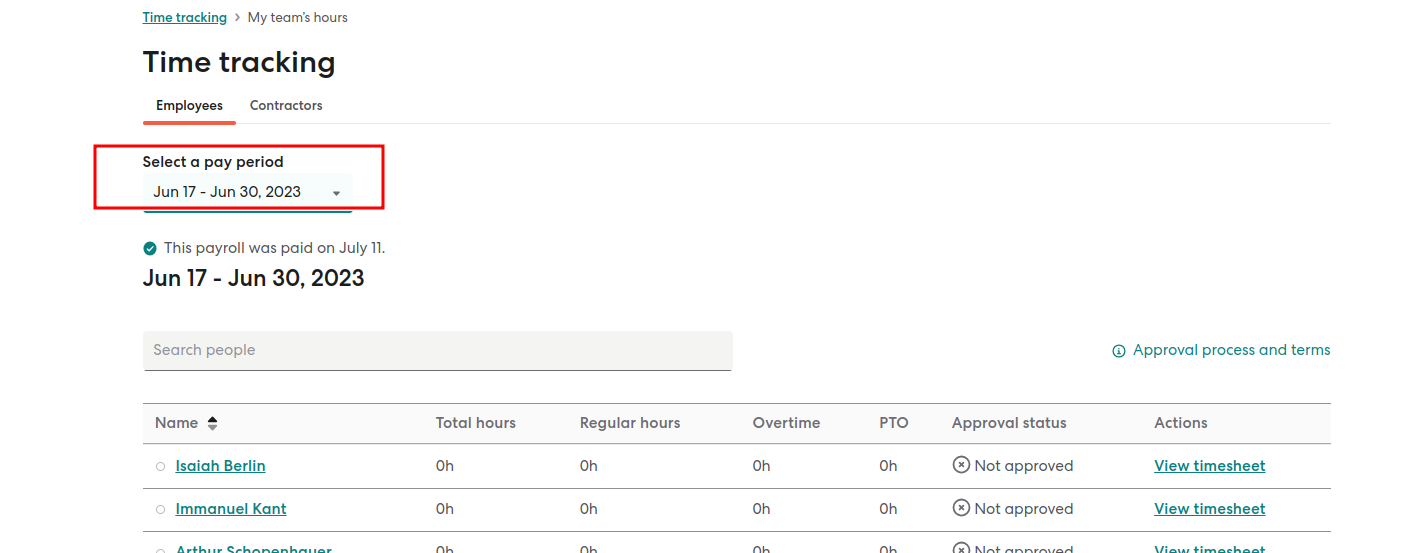

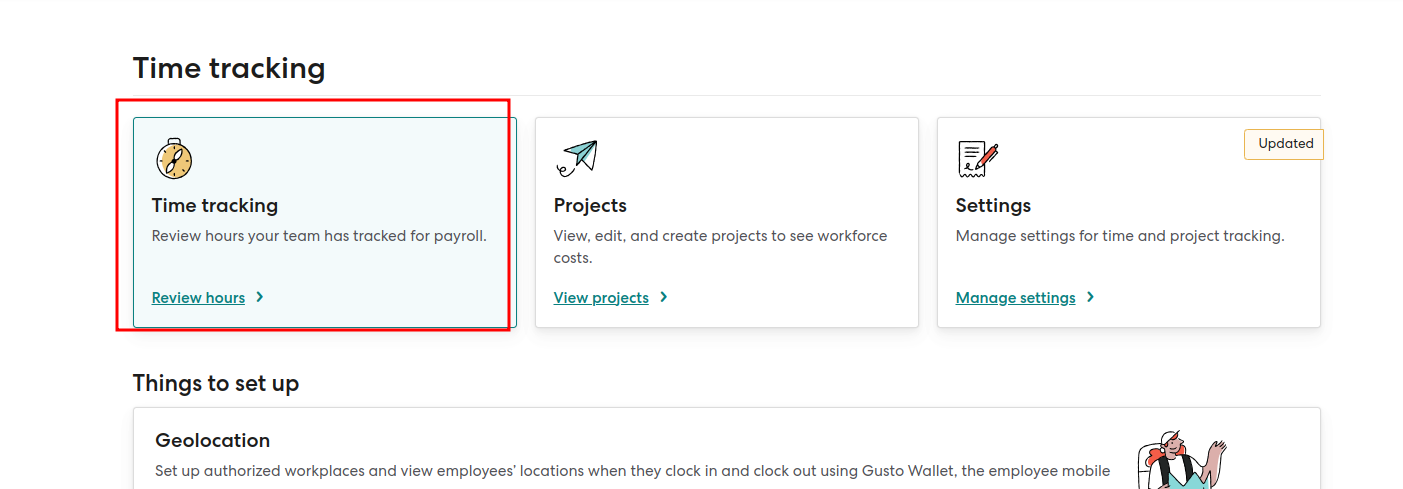

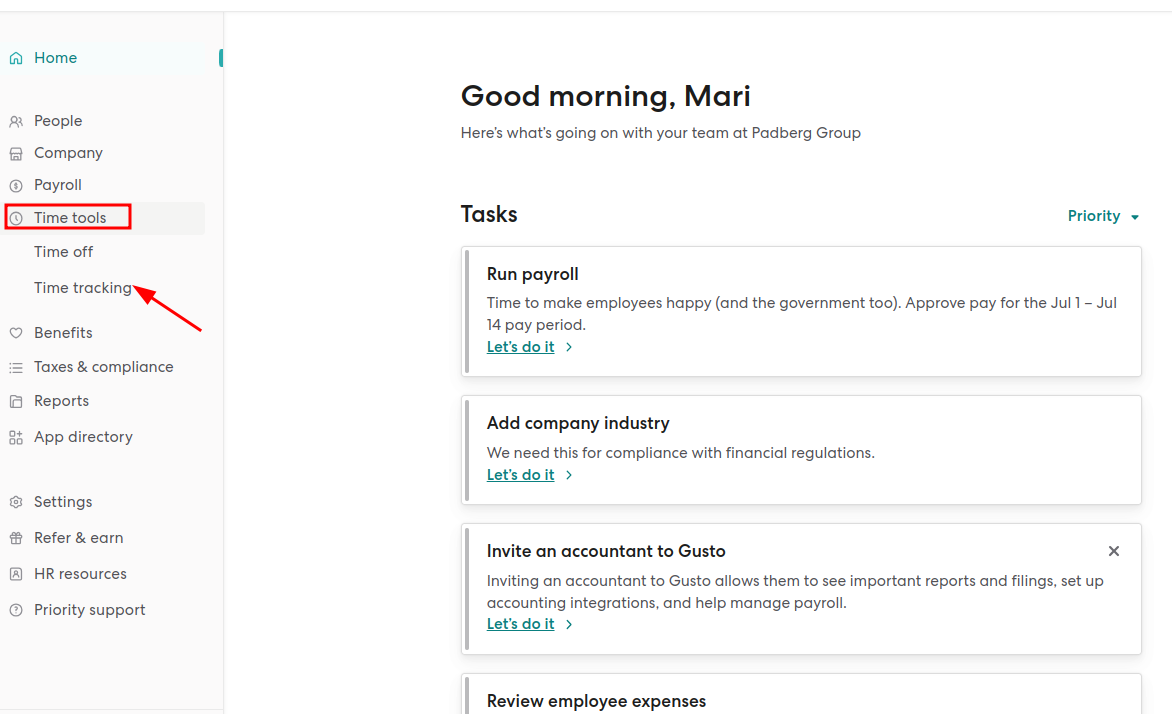

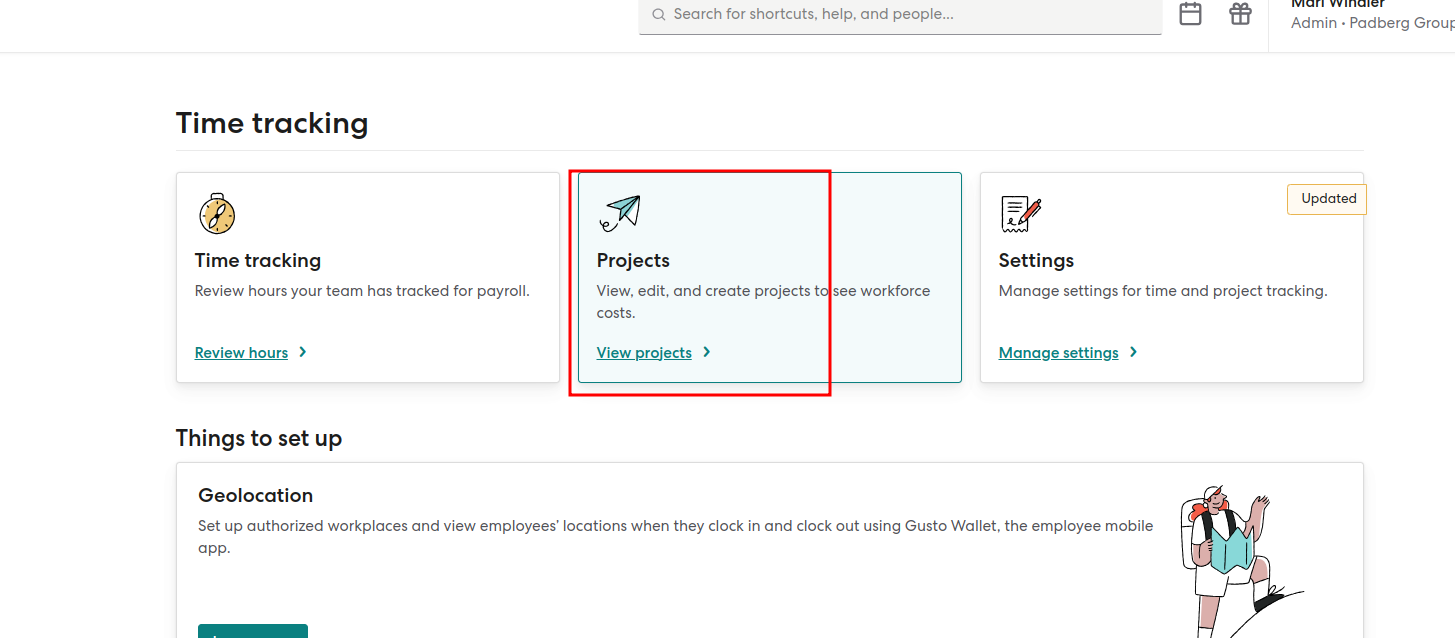

How To View And Manage Time-Tracking Data In Gusto Payroll Software?

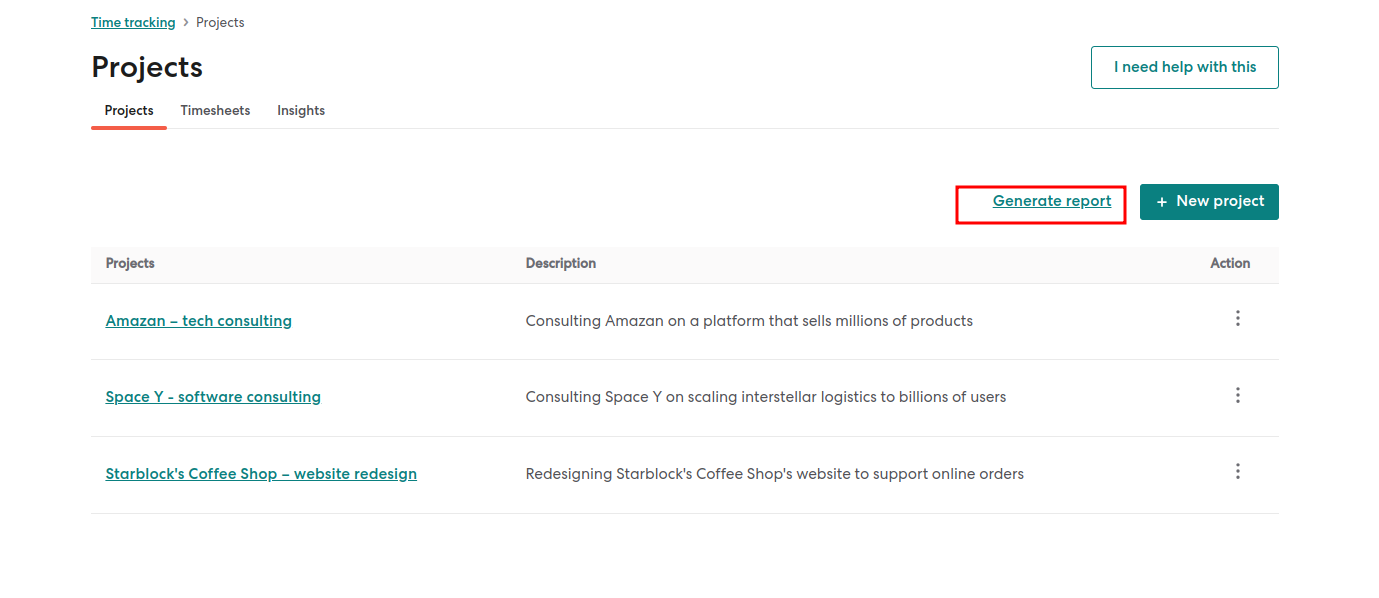

Gusto Project Tracking allows you to monitor and create projects to track workforce costs. Employees can log their hours for specific projects and tasks, while you can generate detailed reports showcasing the expenses associated with your team’s time, including wages, benefits, taxes, and more.

Key Point: “Project Tracking is available for our Plus and Premium customers. If you don’t currently have access to this feature, you can upgrade your plan to take advantage of it. Gusto Project Tracking is not compatible with pay schedules based on “employee type” or applicable to contractors at this time.”

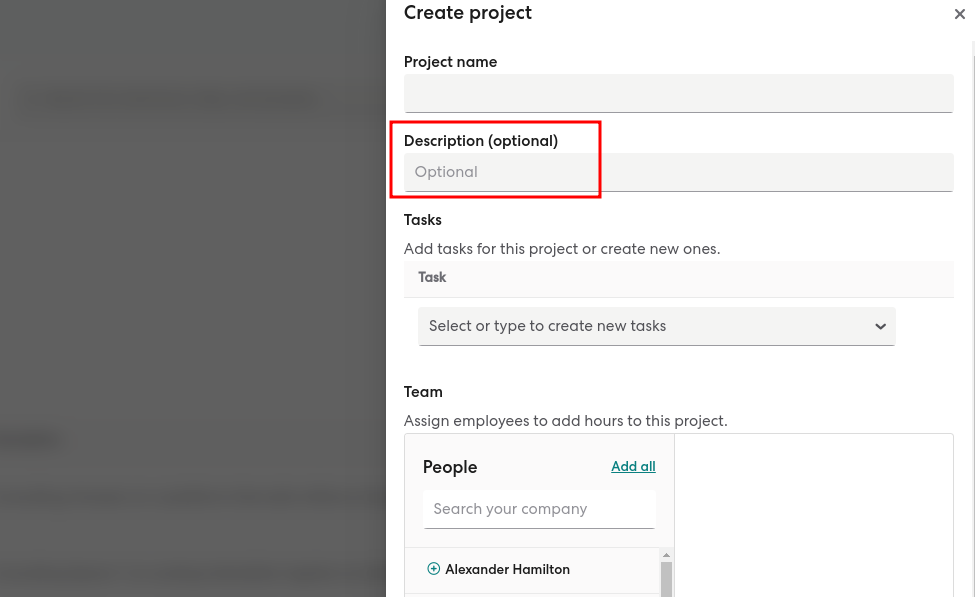

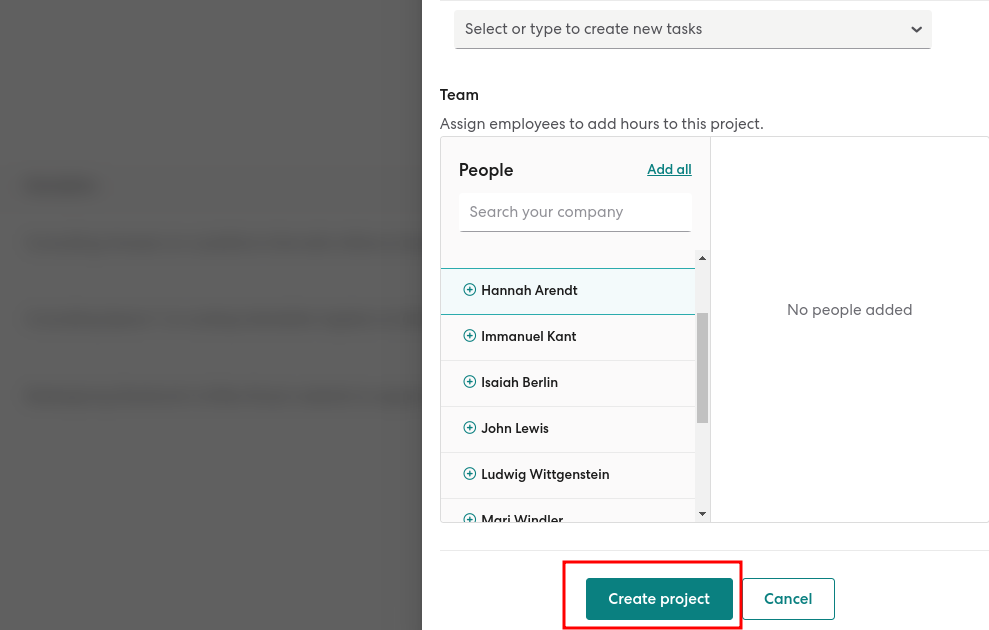

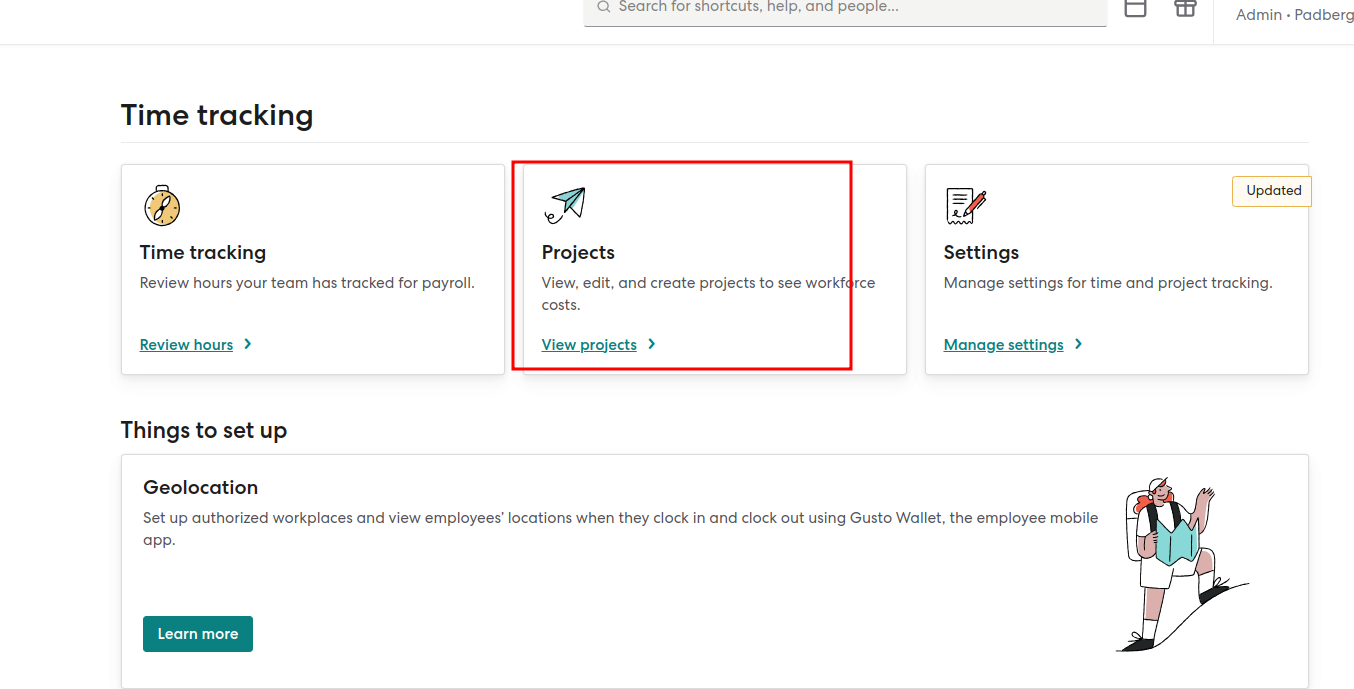

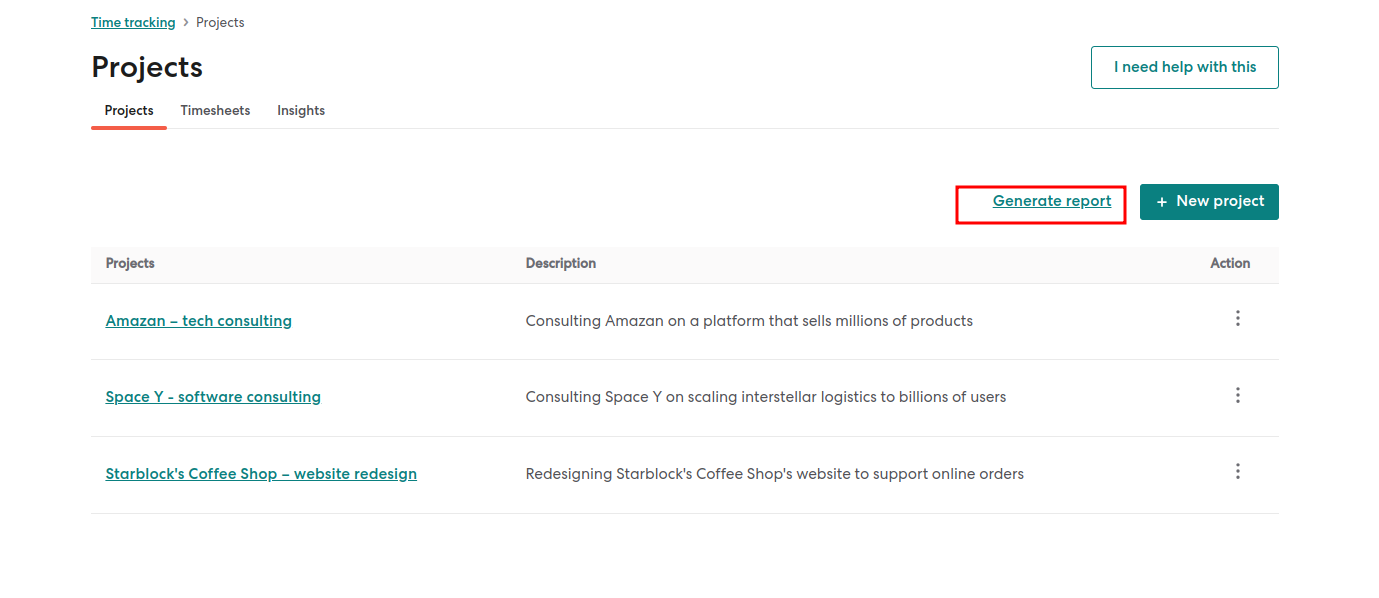

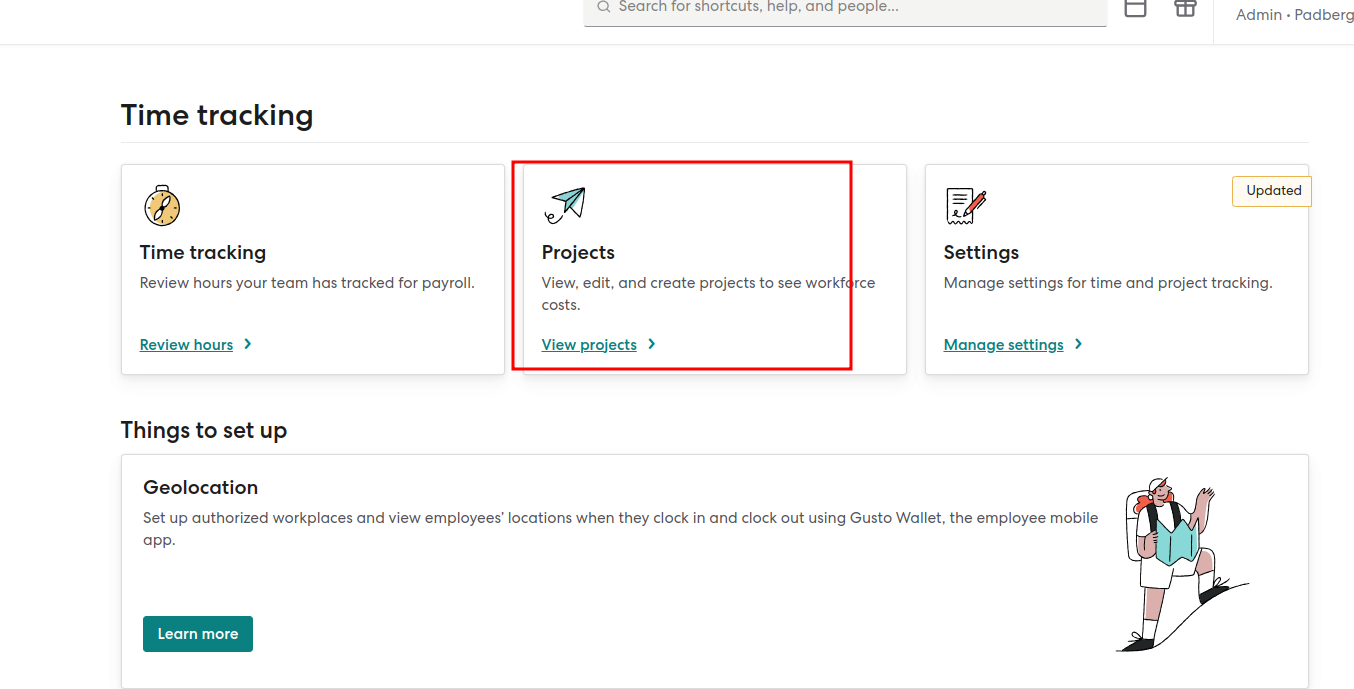

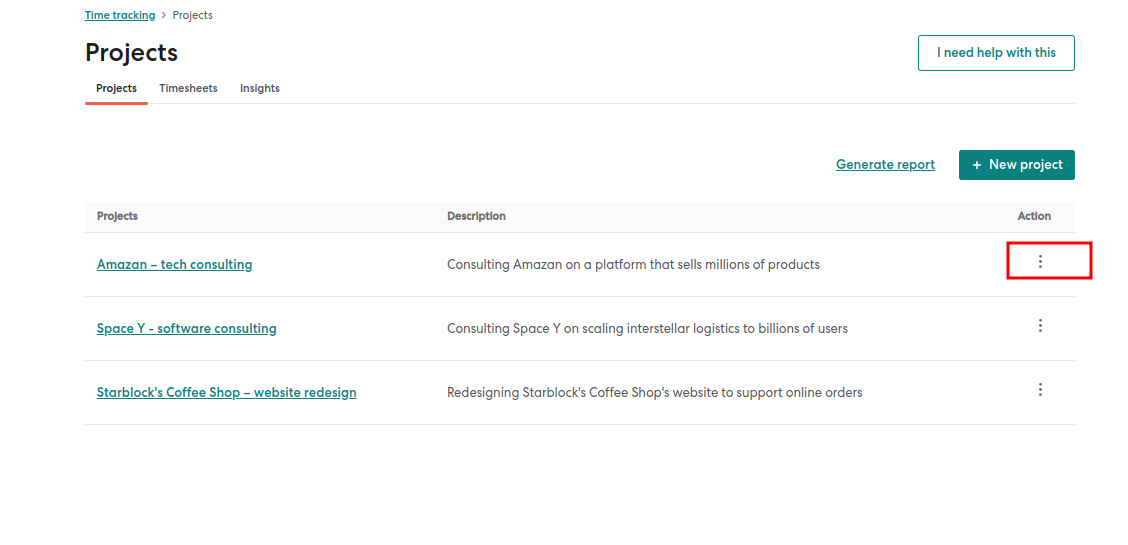

Steps To Create And View Projects

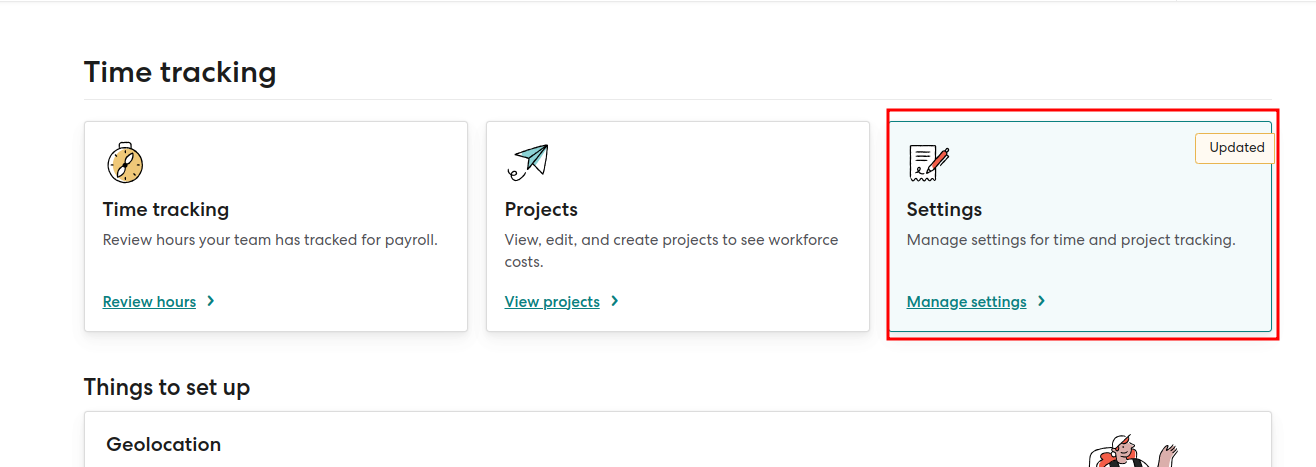

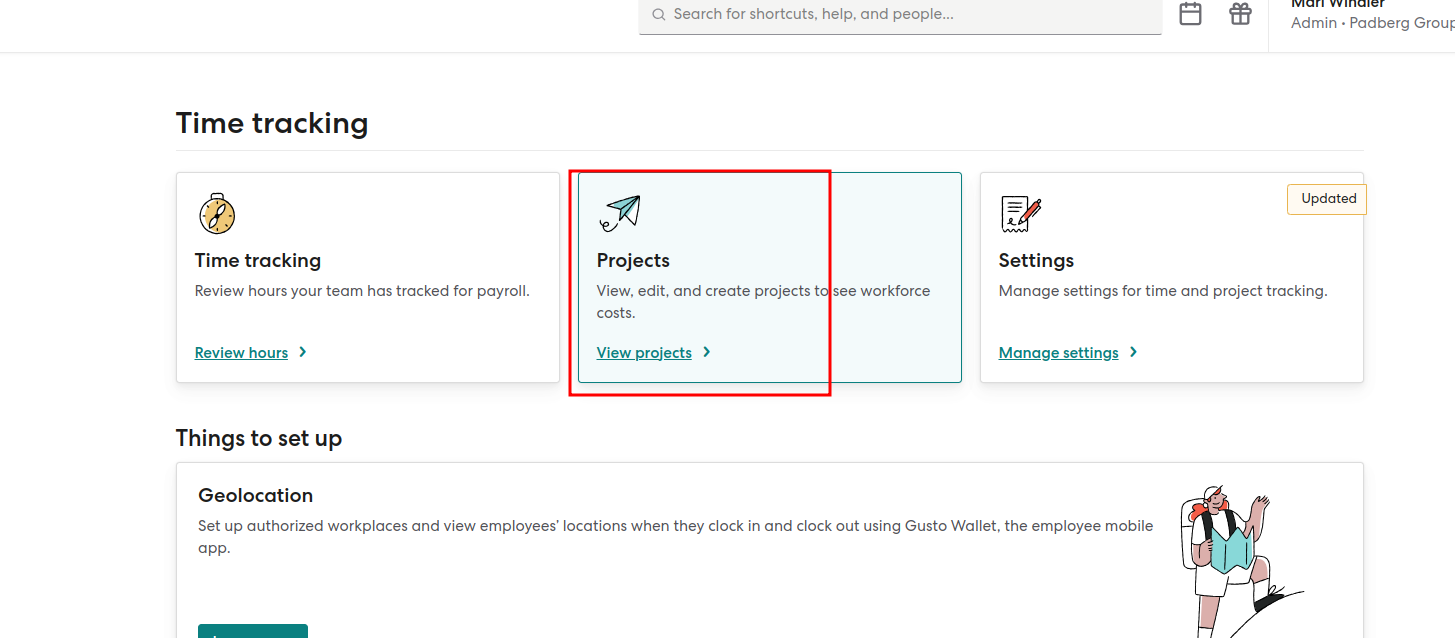

To begin tracking time for projects in your Gusto account, follow these steps:

- Sign in to your Gusto account.

- Go to the Time tools section and select Time tracking.

- Under the Time tracking, choose ‘Projects’ tile.

- Here’s how the process works:

- Whenever there are projects/clients, make them a part of Gusto by adding them.

- Your team members track the amount of time they spend on each project and its tasks.

- You can generate a report that provides cost breakdowns by project, task, employee, and specific time periods.

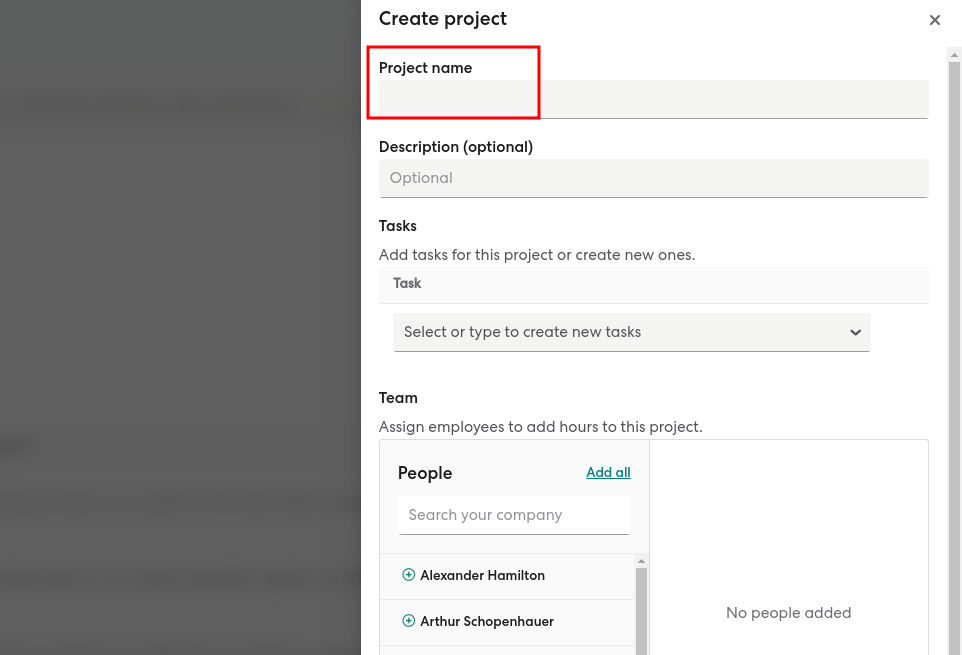

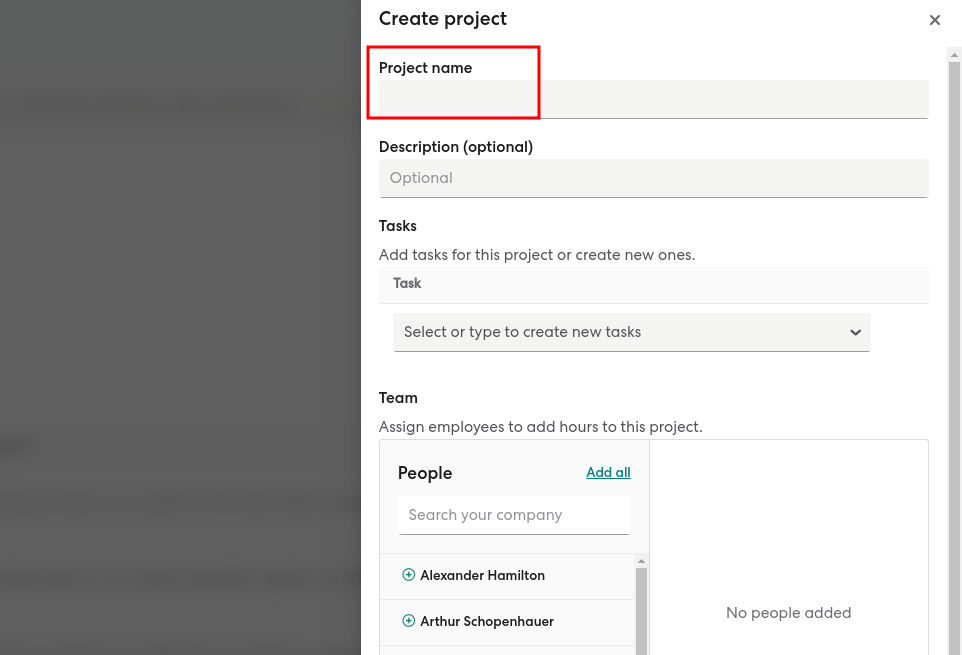

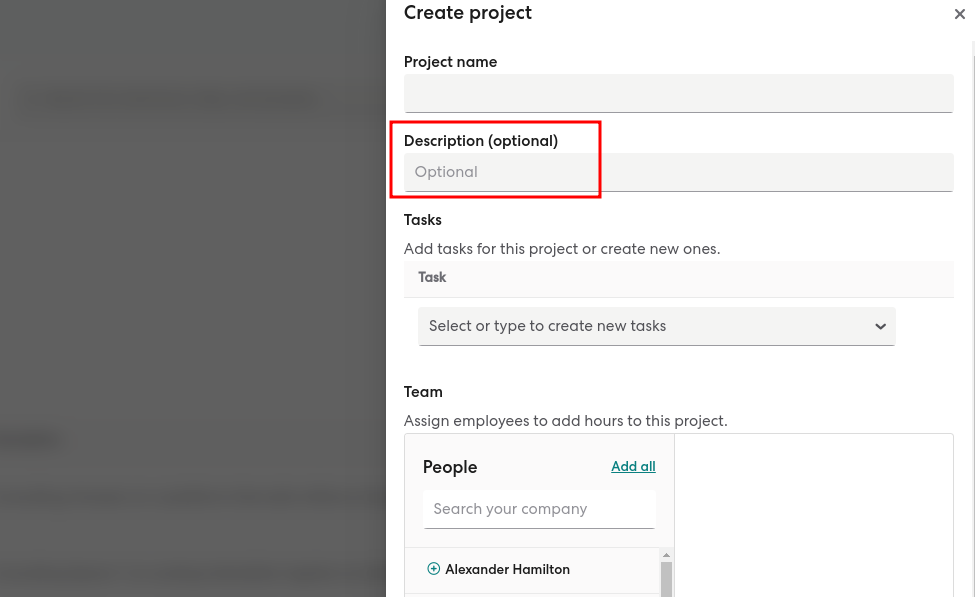

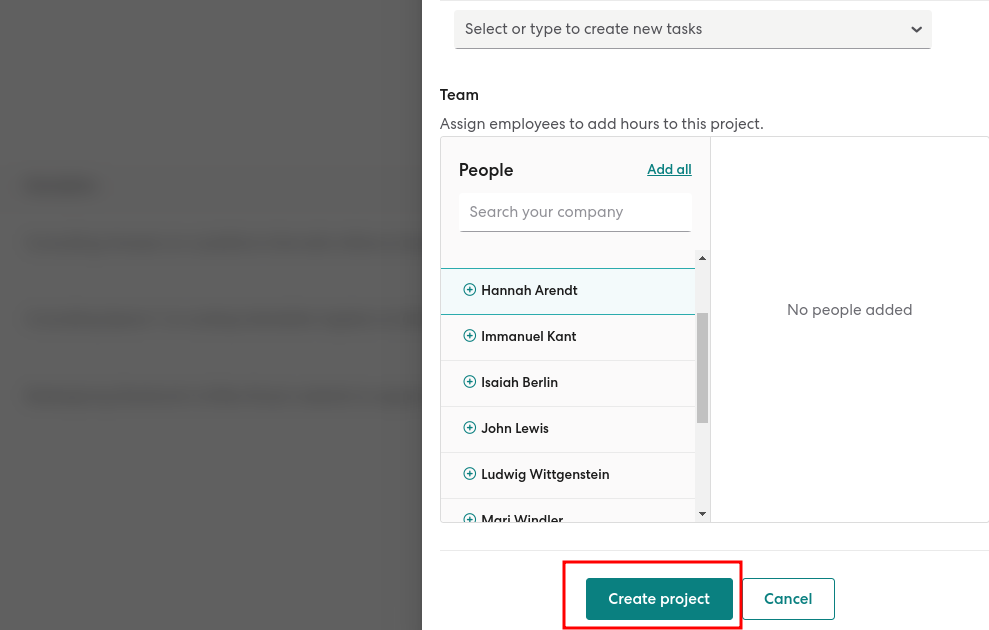

- To create a new project, proceed as follows:

- Click on “Create project.”

- Provide a name for the project.

- Optionally, add a task associated with the project.

- Optionally, enter a description.

- Click on “Create project.”

Once the project is created, employees can begin tracking their hours against it.

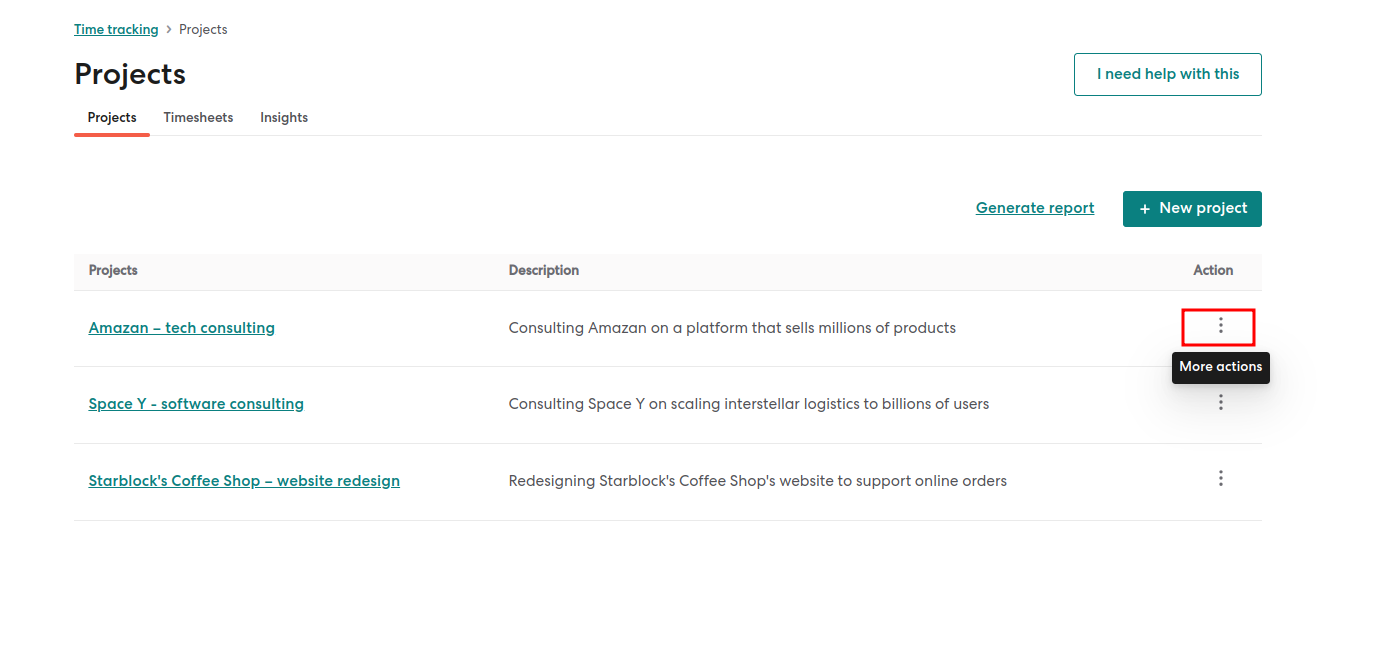

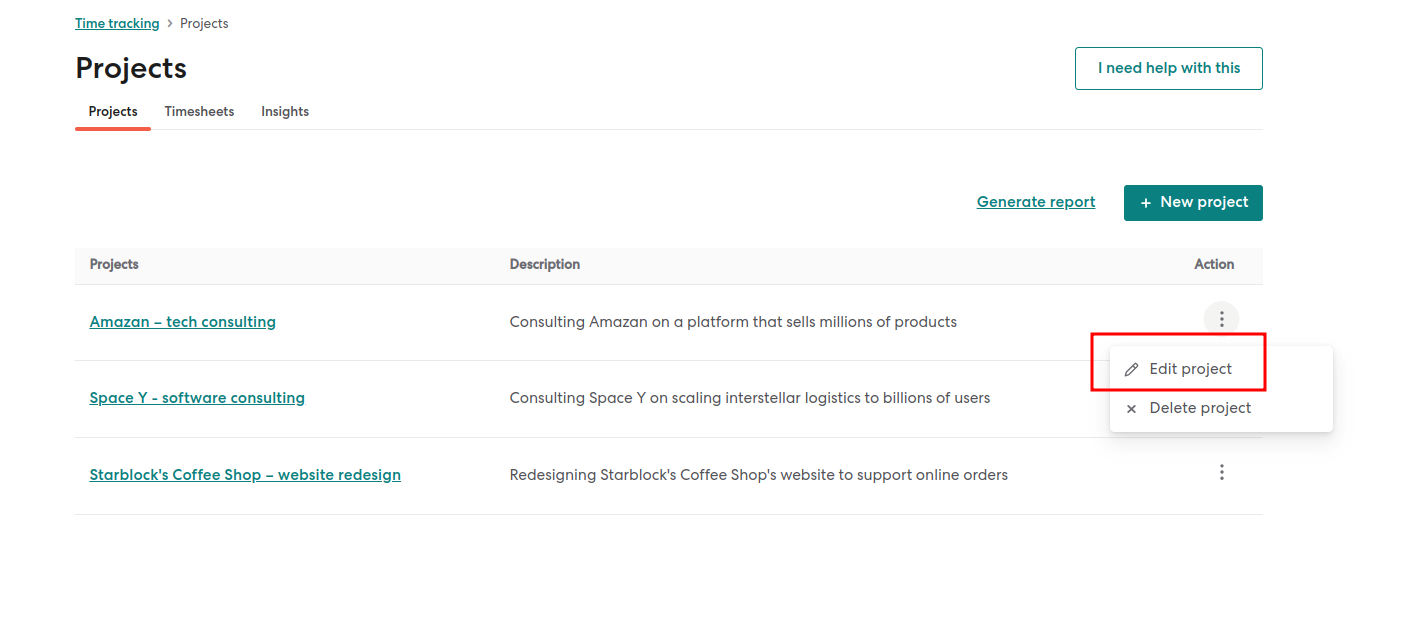

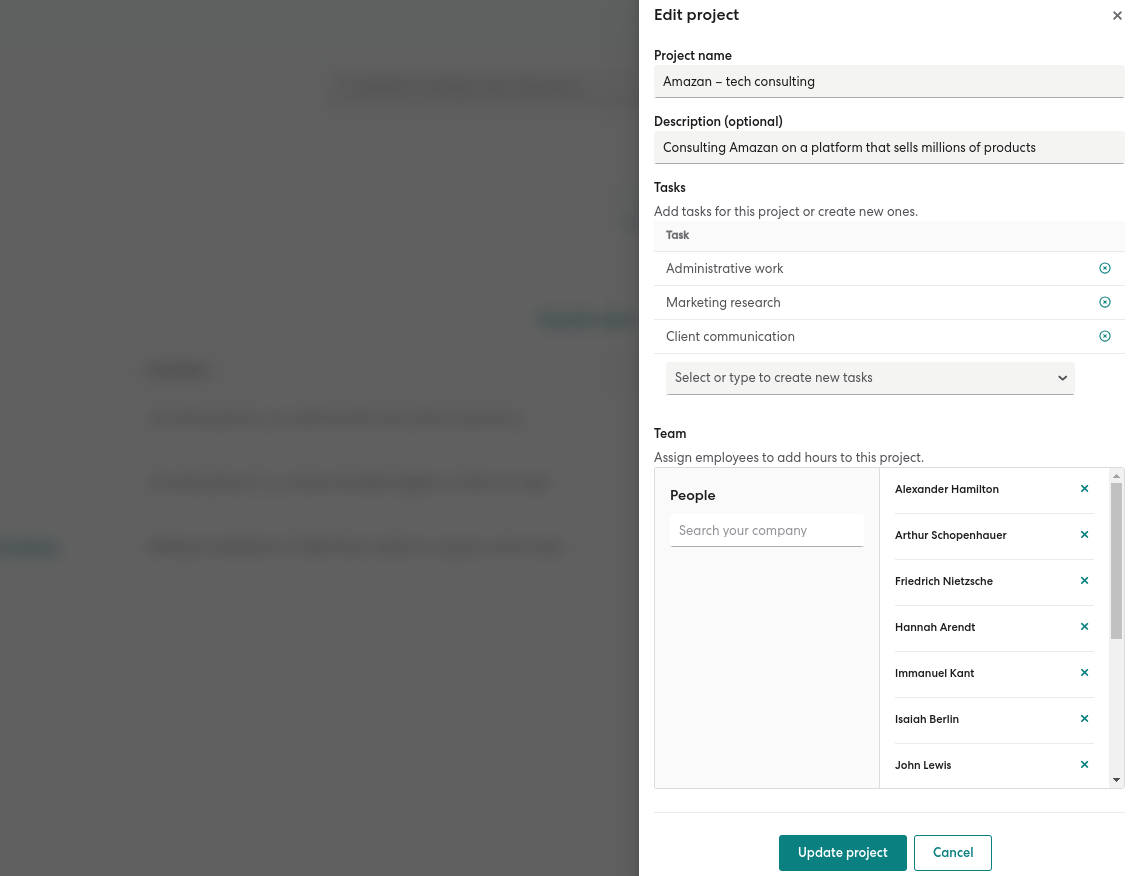

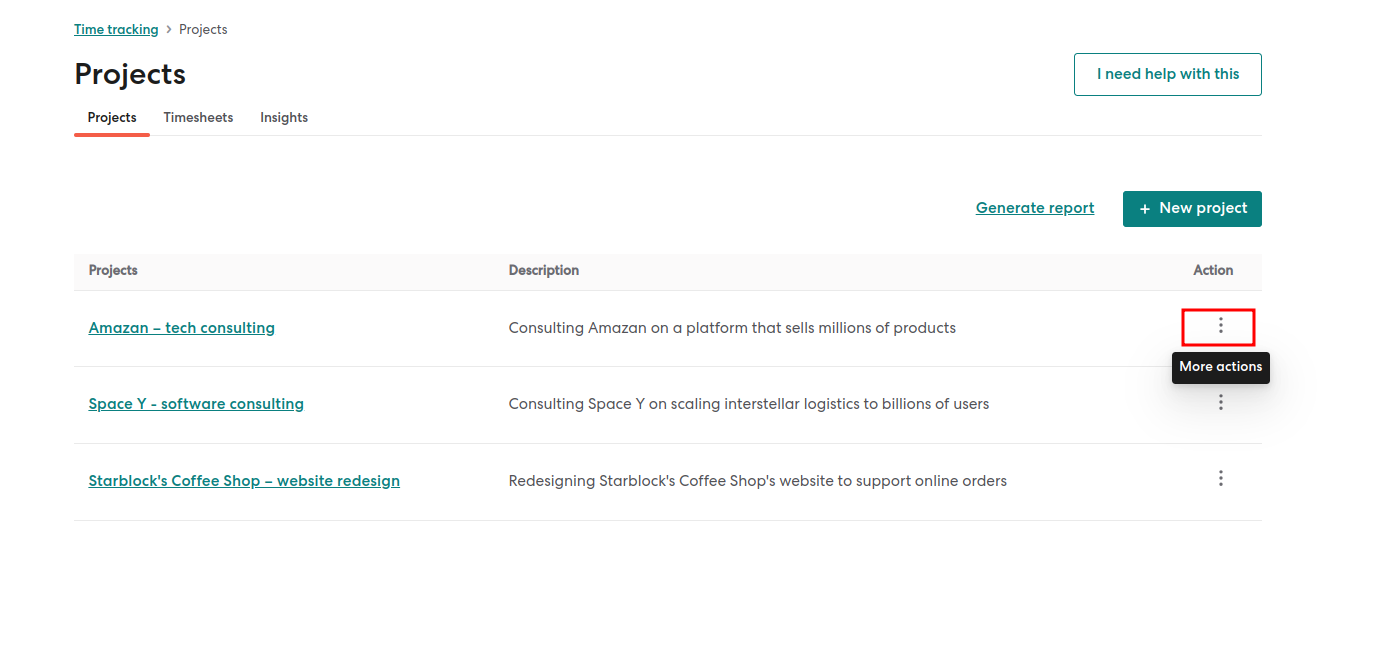

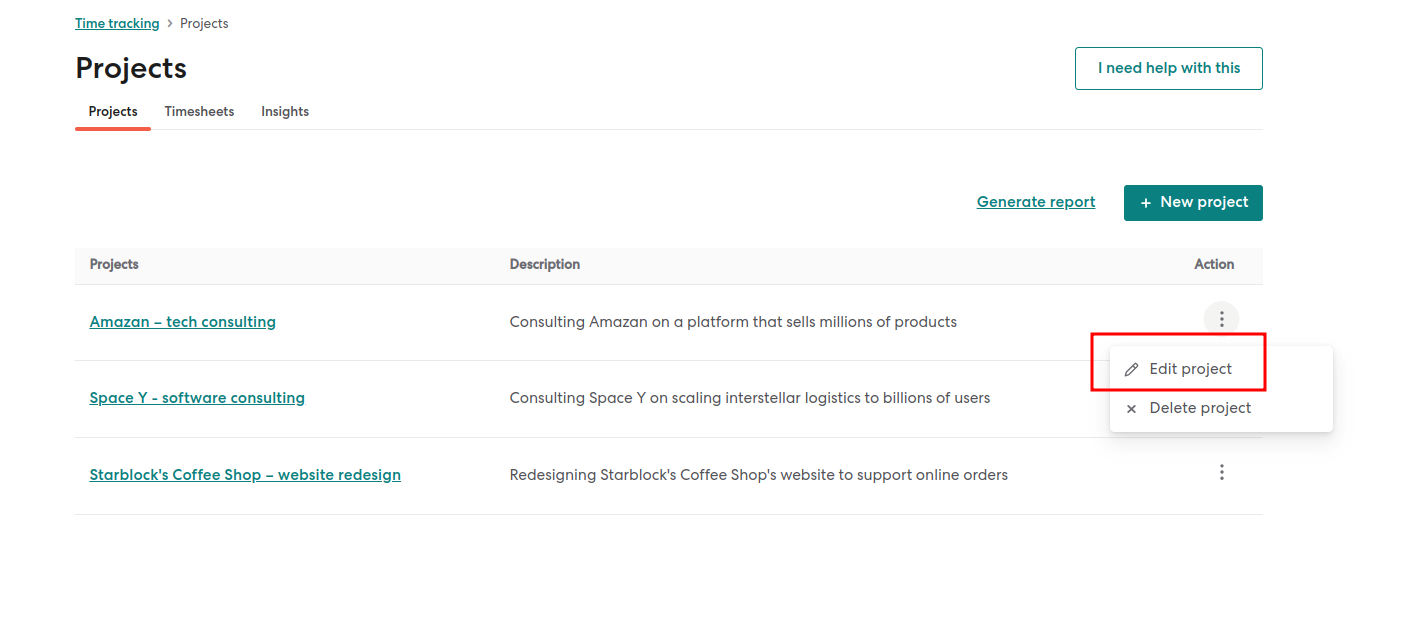

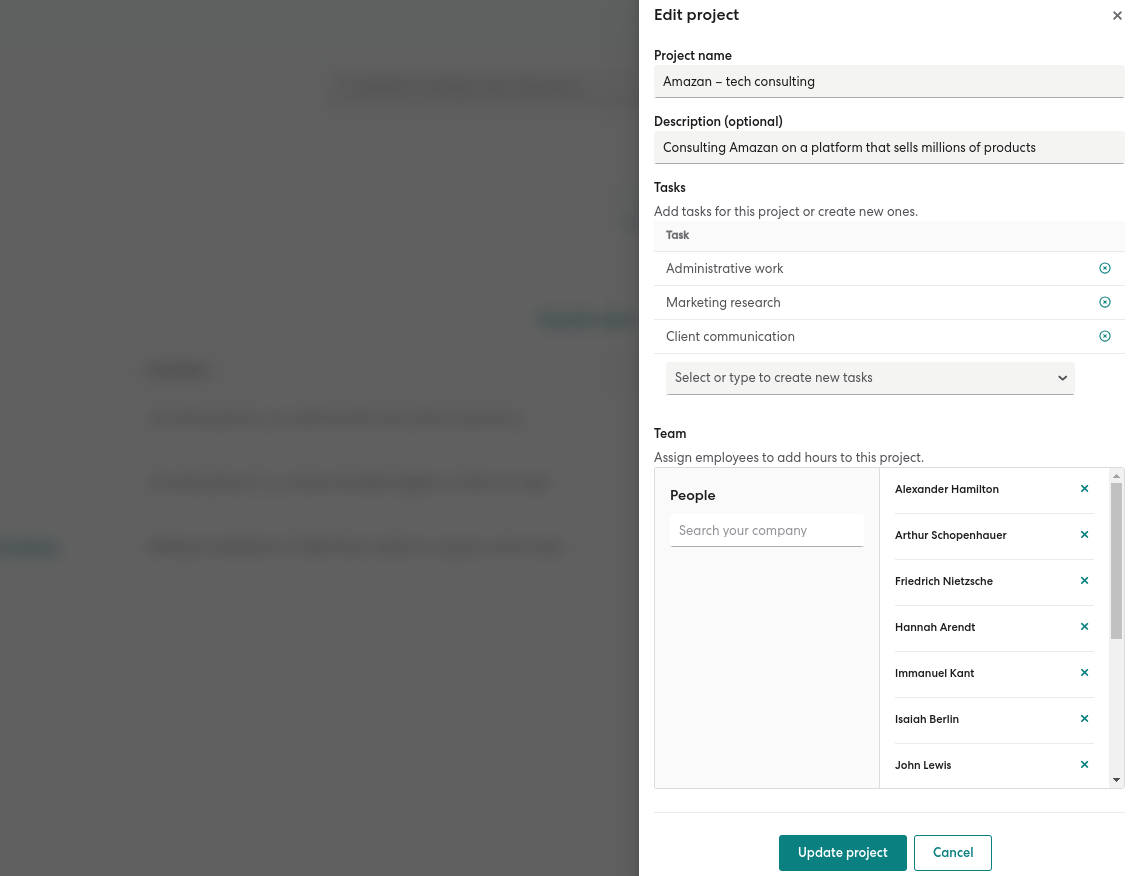

Steps To Edit A Project

- Sign in to your Gusto account.

- Go to the Time tools section and select Time tracking.

- Click on the Projects tile under Time Tracking.

- Locate the project you wish to edit and click the three dots next to it.

- Make the necessary changes and click “Update project.”

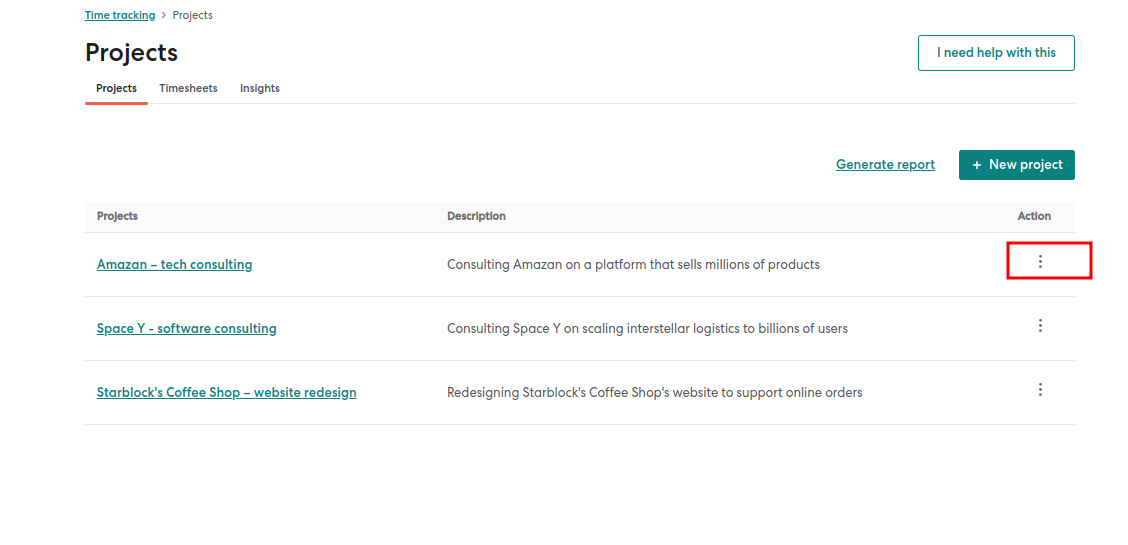

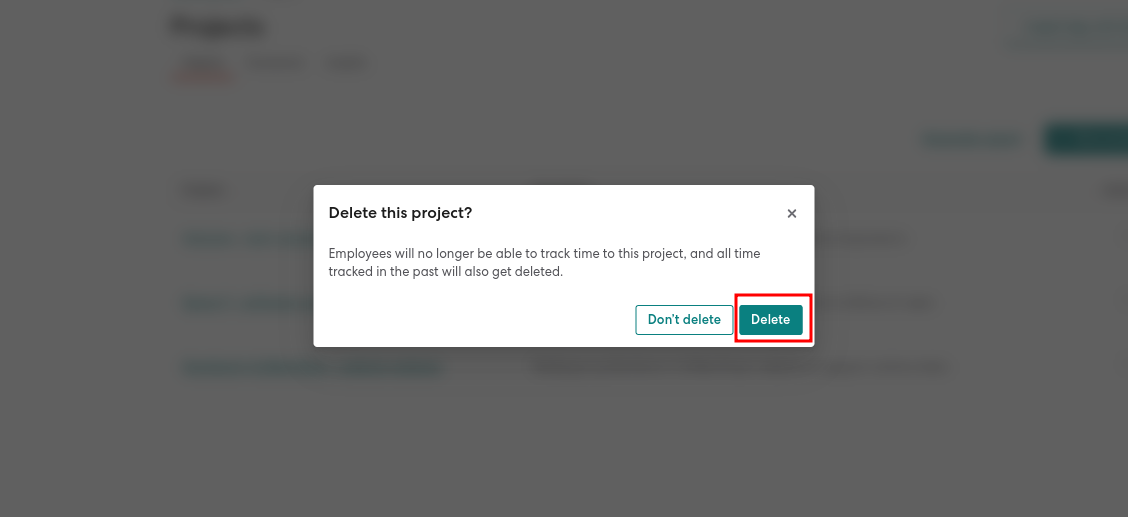

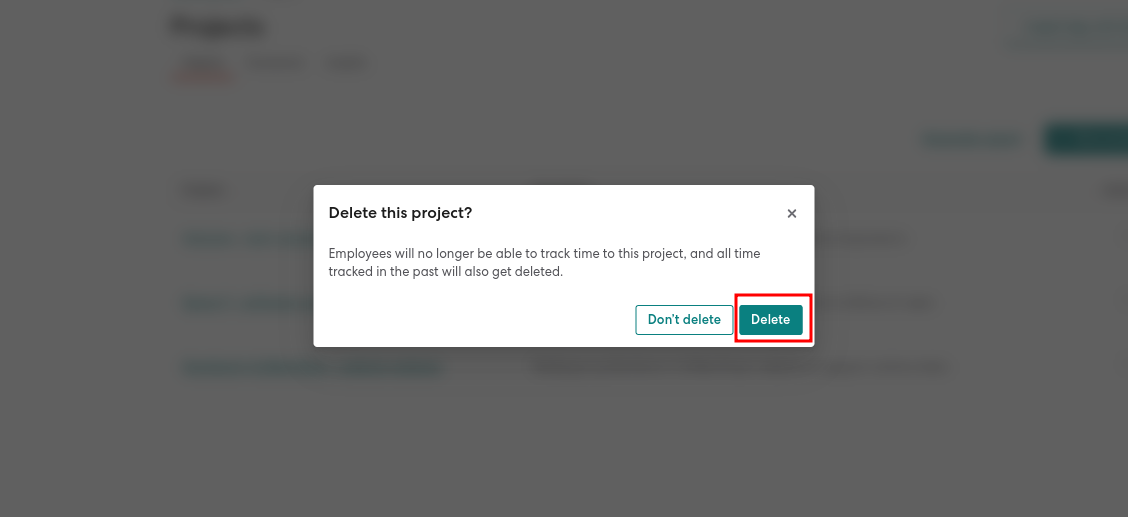

Steps To Delete A Project

- Sign in to your Gusto account.

- Go to the Time tools section and select Time tracking.

- Click on the Projects tile under Time Tracking.

- Find the project you want to delete and click the three dots next to it.

- Confirm the deletion by clicking “Delete.”

Key Point: “Deleting a project will also remove all associated historical data.”

What is Gusto Payroll Software’s “Benefit Tab”?

The “Benefit Tab” in Gusto Payroll Software is a feature that allows users, both employees and administrators, to access and manage various benefits offered by the company. This tab provides a centralized location to view and update enrollment status, coverage details, Summary of Benefits, and carrier contact information. Overall, the Benefit Tab streamlines the process of accessing and managing benefits within Gusto Payroll Software.

For Employees:

If your employer uses Gusto for providing benefits (including broker integration), you can access important information regarding your enrollment status, coverage details, Summary of Benefits, and contact information for carriers. Simply navigate to the Benefits section of your account to view these details.

For Admins:

To view and manage your company’s benefits, it is necessary to have either Full Access or benefits permissions. Please ensure that you have the appropriate level of access to access and handle your company’s benefits effectively.

How To Calculate Payroll Taxes In Gusto Payroll?

Finding the right candidate for a new team member can be challenging. The process involves searching for the perfect fit and considering the associated expenses. However, you don’t have to navigate this alone. We are here to provide the solutions you need. Our employer tax calculator is designed to swiftly provide you with a comprehensive overview of the payroll taxes you can anticipate when hiring a new employee. By using our calculator, you can gain a clearer understanding of the financial implications involved in the process.

What Are The Ins And Outs Of The Payroll Taxes?

Running a payroll can feel overwhelming, especially when you have to pull out the calculator. It’s likely the last thing you want to deal with. However, it’s important to get it right for the sake of your employees and your taxes. To simplify things, we’ve divided the process into a few straightforward steps.

Primary Categories Of Payroll Taxes:

There are three main categories of payroll taxes:

These are the taxes you, as an employer, are responsible for paying. They include federal and state-level unemployment taxes.

-

Employee Withholding Taxes:

These are the taxes you deduct from your employee’s wages on their behalf. They are used to cover federal and state income tax obligations.

These are the taxes that both you and your employees are responsible for. They include contributions to Medicare and Social Security.

The specific taxes you need to pay will vary depending on factors such as your business type, size, and location. It is advisable to consult with a tax professional who can provide guidance on the relevant taxes for your specific business.

What Are The Unemployment Taxes That You May Have To Pay?

Unless your organization is exempt, such as a charitable organization, you are required to contribute to federal and state unemployment insurance in addition to paying your employees.

Unemployment insurance is designed to provide financial support to workers who are unemployed due to circumstances beyond their control (i.e., they didn’t voluntarily leave their job). Eligibility for unemployment benefits is determined by meeting specific requirements set by each state, such as minimum work hours or earnings.

The Federal Unemployment Tax Act (FUTA) governs contributions at the federal level, while each state operates its own unemployment insurance program (SUI). Your location can impact your SUI rate and potential tax credits. Here’s how it works:

“FUTA sets a maximum taxable earnings limit, known as the “wage base,” which is $7,000. Any earnings beyond this amount are not subject to taxation. The standard FUTA tax rate is 6%, so your maximum contribution per employee could be $420. However, you can claim a tax credit of up to 5.4% (a maximum of $378). As long as you pay your unemployment taxes on time and in full, you can usually claim the full credit.”

With the full credit, your net FUTA tax rate would be only 0.6% ($42), in addition to any state unemployment taxes you owe.

However, your location can also impact your tax rate. If your state lacks sufficient funds to cover unemployment insurance benefits and needs to borrow from the Unemployment Trust Fund, it becomes a “credit reduction state.” If the loan remains unpaid, your FUTA tax credit may gradually decrease by 0.3% each year.

What Your Employees Need To Know About Income Taxes?

Income taxes are amounts that individuals need to pay based on their earnings. As an employer, it’s your responsibility to collect and remit these taxes throughout the year. Income taxes are imposed at the federal and state levels, and in some cases, at the city or county level as well.

To ensure accurate tax withholding, your employees need to provide you with the necessary information. They can do this by filling out Form W-4 when they are hired and updating it as needed. By using the IRS withholding calculator, you can determine the appropriate tax rate to apply for each employee.

The income tax rates vary from state to state. Some states have a flat tax rate, like 3.07% in Pennsylvania, while others have progressive tax rates that increase with higher income levels. For example, California has rates as high as 13.3%. Additionally, there are nine states that do not collect individual income tax, although there might be other taxes that employees need to consider.

By the time your employees file their tax returns in April, around 90% of the taxes owed on their salaries or wages should have already been deducted and paid by you. If you have deducted too much, they may be eligible for an income tax refund. On the other hand, if too little has been collected, they might be subject to penalties or fines.

How To Add Or Edit Your Federal And State Tax Details?

Let’s get into the step-by-step guide to how to add the federal and state tax:

Managing Federal Tax Details:

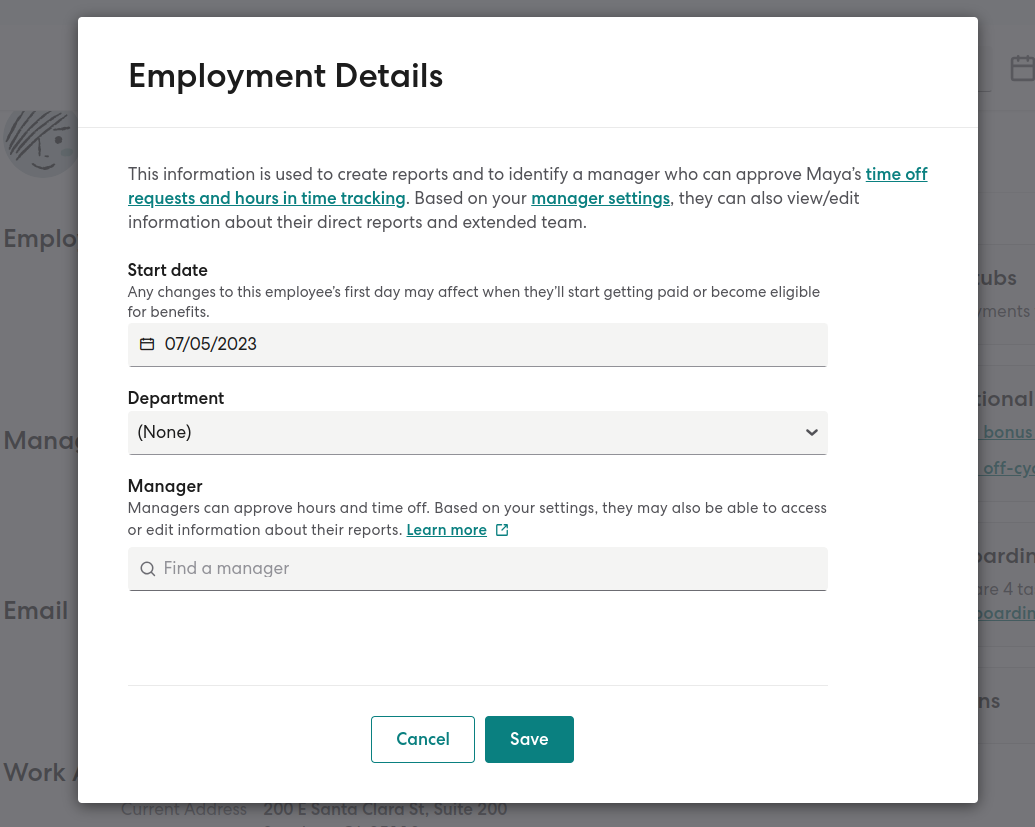

Steps To Add Federal Tax Details During The Onboarding Process:

As a payroll software, we take the responsibility of handling the employer’s federal tax returns and deposits, while making it a seamless process. However, for the process to go smoothly we request certain essential information from your side including Federal Employer Identification Number (FEIN), Company Type, and Official Company Name.

If you don’t know where to find the information, you can check for the form CP-575 issued by the IRS.

Now, let’s get into the step-by-step process of onboarding:

- Click on Step 5: Federal Taxes.

- Choose the option “Add Federal Tax Details”.

- Enter your FEIN and the correct company type.

Key Point: “It is vital to not use Social Security Number (SSN) as your FEIN. It is one common mistake that most new sole proprietors and new employers make. The IRS mandates the use of a FEIN once you have hired your first employee.”

- You’ll need to register as an employer with the IRS, and with the completion of the registration process, you will be assigned with the FEIN immediately.

- Once you’ve entered the necessary information, click “Save”.

- Finally, proceed to the next step to continue with the setup.

Rest assured that we’re here to support you throughout this entire process. If you have any queries or need further assistance, don’t hesitate to reach out to our dedicated team.

Steps To Change The Federal Deposit Filing Form Or The Deposit Schedule:

The Internal Revenue Service (IRS) will determine your company’s tax payment schedule (either semi-weekly or monthly) and designate a specific payroll tax return for you to file based on your past tax payment history. This may involve filing either Form 941 or Form 944.

Gusto’s Handling Process Of IRS Deposit Schedules:

To ensure timely tax payments and avoid penalties or tax delinquency notices, Gusto defaults to the faster semi-weekly deposit schedule process.

Key Point: “If you have specifically requested the monthly deposit schedule, and the IRS changes your schedule to semi-weekly, you must contact us immediately through the Help section of your account. Failure to do so may result in penalties and interest for late tax deposits, which would be the employer’s responsibility to pay.”

Gusto’s Approach To IRS Filing Forms (941 or 944):

To prevent late filings, we file the quarterly Form 941 for the following:

- Existing customers

- New customers who begin running payroll with us in the first quarter (Q1) of every year

If you joined Gusto after Q1, please confirm the form assigned by the IRS and set up your customer account accordingly. Starting from the following year, Gusto will automatically file a Form 941 for you, eliminating the need to confirm the requirement annually.

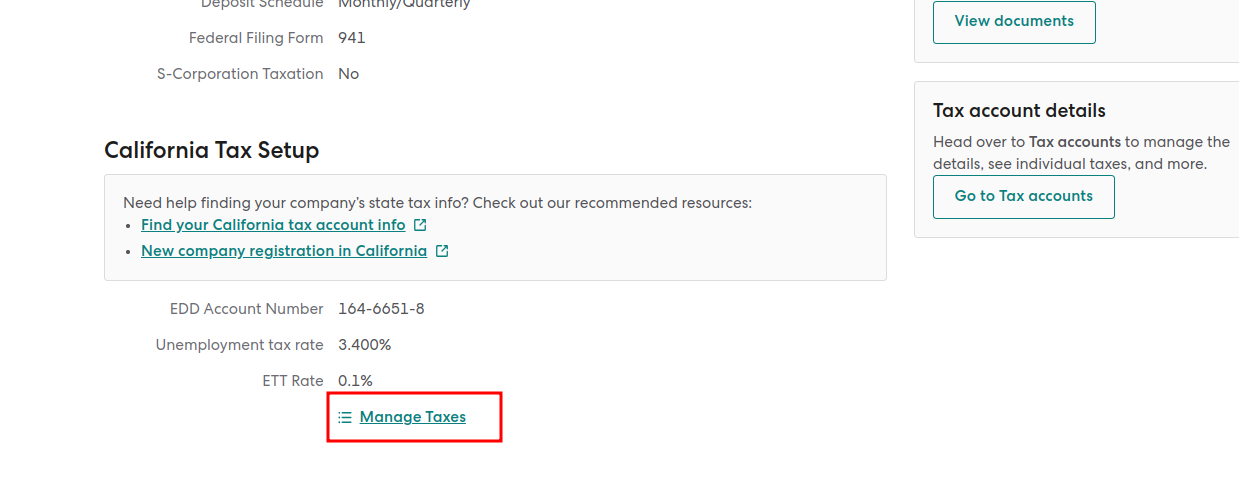

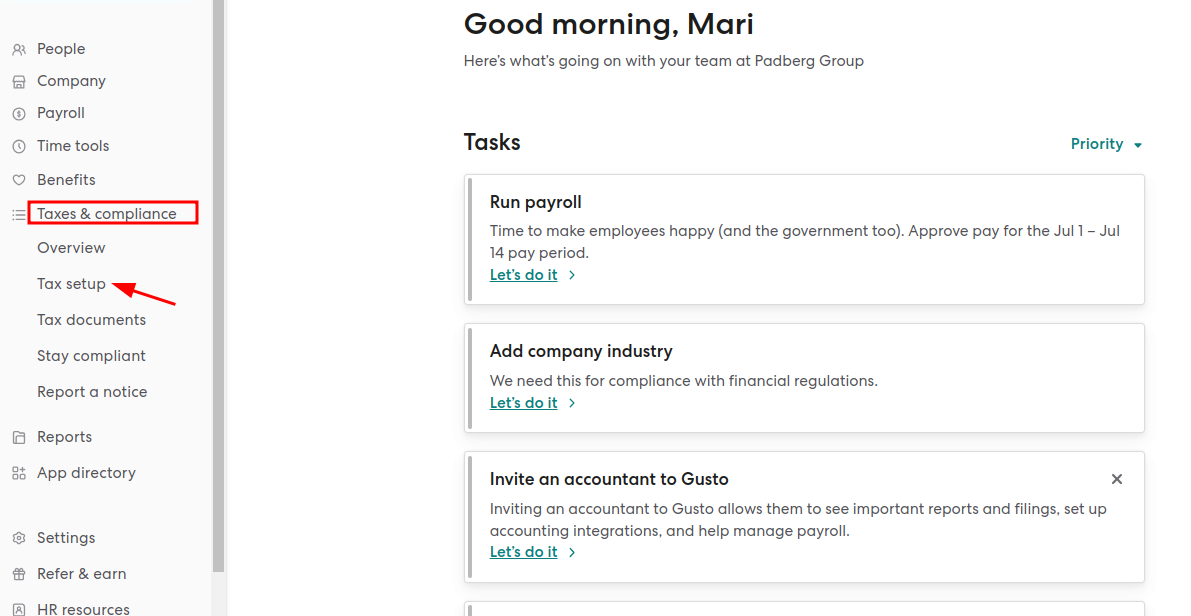

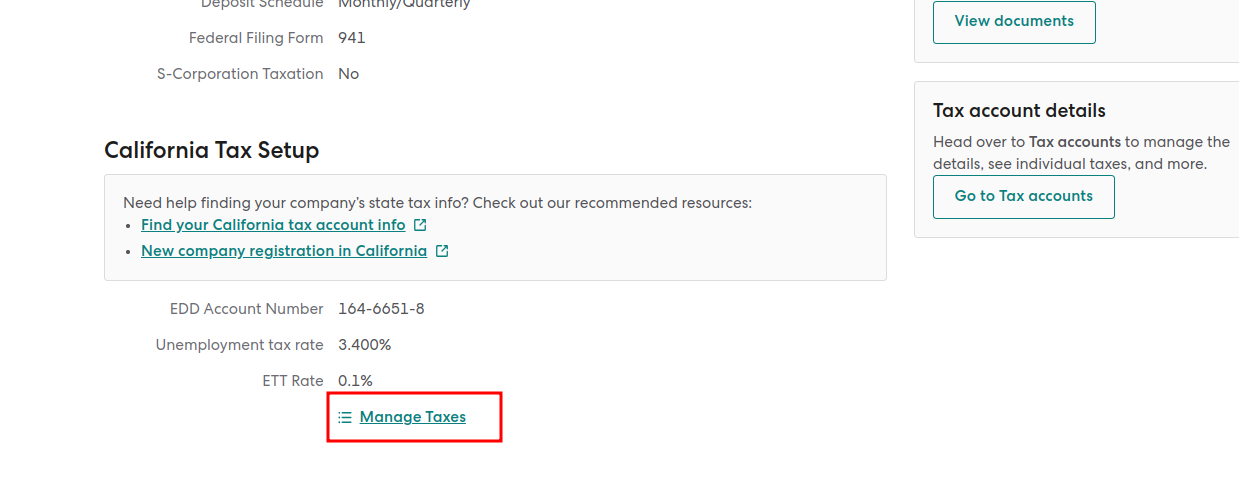

Managing State Tax Details:

Steps To Re-Do The State Deposit Schedule:

Towards the end of the year, state agencies may issue new deposit schedules for the upcoming year based on your tax liabilities in the previous year(s). These schedules may require your company to deposit taxes more or less frequently than in the years before.

Follow these steps to enter your new updated deposit schedule into your Gusto account. These steps can assist you to review the deposit schedules you’ve had in your account in the past.

If you don’t see an option to update your schedule in Gusto, please send the notice to Gusto to ensure your setup is correct.

- Navigate to the Taxes & Compliance section and choose “Tax Setup”.

- Under the applicable State Tax section, click Manage Taxes.

- Scroll down to State Tax Settings and tap on the “Edit” tab next to the Deposit Schedule tab.

- If you do not possess the ability to edit the deposit schedule, it suggests that Gusto is automatically handling it. This is done when we deposit all taxes on the fastest tax deposit schedule, preventing late tax deposits. Please note that this option is available for select agencies only.

- If you believe Gusto is not depositing taxes on time for any reason, inform us through the Help section of your account.

- To add a new schedule or view past schedules, select “Add a New Schedule.” This is also where you can review the deposit schedules you’ve had in your account previously.

- Enter the schedule indicated in the notice you received.

- Set the Effective Date to the date specified on the notice. Typically, it is the beginning of the current year (January 1). In rare cases, it may be the start of another quarter (April 1, July 1, October 1).

Key Point: “If you make this update after the deadline mentioned on the notice, you will be responsible for any penalties imposed by the agency on your account.”

In case you have entered an incorrect deposit schedule, update it in your Gusto account as soon as possible by selecting “Make a Correction” instead of choosing “Add a New Schedule.”

How To Build A Custom Report On Gusto Payroll Software?

After completing your payrolls, you might want to review and analyze the data. This is where reports come in handy. Gusto provides a range of report templates that can be accessed directly or downloaded as a CSV or PDF file (in some cases, downloading is the only option). Here’s what you need to know:

Report Templates:

Gusto offers a great selection of report templates that are categorized for easy access. Some of the categories include:

- Payroll: Cash Requirements, Paystubs, Year-to-date

- Tax and Compliance: Agency payments, Federal tax documents, W-2 and W-3 tax forms

- Custom Fields: A report specifically for the custom fields you have created

Customization Options:

Gusto allows you to easily customize many of its reports using various filters. Let’s take the Employee Report Builder as an example:

- Select the desired columns from a wide range of options, such as employment type and payment method.

- Apply filters based on employee type, such as employment status or specific employees.

- Save your customized selections as a template for future use.

- When running the report, you can preview it on the screen and download it in CSV or PDF format.

However, it’s important to note that Gusto does not currently support drilling down into reports. For instance, you can’t click on an employee’s name to open their profile, as you can in Rippling.

Payroll Journal Builder:

Another powerful and customizable report in Gusto is the Payroll Journal Builder.

You can choose the columns you want to include and download the report in Excel, PDF, or CSV format.

Gusto Payroll Software App Directory and Software Integration

With Gusto’s software integrations, you can effortlessly link your preferred software, streamlining the management of your business operations. Simply navigate to the App directory within your Gusto admin account for easy access.

How To Categorize Gusto Payroll In QuickBooks?

To categorize Gusto Payroll in QuickBooks, you can follow these professional steps:

Open QuickBooks and go to the “Banking” tab.

- Choose the account where you receive your Gusto Payroll deposits.

- Locate the Gusto Payroll deposit transaction in the account register.

- Click on the transaction to open it.

- Select the appropriate expense or liability account where you want to categorize the payroll expenses.

- If the account is not available, create a new one by clicking on “Add New” and providing the necessary details.

- Save the transaction, and QuickBooks will categorize your Gusto Payroll accordingly, helping you accurately track your payroll expenses.

ADP Run

ADP Run is a cloud-based payroll and HR management platform designed for small and medium-sized businesses. It offers features such as automated payroll processing, tax filing, and compliance management. ADP Run also provides tools for managing employee benefits, time and attendance, and HR tasks such as onboarding and performance management. With ADP Run, businesses can access their payroll and HR information from anywhere and at any time through a web browser or mobile app.

Paychex Flex

Paychex Flex is a cloud-based payroll and HR management platform designed for businesses of all sizes. It offers a range of features such as payroll processing, tax filing, and compliance management. Paychex Flex also provides tools for managing employee benefits, time and attendance, and HR tasks such as recruiting and onboarding. With Paychex Flex, businesses can access their payroll and HR information from anywhere and at any time through a web browser or mobile app. Paychex Flex also offers additional services such as HR consulting, retirement plan administration, and employee health insurance.

As much as Gusto stands out as an all-in-one HR platform, there are still plenty of other alternatives available on the market. Each of these alternatives offers unique features and capabilities that may be better suited for different businesses based on their specific needs.

Gusto Payroll Support

Gusto offers a range of customer support systems designed to assist you seamlessly:

Fill out a user-friendly form to submit your inquiries, ensuring prompt and accurate assistance.

Access an extensive collection of resources and articles to find answers to common questions and explore helpful guides.

Quickly find solutions to frequently asked questions, saving you time and providing instant support.

Reach out to Gusto’s dedicated support team via email, receiving personalized assistance tailored to your needs.

Experience hassle-free customer support with Gusto, where we’re dedicated to making your experience smooth and enjoyable.

Conclusion

In conclusion, Gusto Payroll Software is a user-friendly and reliable solution for payroll and HR management. With its ease of use, comprehensive features, and competitive pricing, Gusto simplifies payroll processes for small businesses. From full-service payroll and employee benefits management to time tracking and robust reporting, Gusto offers a range of tools to streamline HR operations. With excellent customer support and positive user ratings, Gusto is a trusted choice for businesses seeking an efficient and stress-free payroll solution.

Frequently Asked Questions

Gusto streamlines payroll, HR, and benefits administration by automating processes and providing an intuitive, user-friendly interface. It can calculate employee paychecks, process tax filings, manage benefits, and more.

-

What features does Gusto offer?

Gusto offers a range of features, including full-service payroll, employee self-service tools, time tracking, automated tax filings, HR compliance, and employee benefits management.

-

Does Gusto offer benefits administration?

Yes, Gusto offers benefits administration for health insurance, 401(k) plans, and other benefits. Gusto partners with leading benefits providers to offer a range of options for businesses.

Yes, Gusto payroll reviews say it’s known for its user-friendly interface and easy-to-use features. Gusto provides a dashboard that gives businesses an overview of their payroll and benefits information.

-

Does Gusto offer a mobile app?

Yes, Gusto offers a mobile app for iOS and Android devices. The app allows employees to view their pay stubs, request time off, and manage their benefits.

-

Is Gusto suitable for small businesses?

Yes, Gusto is a popular payroll software among small businesses due to its affordability and ease of use. Gusto’s pricing plans are designed to be scalable for businesses of all sizes.

![Unlocking Ahrefs Premium: Get Ahrefs Premium Accounts [100% Free]](https://s44815.pcdn.co/wp-content/uploads/2023/10/Ahrefs-Free-Premium-accounts-2023-330x250.webp)